Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 24 December 2020 00:00 - - {{hitsCtrl.values.hits}}

While recognising the difficulties in repaying Government debt in the face of the pandemic-related economic setback and the country’s already heightened debt burden, it would be rather inappropriate to simply use money printing to finance fiscal deficits in Sri Lanka following the MMT, which is used as a means to boost aggregate demand in advanced countries

The notion that a sovereign government can print money to repay its debt without any financial limit has gained increased popularity in recent times, particularly in the US, based on a new approach to macroeconomics, known as Modern Monetary Theory (MMT).

The notion that a sovereign government can print money to repay its debt without any financial limit has gained increased popularity in recent times, particularly in the US, based on a new approach to macroeconomics, known as Modern Monetary Theory (MMT).

It was developed in a small corner of academia and it became famous when some US politicians endorsed it, reinforcing their own accommodative monetary policy viewpoints. MMT is now gaining attention in developing countries too, as money printing is a convenient way to finance the budget deficits in the context of revenue shortfalls amidst the COVID-19 pandemic.

Central Bank’s tendency towards MMT

On similar lines mentioned above, Central Bank Governor Prof. W.D. Lakshman is reported to have stated at a recent economic forum that domestic currency debt in a country with sovereign powers of money printing is not a huge problem, as the modern monetary theorists would argue. Since rupee-denominated bonds are within the ‘sovereign powers’, money could be printed to repay them as indicated by MMT, he argues.

While recognising the difficulties in repaying Government debt in the face of the pandemic-related economic setback and the country’s already heightened debt burden, it would be rather inappropriate to simply use money printing to finance fiscal deficits in Sri Lanka following the MMT, which is used as a means to boost aggregate demand in advanced countries.

Structural constraints

The primary long-run growth challenge faced by developing countries such as Sri Lanka is structural transformation – transition to knowledge-based economy – rather than aggregate demand deficiency. Hence, money printing itself does not promote economic growth, as I explained in a recent column in Daily FT (http://www.ft.lk/columns/Growth-prospects-diminishing-despite-Central-Bank-s-easy-money-policy/4-709567).

In the background of the downward growth path which plunged to negative 5.3% in the first nine months of this year due to the pandemic in addition to the country’s inherent growth constraints, Sri Lanka needs persuasive structural adjustments, rather than liquidity injections, to revive its economy.

Further, it is common knowledge that excessive money growth accelerates inflation. High inflation not only aggravates the twin deficits – fiscal deficit and balance of payments deficit – but also adversely affects the living conditions of the people, particularly those who are in the bottom of the income pyramid.

Developing countries lack international monetary sovereignty

Three MMT proponents, William Mitchell and Martin Watts (both of University of Newcastle, Australia) and L. Randall Wray (Bard College, a private liberal arts college in the US) explain MMT in their textbook titled ‘Macroeconomics’ published in 2019.

According to them, the most important conclusion reached by MMT is that the issuer of a currency faces no financial constraints. Put simply, a country that issues its own currency can never run out of money and can never become insolvent in its own currency. It can make all payments as they come due. As a result, for most governments, there is no default risk on government debt, according to MMT advocates.

MMT works well in advanced countries such as the US or Japan which run debt levels far exceeding their GDP. Such countries can afford to print money continuously, as the hierarchical nature of the international monetary system enables their currencies to perform the fundamental functions of money (i.e. means of payment, unit of account and store of value) on an international scale. Hence, such currencies are known as reserve money, which means that they are acceptable for international transactions.

On the contrary, developing countries such as Sri Lanka are placed at the bottom of the hierarchical structure, as their currencies are unable to perform the functions at international level. In other words, developing countries lack international monetary sovereignty.

Ramifications of money printing

In the case of Sri Lanka, the Central Bank can accommodate fiscal deficits by purchasing Treasury bills directly from the primary market. In turn, the Central Bank prints money equivalent to the value of Treasury bills purchased resulting in a rise in the country’s total money stock. These Treasury bill purchases end up as Central Bank’s net credit to the government (NCG) on the asset side of its balance sheet. This leads to a rise in the monetary base or high-powered money which has multiplier effects on the aggregate money supply and overall liquidity of the economy.

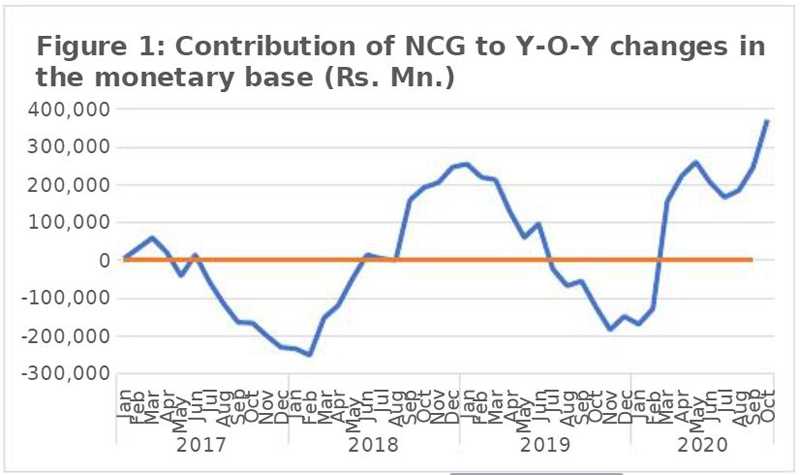

The Central Bank can also accommodate fiscal needs by purchasing Treasury bonds and providing temporary advances to the Government. These too raises the money stock. The Central Bank’s increasing lending to the Government in this manner has had a steep positive impact on the monetary base since the second quarter of this year (Figure 1).

Thus, money printing is a straightforward way to provide lending to the Government by the Central Bank. This does not mean that the Central Bank can continue printing money to finance the budget deficits indefinitely, as suggested by the proponents of MMT. The reason is that an ever-expanding monetary base will have adverse implications for the economy eventually speeding up inflation and causing severe macroeconomic imbalances.

Crowding out effects of domestic borrowings

It is reported that the government intends to restructure public debt so as to change the domestic to foreign debt component from 55:45 in 2020 to 60:40 in 2021. However, continuous increase in borrowings from the domestic market tends to raise interest rates causing difficulties in selling Treasury bills at lower rates.

This is reflected in the recent Treasury bill auctions which were undersubscribed. At the 16 December auction, only Rs. 26.8 billion of Treasury bills were sold out of the total offered amount of Rs. 40 billion, thus resulting in 33% undersubscription. This indicates that the ceiling yield rates pre-determined by the Central Bank at respective auctions are too low to attract the market to fully subscribe Treasury Bills.

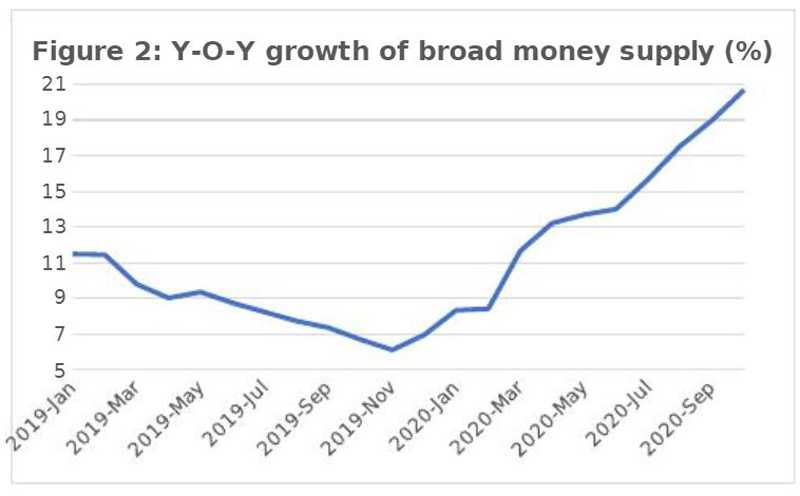

The unsold Treasury bills are usually purchased by the Central Bank printing new money, thus raising the money stock, as explained earlier. As a result, the money supply grew at a faster rate since early this year reaching the peak year-on-year growth rate of 21% by last October (Figure 2).

Excessive reliance on the domestic market to finance fiscal deficits exerts considerable pressures on scarce domestic savings, thus preempting resources from the private sector. While the ‘forced’ administrative ceilings on interest rates help to finance the fiscal deficits at low cost, they tend to create an environment of ‘financial repression’ characterised by low savings, further widening the investment-savings gap which is detrimental to economic growth.

Macroeconomic instability threats of MMT-style monetary policy

The recent monetary expansion points to imminent dangers in adopting MMT-style monetary policy in a country like Sri Lanka, though such policy stance might be unavoidable amidst the unprecedented economic setback caused by the COVID-19 pandemic.

MMT completely ignores the critical importance of ensuring macroeconomic balances which is the very foundation of mainstream macroeconomics developed by leading economists over decades. MMT rests on the assumption that a government can simply finance its budget gap by printing money using the sovereign power, unlike an individual borrower who does not have such divine power.

Given the risks of exchange rate depreciation, weakening export competitiveness and capital outflows, MMT policies are bound to put developing countries like Sri Lanka in extremely vulnerable positions. High inflation emanating from the rising money supply weakens export competitiveness and encourages imports further widening the balance of payments deficit, unless the exchange rate depreciates adequately to compensate for inflation.

Hence, prudent monetary management linked with disciplined fiscal policy needs to be planned for the medium and long-run, phasing out the current expansionary monetary policy stance. Structural adjustments are crucial in this process though they seem to be neglected in current policy discussions.

(Prof. Sirimevan Colombage is Emeritus Professor in Economics at the Open University of Sri Lanka)