Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 14 August 2017 01:03 - - {{hitsCtrl.values.hits}}

Cumulative credit to the private sector has crossed the Rs. 4.5-trillion mark in June as this activity remains a key focus of both the Central Bank and the International Monetary Fund (IMF).

According to Central Bank data, as at June, credit to the private sector amounted to Rs. 4,505 billion (Rs. 4.505 trillion) as against Rs. 4.425 trillion in May. As of June last year the figure was Rs. 3.8 trillion.

Private sector credit growth in June was 18.6%, marginally down from 18.9% in May but sharply down from 28.2% a year ago.

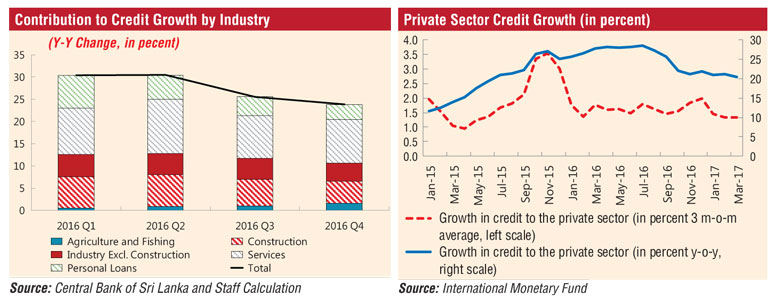

The IMF in its latest country report released on Friday noted that despite some slowing, credit growth remains high. After peaking at 28.5% year-on-year (y/y) in July 2016, credit growth decelerated to 20.4% in March 2017, largely reflecting the base effect caused by a bank merger in October 2015.

The IMF said credit growth was robust across most sectors except for personal loans whose growth slowed from 31% in 2016Q1 to 15% in 2016Q4 (y/y). Following its August monetary policy review, the Central Bank last week said private sector credit that was growing at an elevated level during 2016 and early 2017, indicates clear signs of deceleration in recent months, although at a slow pace. “In view of high nominal and real interest rates prevailing in the market, it is expected that growth of monetary and credit aggregates would moderate further during the remainder of the year. The recent decline in the yields on government securities is expected to gradually transmit to other market interest rates in the forthcoming period,” the Central Bank added.

Credit to public corporations grew by 13.7% in June, lower than the 14.7% increase in May but higher compared to the 0.5% growth a year ago. Cumulative credit to public corporations stood at Rs. 551 billion, as against Rs. 485 billion a year earlier.

In the country report, the IMF noted to contain inflation expectations the Central Bank raised the policy rate by 25 basis points (bps) in March, after having kept the policy rate unchanged since a 50 bp hike last July.

Average lending rates increased by about 200 bps between January 2016 and April 2017.

The IMF also noted Sri Lankan interest rates kept pace with the global trend as represented by the US policy rate since late 2016.

“Further monetary tightening would head off the second round effects of currently high inflation, rein in credit expansion and protect against potential capital outflows from further US rate hikes,” it added. Other measures to slow credit growth according to the IMF include raising the reserve requirement and employing macro-prudential instruments such as broader use of limits on loan-to-value ratios in vulnerable sectors and a credit limit or increasing risk weights in the housing sector.

The IMF said the Government has agreed to closely monitor credit growth, particularly to ensure that credit growth was directed towards productive economic activity and to tighten monetary policy further and use macro-prudential measures if necessary.