Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 27 May 2020 00:00 - - {{hitsCtrl.values.hits}}

At the dawn of the year 2020, the world was celebrating achievements related to the Fourth Industrial Revolution; 3D printing, big data, machine learning and Artificial Intelligence were some of the buzz words associated with it. However, suddenly almost all the countries in the world have been compelled to divert their attention from those complex ideas to simple human habits.

During the last two to four months we have all been learning and teaching how to wash our hands properly to prevent the spread of COVID-19. This pandemic has spread its cruel tentacles all over the globe irrespective of national borders, religions and ethnicities. In addition to the horrendous health hazards of the pandemic, the world is experiencing symptoms of a very destructive and painful economic recession. This has occurred while the scars of the Global Financial Crisis of 2008-2009 are still visible on economies.

The novel COVID-19 disease triggered forceful responses by governments and regulatory authorities to mitigate adverse economic and social impacts. Prolonged periods of social distancing have already disrupted capital formation, employment and production, domestically and globally. Such interruptions lead to bankruptcies in the real economy which will eventually turn out as risks to financial systems as well. Liquidity shortages of financial entities, in turn, hamper credit flows to real economies thereby forming a vicious cycle. Therefore, financial institutions have been compelled to redesign their risk management frameworks to face ever evolving crisis situations.

Coronavirus unveiled an uncertain and unknown future for the whole world. However, one thing is certain. That is the unavoidable requirement to mitigate the effects of climate change. Environmental sustainability needs to be a key priority in all policy - making for the future. When mankind was locked down in their homes, there have been tangible signs that nature was healing herself. Amazing picture of animals visiting isolated towns, resurgence of clean water resources and improved air quality emphasised that human beings cannot completely manipulate nature’s rhythm. This is what the Red Indian leader, Seattle, taught the world very many years ago. We have been given what is probably our last chance to learn that lesson.

Preparedness for a global pandemic was not satisfactory in every field, including financial sectors. However, history has given us an opportunity which should not be missed at all. The focus of the post-COVID economic transition measures should be directed towards a low carbon future to make the recovery greener. When natural disasters hit the world every aspect of social, economic and political spheres get affected. The financial system is no exception. There is, therefore, a compelling case to mainstream sustainability into national planning and budgeting processes.

The “prevention is better than cure” norm should, therefore, be embedded in risk management strategies of financial institutions as well. Greening financial systems has to become an integral part of the toolkit to address climate change. This article, accordingly, seeks to shed light on the importance of adopting “green finance” policies in the post-COVID-19 recovery plans in order to maintain resilience in financial systems while addressing the prospect of climate meltdown.

Although initial stimulus packages for COVID-19 affected sectors were mainly focused on keeping the businesses afloat, medium-term policies addressing the future need to encourage environmentally sustainable activities. Mere focus on the short-term economic recovery, on the basis of “business as usual”, will create the conditions for future climate disasters. Financial institutions will need to align their credit and business policies towards a greener pathway.

Introducing innovative products in line with the sustainable environment concept while reducing the misallocation of funds to polluting products is a must for all industries. The financial industry can take the lead to explain how it can protect, underwrite and foster the transformational industries towards a sustainable future. The IMF has also reiterated the importance of using stimulus policies wisely by promoting green finance and putting the right price on carbon emission.

However, if the innovations in other industries towards low carbon investments are happening at a slow pace, green financing policies would not gain traction. The construction sector, for example, is well placed to take the first step for focusing on green infrastructures. It will help boost other industries in the construction ecosystem to generate employment and kick start business hopes.

The International Institute for Sustainable Development stated that periods of high unemployment and low interest rates are the right time for green investments and infrastructure development. Blue chip corporates, as well as SMEs, need to be encouraged to formulate sustainable business strategies to achieve success in mobilising funds.

Valid Dombrovskis, Executive Vice President of the European Commission, states: “Creating a more sustainable and resilient economy will be a key focus of the recovery phase and the renewed sustainable finance strategy will be essential to mobilising much needed capital.”

Climate change: The ‘Green Swan’

According to the Macmillan Dictionary, a ‘Green Swan’ is a climate event that is outside the normal range of expected events. “Green Swans are different from Black Swans because there is some certainty that climate change risk will one day materialise.” The book authored by Luiz Awaru et al based on the above concept emphasises the requirement to integrate climate risk into costs and prices of economic risk management.

Climate change is not a future risk. The early-warning signs are already with us. The melting of the polar ice caps and Himalayan glaciers has accelerated. Sea-level rise is becoming more of threat to population centres around the world. Forest fires are becoming more difficult to control. Accordingly, the threat has already begun although we have been procrastinating in seeking solutions. Spratt and Dunlop (2019) describe climate breakdown as an existential crisis.

Adoption of the Paris Climate Agreement and the 2030 Agenda for Sustainable Development and its 2015 Sustainable Development Goals became the turning points which directed the global focus on addressing drivers of climate change. Moving to a low carbon environment i.e. 2 degrees Celsius resilient economy and pursuing efforts to limit the temperature even further have been the goal posts under the Paris Agreement. Requirements to make consistent finance flows available for ensuring low greenhouse gas emissions and climate-resilient development gave the birth to concept of “green finance”.

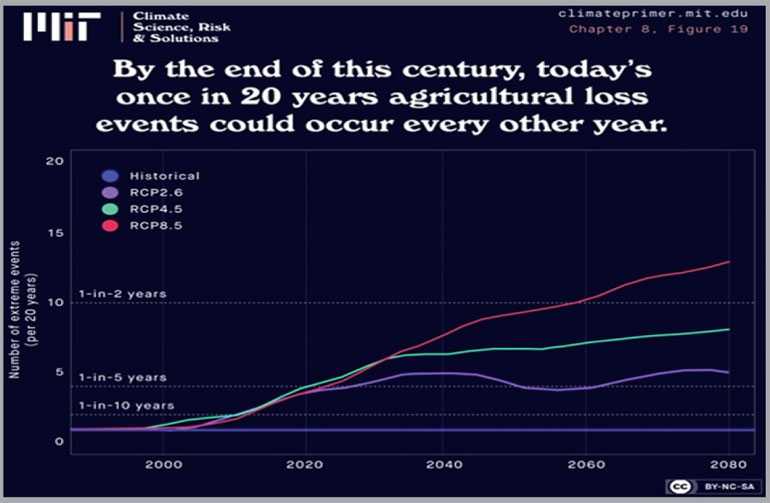

An estimated $ 1 t is required annually for green structural changes. An eightfold increase in annual investment is said to be required for green energy efficiency by 2035. Public, private, domestic as well as foreign investment, therefore, needs to be promoted for this purpose. The financial sector is expected to play a crucial role in accelerating the transformation towards the UN Sustainable Development Goals by mobilising private capital. The financial sector’s association with resolving environmental issues has a long history. In 1972, the Stockholm Declaration also contained recommendations pertaining to financing sustainable development. According to the Bank of England Governor Mark Carney (2015), climate change is the tragedy on the horizon and once climate change become a defining issue for financial stability it may already be too late. The Report of the Intergovernmental Panel on Climate Change on Global Warming (2018) reiterated the need for extremely prompt action to respond to climate breakdown. The graph depicts the rapidness of climate related shocks coming to undermine the Earth’s future.

The COVID-19 global crisis should, therefore, be taken as an eye opener to promote collaborative preparedness for climate change related shocks by all jurisdictions. Understanding the specific risks for the financial system due to climate breakdown is important in this exercise.

Green policies for financial system stability

Mitigating physical risks

Mainly, there are three types of risks linked to climate change. Catastrophic floods, storms, landslides, wildfires, intensification of droughts and other natural disasters cause physical risks by damaging properties, destroying crops and disrupting trade. According to IFC, Sri Lanka will face an estimated 1.2% loss of annual GDP unless appropriate measures are taken to combat climate change. Sri Lanka has been ranked at the sixth most vulnerable country in the Climate Risk Index 2020 by Germanwatch. This highlights the need for urgent action.

Similar to any other entity in the economy, financial institutions also face operational disruptions created by climate hazards. Physical damages to properties may lead to a decline in the value of collaterals and investments putting a strain on the financial system. When severe weather events occur, default risks of agriculture, commercial and real estate loans increase. Fire sale of liquid assets by insurance companies may push down asset prices of other institutions while increasing the cost of funding in financial markets. Accordingly, physical risk eventually becomes a stability risk, as business disruption and capital scrapping lead to financial markets losses and credit losses.

Managing transition risks

Shifting the investments of banks towards the “green and environmentally sustainable category” cannot be done overnight. While green policies are getting heightened attention, asset value of financial institutions may face downside risks. If the journey from high carbon industries to low carbon investments is fast enough, transition risk will be short term.

Exposure to carbon intensive industries and businesses located in extreme weather zones should be given a priority in such portfolio management exercises. Since the effects of climate change are not felt by all countries in an equal manner global coordination has been challenging. Globally consistent policy, is therefore, important to ensure a “just transition” approach.

Tackling liability risks

Providing substantial financing to manufacturing and other activities that intensify climate change might lead to legal and reputational risk for financial institutions. Credit risks of banks will also be increased when corporate clients face professional liability cases in the event of failures to mitigate damages to the environment. The decision taken by Credit-Agricole Bank to curb financing new coal thermal power is an example of managing liability risk. The accountability and governance frameworks of financial entities should, therefore, be strengthened to exercise due diligence over adherence to environmental regulations by customers. Improved transparency of information related to carbon intensity investments is crucial in executing such risk management practices. Policy formulation by governments to promote green projects and credible business models by private sector institutions will enable financial entities also to direct their investments towards greener conduits.

Stress testing methodologies need to be redesigned to include more relevant scenario analysis to measure macro-financial consequence of climate change. These can be either climate change-oriented standalone tests or the scenarios incorporated into existing stress test regimes. Information derived from a robust stress test would be helpful in capital planning processes, imposing credit caps, deciding risk weights and credit flows.

Empowering financial institutions to withstand climate related shocks

Financial regulators have formulated various policies to mitigate risks emanating from climate related shocks that undermine financial system stability. The Network for Greening the Financial System, formed in 2017, is one such international initiative. The Central Bank of Sri Lanka (CBSL) has also launched a Roadmap for Sustainable Finance with a view to guiding financial institutions to manage environmental, social and governance risks associated with projects funded by them.

CBSL Senior Deputy Governor Dr. Nandalal Weerasinghe has explained that from the monetary policy perspective policies may be developed to have the Central Bank’s own climate risk assessment and ensure that such climate risks are appropriately reflected in the Central Bank’s collateral frameworks and asset portfolios. According to the Prudential Regulations Authority (PRA), UK, governance, risk management, scenario analysis and disbursement should be the key strategies to be adopted by financial firms in managing risks arising from climate change.

Introducing appropriate macro prudential regulations developed with green tools will help promoting a low carbon transition and financial stability. Imposing minimum credit floors to green investments and maximum credit limits for high carbon projects is receiving the attention of financial regulators. Credit limits the most appropriate regulatory instrument to address material climate-related risks (Schoenmaker 2016).

Introducing exposure limits to carbon-intensive sectors and acceptance of ‘Green Certificates’ as a part of commercial banks’ legal reserves are also macro prudential tools that can be used in this regard. The Advisory Scientific Committee of the USA (2019) suggests higher risk-weighted bank capital requirement for assets that are sensitive to the price of carbon.

In tandem with financial regulatory policies stimulus packages introduced in the context of the COVID-19 pandemic can be used to influence businesses to focus on an environmentally sustainable path. Efficient inter-agency collaboration is crucial in implementing these green finance policy agendas. The Green and Sustainable Cross Agency Steering Group established by the Hong Kong Monetary Authority is such an example.

The Sri Lanka Banks’ Association has adopted 11 voluntary principles to execute sustainable financial commitment. This conducive platform can be leveraged to Integrate climate related risks into financial stability monitoring and supervision.

Green finance instruments

Green banking, green debt markets, green structured funds, community-based green funds and carbon market instruments are seen as key instruments under the ‘green finance’ theme.

Environmental and biodiversity funds facilitate biodiversity conservation projects. Weather derivative is an innovative product used to handle the negative financial losses caused by climate change. Nature linked securities and green investment funds offer environment-friendly sustainable investment opportunities. Debt for environment SWAPS are agreements entered into between a creditor country and a less developed country to exempt the debt of the latter, if it provides funds for preserving the environment. These funding avenues need to be explored by the governments under external financing mechanisms.

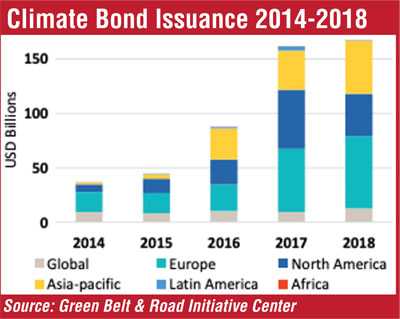

Green bonds are an instrument which have recorded a rapid increase. The European Investment Bank issued the first global climate awareness bond for financing its renewable energy projects in 2007. It is a financial innovation that facilitates sustainable investment of institutional investors, such as pension funds, sovereign wealth funds, insurance companies and mutual funds. However, credible guidelines and standards accepted by financial markets, clearly indicating criteria for green investments are needed to improve the green bond market and accomplish green finance objectives.

India has tapped the green bond market in collaboration with the World Bank and IFC. With the help of the Commonwealth, Jamaica secured $ 500,000 through the first-ever Caribbean green bond, in 2019, and Indonesia also issued a Green sukuk bond. It might be worthwhile exploring this for Sri Lanka too, particularly as the country is ranked as a highly vulnerable country to climate change.

Improved digital platforms being adopted by financial institutions during the current pandemic can also be used for fostering fintech products which would bridge conventional banking with green finance initiatives to achieve SDG goals. ‘Green fintech’ has already been introduced by counties like Singapore and the UK.

Challenges to sustainable finance

Like any other policy framework, green financing is also confronted by many challenges. The lack of adequate funds i.e. ‘the green finance gap’ is the main constraint. There are arguments that existing investment processes, accounting frameworks and financial regulatory regimes impede aligning the finance sector with sustainable finance roadmaps.

The absence of a specific definition regarding the ‘green; component of an investment, maturity mismatches between long-term green investment and short-term demands of investors and false claims of environmental compliance called ‘green washing’ also act as hindrances. It is, therefore, important to have an internationally-agreed-upon regulatory framework as advocated by the Financial Stability Board Task Force on Climate Related Disclosures pertaining to the commonly defined taxonomy or disclosure framework to enable national regulators to impose appropriate country specific rules.

Conducting comprehensive public awareness is also significant in encouraging the embracing of green business products and to change consumer behaviour.

Using the health emergency to prepare for the climate emergency

Economic recession, triggered due to the COVID-19 pandemic, has exacerbated the challenges to green finance. Mitigating climate related financial risks is, however, an inevitable and inescapable reality. An internationally consistent cohesive national policy on climate change, which promotes disclosure of information and enforcement action, will be significant for a smoother and just transition towards a lower-carbon economy. Existing macro prudential tools can be used innovatively by the regulators to make policy frameworks green enough for decarbonising banks’ balance sheets. Efficient collaboration among regulators, energy experts, environmentalists, economists and financial industries is imperative in balancing green transformation with keeping the safety and soundness of financial entities intact. Regulatory, financial, public and environmental policies need to be better coordinated to create a conducive playing field to internalise environmental externalities.

Green finance can manage environmental risk and flow of funds effectively through an efficient market mechanism. Capacity building of financial institutions for proficient green lending by integrating sustainability factors into portfolio management is another vital requirement. More engagement of high-income countries in green finance policies is crucial as the adverse impacts of their unsustainable policies are disproportionately borne by low income countries.

Lockdown periods have given us opportunities to experience a cleaner and greener environment. Low carbon habits we practice during this calamity, such as reducing motor traffic and minimising paperwork should be continued paving the way for a green economic recovery. Stimulus packages that are being introduced need to steer the development agenda in a sustainable direction without locking in carbon intensive projects focused on short or medium term growth targets. Postponing the fight against climate change till the end of the COVID-19 pandemic will trap the world in a more disastrous crisis. The COVID-19 pandemic taught the world to expect the unexpected. Therefore, the current health emergency should be used as a foundation to address the future climate emergency proactively by embedding sustainability in mainstream policy making. Green finance should, therefore, be a key priority in the post-COVID-19 recovery planning. Only when the last tree has died and the last river been poisoned and the last fish been caught will we realise we cannot eat money – Cree Indian Proverb.

(The writer is Deputy Director, CBSL, Attorney-at-Law, and can be reached via [email protected]. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)