Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 7 June 2016 00:01 - - {{hitsCtrl.values.hits}}

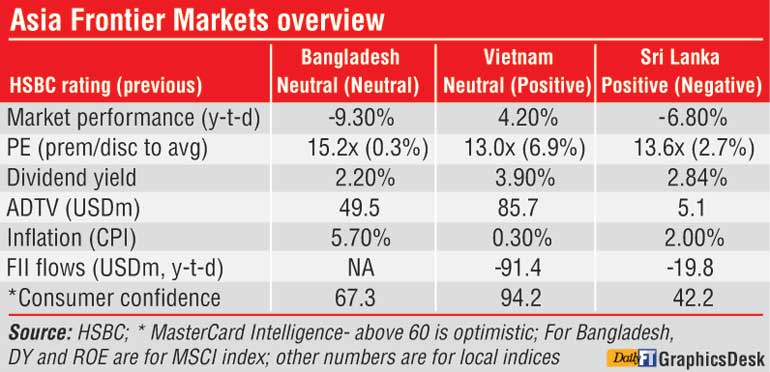

In a major boost to the capital market, HSBC Global Research latest Equities Strategy report has upgraded Sri Lanka to positive from negative whilst it has downgraded Vietnam to neutral.

“We believe that all the negative news is now priced in; the agreement with the IMF is positive for the economy. In addition, market valuations look reasonable and yields are attractive,” HSBC said.

Explaining why Sri Lanka is being upgraded to positive from negative, HSBC said Sri Lanka has been facing rising fiscal and external vulnerabilities. Weak global demand has dented export revenue and capital outflows have intensified, putting pressure on the balance of payments, weakening the local currency and reducing foreign exchange reserves to low levels.

The fiscal deficit has worsened amid mounting pressure from debt servicing and low tax revenue. The equity index, CSE ASPI, has corrected 6.8% y-t-d (to 29 April), underperforming the MSCI FM index by c7%. We believe the market has bottomed, with all the negative news priced in. The IMF loan agreement is a positive catalyst for the market.

On 29 April the Government reached an agreement with the IMF, comprising a three-year Extended Fund Facility (EFF) of $ 1.5 b and an additional $ 650 m expected to come from other bilateral and multilateral loans once the deal is formally approved.

The deal is a good opportunity for the Government to replenish its forex reserves, ease the debt burden and pursue long-term fiscal and macro reforms. Some of the areas highlighted by the IMF include: Comprehensive tax reforms, including broadening the tax base, simplifying tax rules and removing tax holidays; Boosting the tax-to-GDP ratio to c15% by 2020; steady reduction in the fiscal deficit to 3.5% of GDP by 2020; State enterprise reforms to limit risk to future public finances; external tariff structure reform to reduce effective rates of protection and flexible inflation targeting by the Central Bank.

Sri Lanka last sought IMF help in 2009 and received the final tranche of a $ 2.6 b loan in 2012.

“The local equity market rose 42% in the following six months and we expect to see another strong bounce, especially as valuations look reasonable. At a 12-month trailing PE of 13.6x, the equity market trades at a marginal 0.6% premium to its average since 2011. A high dividend yield of over 3% is another factor which should keep yield-seeking investors interested in Sri Lanka. There are early signs of stabilisation emerging and the market has regained some of the losses, returning c7% q-t-d,” HSBC said.

In addition, corporate earnings appear to have bottomed and we expect some improvement.

HSBC economist, Prithviraj Srinivas, highlighted an interesting trend apparent during previous IMF programs – the private investment rate has consistently improved. If this recurs it would help the Government, which is intent on expanding private sector participation in the economy. This should also support earnings.

Looking ahead, growth will have to depend heavily on resumption in project investments since the initiation of policy tightening is likely to temper consumption going forward. Prithviraj expects 2016 GDP growth to moderate to 4.7% (vs. an improvement to 6.3% seen earlier) and remain below diminished potential growth of 5-6%.

Sri Lankan companies, especially those in the construction and building materials sectors, should, we believe, benefit from the restarting of several stalled infrastructure initiatives (e.g. the $ 1.4 b Colombo port city project).

HSBC also said tourism remains a bright spot. Last year tourist arrivals totalled 1.8m and numbers are already up 22% y-o-y in the first three months of 2016.

In particular, HSBC thinks increasing tax rates could be challenging if the Government decides to maintain a balance between reforms and political capital. Opposition parties have already started to raise concerns about tax increases.

Other risks include poor market liquidity and another round of capital outflows later in the year should the US Fed raise interest rates.