Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 27 June 2017 00:04 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

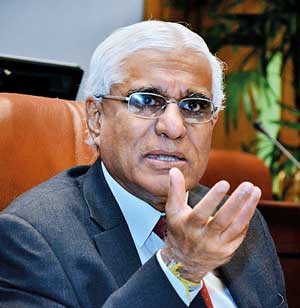

Continuation is key believes Central Bank Governor Dr. Indrajit Coomaraswamy, who has backed the Government to continue its fiscal consolidation process and aim for sustainable growth by keeping policy rates steady despite 2017 facing turbulence in reaching its growth targets after record natural disasters.

Dr. Coomaraswamy highlighted slowing private credit growth, flexible exchange rates, moderate inflation and better reserves as key reasons for optimism even though first-quarter growth numbers posted a slugging 3.8% as a prolonged drought took its toll. The second quarter also got off to a shaky start after the worst flooding in 14 years hit many parts of the county in May. Even though the Central Bank has not officially downgraded its 2017 growth prediction of 5%, the Central Bank Governor acknowledged the economy would have to dust itself off and perform well in the second half to deliver growth of about 4.5% to 5%.

“Despite the setbacks caused by the drought and floods I think the economy is in reasonably good shape. The one concern is the growth rate. What we have done in the past is that when the growth rate gets to this level we artificially pump it up, either the Budget pumps money into the system or we reduce interest rates and pump credit into the system or we do both.

That is what we have done in the past. And 18 months to two years after that you end up with high inflation and a balance of payments crisis. It is a repeating cycle.”

Dr. Coomaraswamy was adamant that the Government would have to continue its fiscal consolidation process as exports need time to increase substantially. He was also insistent that fiscal policy should remain consistent to give the Central Bank an opportunity to be proactive in its exchange rate and interest rate control. To this end introducing flexible fuel and electricity pricing measures would be welcomed, he noted, but pointed out it was up to the Government to decide when the time was right to implement such steps.

“This time we are trying to maintain discipline, to maintain the fiscal discipline on track, to keep monetary policy forward-looking and to make sure that we are sticking to our inflation target. So given where we were in January I do feel that we have made progress in putting in place a good foundation,” he told reporters.

“Now the next step is to take advantage of a better foundation to improve the investment climate, to do trade agreements and to implement the Government’s development programs efficiently and efficaciously so that you get good quality growth. The growth rate has to be increased in such a way that it can be sustained for three, four or five years. Not to relax policy now and create a sugar high of growth.”

Releasing its latest monetary report last week, the Central Bank also raised two additional concerns, namely a hike in public credit, mainly in the form of loans funnelled to state-owned enterprises (SOEs) and a drop in remittances exacerbated by the Qatar crisis.

Credit to SOEs rose to Rs. 557 billion in April 2017 from Rs. 495 billion in December 2016 as oil prices rose and a drought forced more thermal generation of electricity, reversing a trend of the State-run Ceylon Petroleum Corporation (CPC) paying back its loans.

However, since May, oil prices have begun to ease, though they remain at much higher levels than in 2016 and the Central Bank was optimistic it would continue to see a reduction.

Remittances also declined by 15.6% to $ 487.9 million in April, though the decrease for the first four months of the year was 6.3% at $ 2.2 billion. The Central Bank acknowledged that further reduction would depend on how the Qatar crisis would play out where an estimated 150,000 Sri Lankans work. The Government has already put in place evacuation measures for its migrant workers even though its Qatar counterpart has assured such measures would be unnecessary.

Headline inflation declined to 6% in May after a high of 7.3% in March and the Central Bank is confident its modelling of inflation targeting would continue to keep inflation at current levels or slightly lower till early 2018. Private sector credit is expected to decline to mirror slowing Government security interest rates and moderate over the next few months.

“One of the reasons the monetary board left the rates unchanged is because the expectation that private sector credit would ease down during the course of the year. Inflation will also come down to the mid-single digit levels, as is our target. We expect inflation to be 5% or a little less in the first quarter of 2018. We expect the Government securities market rate to ease down further because after July there aren’t any bond actions so we don’t see that much pressure in the market. The disconnect between bank credit and the Treasury bill rate, I suspect its only a matter of time because the gap is closed and bank interest rates reduce as well.”

The Central Bank has also progressively removed caps on loans including credit card and housing loans as well as resisted imposing reference rates and resorting to moral suasion to control exchange rates. The rupee depreciated against the US dollar by 2.3% during 2017 up to 21 June.

“One of the reasons the Central Bank was comfortable about removing the cap is because we have seen a significant increase in personal borrowing. The indebtedness of households has been increasing to the point where in our view there were grounds to put sand in the wheels to slow that down a little bit. This increase in credit cards and other borrowings should help to contain that because that is not very productive lending. If money is redirected to more productive activity clearly that is better for the economy.

“What we are going to do is allow the currency to find its level very gradually to get the real effective exchange rate index to 100, at which point you have a competitive exchange rate. So it will be a gradual process. We will not allow wide fluctuations and be harsh in the way we deal with speculation not aligned with the fundamentals of the market.” He added that the real exchange was currently about Rs. 105.

Reserves have been expanding gradually, reaching $ 7 billion by mid-June. However, most of the reserves remain borrowed and $ 1.12 billion infusion expected from the sale of the Hambantota Port through partnerships with China Merchant Holdings and the adjacent international airport is yet to materialise. Plans to list other non-strategic public enterprises such as hotels and hospitals also remain bottlenecked.

“Reserves are now a little over $ 7 billion and we expect to end the year at about $ 7.2 billion. We can’t be satisfied because these are borrowed reserves and they went up largely because of the sovereign bond issuance and the syndicated loan. We must start to earn our reserves but that will take some time.”

The Governor also stated that the Central Bank would respond accordingly if the US Federal Reserve raises policy rates for a second time this year but signalled that the predictability of that front was not easy as many of President Trump’s major policy pledges are yet to be implemented.