Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 31 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

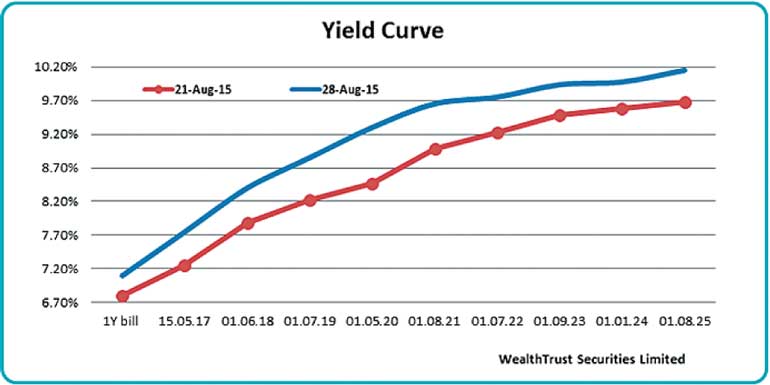

The primary and secondary bond market took a beating during the week ending 28 August, as yields continued to increase for a second consecutive week, driven by a tight money market, foreign selling of rupee bonds and a depreciating rupee. Furthermore, mixed predictions about the outcome of the monitory policy announcement due at 7:30 p.m. 31 August and the considerable increase in the weighted averages of both Treasury bills and bonds at the primary auctions, also contributed to this increase.

In secondary bond markets, the liquid maturities of 15.05.17, 01.06.18, 01.05.20, 01.08.21, 01.09.23 and 01.08.25 were seen increasing to pre April rate cut levels of 7.75%, 8.40%, 9.30%, 9.65%, 9.95% and 10.10% respectively against its previous weeks closing levels of 7.20/30, 7.85/90, 8.43/48, 8.95/00, 9.45/50 and 9.65/70.

In the meantime, the Public Debt Department (PDD) of the Central Bank announced plans of conducting a Treasury bond auction on Monday (31) for the value of Rs. 30 billion consisting of Rs. 5.0 billion of a 4.08 year maturity – 01.05.20, Rs. 12.5 billion each of a 6.11 year maturity – 01.08.21 and of a 10.09 year maturity – 01.06.26.

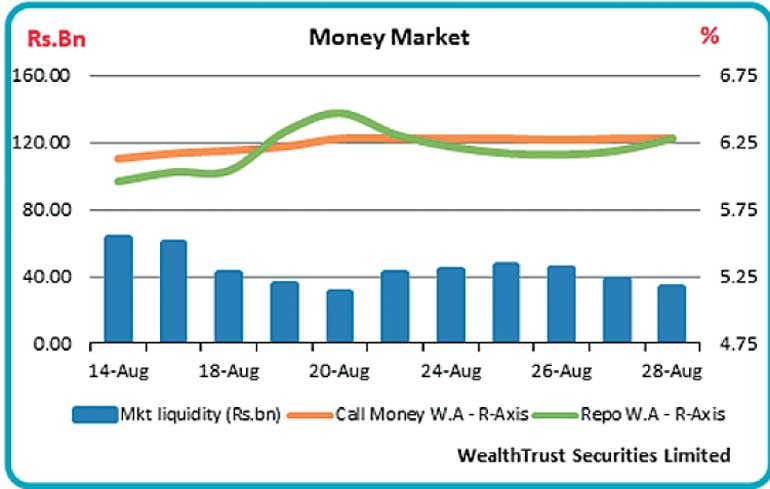

In money markets, overnight call money and repo rates remained mostly unchanged during the week ending 28 August, to average 6.28% and 6.20% respectively as surplus liquidity stood at Rs. 41.30 billion for the week against its previous week’s average of Rs. 41.88 billion.

However, overnight rates increased marginally towards the later part of the week as the Open Market Operations (OMO) Department of Central Bank was seen suspending overnight auctions in a bid to infuse liquidity and stabilise rates.

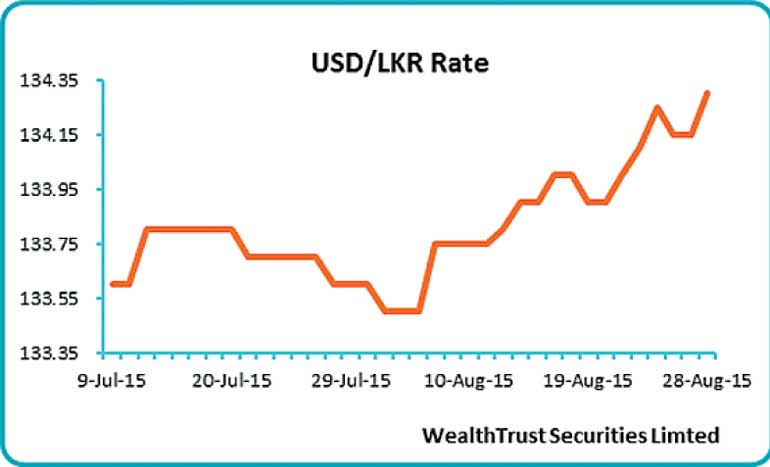

Rupee continues depreciating trend

The rupee closed the week considerably lower at Rs. 134.30 in comparison to its previous weeks closing levels of Rs. 134.00.

The daily average USD/LKR traded volumes for the first four days of the week stood at $ 63.31 million.

Some of the forward dollar rates that prevailed in the market were one month – 134.90/00; three months – 136.12/20 and six months – 137.94/04.