Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 15 November 2017 00:03 - - {{hitsCtrl.values.hits}}

Crowdfunding is the pooling of small amounts by a large number of investors to fund a project and crowdfunding is carried out using the internet. Crowdfunding is a novel approach for raising funds and is known to have been in existence for a little less than a decade.

A small contribution on a crowdfunding platform has not only helped a creative person to bring an idea to fruition but has made a significant impact on the economy. It has opened a vast number of employment opportunities.

Crowdfunding is made use of for raising funds for business purposes and therefore forms part of the capital market. It is also known as a mode of fundraising for charities but this aspect shall not be dealt with in this article which shall be limited for raising funds for business purposes.

The advantage of crowdfunding is that it makes it possible for small start-up businesses to raise funds if they have a good business plan. Businesses with a good track record have access to funding from traditional banking channels but it is not so in the case of business start-ups. Most business start-ups are fraught with risk and end in failure which may in some cases be due to lack of funding.

In many countries crowdfunding is regulated primarily to protect investors who are not ’sophisticated’ or professional investors and who lack the skills and the expertise necessary to discern if an investment is a good investment or not. Regulation also serves to protect retail investors who are not wealthy and whose financial position is such that they cannot sustain a huge loss.

There are crowdfunding websites that perform the function of pooling funds of investors and making funding available for entrepreneurs. The most popular ones are Kickstarter and Indiegogo. Such websites are known as crowdfunding online portals.

There are broadly two types of crowdfunding as a business may be funded by debt or equity. These are known as loan based crowdfunding and equity crowdfunding. In loan based crowdfunding (also known as P2P lending) investors are paid interest on amounts loaned by them and the capital is repaid to them over a period of time. In equity crowdfunding, the investments made are in securities issued by a business entity. In reward based crowdfunding donations are not paid back but in return for donations businesses provide rewards for donors.

Investors who invest in crowdfunding by using online portals are at risk of losing their investments due to frauds perpetuated by operators of such online portals. Such frauds may even destabilise the entire financial system depending on the size of the crowdfunding industry relative to the size of the economy.

While the need for regulation of crowdfunding is acknowledged, the prevailing consensus in many countries appears to be that the regulatory approach adopted should not be as rigid as the regulation approach adopted for listed securities. Otherwise it would stifle the growth of the crowdfunding industry.

Australia

This certainly appears to be the thinking in Australia as stated in the 2015 Federal Budget where the Government stated its intention of simplifying procedures for small businesses to access capital by permitting crowdfunding.

The salient features of the regulatory model followed for crowdfunding in Australia are as follows:

Singapore

The Monetary Authority of Singapore relaxed the crowdfunding regulations recently to provide for the following:

China

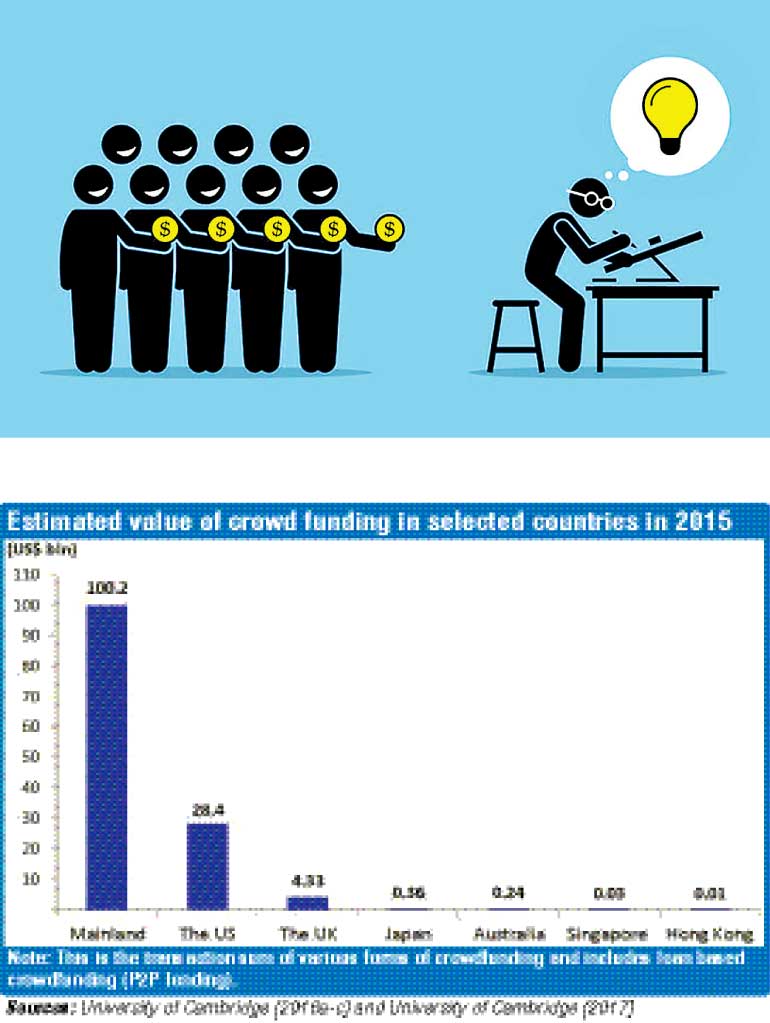

In China the crowdfunding market is about $ 100 billion (Robert Wardrop et al March 2016) and it is the largest in the world. The regulatory model followed in China for crowdfunding is different to the US and the UK.

Till recently crowdfunding in China was largely unregulated. Crowdfunding portals are not required to be licensed in China. The disclosure and due diligence requirements for crowdfunding are not mandatory in China but since August 2016 lending statistics and default rates have to be disclosed.

The China Banking Regulatory Commission along with three other government agencies issued interim measures effective from August 2016 which prohibited loan based crowdfunding companies from accepting deposits and  imposed a limit for crowdfunding borrowers.

imposed a limit for crowdfunding borrowers.

According to the new interim measures the funds of borrowers and lenders have to be held by a custodian which is a registered financial institution. Retail investors in China lost billions of dollars in 2015 when lending based crowdfunding platforms disappeared with the money of investors.

US

In the US the size of the crowdfunding industry is about $ 28 billion and 94% of the crowdfunding industry is loan based crowdfunding. This is according to a study carried out by the University of Cambridge in 2017. The equity crowdfunding component is as little as 2%. Other forms of crowdfunding constitute the balance.

In the US, crowdfunding is regulated by the Jumpstart Our Business Startups (JOBS) Act. This has the effect of exempting from registration certain crowdfunding transactions. The rules are known as the Crowdfunding Regulations. The salient features of the regulatory process in place in the US designed to regulate equity crowdfunding are as follows:

As for loan-based crowdfunding there are two models which are followed in the US. One is where crowdfunding operators partner with banks to originate loans which are later purchased by the crowdfunding operators and sold to investors either as loans or as securities.

Crowdfunding operators who follow this model are regulated by the banking regulator. However if loans are sold to investors in the form of securities then they fall within the regulatory ambit of the Securities and Exchange Commission (SEC). If securities are sold to individuals then the individual investors are protected by consumer protection laws and a host of other legislation in addition to the SEC regulatory ambit.

UK

In the UK the size of the crowdfunding industry is about $ 4.3 billion and 86% of the crowdfunding industry is based on loan based crowdfunding and the equity crowdfunding component is 12% with other forms of crowdfunding constituting the balance. The crowdfunding in the UK is regulated by the Financial Services and Markets Act 2000 (FSM Act). The salient features of the regulatory framework for equity crowdfunding in the UK are as follows:

The salient features of the regulatory framework on loan based funding are as follows:

The regulation is limited to individuals, small partnerships and unincorporated bodies only.

Sri Lanka

Crowdfunding is a financial innovation which will undoubtedly grow in leaps and bounds in the future. The concept of crowdfunding is relatively new to Sri Lanka. The size of the crowdfunding industry in Sri Lanka is estimated to be about $ 100,000 to $ 500,000 in 2015 (Robert Wardrop et al March 2016).

Loan-based crowdfunding may amount to accepting public deposits which requires such entities to seek registration/licensing with the Central Bank. Equity crowdfunding requires a private company to seek public investors which runs counter to the provisions of the Companies Act.

These legal concerns may have to be addressed if the crowdfunding industry in Sri Lanka is to be nurtured and developed. Crowdfunding is an industry which should be fostered in Sri Lanka but the proper regulatory framework is vital to protect investors in crowdfunding.

Inequitable access to finance has been identified as one of the barriers to economic growth in the Vision 2025 of the Government of Sri Lanka which has also identified peer to peer (P2P) lending as an area in which innovation is encouraged subject to relevant oversight.

[The writer, LLM (London) FCMA

(Sri Lanka) ACMA (United Kingdom) CGMA, is an international expert on capital market regulation.]