Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 29 October 2016 00:00 - - {{hitsCtrl.values.hits}}

By Dharisha Bastians

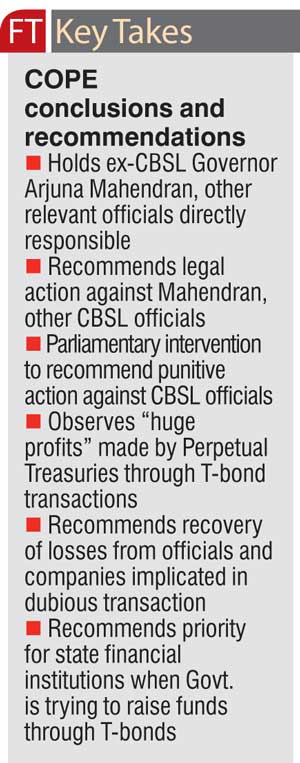

Following an 18-month investigation into the Central Bank’s Treasury Bond auctions, the Committee on Public Enterprises (COPE) ruled yesterday that former Governor Arjuna Mahendran was “directly responsible” for a transaction in February 2015 that allowed a company linked to his son-in-law to rake in large profits from the auction.

“According to facts and evidence presented before this committee, there is reasonable suspicion of former Central Bank Governor Arjuna Mahendran’s intervention or influence in the February 27, 2015 treasury bond transaction,” COPE Chairman Sunil Handunetti said reading from his 55-page report as he tabled it in Parliament.

“Former Governor of the Central Bank Arjuna Mahendran must be held directly responsible for this transaction,” the Chairman read.

“I urge all citizens, students and professionals to carefully study this report and its annexures. Then you will discover the corrupt individuals who stole public funds and those that protect the corrupt,” he added.

The findings contravene conclusions reached by a three-member committee of lawyers appointed by the Prime Minister to probe the transaction in 2015 which said Governor Mahendran had “no direct role” in the controversial decision to accept bids higher than the volumes initially offered in the auction. Verbal testimony given before COPE contradicts this position, with Central Bank officials telling the oversight committee that the Governor had suggested accepting a higher volume of bids than initially advertised.

Handunetti said that COPE was recommending legal action against Mahendran and other relevant Central Bank officials for their role in the controversial transaction. His committee was also recommending action to recover the losses to the state from these officials and companies through a judicial process.

The COPE Chairman said the committee had observed that Perpetual Treasuries, a registered primary dealer with the Central Bank had made “huge profits” from Treasury bond transactions during this period.

COPE findings however stop short of proving that Governor Mahendran was guilty of providing insider-information - a financial crime - to Perpetual Treasuries, the company linked to his family.

“The fact that we could wage war against corruption inside this Parliament, even for a moment, is a great victory for us,” the COPE Chairman emphasised during his presentation last morning.

The explosive report ends a dramatic and tumultuous week inside the sittings of the parliamentary oversight committee during the drafting process, including a walkout by the Committee Chairman. COPE members sat for seven hours on Wednesday (26) to get consensus on the report.

The COPE Chairman told Parliament that 16 members of the 26-member committee had approved the report without footnotes, while 09 members – all of them from the ruling UNP – had agreed with the report containing footnotes. Ranjan Ramanayake who is also a member of COPE had been overseas and had not approved either report, the Chairman said.

“All members of the Committee unanimously approved the recommendations in the report,” Handunetti told the House.

Annexures to the COPE report on the financial irregularities in the CBSL bond auctions comprise nearly 2000 pages, the Chairman noted.

Prime Minister Ranil Wickremesinghe hailed the presentation of the report, saying “Parliament has been victorious today.”

Addressing the House, the Premier said that for nine years, under the Rajapaksa Government, the Opposition had been fighting to strengthen Parliamentary oversight bodies like COPE. “All those of you screaming in the opposition now, opposed those attempts by us then,” said the Prime Minister. “I am glad that we have succeeded in getting even rogues on that side to champion the principles of Yahapalanaya,” he said, amid shouting and disruptions from the joint opposition benches last morning.

The Prime Minister said that once the COPE report was published, a debate on the report could be scheduled and its findings referred to the Attorney General’s Department for legal action.

The Prime Minister also responded to allegations by the Joint Opposition that former Central Bank Governor Mahendran – who is central to the controversy – had fled the country, saying the former official had gone overseas to attend a wedding. “I met him last week and he told me he would be going overseas to attend a wedding. He has not run away like Udayanga Weeratunge and others,” Wickremesinghe charged.

Joint Opposition MPs meanwhile, holding a press conference in Parliament, claimed called UNP members in COPE the “footnote kalliya” or footnote group, and said they had attempted to show Governor Mahendran in a more favourable light by the insertion of these annotations in the report.

The Premier defended the ‘footnotes’ in the COPE report that had been recommended and approved by his party members in the oversight committee, saying every member in a committee had a right to dissent. “The important thing is that the recommendations are unanimous,” Wickremesinghe noted.

Deputy Foreign Minister and UNP member of COPE Dr. Harsha De Silva also clarified the insertion of footnotes, saying the entire committee had accepted the recommendations, and the footnotes in the body of the report were aimed at explaining certain issues in what he called the “spirit of renewed democracy in Sri Lanka.”

“This is certainly a big win for good governance and the strengthening of the Parliament on the oversight committee policy that the new Government is introducing,” the UNP MP and Deputy Minister said on his official Facebook page.

Joint Opposition Convenor and UPFA MP Dinesh Gunewardane demanded a full debate on the COPE report on the CBSL investigation into the controversial transactions. “This debate should be held before the presentation of the budget,” he demanded.

In response, Leader of the House Lakshman Kiriella promised that the Government would set a date for the debate at the next party leaders meeting. “Let’s debate. We are not afraid. Thirty COPE reports were presented during Mahinda Rajapaksa’s tenure. Where were those debates? Do you remember how COPE Chairman Wijedasa Rajapakse was sacked?” Kiriella demanded.

Addressing a media conference soon after the COPE report was tabled, JVP Leader Anura Kumara Dissanayake said his party’s agitation against this transaction began two weeks after the auction in February 2015.

Dissanayake said the Central Bank was a subject under the Prime Minister. “This is the fundamental responsibility of the Prime Minister. We are now awaiting his response,” the JVP leader asserted.

“We have pushed and pushed to get to this point. We have now done everything parliament can do. It is up to everyone now to keep this issue alive and ensure people are held accountable,” he added.

Speaking to Daily FT, former Deputy Governor of Central Bank W. A. Wijewardena, who has been a relentless critic of the Central Bank’s controversial Treasury Bond transactions, said that the Monetary Board, which had always defended the actions of the former Governor was equally guilty, even though there is no mention of its role in the COPE report.

“The Monetary Board is responsible for everything that happens in the Central Bank. The Board turned a blind-eye despite the fact that its reputation was at stake. They have failed in their duty, as has the Central Bank,” Wijewardena remarked after the release of the COPE report.

In its observations, COPE said the confidence in the Central Bank had been eroded by the less than transparent bond transactions. COPE recommended that Parliament directly intervenes to recommend punitive measures to be taken against Central Bank officials and companies responsible for the transaction. Parliament should also ensure that a system of checks and balances is put in place by Central Bank to avoid such transactions in the future, and said Treasury Bond auctions should be subject to review and supervision by a special supervisory board set up by the Executive. COPE also calls for reform of existing laws to increase transparency in such transactions and protect confidence and integrity of CBSL.