Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 1 August 2017 00:02 - - {{hitsCtrl.values.hits}}

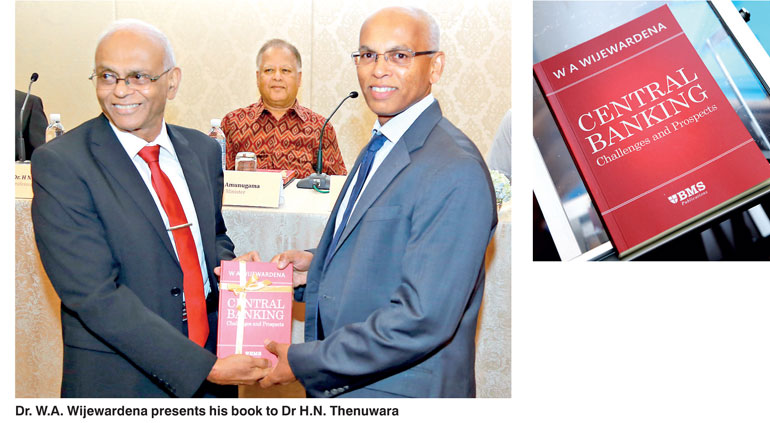

This article is based on a presentation made by the author Dr. H.N. Thenuwara, Iowa University’s Adjunct Professor Dr. H.N. Thenuwara, at the launch of the book titled ‘Central Banking: Challenges and Prospects’ by Daily FT columnist and former Central Bank Deputy Governor W.A. Wijewardena on Saturday. Senior Minister Dr. Sarath Amunugama was the Chief Guest and Central Bank Governor Dr. Indrajit Coomaraswamy was the guest of honour.

By H.N. Thenuwara Ph.D.

By H.N. Thenuwara Ph.D.

Dr. Wijewardena has timed this valuable book very well, as this is the immediate aftermath of unprecedented media scrutiny of the Central Bank. The book reminds us of the essential service the Central Bank supplies to the economy, and explains how to supply it well.

The book becomes even more memorable with the foreword written by Dr. Saman Kelegama. This may be one of the last pieces of scholarly works of Dr. Kelegama.

Dr. Kelegama emphasises the author’s persistent assertion that a country requires an independent and professional Central Bank. Dr. Kelegama provides an excellent synopsis of the book, and an accurate account of Dr. Wijewardena. In his words Dr. Wijewardena is ‘…an economist of wide experience, analytical background as well as insights, …with rich …experience in the worlds of banking and finance … with a deep commitment to justice and fair play, …and an interest to weave together a narrative of the issues relevant for Sri Lanka.’

The book is dedicated to “all Central Bankers who have the courage to say ‘No’ while others say ‘Yes’”. In this dedication, Dr. Wijewardena singles out two groups of people. One group is those who selfishly profit from imperfections in the system, the other is those who make efforts to fix those imperfections to benefit the country.

The book reveals Dr. Wijewardena’s disappointments on the way the Central Bank performed during the recent past. Throughout the book he provides strong beliefs on how to run a central bank well. He provides strategies with theoretical, empirical as well as anecdotal illustrations in the book.

10 themes

Dr. Wijewardena pursues a large number of themes throughout the book. I have chosen to highlight 10 such themes.

First, money causes inflation. This is similar to adding sugar to a cup of tea. It becomes tasty first, and after an optimal level, becomes unhealthy. Unlike sugar, money has the awkward habit of multiplying itself. Second, money cannot generate economic growth. Third, a central bank should be independent, professional, apolitical and should command the trust of the people. Fourth, a government that controls its central bank raises money growth and inflation, and impoverishes its citizens.

Fifth, the primary objective of a central bank is not to make profits, but to maintain price stability. However, a central bank should make profits from its international operations. Sixth, there are serious drawbacks in our Central Bank. Seventh, there are international standards in professional central banking. Eighth, the communication policy of a central bank should be comprehensive.

Ninth, maintaining the financial stability should be a function of a central bank. In this role, the central bank is the regulator, and not a market player. Tenth, imprudent practices may bankrupt even mighty central banks, and there were several visible such practices in our Central Bank. Dr. Wijewardena uses multiple chapters in the book to illustrate each of those themes.

Exter, inflation and experience of last 60 years

The book starts with a chapter dedicated to the first Governor of the Central Bank, Mr John Exter, and a vivid illustration of how evil inflation is. Dr. Wijewardena praises the wisdom of John Exter, and extends his appreciation to Chapter 2 also.

He strongly suggests that inflation is a direct result of using easily printed money. The remedy for inflation is to contain money growth and improve the nation’s productivity. Dr. Wijewardena’s passion for low inflation is demonstrated well in the book, since he takes up the issue of inflation in the last chapter too.

The second chapter is dedicated to examining the experience of last 60 years in central banking in Sri Lanka since John Exter. The chapter explains why a central bank was established replacing the currency board system. A central bank was a symbol of being a proud and independent country, but the peril was that it also had the ability to print large sums of money disturbing the domestic and international stability of the rupee.

John Exter thus had stated that ‘…it would be a mistake to expect startling results immediately… from the Central Bank. …the contribution must be a long run contribution. The bank does not itself produce goods and services, but it should, by creating right conditions enable the country to do so.’ In this regard, price stability is a public good similar to clean air, upon which the economy can grow.

Dr. Wijewardena, while praising Exter’s wisdom, highlights three serious drawbacks that were created when the Central Bank was established. First, the room created to grant provisional advances to the Treasury. Second, allowing the Central Bank to purchase treasury bills from the primary issue. Third, the need for profit transfer from the Central Bank to the treasury. Dr, Wijewardena does not attribute these drawbacks to Exter, but to the respective governments.

Exter may have expected that both the Central Bank and the Government would be run by individuals of high integrity who will always do good things, or in Exter’s words ‘people with moral consciousness’. Thus, it appears that not enough checks and balances were introduced to the Monetary Law Act (MLA). The result, as Dr. Wijewardena states, is generating unhealthy volumes of provisional advances and Treasury bill holdings, and transfer of profits even when the Central Bank makes losses.

Modern economics does not believe in people with such ‘moral consciousness’, rather selfish and self-interested people always trying to make a profit. Hence, if the MLA were written today, many more checks and balances would have been introduced to it.

The chapter addresses the issue of the secretary to the Treasury being a member of the Monetary Board. Dr. Wijewardena shows some concerns on the independence of the Central Bank arising from this.

Moral consciousness and governance issues

In Chapters 3 and 4, Dr. Wijewardena emphasises this again. Chapter 3 is well entitled ‘Why should people place their trust in central banks?’ The Government ownership of the Central Bank does not generate trust, but leads to oversupply of money, and serious loss of its value, or hyperinflation, as was seen in Zimbabwe, and Venezuela. The chapter also contains a rich analysis of various measures that would prevent hyperinflation, as well as a discussion on professionalism and humility of central bankers.

Chapter 4 extends Dr. Wijewardena’s grievance on the absence of people with moral consciousness, and the resulting governance issues in our Central Bank. The key points are that both board members and key officials of the Central Bank should be of highest integrity, well versed in central banking, and should have a diverse knowledge. They should deal only with monetary affairs of the country, and serve the society well. The independence of the Central Bank is paramount to the proper delivery of central banking services.

After recognising these, the author then turns to governance issues. A milestone in the deterioration of good governance in the country is an important event that took place in Sri Lanka in 1978. In that year ‘permanent secretaries’ of government ministries were changed to ‘impermanent ones’. In the Finance Ministry, the secretary changes with the change in government, and some secretaries are aligned with political parties. Thus, the Secretary to the Treasury being a member of the Monetary Board has led to serious governance issues. The chapter ends with a comprehensive list of governance requirements, and an “ABC” of governance code.

Political appointments and discretionary powers

Chapter 5 further illustrates those matters, and raises another very important issue. The author argues that Sri Lanka’s method of appointing governors and board members is defective. The result is that in some occasions, political loyalty has played the dominant role in the selection rather than the knowledge and other important attributes. Thus, the author suggests that the MLA needs to be amended to include international standards in selecting a governor and board members.

Chapter 6 investigates an international issue in central banking, i.e. Rules vs. Discretion in monetary policy. A central bank without sufficient independence may be directed by the Government to follow an easy monetary policy.

Dr. Wijewardena labels discretionary powers of a central bank as its biggest enemy. He further clarifies that while discretion is desirable in managing complex and changing economic conditions, such powers given to unqualified personnel will pose serious problems. Dr. Wijewardena concludes that such discretion will lead to the government ‘hijacking the monetary policy’, which he labels as ‘Monetary Politics’.

Profit and loss making

In chapter 7, Dr. Wijewardena examines the issue of central banks making profits. Central banks can make a lot of profits by lending to its operational participants including the government. In a good central bank, profit is just a by-product of maintaining price stability, which is the primary objective of a central bank. Thus, a central bank can make losses too while pursuing the primary objective. To absorb such losses a central bank should expand its capital base by retaining profits, without transferring to the government. Some scholars have shown that high capital base has a negative correlation with inflation.

Dr. Wijewardena suggests in Chapter 8 that profits of the central bank should come from international operations, and not from domestic operations. Chapter 8 extends the arguments presented in previous chapters, with an illustration of where the Central Bank of Sri Lanka making a profit transfer while incurring losses in 2014. The result was an alarming erosion of the Central Bank’s capital base.

Chapters 9 and 10 are also devoted to examining the impact of a loss-making central bank on the economy. The author shows that in 2013 and 2014, the bank has incurred Rs. 24.3 and 32.3 b respectively, due to net interest out payments to commercial banks and a questionable expense called ‘consultancy fees’.

Chapter 9 also suggests that those who aspire to become governors and board members should read the MLA in its full spirit, and not take mere literal meaning. In Chapter 10, the author compares the loss-making Central Bank to the loss-making SriLankan Airlines. He has shown a greater concern when the Central Bank has taken such losses mildly and had expected the Government to rescue the Central Bank one day. Furthermore, at that time of making losses, the Monetary Board had not apprised the Government about this dire situation in its Annual Report. So, the author demanded that the Monetary Board provides an explanation to the public.

Commercial business and auditing requirements

In Chapter 11, the author takes up a new governance issue, which is the Central Bank engaging in commercial business. The author implies that there have been several occasions of the Central Bank engaging in commercial business, and he elaborates on the sections of the MLA that prohibits the Central Bank owning business enterprises.

The chapter reiterates the perils of money printing if the Central Bank were to own commercial businesses, thereby increasing the money supply. The author explains that the Central Bank is a referee of banking business, thus should not own commercial banks. It appears that the author is deeply concerned about some events taken place in the Central Bank in the past.

Chapter 12 examines the auditing requirements of the Central Bank. The author is of the view that the core objectives of the Central Bank, i.e. maintaining economic and price stability and financial system stability needs professional auditing. However, such auditors should be well versed in central banking. The chapter is extended to explain various risks faced by the Central Bank.

Money printing and

growth relationship

Chapter 13 revisits the money printing and growth relationship. The author has discovered a scholarly work by John Law on the positive relationship between money and output in the late 17th century. However, the nature of money has changed since then from commodity money to fiat money, and the positive relationship may have turned negative. Dr. Wijewardena narrates how John Law printed too much money and destroyed the French economy single handedly in 1720.

Politics and independence

Chapter 14 presents how candidly some of the past governors defended the apolitical nature and independence of the Central Bank. Chapter 15, on the other hand, illustrates how in recent times the Central Bank and its officers provided politically-biased views on matters put forward by the Government.

Such ill advice has brought disrepute to the Central Bank and failure of government projects so praised by the Central Bank. The author recommends that the Central Bank must be an impartial spectator of Government policies, and must not try to own those policies. The best practice would be to give impartial evaluations on Government policies.

Financial system

stability and

communication policies

Chapter 16 warns of a central bank senselessly defending an unrealistic exchange rate invites bankruptcy. Chapter 17 brings back the readers’ attention to the main objectives of central banking, that is to maintain economic and price stability.

The author praises the wisdom of A.S. Jayawardena, a former Governor of the Central Bank, who invented ‘economic and price stability’ as the primary objective of the Central Bank. Chapter 18 examines why financial system stability is also an objective of the Central Bank.

Chapter 19 explores communication policies of central banks. Dr. Wijewardena is critical of communicating the input while ignoring the output of projects. He quotes a few examples of such futile communications. When it comes to communication regarding monetary policy, Dr. Wijewardena quotes the latest research to show that the clarity in communication improves outcomes.

Chapter 20 revisits the issue of inflation. It also takes on the need for accurately reporting the rate of inflation.

The book was written with extreme passion, and provides examples and clear instructions on how to reform the Central Bank. At the heart of today’s problems impacting central banking, as well as other Government functions, is not having sufficient checks and balances to prevent ‘morally corrupt’ individuals being appointed and running those institutions in a destructive manner. The book is an important and timely addition to Sri Lanka’s literature on economic policy.

– Pix by Nirmala Dhananjaya