Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 4 July 2018 00:00 - - {{hitsCtrl.values.hits}}

Defining SMEs

Defining SMEs

It is widely-accepted that the role played by SMEs towards economic development of any country is of paramount importance. Contribution of SMEs towards economy is considered to be a major force behind developed and fast developing economies and helps countries to achieve sustainable and inclusive growth.

The SME sector plays a pivotal role, being breeding grounds and nurseries for small enterprises to become big corporates by gradual creation of entrepreneurial skills of nations. SMEs are generally labour intensive and can be established with a relatively less capital. Therefore this sector helps economies to address major issue of unemployment problem to a greater extent and fair distribution of wealth.

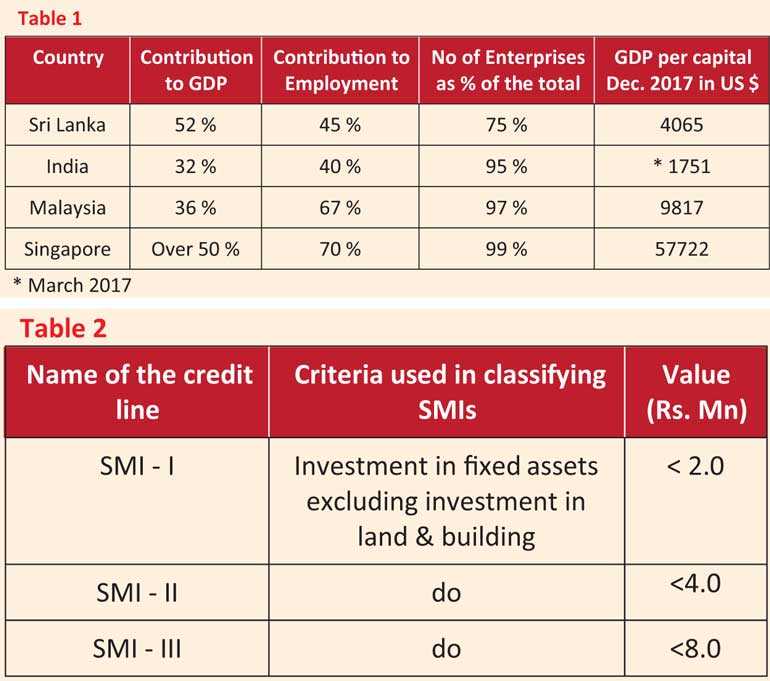

The SME sector in Singapore for example contributes to over 50% towards GDP and 70% towards creation of employment. Relative contributions of four countries are indicated below highlighting unique features of SME sector contribution towards economic development.

The figures given in table 1 will help us to compare Sri Lanka’s SME sector statistics with three other Asian economies on the basis of fast-developing (India), developed (Singapore) and similar economy in term of population (Malaysia).It clearly exhibits that number of SME enterprises are above 95% except for Sri Lanka while Singapore achieves as high as 99%.

However, contribution to GDP in Sri Lanka seems to be the highest among four countries considered despite least percent number of enterprises. Accuracy and reliability of these figures, however largely depend on classification of industries into various segments namely micro, small and medium and corporate.

However, contribution to GDP in Sri Lanka seems to be the highest among four countries considered despite least percent number of enterprises. Accuracy and reliability of these figures, however largely depend on classification of industries into various segments namely micro, small and medium and corporate.

It is very unfortunate that Sri Lanka did not have a clear and uniform definition for SME until 2015 in terms of parameters that defines SMEs. The other three countries have dealt this issue much better than Sri Lanka. India had a uniform definition since 1956 and SME sector has been formally defined under an Act of Parliament named ‘Micro, Small and Medium Enterprise Development Act 2006 (MSMED Act 2006)’.

In Malaysia it has been governed by SME Corporation since 1996, while it comes under Ministry of Trade and Industry in Singapore. What is common in these three countries is that the parameters that define SMEs have been same throughout although quantities have changed with the growth of GDP.

SME definition in Sri Lanka has been somewhat loose and one can argue that it has been greatly influenced by definitions used in various credit lines from time to time. Government, with the help of various multilateral agencies has been implementing credit lines focused on SME development. These credit lines were implemented mainly through banks and each and every credit line did have its own definition to qualify as SMEs for funding under these credit lines. Table 2 and 3 exhibit definitions used for SMEs by these credit lines which were in operations from early 1980 to 1990.The industry was then better known as Small and Medium Industry (SMI).

Tables 2 and 3 clearly exhibit that SMEs have been classified under different parameters by different credit lines implemented towards SME sector since 1980. However, we have observed that various attempts were made to finalise a definition for SME by several authorities although no clear definition was finalised. It is worthwhile to mention that one such attempt has been towards finalising a “white paper on SME” during 1990s.

Definitions used by India, Malaysia and Singapore.

India: India defines MSMEs (Micro Small and Medium Enterprises) based on investment in plant and machinery and equipment. The value of the investment depends on the sector as per MSMED Act 2006is given in table 4.

Malaysia: Malaysia defines SMEs based on annual turnover or number of employees since 2013 as per SME Corporation which is a coordinating agency for SME development coming under Ministry of International Trade & Industry (see table 5).

Singapore: Singapore defines SMEs as enterprises having annual turnover less than S$ 100 m or less than 200 number of employees, implemented since 2011. Singapore does not define Micro or Small and Medium industries separately but all three types as a whole.

Sri Lanka: After long years without a clear definition for SMEs, Ministry of Industry and Commerce has finalised a definition for SME in 2015 under its ‘National Policy Framework for Small and Medium Enterprise (SME) Development’. The criteria is annual turnover and number of employees is given in table 6.

It is clearly identifiable that most of the countries currently use annual turnover and number of employees as criteria for classifying SMEs. Of the three countries considered, India still uses investment in plant and machinery and equipment as the criteria. Singapore has a less complicated definition based on turnover and number of employees. Sri Lanka’s new definition, therefore is in line with other countries to a greater extent and it is commendable that the Ministry of Industry and Commerce has finally concluded an acceptable definition.

It has been clearly defined that in the event of an enterprise falling into more than one category, then number of employees should be the deciding factor. Further this definition will be reviewed in three years and amended when necessary based on the economy and business development in the country.

Challenges in implementing uniform definition and recommendations

1.0Although the definition has been finalised about 2 and a half year ago, we are yet to see wide use of the definition by relevant parties in the sector. Do banks and financial institutions classify borrowers accordingly to this definition when they grant facilities? If the answer is “no” then there should not be a mechanism and process to classify these enterprises according to the definition. This demands immediate actions needed to introduce a process to monitor implementation of the policy across the industry. Although the policy framework discusses about an Inter-ministerial coordination body and SME advisory council, fact that the policy has not been implemented after two-and-a-half years, forced us to question the effectiveness of the model.

2.0With the vital role played by SMEs in overall economic development, other countries have set up several authorities and models to implement SME strategy. SME Corporation for example in Malaysia, coordinates all related ministries and agencies. It takes the responsibility for data dissemination and act as a secretariat to National SME Development Council (NSDC), which is chaired by the Prime Minister of Malaysia. Why not Sri Lanka too takes this task at the top as has been done by some countries very effectively.

3.0We are trying to implement a uniform definition across the country for the first time. Hence implementation will be easier when the definition is less complex. We have two parameters in the definition: annual turnover and number of employees.

One of the barriers for SME development generally is non-availability of operational results. Many SMEs do not prepare audited accounts. Hence measuring annual turnover will be an issue. The definition is silent as to how we measure annual Turnover of SMEs when audited accounts are not available. This will therefore create some difficulties in implementation. However, number of employees is clear and straight forward in measuring.

Further, definition itself recognises that number of employees is more important than turnover in case if a SME falls into more than one category. Since it is mandatory that employees register be maintained for EPF and ETF purposes, data collection on number of employees will be easy and can be considered accurate. Hence it is recommended that enterprises be classified only based on the number of employees in the initial stage of implementation.

4.0Do we really want to segregate into Manufacturing and Services? It is not very uncommon in SMEs that manufacturing units are engaged in services under same business registration. Therefore it will further complicate implementation since we have to select either manufacturing or service for classification purpose. Additionally, when we look at the parameters, the only different between manufacturing and services is the medium category where upper limit for number of employees is 50 less for services than manufacturing. Hence if we take the middle number and use number of employee range as (51-250) for Medium category, requirement for segregating between manufacturing and services does not arise since rest are same. Hence it is suggested that manufacturing and services to be treated on the same criteria with the above amendment.

5.0As indicated earlier, different credit agencies have used different definition for SMEs when they grant credit lines for SME sector through government. Moving forward respective ministries/authorities should not use different definitions but align with this definition at the time of negotiation and finalising credit lines for SME sector.

6.0Central Bank (CB) has an important role in implementing this definition uniformly. Firstly, CB also provides credit lines for Micro, Small and Medium enterprises (MSME).Therefore, when CB launches new credit lines on its own for MSME, it should use the same definition. Secondly, CB may issue a direction to use the definition across all banks and financial institutions to ensure that all enterprises are classified correctly at the time of granting financial accommodation. Thirdly, CB may use same definition for minimum capital requirement calculation of SME portfolio for banks and financial institutions. However, apparently, CB uses annual turnover up to Rs.750 m and credit exposure up to Rs.250 m for SME exposure in its frame work for capital adequacy calculation for SMEs.

The Government has just introduced a number of concessionary loan schemes under Enterprise Sri Lanka project and a number of loans schemes such as Riya Shakthi, Govi Navoda, Ran Aswenna 1, Maadya Aruna 1, Maadya Aruna 2, Rivi Bala Savi, Green Loan 1 and Green loan 2. These schemes will focus on SME sector mainly. Hence early implementation of correct SME classification will help strategy and policy formulations and realise benefits of vital SME sector contribution towards the economy.

[The writer, MBA (AIT), BSc Eng, CIMA, MIESL, is CEO of a Non-Bank Financial Institution and past Senior Vice President (Branch Banking and SME), DFCC Bank. He counts over 25 years of experience in SME funding and can be reached via [email protected].]