Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 17 June 2015 00:10 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

Sri Lanka’s banks are set to hit a growth stage, having withstood the global credit crunch, on strong asset consolidation and diversification, an analytical report released by Asia Securities showed yesterday.

In 2014, total banking assets grew by 17.3% YoY to Rs. 6.97 billion and accounted for 71.3% of the country’s nominal GDP. The growth was led by rupee lending activities mainly funded by deposits.

Loan growth picked up towards the end of the year, resulting in a marginal drop in liquidity. Gross loans and advances grew 13.7% YoY to Rs. 3.89 billion while deposits grew 12.4% YoY to Rs. 4.68 billion last year, noted the report titled ‘Banks: An Evolving Story of Elephants and Cheetahs’.

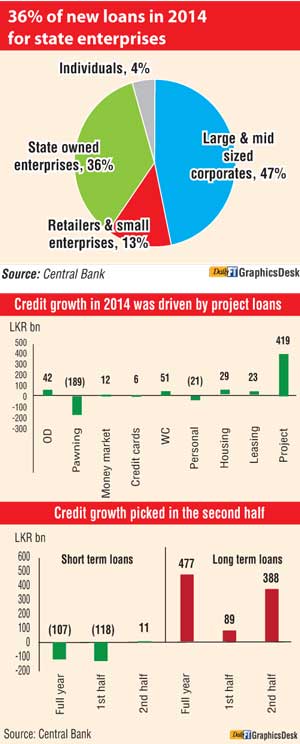

Project loans fuelled growth in 2014 with the 12 local banks disbursing Rs. 419 billion during the year. Personal loan growth was poor due to the private banks reducing exposure to gold loans on the back of declining gold prices and non-performing loans. The dozen local banks aggregated pawning contracted by Rs. 189 billion during the year.

Deposit growth was constrained by stringent liquidity regulation resulting in banks looking towards other sources to support credit growth, according to the report that was published as part of Asia Securities Wealth Insight Series.

Due to the combined factors of low capacity in the domestic market, regulatory relaxation on foreign currency borrowing and the relatively cheaper cost pushed banks to increasingly borrow from foreign financial corporations.

Total borrowings in 2014 grew by 42.6% YoY to Rs. 1.44 billion as opposed to a growth of 26.2% YoY recorded in 2013. Foreign currency borrowing accounted for 59.8% of the total borrowing in 2014, whereas in 2008 it was just 33%.

“The sector is promising for investors through improving profitability with reduction in non-performing loans in 2014. Sector net profit grew by 17.9% in 2014 after recovering from a 9.8% contraction in 2013. The lag effect of revising rates of deposits against loans, gains on investment securities and lower provision requirements due to recovery of non-performing loans were the main contributors to the improvement,” the report noted.

Net interest income grew by 12.8% to YoY Rs. 221 billion in 2014 while non-interest income grew 14.5% YoY to Rs.98 billion. Total provisions dropped by 39.1%YoY to Rs. 11 billion and forex income increased to 14.5% YoY to Rs. 135 billion. Accordingly the Return of Equity (ROE) of the sector improved to 16.5% in 2014 from 16% in 2013.

“We expect the lag effect of revising deposit rates against the lending rate, exchange gains with rupee depreciation and reducing non-performing loans and impairment provisions with low exposure to gold with minimum guarantee by the Central Bank, to contribute positively on banking profits in 2015. Due to relatively slow credit growth in 2014, this resulted in an excess liquidity situation in the sector.”

Maintaining the interest rate spread and the deposit growth will be difficult for banks in a low interest situation mid to long term, the report added. As a result the study sees Sri Lankan banks diversifying in to non-interest income generating financial services, such as external trade services, asset management, credit/debit cards, forex dealing, equity and fixed income.

In 2014 commercial banks recorded an improved non-interest to net interest income ratio of around 45%, mainly driven by trading in Government securities in 2014.

“Loan growth remains challenging in the short-term with increasing uncertainty in the political and economic environment due to upcoming policy changes and elections. The slowdown in infrastructure, construction and subcontracting sectors would affect the growth in project loans in 2015. Loan growth was sluggish in the first half of 2014 with banks reducing exposure in gold loans, however, the growth revived in the second half mainly due to increasing project loans. Total amount of loans disbursed by the 12 banks that contributed to 85% of the total loan growth in 2014 was Rs. 419 billion,” it said.

Sri Lanka’s banks have managed to remain largely unaffected by the global credit crunch. At present there are 25 licensed commercial banks and nine licensed specialised banks registered in the country operating through 6,554 branches island-wide.