Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 14 December 2020 01:21 - - {{hitsCtrl.values.hits}}

Aseni, the wiz kid who is interested in everything that is economic, has been dismayed by media reports that Sri Lanka Government’s long term international borrowings have been downgraded by Fitch Ratings from B- to CCC. She asked her Grandpa, Sarath Mahatthaya, an ex-officer of the Ministry of Finance, for a clarification. The following is the discussion that took place between them:

Aseni: Grandpa, I read in the papers that Fitch Ratings had downgraded Sri Lanka Government’s long term international borrowings from B- to CCC. Some papers had projected it as one of the biggest catastrophes that has happened to Sri Lanka. Is there any truth in that?

Aseni: Grandpa, I read in the papers that Fitch Ratings had downgraded Sri Lanka Government’s long term international borrowings from B- to CCC. Some papers had projected it as one of the biggest catastrophes that has happened to Sri Lanka. Is there any truth in that?

Sarath: It is not so catastrophic as some of the critics have projected. But it is not something which Sri Lanka should ignore either. It applies to Government’s international borrowings from financial markets by issuing medium to long-term international sovereign bonds or ISBs. The Government issues these bonds to finance the budget, repay maturing bonds and build up foreign exchange reserves. The Government can still borrow from other foreign sources like friendly countries or international lending banks like World Bank, Asian Development Bank, and International Fund for Agricultural Development. Besides, it does not apply to Government’s borrowings from local markets.

Aseni: You said that it is not something which the Government should ignore also. Why is it?

Sarath: It is a warning given to Government about an impending disaster. You can compare it to a physician warning a patient that he has a serious ailment, and immediate measures be taken to tackle it. The patient will ignore the warning to his own peril. Similarly, if the Government also ignores it, it is paving way for a bigger disaster. So, taking the right action in the right time is what the Government should do if it is interested in the country’s long-term prosperity.

Aseni: What are those ratings? Why should Sri Lanka go for ratings?

Sarath: Ratings are an assessment given by an outside party about a borrower’s capacity to repay his loans and pay interest on time. Therefore, it is a communication addressed to those who are interested in lending to that borrower. In this case, the borrower is the Government of Sri Lanka. When a government or a company wants to issue bonds in the international markets to borrow, it is compulsory that the borrower should get credit ratings from at least two international rating agencies. There are three such established rating agencies. They are Standard and Poor’s, Moody’s, and Fitch Ratings. Sri Lanka has got ratings from all the three.

Just like you get different grades at an examination like A, B, C, S or F, borrowers also get different ratings. Depending on the grade which the country has got, the prospective investors could assess the risk of lending to that country. Therefore, rating agencies help investors to make their investment decisions after assessing the risks involved. It has therefore helped international credit markets to function smoothly.

Aseni: You said that rating agencies give rating numbers to borrowers like the gradings that we get at examinations. Can you tell me more about those rating numbers?

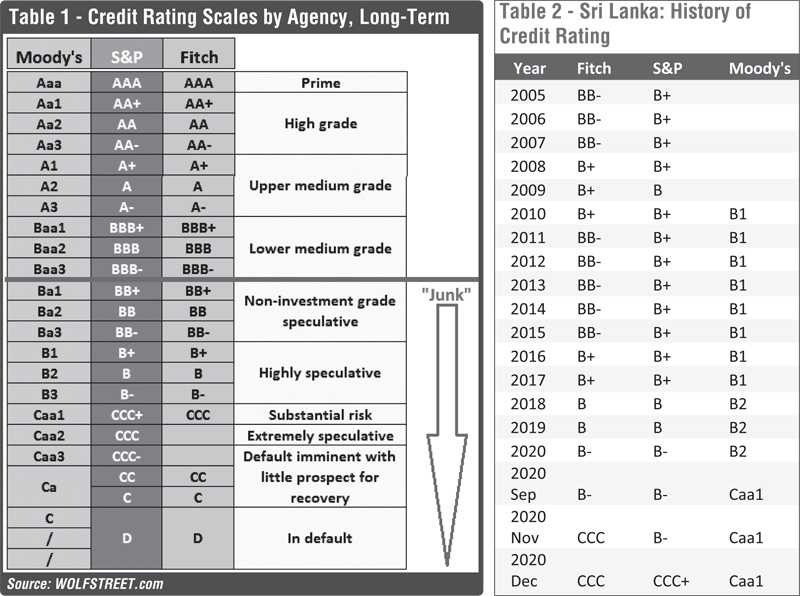

Sarath: I will show you. There is a table which I had collected from the internet. (Sarath looks for a piece of paper in one of his files and picks up one) Here it is. (He shows Table 1 to Aseni) Look at this. These are the ratings which the three rating agencies assign to a borrower. You will see that all the three have a similar rating grades for borrowers. You will note that any rating equal to or above Baa3 in the case of Moody’s and BBB- in the case of S&P and Fitch is regarded as a good rating. They have a lower possibility of default.

Therefore, they are called investment grade ratings. An investor should not have that much of fear in investing in them. Since the risk is low, the borrower does not have to pay a big amount, called risk premium, to the investor. Therefore, for them, depending on the rating grade, the interest which they must pay is relatively low in the market. But this is not the case with those who have got a rating equal to Ba1 or BB+ or lower. Those bonds are considered as non-investment grade bonds.

Therefore, the risk factor is high. As a result, the borrowers who have got those ratings will have to pay a higher risk premium. Therefore, the interest rate payable by them is relatively high. There is another important thing to remember. Since the default risk is high, these bonds are known derogatively in the market as junk bonds or simply as junkies.

Aseni: What is the rating which the Sri Lanka Government had got in the past? Were they above the investment grade?

Sarath: No, ever since Sri Lanka went for credit rating in 2005, its ratings were all below the investment grade. You can see this from Table 2 (Sarath shows Table 2 to Aseni) Therefore, Sri Lanka had to pay a little higher interest rate to prospective investors than those who had got investment grade credit ratings. From time to time, these ratings were downgraded and then upgraded but it was all within this B category. But this is the first time Sri Lanka’s credit ratings were downgraded to a C grade level.

Aseni: Your Table 1 tells us that CCC or Caa1 are extremely speculative or substantially risky. Is it the true position?

Sarath: Yes, that is the meaning of the rating which is communicated to prospective investors. That is why I said that the Government should not ignore it. Last Friday the Government was hit by another downgrade. This time, it is by S&P which downgraded Sri Lanka from B- to CCC+, a rating equal to what the other two have given. Its contention has been the bleak budget and institutional risks. This warning about the institutional risk is important to all Sri Lankans. S&P has not explained it but what it really means is that the strong government itself is a risk factor if it does not follow a policy of democratic economic policy governance. In this type of governance, all decisions are taken in a consultative process and not by one or two individuals. All what President Gotabaya Rajapaksa has done so far shows that his democratic economic policy governance is weak. One example is the decision to abolish the Public Utilities Commission which was setup in 2002 to protect the consumers from the arbitrary decisions to be taken by the three government monopolies in the electricity, water, and energy sectors. The decision has gone further than what was proposed in the Budget 2021. That was only to reform the commission and not to abolish it. The relevant line ministers have said that they were not consulted when the decision was made. So, it has ignored the institutional structure and generated institutional risk. This type of risk is a blow to those who believe in policy consistency and a stable and strong government.

Aseni: I observe that these rating agencies had downgraded Sri Lanka earlier too. But this is the first time they have ranked Sri Lanka Government at C level. What are the reasons for doing that?

Sarath: There are many reasons and they have been the same throughout. They take issue with the poor budgetary performance of the Government, foreign exchange crisis and overhanging debt issues. In the most recent downgrade, these three issues had turned from bad to worse and Fitch and Moody’s have decided to put Sri Lanka down to Caa1 and CCC levels, now followed by S&P too.

Aseni: But the budget for 2021 was approved in Parliament by a two-third majority. Then, why should these rating agencies judge that Sri Lanka’s budgetary performance is poor?

Sarath: The passing of the budget in Parliament does not mean that budgetary performance too is acceptable. There are many holes in the budget as found by rating agencies. For instance, Fitch has said that the Budget 2021 does not have a clear strategy to improve the budgetary performance. In their language they have said that and I quote it: “The budget lacks a credible fiscal consolidation strategy and provides only limited details on the potential revenue impact of some of the measures announced, raising uncertainty about the Government’s planned reduction in Government debt and budget deficit”.

What they mean by fiscal consolidation is the reduction of the budget deficit by increasing revenue and cutting expenditure. Budget 2021 does not have a clear plan for this. The Government had said that the budget deficit in 2021 would be at 8.9% of the Gross Domestic Product or GDP, up from 7.9% in 2020. But Fitch has estimated the budget deficit in both 2021 and 2022 to be around 11.5%. It may be a numbers game between the Government and Fitch.

Aseni: Why do you say that it may be a numbers game?

Sarath: To calculate the budget deficit ratio, you need two numbers, budget deficit above the line or in the numerator and GDP below the line or in the denominator. The Government has projected a faster economic recovery in 2021 and put the growth figure for that year at 5.5%. This is based on its projection for 2020 where it says that the growth will be slightly in the negative range. For instance, the Central Bank had used a negative growth figure of 1.7% when it presented the recent economic development report to Parliament.

But all others feel that it is a deep contraction in the range of 6-7% of GDP. Fitch had projected growth to be negative by 6.7%. Because of these differences, the growth estimates for 2021 are also different. The Government says that the growth in 2021 will be 5.5% but Fitch says it will be only 4.9%. Since the GDP estimate by Fitch is lower than that by the government, the budget deficit to GDP ratio is higher than the ratio calculated by the Government. That is why I said that it may be a numbers game.

Aseni: Are there other issues relating to budgetary performance in 2021?

Sarath: Yes, there are. It has said that the Government’s revenue target for 2021 with a growth rate of 28% over the revenue figure of 2019 is highly ambitious. Fitch says that the budget has suffered from several revenue-lowering measures. The budget does not contain major revenue increasing measures. Revenue has been cut by the generous tax incentives given to some categories at the beginning of 2020. On top of this, the budget 2021 has several expenditure increases, particularly, capital expenditure from 2.6% of GDP in 2020 to 6.1% in 2021. These deficiencies in the budget is the prime reason for rating downgrade.

Aseni: You said that there are foreign exchange issues also contributing to rating downgrade. What are these issues?

Sarath: Sri Lanka’s main foreign exchange issue is a lack of enough foreign exchange earnings to meet its short-term obligations. There had been a very high trade deficit in the past. With some import controls, it has been brought down marginally in 2020. During January to September 2020, imports were down by 19% but exports were also down by 17%. Hence, the trade deficit fell during this period from $ 5.6 billion in the previous period to $ 4.3 billion in the current year. When prorated, it is a decline from $ 8 billion in 2019 to $ 6 billion in 2020. There is a relief because remittances have increased by about 2.7% so far. But Fitch thinks that it is a temporary thing because all those migrants who were repatriated to Sri Lanka would have closed all their bank accounts and remitted back to Sri Lanka all their savings before leaving those countries. With debt repayment obligations, it is likely that Sri Lanka will face a severe exchange crisis in the period to come. Some signs of this adversity are evident now. The usable foreign exchange reserves of the country after taking out the gold reserve which cannot be used in a hurry has fallen to $ 5 billion at the end of November 2020. But the debt repayment obligations of the country in the next 12-month period will amount to $ 5.9 billion.

The lack of foreign exchange will not help Sri Lanka to maintain the value of the rupee at the current level of Rs. 185 per dollar. As a result, the exchange rate is already under pressure for depreciation and the Government will not be able to hold onto it anymore. These are serious risks, and the Government should not go on as if there is no problem for the country.

Aseni: But Grandpa, the Government has invited Sri Lanka diaspora to help us by sending their dollars and other currencies to us for credit of special deposit accounts earlier in the year. Later, it announced a very attractive incentive package for foreigners to buy Sri Lanka government Treasury bills and Treasury bonds. One of the incentives was that the Central Bank would bear the exchange rate risk when they take the money back after the maturity of those papers. Haven’t these measures worked out for Sri Lanka?

Sarath: Not up to the level of expectations. Recently, the Central Bank said that the amount sent to special deposit accounts was some $ 272 million. When we need billions today, this is just a peanut. The other proposal has indeed worked in the opposite direction. Foreigners have reduced their investments in government securities from Rs. 14 billion or $ 75 million a few months ago to Rs. 7 billion or $ 38 million today. Hence, Sri Lanka cannot count on these two measures.

Aseni: What is the impact of the downgrade on the country?

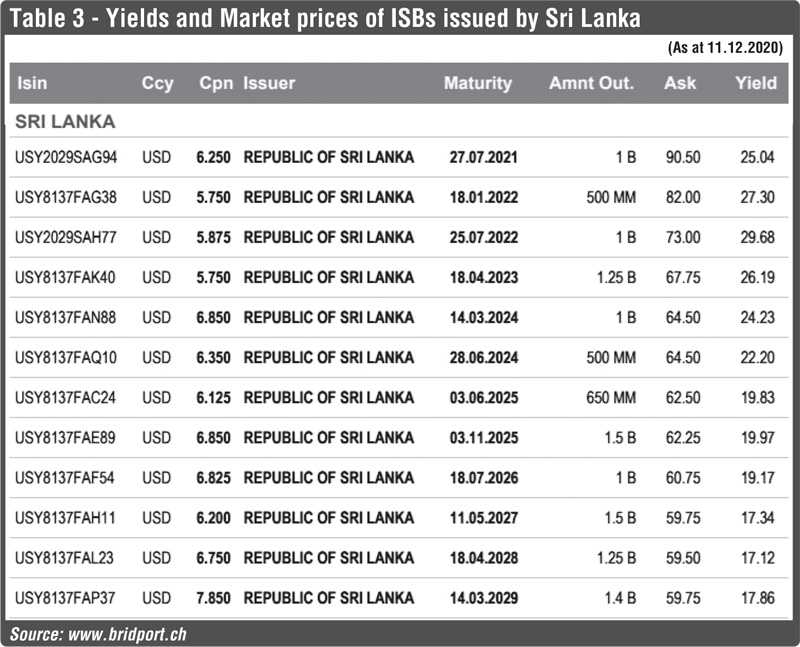

Sarath: Two immediate impacts. First, Sri Lanka will have to pay a higher interest rate to investors if it wants to issue ISBs in the market today. This is because with the economic uncertainty, ISBs already issued are traded in the secondary markets at a deep discount. I have the table here and look at this. (Sarath shows Table 3 to Aseni) This situation has worsened after the credit downgrade. For instance, the bond to be repaid next year is traded at $ 90.50 increasing the yield rate to 25.04%. Its permanent interest rate called the coupon rate is only 6.25%. And the bonds that are to mature medium to long-term are the worst affected. For instance, the bond due to mature in 2029 is traded at $ 59.75 with a yield rate of 17.86%. The coupon rate of this bond is simply 7.85%.The other impact is that when sovereign ratings are down, all the local institutions also get downgraded. Already Fitch has downgraded Bank of Ceylon and Sri Lanka Insurance from B to CCC. If these institutions want to borrow from commercial markets abroad, they will also have to pay a higher interest yield.

Aseni: What is this coupon rate and the interest yield of a bond, Grandpa?

Sarath: Good that you raised that issue. Coupon rate is the fixed interest rate which the borrower promises to pay on the face value of a bond. Face value is the amount of the principal to be repaid on maturity. For instance, if the coupon rate 6,25%, the holder of the bond will get from the Government $ 6.25 for every $ 100.

Interest yield is different from this. That is the rate of return which the investor gets for the money he has invested. It depends on the coupon rate and the market price of a bond. Market prices are determined by the demand and supply of a bond. If the demand is higher than supply, the price tends to go up and if the supply is higher than the demand, the price tends to go down. Interest yield is simply the coupon rate expressed as a percent of the market price.

If the market price is same as the face value, then, interest yield is equal to the coupon rate. If the market price is above the face value, then, the interest yield is lower than the coupon rate. Similarly, if the market price is lower than the face value, then, the interest yield is higher than the coupon rate. In Table 3 I have shown you, all these numbers are given for each bond which the government of Sri Lanka has issued.

Aseni: Thanks Grandpa. I now know the reality of the rating downgrade.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)