Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 2 September 2019 00:45 - - {{hitsCtrl.values.hits}}

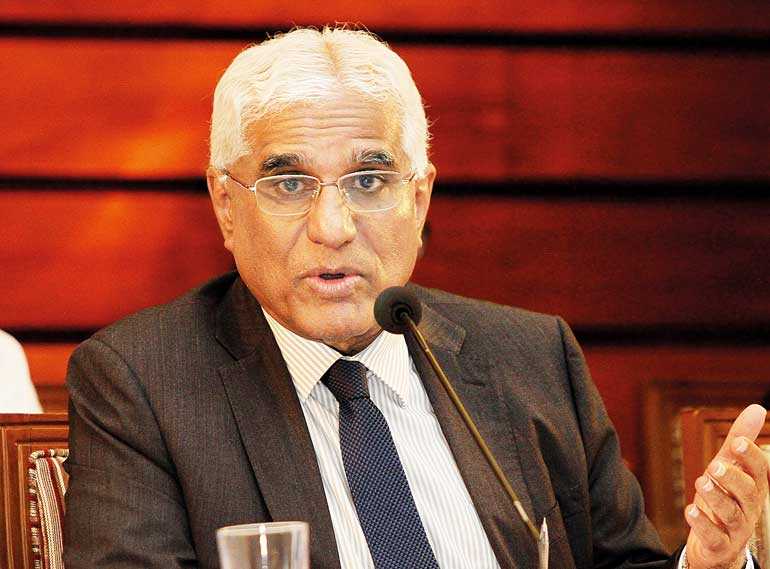

The boy from Cambridge

It was the year 1974. The Central Bank had recruited a new batch of staff officers. News soon came that, among them, there was a boy from Cambridge University who spoke English with a foreign accent. By that time the bank’s lower rank inhabitants, including this writer, were all local graduates.

Driven by the protection mentality that displayed itself in a camouflaged veil of extreme local sentiments, they had felt the need for projecting the bank as their exclusive preserve. Any attempt by the bank’s management to penetrate that preserve by adding foreign graduates to its rank was considered as a conspiracy against local brains. Hence, when this Cambridge boy was taken in, he was considered an outsider and a threat. We, therefore, looked at him with suspicion.

That boy was Indrajit Coomaraswamy.

An extremely friendly young man

Therefore, our initial dealings with him were cautious. We watched him from a distance to see any sign that would betray his exclusive elitist upbringing. But the reports that came from his colleagues in the Bank Supervision Department to which he had been attached presented a different story. Like any other cub-examiner, he had walked, sometimes soaked in rain and sometimes under scorching sun, with his team to examining banks and behaved in every way as one of them. There was nothing elitist about this Cambridge boy.

After our initial fears had somewhat dissipated, I approached him personally one day at the lunch room to get acquainted with him. To my surprise, he was extremely polite, friendly, easy-going, humour-filled and social-spirited. He was a professional to a fault. I found him to be one of us and not an outsider. Even after 45 years, I still have the same feeling about him.

An unbowed critic of economic policy

Coomaraswamy is known to his friends as Indrajit. I had a very close relationship with him throughout his professional career in the bank as well as outside. We appeared together on public platforms as panellists, wrote on contentious economic issues and served in official committees and private think-tanks. One remarkable feature I had noticed in him was his independent thinking. He was daring enough to express his reasoned views on economic policies even when they were not to the liking of those who were responsible for them.

At one such public forum held in February 2012 in which I too appeared with him, Indrajit was critical of the misalignment of the fiscal policy, exchange rate policy and the monetary policy pursued by the previous administration. He fearlessly opined that ‘the exchange rate was out of alignment with an overvaluation of 25%. When the monetary policy was eased in this background, it is inevitable that credit should expand and imports should surge’ (available at: http://www.ft.lk/special-report/flexible-exchange-rates-and-impact-on-exporters/22-74206). He was in fact driving home the need for having discipline in both economic policy making and handling the government budget.

A one-on-one conversation

In order to have a one-on-one conversation with him, I met him on a Sunday morning at the Bank House, the official residence of the Governor of the Central Bank. It was raining heavily and the atmosphere outside was gloomy. Yet, he was up and ready to welcome me. After the exchange of polite greetings, he escorted me to the special section in the Bank House where he met visitors. Locked inside, we were able to carry on the conversation without being disturbed, except on occasions by his housemaid who served us with steaming cups of finely brewed Ceylon tea.

Schooling in numerous countries

I asked Indrajit about his school career. “I studied up to Grade 4 at Royal College in Colombo,” he started his story. “Then my father, Raju Coomaraswamy who was a civil servant got a UN post and we all had to move to New York. There, I joined the UN International School and completed Grade 9. The last lap of my post-secondary education I had to do in a boarding school in UK, Harrow School for Boys. I completed up to Grade 13 there.”

The young sportsman

Indrajit’s school career had been illustrious with both high academic performance and active engagement in sports. He captained Royal College’s primary cricket team as well as Harrow’s school team. He also played Rugby for Harrow School for three years. It did not stop at that. When he joined Cambridge University later, he played first class cricket for the University’s Cricket Club. In the world of cricket, first-class cricket is the official classification of the highest standard of international or domestic matches in which the two teams would play the game for three days. One needs to be a real cricketer to get into this exclusive cricket club.

• In his first address to the staff of the bank, Indrajit reiterated that the primary responsibility of the Governor was to “uphold the reputation and the credibility of the bank”. The first step of doing so, he assured the staff, was to establish strong macroeconomic fundamentals in the country

• According to Indrajit, the bank should have three attributes within it to do the job properly. The first was integrity. The second was technical expertise. The third was professionalism. When these three have been firmly imbedded in the culture of the bank, he said that it would be in a better position to deliver its promises

From Harrow to Cambridge

“From Harrow School, I joined Emmanuel College of the University of Cambridge to do Economics Tripos for my Bachelor’s degree,” Indrajit continued. Economics Tripos is a three-year special degree in economics offered by Cambridge University in which students are assessed at the end of each year. Indrajit got his BA as well as MA from Cambridge.

“After completing the degree, I returned to Sri Lanka in 1972 and joined the Hatton National Bank as an executive officer. I joined the Central Bank as a staff officer from HNB after serving that bank for nearly one and a half years. Because of my banking background, I was posted to the Bank Supervision Department where I functioned as an examiner along with such giants in bank supervision like Mr. Balasingham who later became its head. That hands-on experience was invaluable.”

Doctoral research at Sussex

It is from Bank Supervision that Indrajit secured a scholarship to do his doctorate in economics at UK’s Sussex University. “I was there from 1977 to 1981,” said Indrajit.

What was his research at Sussex for its DPhil Degree, I asked him. “I did my research in unemployment and growth area specifically concentrating on rural poverty in Sri Lanka. The findings of my research were contrary to what many believe that rural poverty is caused by rural unemployment. There is heavy underemployment in rural areas but poverty is not due to unemployment but due to low productivity and low income. What it means is that rural poverty cannot be eliminated by offering jobs to rural people. It can be eliminated by helping them to improve productivity and through it, incomes.”

A short stint at Statistics Department

After completing his DPhil at Sussex, Indrajit returned to the bank in 1981 and was posted to its Statistics Department. “I’d a special job there,” he said. “That was to finalise the report on the Consumer Finances and Socio-Economic Survey which had been done by the Central Bank in 1976. Data had been finalised and the report had to be edited. I was on the job and had almost finished it. But before I could do the finishing touches, I was called to Ministry of Finance to work in its Economic Affairs Division. Then, I moved from the bank to Ministry in August 1982.”

Working under Ronnie

At the Ministry, Indrajit had worked directly under the then Minister of Finance, Ronnie de Mel. To work with such a veteran civil servant cum master politician was another experience for him. “He was a methodical man,” he commended Ronnie.

“To satisfy him was not easy. But, he was a good listener and if you explained something clearly to him, he agreed and the work was easy. He was much ahead of the time and ahead of many of us. So, we had to do better than him if we were to survive under him.”

The Finance Ministry was a different kind of a learning platform for Indrajit. He had exposure not only to the local bureaucracy and politicians but also to international organisations like IMF, World Bank, ADB and so on.

Long career at the Commonwealth Secretariat

From the Ministry, Indrajit did not return to the bank but proceeded to the Commonwealth Secretariat to accept a new position. That was to function as its Director of Economic Affairs, the unit entrusted to design its economic policy toward member Commonwealth nations. That position enabled him to travel in all the 54 member countries of the Commonwealth.

“I was able to gain firsthand experience about the diverse economic issues faced by them. When you moved from one country to another, economic challenges faced by them were different. But the Commonwealth provided an umbrella for all of them to rise together as a single unit,” he opined. This is where he worked from 1988 till he retired in 2009.

A freelance policy analyst

Indrajit returned to Sri Lanka to spend his retirement. He was a freelance researcher and policy analyst. His long experience at the Central Bank, Ministry of Finance and the Commonwealth Secretariat had solidified his economic thinking. In any given economic policy, he could see not only what is being seen at the moment, but also what should be seen in details.

Hence, this seasoned economist could not be deceived by camouflaged numbers. One example was his disaggregated analysis of Sri Lanka’s foreign exchange reserve numbers in the public forum held in February 2012 and referred to above. It had been customary for the Central Bank to highlight the gross foreign exchange reserve numbers to prove that the country had a sufficient cushion to meet its foreign exchange liabilities. But, when one looked at the detailed break-down, one could hardly be happy about them.

In the above mentioned public forum, he disaggregated the country’s foreign exchange reserve of $ 7.5 billion and found that it was all made up of borrowed funds. Of this, $ 3 billion had been raised by issuing sovereign bonds, $ 2.5 billion by selling Sri Lanka government Treasury bills and bonds to foreigners and another $ 1.8 billion by borrowing from the IMF. When all these had been taken out, Sri Lanka had only $ 300 million as free reserves. With this type of critical policy analysis, he was a much sought after resource person in public economic policy forums.

Pinnacle in career

In July, 2016, Indrajit reached the pinnacle of his career. He says it came as a surprise to him. And in a manner that he could not say no. Therefore, when the job of the Governor of the Central Bank was offered to him, he had to accept it. That was how Indrajit became the 14th Governor of the Bank.

Upholding credibility and reputation of the bank

In his first address to the staff of the bank, Indrajit reiterated that the primary responsibility of the Governor was to “uphold the reputation and the credibility of the bank”. The first step of doing so, he assured the staff, was to establish strong macroeconomic fundamentals in the country.

What he meant by strong macroeconomic fundamentals was to have a proper balance among numerous macroeconomic influencers of prosperity – inflation, exchange rate, balance of payments, budget and credit levels. He wanted to mobilise the enormous talent pool within the bank to work as a single unit to achieve that goal.

The required three attributes

According to him, the bank should have three attributes within it to do the job properly. The first was integrity. The second was technical expertise. The third was professionalism. When these three have been firmly imbedded in the culture of the bank, he said that it would be in a better position to deliver its promises.

He wanted to create an open society within the bank in which all ideas are openly discussed and debated. He offered himself for criticism by bank’s staff and invited them to bring to his notice whatever the failures on his part without fear. With respect to political pressure that would be exerted on the bank, he said that it was the responsibility to the bank’s staff to convince the political masters.

Addressing the bank’s critical issues as a team

Indrajit started his work in the bank with a clear mind and a focussed objective. But all the odds were against him. The country’s growth had been slowing down, public debt mounting, debt repayment challenging, external sector crashing, the rupee falling and so on.

I asked him how he would rate the bank’s achievements against these odds. He took me through a range of such achievements. “Of course, they were not my personal achievements. It was a team work fully supported by the Monetary Board. I’ve to give credit to all officers of the bank from the highest to the lowest for what we have achieved,” he said. “There were a number of legacy issues which we had to tackle. They in fact took a substantial amount of our time and financial resources. One by one, we were able to tackle them.”

By legacy issues, what he meant was the fallout of the much publicised Treasury bond scam denting the bank’s reputation. After reacquiring the lost reputation, Indrajit and his team was able to introduce a number of other reforms that would certainly take the bank forward.

Flexible inflation targeting

“We’re now on track to go for a flexible inflation targeting regime as our monetary policy framework,” he said. “The previous monetary policy framework was based on controlling money supply or base money to control inflation. It was not a satisfactory system since base money and money supply became uncontrollable by a Central Bank. Now, we directly target inflation. The flexible feature gives us space to deviate from rigid targeting whenever the economy needed more liquidity to sustain its growth. The necessary legal power to go for flexible inflation targeting is being given to the bank by way of enacting a new Monetary Law Act. It is almost ready now.”

Bank supervision on par with global practices

What about the other objective of the bank, the financial system stability? I asked him. “Our banks are in a sound position despite the slowdown in the economy. We’ve introduced IFRS 9 and Basel III to our banking system so that they are now on par with global banking standards. In this respect, we are pretty much ahead of our peers,” Indrajit put me in the picture.

IFRS 9 refers to the International Financial Reporting Standard 9 introduced by the International Accounting Standards Board to cover accounting for financial instruments. It has succeeded the previous standard on the subject – International Accounting Standard 39. Basel III is a set of banking regulations developed by the bank for International Settlements for adoption by member countries. It is designed to reduce the damage to the economy when banks take excessive risks. Sri Lanka’s migration to Basel III is indeed a positive development.

Central banks should embrace technology

I asked him his view of the future of central banking. “The future central banking will be technology driven. Instead of the rupee notes and coins which are in physical form, central banks may have to dematerialise the notes and coins and go for something like an e-Fiat currency. On top of this, banks have also been embracing modern technology and we at the central bank should be ready to meet the challenge. This will require us to introduce technology based bank regulation which is code-named RegTech. Right now, the Central Bank is getting ready for this transmission. We’re training our present staff in these lines. We’ll have to acquire new talents, especially in technology based disciplines, to supplement our present talent pool,” he said.

A family man

Overall, Indrajit has been happy about the bank’s achievements. He is also happy about his own professional achievements over the past five decades. I asked him who was behind his success. “My wife Tara has been the shadow behind me. I’m grateful to her for what she has done,” he admitted. His two sons, Imran and Arjun, have been well placed in their respective professions. None of them have chosen to become an economist. Perhaps, they might have seen enough of their father languishing in economic issues to keep themselves away from this dismal science.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)