Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Saturday, 21 November 2015 00:00 - - {{hitsCtrl.values.hits}}

Economy on the up seems to be what Prime Minister Ranil Wickremasinghe is gesturing during a conversation with President Maithripala Sirisena at the 2016 Budget tea party

The Unity Government yesterday presented what the Finance Minister Ravi Karunanayake described as “a Budget for all” providing relief to the masses, the working class and the private sector, initiating reforms , opening up the economy for foreigners and non-residents as well as heavily taxing vices.

The Unity Government yesterday presented what the Finance Minister Ravi Karunanayake described as “a Budget for all” providing relief to the masses, the working class and the private sector, initiating reforms , opening up the economy for foreigners and non-residents as well as heavily taxing vices.

Government MPs hailed the 2016 Budget but Opposition members breathed fire saying it reflected failure and spelt disaster for the economy and the country.

The private sector’s initial reaction was one of cautious welcome with some saying it is a people and business friendly or a “win-win” Budget whilst others opined that it was a zero-gain Budget.

Independent analysts said Budget 2016 was comprehensive and progressive though it lacked the so-called “revolutionary” element which the Finance Minister assured many weeks ago. Initial reactions to tax proposals were mixed but more clarity and a well assessed response is likely in the next few days.

However, wrapping up a four and a half hour Budget presentation, Finance Minister Ravi Karunanayake termed Budget 2016 as “an unprecedentedly innovative set of proposals encompassing benefits and opportunities for all strata of the society.”

He said Budget 2016 reflects the Government’s new dimension in national economic policy within the framework of good governance and transparency.

“Our objectives are based on futuristic policies to create an Upper Middle Income economy guaranteeing economic resurgence, thus upgrading Sri Lanka to a higher plateau. I am sure that the goodness of the proposals will cascade through benefitting all Sri Lankans rather than a chosen few,” he said.

He also urged the MPs and the nation to unite to make Sri Lanka prosperous.

“Let us bury the history and let bygones be bygones. Let us start fresh, with a new outlook, dedicated to building our nation to be second to none. We have the vision to do so. The nation-building mission is on, united and undivided,” Karunanayake said, adding, “our endeavour is focused on providing a better tomorrow.”

The Finance Minister further said the Government has incorporated many of the valuable proposals forwarded by numerous individuals and organisations in this effort and he is “positively overwhelmed by the responses.”

“Now we need to ensure that the proposals are implemented, and we look forward to the cooperation and commitment of all concerned,” Karunanayake added.

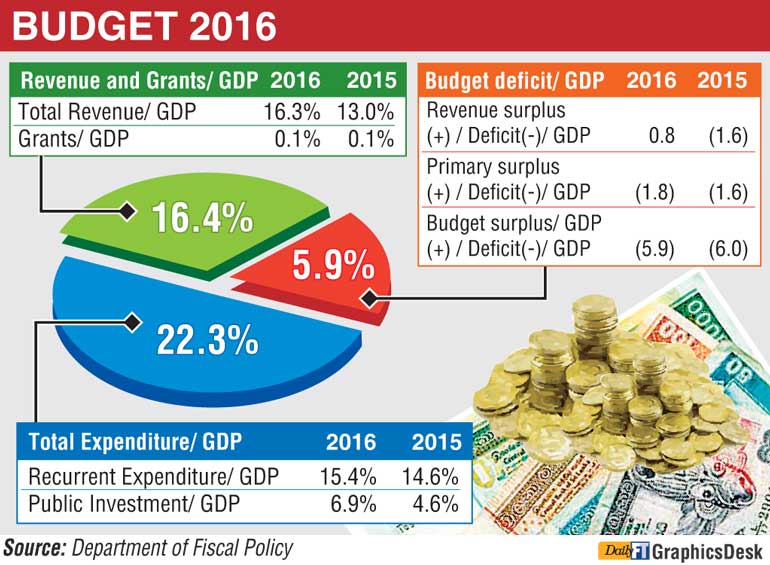

Wanting to boost revenue, the Government opted to enhance some taxation and expanded the net whilst some nuisance taxes were withdrawn. Tobacco, liquor and casino sectors will be subjected to maximum taxation. Instead of simplifying, the Government has also added more layers to taxation for example opting for a two rate band corporate tax (15% and 30%), and three-tier VAT though wholesale and retail trade were exempted from the latter. Taxes on goods and services is estimated to bring Rs. 993 billion, up from Rs. 786 billion in 2015. Apart from tobacco and liquor, financial services and trading have been placed at the higher 30% corporate tax, but overall income tax is estimated at only Rs. 233 billion, down from Rs. 249 billion. Taxes on external trade is envisaged to see a jump from Rs. 248 billion to Rs. 358 billion.

Considerable public sector reforms were announced apart from administrative reforms. However, public sector and provincial council salaries and wages will be Rs. 658 billion, up from Rs. 615 billion, and interest cost will be Rs. 520 billion from Rs. 492 billion. Expenditure on subsidies will be Rs. 437 billion, up from Rs. 378 billion.

Sticking to the pledge made during Elections, investment on education and health has been increased to Rs. 210 billion, as opposed to Rs. 98 billion in the previous year. Furthermore Rs. 658 billion is envisaged as investment in infrastructure is up from Rs. 419 billion in 2015.

The Government has also opened the economy further for both the local private sector and foreigners, in addition to luring money held by resident and non-residents. Relief to the public included reduction in prices of several consumer items whilst local entrepreneurs, industries and farmers/fishermen are being boosted by slapping duties on imports.

Pix by Upul Abeysekera and Shantha Rathnayake

The Former President Mahinda Rajapaksa faction slammed the 2016 Budget saying it was complicated and a failure. Rajapaksa also urged the Government to stop criticising his tenure, which figured in the Finance Minister’s speech. The Janatha Vimukthi Peramuna (JVP) said the budget seeks to privatise education and will result in weaker economy, while MP Dullas Alahapperuma claimed Budget 2016 reflects total failure.

MP and former President Mahinda Rajapaksa looks studious during the unity Government’s 2016 Budget presentation

UNP Ministers and MPs, however, hailed the Budget. Public Enterprise Development Minister Kabir Hashim said it was the “best budget ever” whilst Deputy Foreign Minister Harsha de Silva said it credibly took forward Prime Minister Ranil Wickremesinghe’s economic policy statement with desired action.

Tamil National Alliance (TNP) MP R. Sumanthiran said, “at first glance this is a relief budget for the people.”

The Government aims to cut the budget deficit marginally to 5.9% of the GDP in 2016 from a revised 6% this year. The Government is aiming for a 38% jump in total revenue and grants, including a 23% rise in tax revenue. On top of 6% growth this year, the Government is confident of 7-8% growth in the next few years.