Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 7 January 2020 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka needs to give priority to wind power, supported by solar

The last Presidential Election was held under precarious electricity supply conditions to citizens, after power-cuts in March/April. Easter Sunday attacks reduced tourist arrivals and heavy rainfall from July to Christmas filled the country’s reservoirs, saving the country from further power cuts.

Gotabaya Rajapaksa contested elections under backdrop of above and his drive was backed by historical changes in political campaigning. His presented election manifesto, a 78-page document named ‘Vistas of Prosperity and Splendor’ detailed policies if he were to be elected as President. The manifesto identified the power sector being the most crucial in the country and relevant sections from ‘Vistas of Prosperity and Splendor’ are given below.

Renewable energy

Renewable energy has now become a widely-discussed subject and is needed as part of the overall energy mix of a country, which consists of hydro, thermal, coal and alternative renewable energies. It will ensure that the country has access to low cost energy needed for rapid economic acceleration. By 2030, we expect the country’s renewable energy mix to be 40% of the total portfolio. We also anticipate that hydro and renewable energy together would account for 80% of the overall energy mix by 2030.

Transformation toward renewable energy

Major policy change

The new President’s policy on power generation involves major changes to country’s power generation programme. Currently, power requirements are obtained from hydro-power, coal and thermal power generated by CEB and private power producers.

Thermal power is extremely expensive costing Rs. 25 to 35 per unit vs. Rs. 6 for major hydro and over Rs.17.50 from coal. The additional costs from thermal power plants is a major burden of foreign exchange to the country. The high cost of power generation resulted CEB losing Rs. 30.4 billion in 2018, becoming the biggest loss-maker, which are finally borne by the citizens, resulting highest electricity charges in South-East Asia.

History of power crisis

The CEB’s failure in power generation goes back decades, in the early 1990s electricity supply became a crisis and citizens faced six-hour power-cuts. The first coal-fired plant proposed in the 1980s in Trincomalee had to be abandoned due to security concerns and was moved to Mawella.

Mawella Bay in the south, a natural harbour with nearby deep sea capable of handling coal ships of 60,000 dwt, was considered most suited. But President Premadasa abandoned Mawella when locals protested over possible loss of their residences. But a few weeks afterwards, local Pradeshiya Sabha passed a resolution requesting the power plant be brought back to Mawella and assured fullest cooperation, but Premadasa refused to yield.

Thereafter, Norochcholai was proposed, but construction delayed due to protests over environmental issues until 2004 when Mahinda Rajapaksa decided to proceed. Even after Premadasa’s demise in 1993, faced with massive protests over Norochcholai, CEB refused to reconsider Mawella and made use of the opportunity to install oil-based power plants by themselves, also private producers and CEB engineers financially gained by actions. The situation continued for nearly two decades.

If Mahinda Rajapaksa was properly informed of Mawella, he would have certainly moved the power plant to Mawella, resulting lower overall costs. The failure to establish Mawella coal power plant in the late 1990s and the use of expensive oil for power generation is the main cause of high power costs over the past decades.

Norochcholai power plant stages 1 to 3, which became operational during 2011 to 2014, were expected to produce 300MW each. Although the power plants failed to produce power as expected, they met the power demand and some thermal power plants were retired.

In 2012 responding to a public invitation, a company offered to install a gas unloading terminal with storage facilities and to supply power with a 4X300MW plant at $ 0.07 (or Rs. 11.90) a unit. The project received cabinet approval in 2015 and lands were allocated, but dropped for petty reasons. The best offer the country ever received got dragged for five years and declined by politicians.

During the Yahapalanaya Government not even a single major power plant was constructed or even awarded for construction. With continuous increase in power consumption meeting the electricity needs became critical resulting power-cuts in March-April 2019.

Alternate power sources

With the possibility of local gas over the horizon, a section of CEB engineers promoted alternate sources of power and the 300MW Kerawalapitiya power plant capable of running on natural gas completed in December 2008. Until gas was available the power plant would run on oil.

Unfortunately even to date no proper plan have been prepared to import, store and distribute natural gas, while accommodating locally available gas. In addition, use of wind and solar based electrical power generation was promoted, but dropped when became popular with private investors.

Wind power

A World Bank report in August 2007 under ‘Private Sector, Small-scale, Renewable Power Generation in Sri Lanka’ informed that the country has nearly 5,000 sq km with good-to-excellent wind resource potential. About 4,100 sq km of this area is land and the balance 700 sq km is lagoon.

Largely concentrated in the north western coast from the Kalpitiya Peninsula north to Mannar Island, Jaffna Peninsula and the central highlands. On a conservative assumption these could support a potential of 24,000 MW of installed capacity.

Electricity through wind power

Electricity through wind power is supposed to be the cheapest. Wind power’s capabilities are shown in Denmark where wind power delivered almost 47% of electricity requirement in 2019, in a country where solar power capacity is poor. Sri Lanka’s first wind power plant by CEB producing 3MW was commissioned in March 1999, was dismantled when the land came under Hambantota industrial zone. Currently CEB is installing a 100MW wind power plant in Mannar with ADB assistance, but proceeding slowly with farmers protesting that winds from mills would disturb their farming.

Sri Lanka’s wind energy industry witnessed a boom from 2010 on when the private sector was offered on ‘first comes first served basis’ and continued till 2014; this was suspended on the President’s orders after numerous scandals were reported. But the ministry to date has failed to implement a fool-proof scheme. Currently there are 15 wind farms all privately-owned, producing 128MW.

Solar energy

The introduction of rooftop small solar power units to reduce household electricity bills to zero in 2010 by the Sri Lanka Sustainable Energy Authority (SLSEA) became a success. Under the scheme if the householder produces less electricity than consumption he needs to pay; if more the extra will be credited to his account to be used later, but will not be paid.

The success of the programme led to Surya Bala Sangramaya or the battle for solar energy in 2016 under Net Metering, Net Accounting and Net Plus, targeted to generate 1,000MW in one million solar roof tops by 2025. The original scheme became Net Metering.

Net Accounting

When electricity generated with solar panels are greater than consumed, the customer will be paid Rs.22.00 per unit during the first seven years and Rs.15.50 per unit thereafter. If the consumption is greater than the generated, the consumer has to pay at the existing electricity tariff.

Net Plus

The CEB purchases the total electricity generated at Rs.22 per unit. The customer pays for the electricity consumed according to existing tariff, meaning domestic customers consuming over 180 units a month are forced to pay Rs.45 a unit.

For households, a two kilowatt capacity solar power panel would be sufficient to generate electricity for a consumer of about 200 units per month (1kW=115-120 units per month). The investment for a 2 kW solar power plant is around Rs. 500,000.

However, in early 2019 CEB modified the power purchase system without informing the Cabinet or the President. According to proposals, ‘Net Metering’ and ‘Net Accounting’ would be cancelled and ‘Net Plus’ tariffs be drastically reduced, rendering the scheme commercially nonviable. In addition CEB will not accept applications for solar power projects over 50KW in size.

Small power producers

Earlier, CEB purchased solar power from private producers under 5MW capacity and the scheme became popular. But CEB suspended the scheme in January 2016 claiming conflicts in legislation.

The Solar Producers Association protested claiming there are over 600 applications capable of producing 1,550MW of power registered with Sri Lanka’s Sustainable Energy Authority, after payment of a fee. The approved tariff for solar-power below 5MW is Rs.23.10 per kWHr, but CEB wishes to reduce the payment to Rs. 16 a unit, claiming solar panel costs have come down in the world market.

Government solar parks

The Buruthakanda Solar Park in Hambantota is the first commercial scale solar power station completed in 2012 producing 737KW in the first stage and 500KW in the second stage.

The plant is owned and operated by the Sri Lanka Sustainable Energy Authority. A solar park of 100MW is being constructed in Siyambalanduwa in the Monaragala District.

Poor progress under Yahapalanaya

Since 2015 not a single major power plant was constructed or even awarded. Kerawalapitiya natural gas plant tendered in 2016 dragged on nearly three years. Finally after intervening by the President, an award was made to two tenderers at two different prices, one at Rs. 14.98 per unit and other at Rs. 15.97. The lower tenderer went to court and the case is pending. Meanwhile, CEB met the power shortage by re-commissioning retired oil-based power plants at high costs.

With local power supply in disarray foreign companies attempted to take advantage of the situation. First a Korean SK E&S Company offered Floating Storage and Regasification Unit (FSRU), proposing to supply one million tons of LNG a year on take-or-pay basis for 20 years. Meaning, even if the quantity is not consumed, the country will have to pay.

The 50-day Government called for international competitive counter proposals under the Swiss Challenge be submitted within five weeks, against the Korean company’s proposal. CEB engineers are against the project and may never get off ground. The proposed FSRU supplier SK E&S has never owned or operated an FSRU, also never operated a process facility offshore. The company has been operating LNG carriers.

Indian-Japanese joint venture

Meanwhile an Indian-Japanese joint venture proposed another FSRU of one million tons a year capacity to be located near Colombo South harbour’s west terminal and the environment proposal is under review. According to the proposal, an under-sea pipeline from the FSRU would deliver natural gas to Kerawalapitiya and a land based pipeline to Kelanitissa. But the question is, when local gas becomes available will the FSRU be able to handle? Also if the Port wishes to develop the west terminal, what would be the solution?

Meanwhile, on the request of CEB an investigation is underway funded by ADB to find a solution to receive, store and distribute gas, including possible supply of gas to Maldives, a research that should have been conducted 10 years ago.

Least Cost Long-Term Generation Expansion Plan

The country’s power generation expansion is expected to be according to Least Cost Long-Term Generation Expansion Plan prepared by CEB and approved by the Public Utilities Commission of Sri Lanka (PUCSL).

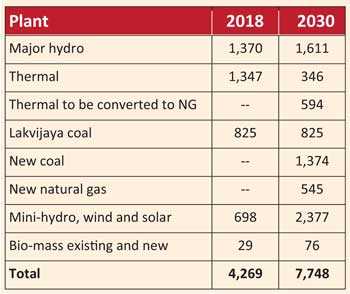

PUCSL made extensive modifications to CEB’s Power generation plan of 2018-2037, CEB refused to agree, however was approved by the Cabinet. The table shows extracts of existing and proposed power generation capacities of different sectors in 2018 and 2030 as per CEB presented generation plan for 2018-2037.

As above, by 2030 the generation capacity needs to expand by 3,479MW. But the President’s power proposals anticipate hydro and renewable energy would account for 80% of the overall energy mix by 2030 or rise up to 6,200MW from current 2,100, a threefold increase. From the above programme 346MW of thermal power and 1,374MW of new coal need to be discontinued and replaced by renewable sources as wind power and solar, requiring a massive expansion of same.

Solar power is only available during the day, wind power being available throughout, thus wind power need become a substantial part of country’s energy plan. As shown by Denmark which produced 47% of its power requirements in 2019, our country too needs to give priority to wind power, supported by solar. But since 2013 no wind power projects were allowed from the private sector by CEB.

Implementing the President’s program would require major changes to CEB planning, which is responsible for the current mess. If power generation through renewable sources was allowed to expand through private sector participation, the current power shortage would not have arisen.

The country needs to develop available natural gas identified in the three identified zones, but to accommodate local gas, usage of imported gas and gas infrastructure is essential. Natural gas, the most environmentally-acceptable thermal fuel, is needed as a firm load base, especially during dry periods when hydro-power generation becomes low.