Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 8 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Nisha Arunatilake

The Sri Lankan Government’s efforts to alleviate discrepancies in the pensions received by public servants, in July this year, are highly commendable. However, pension anomalies in the country are present not only amongst different types of public servants. As highlighted below, the access to pensions is highly uneven in the country.

Sri Lanka’s population is ageing at a rapid pace. The 60 and above population is estimated to increase from its 2001 level of 9.5% to 19.7% by 2030. As such, an adequate pension is essential to ensure income security for elderly, without being dependent. This article argues for the need to eliminate pension anomalies for all elderly in the country.

A good pension system has three main conditions. One, it should provide at least one affordable pension scheme per individual. The scheme may have different pension options for different people, but each person should have access to at least one affordable pension scheme. Two, it should be sustainable. That is the chosen pension should be available uninterrupted till the death of the beneficiary. Three, the pension amount received should be adequate. The adequacy of a pension amount will depend on the lifestyle of a person. But, in the very least the pension amount should keep a person out of poverty. In summary, all elderly should have access to at least one reliable, affordable and adequate pension.

Sri Lanka has several old age income support schemes. These include, the Public Service Pension Scheme (PSPS), which is available for public servants. The Employee Provident Fund (EPF), which is used mainly by those in the private sector. There are also several contributory pension schemes for the informal sector workers. These include the Farmers Pension and Social Security Benefit Scheme (FMPS); Fishermen’s Pension and Social Security Benefit Scheme (FSHPS); and the Self-employed Persons Pension Scheme (SPPS). Other than for these there is a Public Assistance Monthly Allowance (PAMA), which provides an allowance to households whose monthly income falls below a minimum amount.

In addition to the above the Ministry of Social Services gives a monthly cash transfer of Rs. 2,000 to eligible elders aged 70 and above under the Elderly Assistance Program (EAP), since the end of 2014. Some elders benefit from both the PAMA allowance and the Elderly Assistance program. In addition poor and disadvantaged 60 and above elders also receive a cash transfer under the Samurdhi Program.

Is everybody covered by the different old age income support schemes?

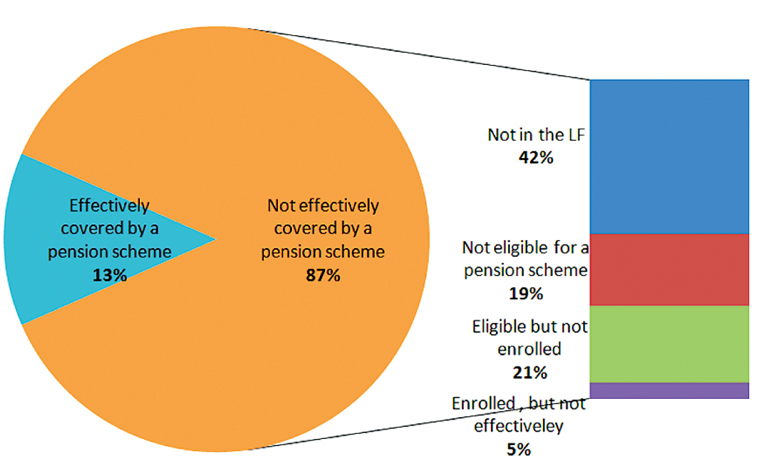

In 2012, 13.2 million of the population were 15 to 59 years old. Of these, 7.6 million were economically active. However, only five million workers were eligible for pensions under various employment based pension schemes. Of those, only 2.3 million workers were enrolled in a pension scheme. Even then all enrolled were not effectively covered. Only PSPS covers the total eligible population. The estimated coverage for other pension schemes fluctuates between 18% for the SPPS to 64% for the FMPS. However, the effective coverage is estimated to be much less (11% for the SPPS and 38% for the FMPS) due to non-payment of dues in the contributory programs. Only estimated 1.7 million were effectively covered by a pension scheme (see Figure 1).

Are the pension amounts adequate to keep elderly out of poverty?

The pension benefit amounts are inadequate for all pension schemes except for the PSPS. Only the PSPS provides benefits greater than the poverty line. The average monthly pension for beneficiaries of PSPS raged from 307% of the poverty line to 441% of the poverty line. The benefit amounts for beneficiaries of FMPS, PSHPS and Self-employed were 40%, 34% and 26% of the poverty line.

Further, all informal sector pension programs define benefits in nominal terms. The real value of these benefit amounts will be much less when the pensions are received. For example, the pension scheme for self-employed promises a Rs. 1,000 pension benefit at retirement. The real value of this benefit for a person aged 40 today will be Rs. 471, assuming 5% inflation.

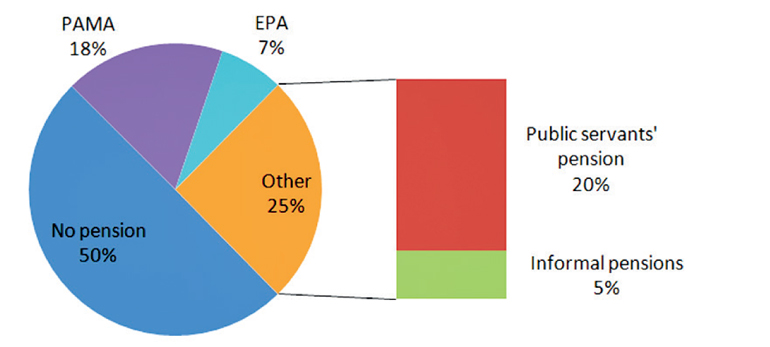

Of the 60 and above population who is receiving a pension?

At present only 30% of the 60 plus population in the country is receiving any pension. These include those receiving the public servants pension, as well as well as widowers, widows and orphans receiving benefiting from the public servants’ pension. A further 18% receive an old age allowance through the PAMA. Only the 20% of the 60 plus persons who receive the Public servants’ pension receive an adequate pension to keep them out of poverty. The benefit amounts received by others are not adequate enough to keep them out of poverty, if they are solely dependent on the pension.

The above analysis shows that only 20% of the population has access to an adequate pension in the population. This July the Government undertook to reform pensions to alleviate long overdue pension anomalies in the public sector. It is now time to think of alleviating pension anomalies in the greater population.

Figure 1: Old Age Pensions Coverage for 15-59 population in Sri Lanka (2012)

Source: IPS calculations based on Labour Force Survey data, Department of Pensions, Sri Lanka, Agriculture and Agrarian Insurance Board, Sri Lanka Social Security Board.

Note: When data for 2012 was not available, the data for the closest available year was used

Figure 2: Pension Coverage of 60 and Above Population in Sri Lanka (2012)

Source: IPS calculations based on data from the Department of Pensions, Sri Lanka, Agriculture and Agrarian Insurance Board, Sri Lanka Social Security Board, (Tilakaratna, Galappattige, & Jayaweera, 2013), and (Institute of Policy Studies of Sri Lanka, 2014).

Note: Public servants’ pension includes pensions received by widows, widowers and orphans. Those receiving EPF is included under ‘No pension’ category as it is not a pension. PAMA numbers include some non-elderly, and EPA and PAMA numbers may overlap. In addition to these some elderly who are Samurdhi beneficiaries also receive cash transfers.

[Dr. Nisha Arunatilake is a Research Fellow at the Institute of Policy Studies of Sri Lanka (IPS). To view this article online and to share your comments, visit the IPS Blog Talking Economics http://www.ips.lk/talkingeconomics/. This article draws on a research report by Dr. Shanika Samarakoon and Dr. Nisha Arunatilake on the “Adequacy and Coverage of Old Age Income Security in Sri Lanka” with funding from UNESCAP. The findings of this study will be discussed with relevant stakeholders at an upcoming National consultation on Pensions in Sri Lanka.]