Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 14 February 2017 00:00 - - {{hitsCtrl.values.hits}}

Recently, MP and former President Mahinda Rajapaksa issued a statement on Hambantota Port; extracts from his statement:

1. The loans taken for the construction of Hambantota harbour were $450 million for the first phase, $70 million for the bunkering facility and $802 million for the second phase, bringing the total to around $1,322 million.

2. When completed the harbour would have four terminals and 12 berths, a free port covering 2,000 hectares where goods could be manufactured or value added and shipped overseas. The annual interest plus capital repayments would amount to about $111 million.

3. The first phase of Hambantota harbour became partially operational in 2011. The transhipment of vehicles began in 2012. In 2014, 335 vessels called at the Hambantota harbour and 295 vessels in 2015. The port made an operating profit of Rs.900 million in 2014 and Rs1.2 billion in 2015.

4. My Government signed a Supply Operate and Transfer management contract with a joint venture between China Harbour Co and China Merchant Co to supply equipment and operate the Hambantota container terminal for 40 years. The Ports Authority was to receive a rental of $35,000 per hectare per year for the 56 hectares in the container terminal (a total of $1.96 million per year), a royalty of $2.50 on every container loaded or unloaded, wharfage of $30 per container for cargo coming into Sri Lanka and all other usual harbour charges for navigation, piloting, tonnage, etc.

5. The Ports Authority had developed the Colombo East container terminal and upon its completion by 2016, this terminal would have produced a revenue of more than $100 million a year which the Ports Authority had earmarked to pay off the Hambantota loan until the latter generated sufficient income.

6.By the end of 2014, my Government had signed agreements with several foreign and local companies to lease out about 80 hectares in the Hambantota port industrial zone at the minimum rate of $50,000 per year per hectare.

7. A framework agreement was signed by the government with China Merchant Co to lease out the entire free port for 99 years for a payment of $1.08 billion on an 80%-20% equity sharing basis. No other income will accrue to the Ports Authority for 15 years, after which they will receive dividends for their 20% stake only if dividends are declared. The lease will be extendable for another 99 years and a 44 hectare artificial island outside the port has been included in the deal.

8. There is provision for the construction of another 20+ berths and the rights over these too have been given to the lessee.

9. The lease has been based only on the port construction cost without an accredited international valuation reflecting the strategic location value of the port, the value of the 99 year period, its 2,000 hectare land, the oil tank farm and the value of its present commercial operations.

10. I am against the leasing of the entire harbour for 99 years and giving the rights of the landlord over the industrial zone to a foreign private company. The industrial zone and the harbour should be controlled by the Ports Authority while harbour operations may be given on management contracts to the private sector. For example, the Colombo Port is run by the Ports Authority and two private operators. The Ports Authority has full control over the Colombo harbour as well as equity in the two privately run terminals. I believe this should be the approach to the Hambantota Port as well.

11. Apart from the entire Hambantota Free Port, the Government has decided to lease a further 15,000 acres outside the free port to a foreign company for 99 years.

The Government failed to answer questions raised by the former President and I propose to discuss some of them.

The Framework Agreement

The Government has signed a Framework Agreement and is finalizing the deal to hand over the Hambantota Port on a 99 year lease under Public-Private Partnership. Hambantota Port would be managed by a company formed between the Ports Authority (20% shares) and China Merchant Port Holdings Company (80% shares) and SLPA will have a single Director on the Board.

Hambantota and Colombo South Ports

The Hambantota Port was gazetted in 2001 when Mahinda Rajapaksa was the Minister of Ports and Shipping. Construction of the Port commenced in 2007, officially opened in November 2010 and commenced vehicle transhipment operations in June 2012.

Meanwhile, others promoted Colombo South Port. The harbour break-water construction started in 2008 with Asian Development Bank funding. Colombo South Container Terminal was awarded to Colombo International Container Terminals Ltd, started construction in December 2011 and commenced container handling in August 2013 and proved their capability by winning the ‘Global Port Operator of the Year Award – 2016’

Meanwhile, East Container Terminal in Colombo Port is zigzagging between SLPA and a private operator as the Government wavering for the past 2 years. SLPA completed the first 440m berth in East Container Terminal in May 2015 costing $80 million; was officially opened by the Minister Arjuna Ranatunga and got Cabinet acceptance to purchase container handling cranes. Afterwards, SLPA called and have received international bids to operate the terminal. Even to date terminal is idling without a final decision.

MR claimed he expected a revenue of $100 million a year from East Container Terminal and had earmarked to pay off the Hambantota loan.

Stage I

The Hambantota Port Stage I includes two 600m berths, a 310m bunkering berth and a 120m small craft berth, also a 15-storeyed administrative building. The Port failed to attract container ships and finally settled down to transhipment of motor vehicles. The port in 2016 made an operating profit of US$1.81 million, insufficient even to cover loan repayment.

Previous deal for Stage IIChina Harbour Company was awarded the contract for Hambantota Port Development Phase II in November 2010. Subsequent agreement signed in the presence of visiting Chinese President in September 2014, the Chinese Joint Venture was awarded the right to operate two container berths and two feeder berths for 40 years.

In construction of Phase II, deepening of basin was completed, and was filled with sea-waterin July 2015, thus the Stage II should be almost complete.

Agreements in Colombo Port

In Colombo Port, two private investors operate container terminals on BOT basis for 35 year lease, built terminals and equipped them with own funds. SAGT and CICT pay SLPA an annual lease, royalty fee on every container handled, port entry dues, wharfage charge and dividends on the shares, etc. In addition CICT had to pay a lump sum in advance. In CICT 85% share is held by China Merchants Port Holdings. The payments made for Hambantota privilege was not disclosed.

Revival of Hambantota

Although the port commenced in 2010, poor performance resulted substantial losses. Meanwhile, the annual debt service payments, reached $73 million (Rs.10.6 billion) in 2016. Losses in Hambantota Port was due to non-utilising the port for container handling.

The inability to handle containers in Hambantota was due to a clause in the agreement signed by SLPA with China Merchants Holdings (International) Co., Ltd. (CMHI) for the Colombo South Terminal. In addition, SLPA’s agreement signed in September 2014 with China Harbour Engineering Company prevents the Government negotiating with any other operator.

Hambantota Port needs a proper financial and business plan to increase port operations,expand its revenue base, popularise the port among international ship operators. This requires the services of an organisation, with vast experience in maritime operations and strong links with international maritime operators.

Also, the selected operator should have the capability of attracting foreign developers and industrialists to set up their factories to develop Hambantota Port as a world class industrial port in the future.

CMHI as Port Operator

China Merchant Port Holdings, operating the Colombo South Terminal under their subsidiary CICT achieved two million TEU in the second year of full operation, displaying the fastest growth among global ports.

In the award of the “Port Operator the Year at the Lloyd’s List 2016 Global Awards” in September 2016, the role played by China Merchants Port Holdings in the development of the Port of Colombo into a leading transhipment hub in South Asia was among the factors in the company being adjudged. Thus the selection of China Merchant Port Holdings as the operator for Hambantota Port can be considered reasonable, but how about the terms of the agreement?

Conditions of agreement

According to the Framework Agreement a Joint Venture would formed with 80% shares to China Merchants Port Holdings (CMPort) and 20% to the Sri Lankan Government for a 99 year period and be handed over with Hambantota Port and Special Economic Zone, subject to transaction value not exceeding $1.4 billion.

For their 80% share Chinese would pay $1.1 billion, which would help Lankan government to settle portion of their massive foreign loans. The Government hoped to sign the agreement on 8 January, it was delayed and the Minister Samarawickrama claims eight or nine more agreements are to be negotiated.

Assets of the landlord

According to the agreement the JV would be the land-lord of Hambantota Port and Special Economic Zone. Hambantota Port with 2000 Ha land including developed and operational Phase I, the Bunkering Facility with Tank Farm consisting 14 tanks with storage capacity of 80,000 m3 and Phase II is almost complete. The Special Economic Zone indicated has 15,000 acres. In addition, the 15-storeyed administration building and the 100 acre island formed at the port mouth are included in the deal.

Possible problems with the agreement

With the JV taking over the role of land-lord number of problems arise, especially when Chinese partner control 80% and Government hold only 20% with one director, JV would become monopoly of Chinese.

Phase I handling transhipments

In Phase I, Ro-Ro operations proved to be a success making an operating profit of Rs.900 million in 2014 and Rs1.2 billion in 2015. When the port operators went on strike in last December, they were promised of being absorbed into the Chinese company, meaning SLPA will lose the right to continue operations.

Phase II agreement

MR’s statement informed the terminal was leased for 40 years. Accordingly annual rental of $35,000 per hectare for the 56 Ha container terminal or $1.96 million, a royalty of $2.5 on every container handled, wharfage of $30 per incoming container and usual harbour charges for navigation, piloting, tonnage, etc.

The agreement signed in 2014 Phase II included right to operate two container berths and two feeder berths. But Phase II includes additional two multipurpose berths 838.5m and a 208m Transition Berth not covered under the agreement.

Phase III

The third phase will include a dockyard yet to start construction and upon completion, the port willaccommodate 33 vessels at any given time, making it the largest port in South Asia. According to MR’s statement there is provision for the construction of another 20+ berths and the rights over these too have been given to the lessee.

Vision for ports in Sri Lanka

Hambantota Port located 10 nautical miles from Singapore-Aden route, and approximately 200 to 300 ships pass daily. The route was operational from ancient times and was part of the ‘Maritime Silk Route’ by Arabian and Chinese merchants. The development of Hambantota has been part of Government’s vision of developing Sri Lanka as a logistical hub between Singapore and Dubai.

The Port of Colombo is expected to operate as a transhipment hub, while Hambantota Port could be development as an industrial port, with the large extents of land availability in the area, geographical location and already built road network.

India’s first transhipment port

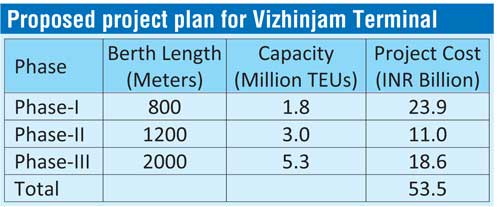

Meanwhile, an Indian conglomerate has started building the country's first transhipment port at Vizhinjam on India's southern tip, 16km away from Thiruvananthapuram, capital of Kerala State. The new port is expected to be operational in 2018. New Delhi will grant 16 billion rupees ($240 million) so-called "viability gap" funding to help the new port.

The proposed port is just 10 nautical miles from the International Shipping Lane. The Vizhinjam port is only one nautical mile away from the sea depth of 24m. In addition the proposed site has minimal littoral drift and would require minimum dredging during operations, resulting in low operation and maintenance costs.

In addition to Vizhinjam, the Indian Government will construct another port in Enayam in theneighbouring Tamil Nadu, costing $4 billion and capable of handling up to 18,000, 20-foot containers, to create a shipping hub rivalling Chinese facilities in the region.

Future of Hambantota Port

The proposed JV could be expected to run the port in an efficient manner, but following concerns are possible under majority control and need to be addressed.

1. Automotive Ro-Ro operations under Phase I, the SLPA.s profitable operation could be handed over to a nominee of JV.

2. Under the 2014 agreement with China Harbour Co and China Merchant Co offered right to operate two container berths and two feeder berths on agreed payment. The Government claims this agreement is no longer valid. The two companies are subsidiaries of CMPH and all berths of Phase II could be offered for a nominal price.

3. In the development of Phase III, the dockyard, if the JV calls for additional funding from shareholders, Sri Lanka would not be able to contribute and Chinese would continue, diluting Sri Lanka’s holdings.

4.According to MR the Government had signed agreements to lease 80 hectares in theindustrial zone at the minimum rate of $50,000 per year per hectare. What would be the future of agreements?

5.Who will carry out navigation, piloting of ships entering Hambantota port and collect charges, royalties on containers loaded and unloaded, wharfage of containers?

6.As the 15 storied Administration Building may not be fully occupied by Chinese will others using as customs need to pay rental to JV.

7. Will the 15,000 acres earmarked for industry come under Chinese under special laws?

8.When the port operations become successful, as shown by the experience of the JV partner they could propose further development of another 20+ berths (as indicated by MR) and most profits would be reinvested in development and no other income will accrue to the Ports Authority for 15 years.

Above developments are a real possibility considering the efficiency of the JV partner. Chinese could continue promotion and expansion of Hambantota port, depriving establishing and improvement of Indian ports in Kerala and Tamil Nadu. Chinese are mindful of their influence in the region and could postpone profits for the future. But how about Sri Lanka’s own requirements? Sri Lanka needs return on their largest investment and the authority to direct future investments in Hambantota Port. Already fears are expressed by many quarters that Hambantota would become a Chinese colony.

Way forward

The Government valued the Hambantota port at $1.4 billion without an accredited international valuation reflecting the physical developments and strategic location value of the port for the 99-year period.

After signing of Framework Agreement, signing of the final Hambantota agreement did not take place on 8 January. Minister Samarawickrama claimed prior to signing eight or nine more agreements are to be negotiated. Will these agreements address concerns discussed above? (There may be others as well.)

A possible way would be to declare Sri Lanka’s 20% shares on Hambantota be golden shares with veto rights, as already practiced in Britain when privatising crucial Government assets. The authority would allow Sri Lanka to direct Hambantota Port along country’s national interests. Otherwise, the Port certainly would become a Chinese colony for all purposes.