Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 9 October 2018 00:00 - - {{hitsCtrl.values.hits}}

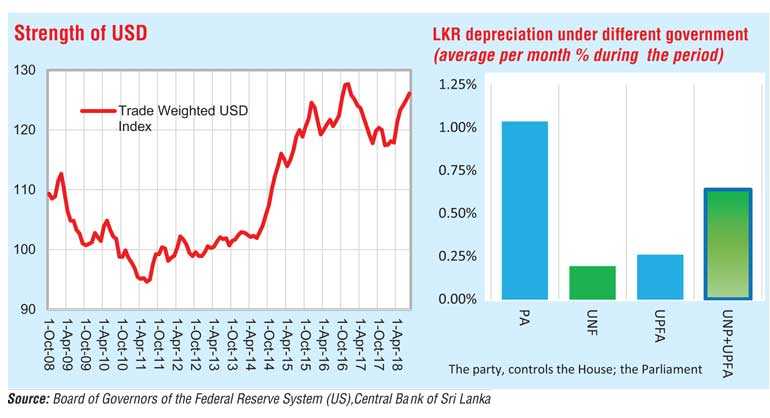

Sharp depreciation of the Sri Lankan Rupee (LKR) made headlines of financial press in the last month. The LKR continue to hit fresh highs against United States Dollars (USD); the primary currency of external trading. Both the Government and the Opposition engaged in the usual blame game while the exchange rate was in a free fall.

In January 2001, the LKR depreciated by a massive 12.7% against the USD, recording the highest-ever monthly depreciation in the 21st century. Thereafter, February (6.3%) and March 2012 (5.8%) created history of the highest consecutive monthly depreciation of the LKR. Nearly three years before, in September 2015, the LKR depreciated by 5.2%.

Many of those incidences of abnormal exchange rate depreciation within a short period of time was accompanied by their own reasons – unhealthy domestic credit formation by accommodative policy and its subsequent impact on LKR exchange rate via large imports demand. However, this crisis is different and primarily emanated from the external sector; largely beyond the control of economic policymakers. Having said, the magnitude of the impact of any external crisis is dependent on the level of accommodation.

Two primary policy options

When a country confronts such an exchange rate shock, there are two primary policy options available to counter them.

nIncrease the local interest rates to curb import demand and signal that the country is resorting to a tight policy stance (known as tightening monetary policy)

nAllow local currency to free float finding its own equilibrium prices and policy intervention is only to curb speculative elements to a certain extent

It was observed that Sri Lanka opted for the second option while keeping local interest rates unchanged from the pre-crisis level. However, analysts believe that the right policy mix is some combination of both policies, owing to following reasons (among others).

nExporters would prefer to hold exports earnings overseas without converting them at current exchange rate as they could benefit from higher conversion rates in the near future. Exporters could engage in this arbitrage only if local interest rates remain lower in order to finance their expenses locally.

nImports prompted by low cost of local borrowings: Importers may rush to import before the exchange rate further depreciate and hold onto stocks since carrying cost could be financed locally at a cheaper rate.

The current exchange rate crisis is broad-based and faced by many emerging economies. In theory, the depreciation of local exchange rate encourages exports while curtailing unwanted imports. Those benefits of exchange rate depreciation depend on the nature and structure of the economy. If the country has a positive trade gap and engages in manufacturing of goods with excess capacity, such a country may benefit in the short run. However, the long run benefits are debatable. Contrary to popular belief, the country which is highly dependent on imports with a wide trade gap will have adverse effects.

Reasons for the current exchange rates crisis

Reasons for the current exchange rates crisis are deep-rooted and have emerged from the structural factors of the economy. Apart from the structural issues, analysts note that certain past fixes which have been perpetuated have subsequently aggravated the present crisis.

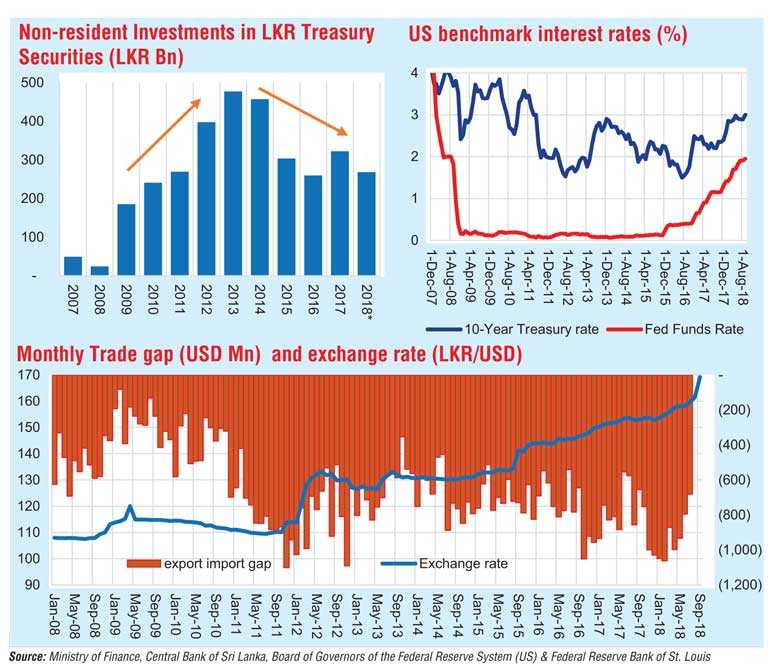

The short-term capital flows for searching arbitrage yields emerging markets due to lower interest rates that prevailed in the developed world, known as hot money, was accommodated through investment in LKR-denominated Treasury securities. Return of those hot money (USD outflows) has caused severe strain on the exchange rate.

Prior to the global financial crisis in 2008, foreign investments in LKR-denominated Treasury securities were an insignificant component. Many emerging economies received temporary capital inflows as Foreign Financial Inflows (FFIs) into bonds and listed equities due to the ultra-low interest rate regime maintained by the developed world central banks in fighting deflationary condition after the global financial crisis.

This hot money is supposed to return when normality is established in originating economies. If recipient emerging economies could increase their exports or foreign exchange income through necessary economic reforms while hot money is within the system, the return of them may not cause big trouble.

While finding a long-term solution to correct the structural weaknesses of the economy to better face external challenges, it is necessary to make short-term corrective actions. The analysts observe no adequate long- or short-term policy actions were instituted in this regard. The hasty short-term measures came too late and is apparently not sufficient. There were a number of warnings about the impending exchange rate crisis. However, there wasn’t proper preparation by enacting appropriate short-term measures until the last minute.

Our growth model is still highly depend on non-tradable sectors. The implication of such a model is that the country will run into external imbalances with low exports income which is not sufficient to cover the demand for imports.

Need for economic reforms

There is a greater need for initiating necessary economic reforms for improving the structure of the economy. Sri Lanka mostly depends on female labour for foreign exchange earnings; the apparel industry ($ 4.8 b), tea industry ($ 1.5 b) and inwards remittances of migrant workers ($ 7.2 b).

The labour supply for all three segments largely comes from the underprivileged female population in rural Sri Lanka. The Sri Lankan female population, especially rural females, contribute to a disproportionate share of foreign exchange earnings.

Exports in the present context isn’t limit to goods and the export of services is an important element. The country needs to attract Foreign Direct Investment into export industries. It is necessary to understand the need for economic reforms to boost exports. There is a need for across-the-board reforms for increasing exports without delay. The Government should create a conducive environment and take appropriate policy measures to facilitate and develop the export industries in Sri Lanka.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)