Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 18 February 2019 00:46 - - {{hitsCtrl.values.hits}}

The matters referred to in the article under this title published in the Daily FT (15 February) are spotlighted in more detail under this scrutiny. While the general attention of the public remains more focused on recently arrested underworld kingpins and drug dealers, leading media institutions in electronic as well as in print owe a great appreciation from the financial sector for highlighting the serious transgressions of this group of companies with foreign investments operating in strategic business fields.

The affairs of listed public companies cannot be kept concealed from the public. When the shares are publicly traded on a stock exchange, financial information in respect of such listed companies is published by the Stock Exchange. Media focus on this aspect become extremely important for the public to be aware of the scope and activities of companies so listed. Hence it is relevant and appropriate to focus attention on the case and the issues underlying.

Serious state of affairs

The state of affairs of this business organisation extends much deeper into the public domain due to various related issues.

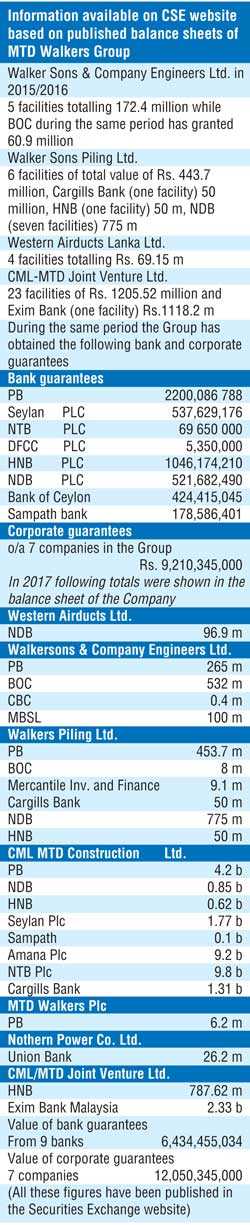

Firstly, several leading commercial banks in the country are involved in a big way in the reported financial fiasco. The list of banks includes all the prime banking institutions of the country along with the two leading State banks, People’s Bank and the Bank of Ceylon.

Secondly, the transacted amounts now fallen into high credit risk category are very high for any private lending in the banking field according to our country standards.

Thirdly, the business engagements of the Group cover a very wide span of activities in the discipline of engineering both in and outside Sri Lanka.

Fourthly, the companies have been dealing with some strategic government contracts of very significant magnitudes, directly and indirectly.

Lastly and not in the least, some of the personalities associated in the affairs of these companies have been holding high positions in topmost State institutions directly connected to the impugned deals now exposed, thanks to the media which stood above the personal interests in contrast to normal passive submissions by most others in the industry.

Banks fall prey

The role of the banking institutions fallen prey to the immoralities and monkey businesses as revealed under this episode appear to be due to influences exerted on them by some personalities whom they held in high esteem due to the positions they were holding.

The total reported liability exposure of the four banks BOC, PB, Sampath and NTB is in the region of 13 billion. It is also known that four other banking institutions, namely, Commercial, Seylan, DFCC and NDB, have resorted to legal steps to recover defaulted amounts due to them.

According to the information released by the Colombo Stock Exchange the total direct liabilities of this Group stand well above 17 billion and if proper assessments are made on potential risks arising out of pending indirect liabilities, this value would increase further. Hence this matter should receive the attention of all including the Government and in particular the Ministry of Finance.

What did the banks do?

In lending to companies, banks normally take a look at their balance sheets before accommodating a facility. They will have a clear idea of all the obligations and other liabilities of a company by this process. According to the balance sheets of this Group available in the website of the CSE it is clear that the company has been borrowing from almost all local banking sources available in the country. And strangely the bad residue is confined to the local banks.

It appears that none of these banks have made a proper assessment of the business activities of this company and their other borrowings before approving the facilities. All banks are expected to know before dealing with a company its dealings with persons outside the company, powers of the directors and the details of company assets they are planning to mortgage in respect of the proposed facility.

Proper securitisation of any advance before granting is a prime responsibility of a banker. Bankers have many different kinds of securities they can requisition as adequate cover for any advance. In the case of companies, stocks and shares are considered as securities in addition to or in place of other securities such as guarantees by responsible parties, title deeds, life policies, promissory notes and title to goods or machinery.

Whatever class of security a banker agrees to accept, he will only very rarely advance up to the full market price, but to cover himself against over valuations and market fluctuations, and the loss which may arise owing to a forced sale, will deduct a sufficient margin depending upon the class of security. The big question before us is, have the banks involved applied this criteria for the facilities granted in this instance. Why, if not so?

And if proper securities are taken there is hardly any need for litigation which is only the last resort of the lending banks due to their failure to realise securities or not having any tangible securities. So are all these banks responsible for this omission? Or is it a deliberate commission on the part of the banks due to relaxation of standards due to some complicity or collusion among interested parties? Or can it be the result of some powerful influence exerted on the bankers?

Anyway very soon we will be able to understand these intricacies when the court cases proceed beyond the current stage of enjoining orders. If the Courts attribute the losses to the negligence on the part of the banks, the borrowing company may get off scot-free.

Punish those responsible

The Government of Sri Lanka holds shares in all these banks except NTB either directly through the Treasury or indirectly through other GOSL (public) sources such as EPF, ETF or ICSL. And in the case of BOC and PB they are 100% owned by the GOSL.

Accordingly if there has been any wilful violation of prudent banking practices or negligence on the part of lending authorities (credit line officials and BODs) in approving facilities to this group of companies they will be responsible for causing a loss not only to the share-owning public but even to the GOSL. This means in addition to the penalisation of the defaulters, those who approved these facilities too should be held responsible and punished.

Bank lending involves many follow up actions such as periodic physical inspections of any tangible securities offered, as well as the business activities of the borrower to minimise risks and ensure the smooth functioning of the borrowers’ activities. There are several possibilities under the undue influencing suspected in this case.

Same collateral is offered as security to different banks in the form of secondary mortgages. It may be that the same machinery has been pledged to all the banks as security. Or even the same personnel guarantee offered as security in all instances. If there has been any irregularity or foul play associated with these borrowings all these possibilities are there.

The case of People’s Bank

The case of People’s Bank is exceptionally unique in this context. Jehan Amaratunga has been described as the Executive Deputy Chairman of MTD Walkers PLC and also as a Fellow of the Institute of Chartered Accountants of Sri Lanka in the Bank Annual reports. Amaratunga, while continuing as Executive Deputy Chairman of this company, has been serving as a Director of People’s Bank since 2010. He was overseeing the operation of the MTD Walkers PLC and its subsidiaries as the Country Head of MTD Walkers at the time of his appointment as a Director of the PB. He has served in the following Board sub committees of the PB:

During this period, PB from time to time has approved several bank facilities to many of the companies in the group of MTD Walkers.

Many questionable transactions

It has been publicly alleged that at one stage the total direct exposure of this Group to the PB alone exceeded Rs. 10 billion. Many questionable transactions have been highlighted among those. One glaring instance was the investment of Rs. 500 million by the bank in the Debentures issued by this Group. PB provided a clarification by a letter in August 2018, signed by the then Chairman of the Bank, Hemasiri Fernando, stating that PB invested Rs. 500 m.

In debentures in 2015 issued by MTD Walkers PLC at an interest rate of 9.75 % and that the approval for this investment had been granted after the earnings ratio of the investors were compared. This debenture now remains extended beyond the redemption date due to the financial distress of this company.

Whatever the foresight of those who approved such a ludicrous investment then, time has now proved otherwise and in hindsight it was a folly unbecoming of any prudential assessment of a banker. A decision to invest in a company to which you have lent huge sums for their operations is laughable.

This incident reminds us of a reference made by the Presidential Commission on the CBSL bond scam regarding a statement made by Prime Minister Wickremesinghe to the Parliament on 17 March 2015, viz “…..we consider that the Hon. Prime Minister would have been better advised, if he had independently verified what had happened at the CBSL on 27 February 2015, before making any statement instead of relying on the briefing note and report submitted to him by…” It is now pretty late for Hemasiri Fernando to realise how improper the judgment of his approving officers has been. The danger in such attempts to cover up the faults instead of admitting the truth is that further commitments become unavoidable.

He further stated in the above clarification that loan obtained by MTD Walkers PLC is at present considered to be a performing loan! Well, we are aware that it is not so now. A careful scrutiny one day will certainly reveal that even then it has been a manipulation to maintain the facility in the performing category.

Gross violation of regulatory requirements

All facilities granted to this group by PB fall within the related party transactions. According to the CBSL regulatory requirements, all related party transactions should obtain the Audit Committee approval either prior to the transaction or if the transaction is expressed to be conditional on such approval, prior to the completion of the transaction.

Jehan Amaratunga has served as the Chairman of PB Board Audit Sub Committee throughout his office as a Director of the bank. According to the Code of Conduct stipulated under the regulatory requirements and corporate governance procedures applicable to Licensed Commercial Banks, directors of a bank should ensure they have enough knowledge or expertise to assess all aspects of proposed related party transactions. Where necessary, they should obtain appropriate professional and expert advice from qualified persons. There appears to be a gross violation of this requirement by the entire BOD of the PB in this regard.

Rules governing review and approval of related party transactions by the Audit Committee requires it to recommend the creation of a special committee to review and approve the proposed related party transaction because of conflict of interest issues when a director (in this instance the Chairman) of the Audit Committee is a related party.

In addition to the regulatory requirements of the CBSL, the Securities and Exchange Commission of Sri Lanka has issued special conditions applicable to Related Party Transactions. The facilities extended to MTD Walkers Group by PB appear to have ignored and violated those. Fortunately, it is commendable to note that the CSE has continuously monitored the affairs of this Group and time and again reprimanded them.

The CSE halted the share operations of the Group on 20 September 2018 and 14 February 2019, attributing non-compliance of minimum public holding requirements. Took note of a corporate disclosure of the Rating review BB+ (Negative) to BB-(Negative) on 21 September 2018.

CSE kept this Group in the Watch List category on several occasions from 2018 for various shortcomings and noted with emphasis the failure of the company to pay the principal amount and interest of debentures issued by them maturing in September 2018 which included the investment made by the investment experts of PB.

Accusations and allegations need examining

Minister Ravi Karunanayake, as reported in this paper, blamed the CBSL for allegedly failing to investigate a PB loan of Rs. 4 billion to a Minister and a loan of Rs. 10 billion to Jehan Amaratunga in a statement he made in the Parliament.

However, PB in a statement denied any malpractice or preferential treatment extended to then Director of the Bank Jehan Amaratunga. However, amidst the various allegations levelled against him, Jehan Amaratunga finally resigned from his portfolio as a Director of PB with effect from 31 August 2018.

The accusations and allegations against PB, a leading State bank of the country, on conflict of interest issues, violation of CBSL regulatory requirements, related party transactions, irregular lending operations and overlooking risk parameters stipulated for prudential lending remain to be examined in detail to put an end to this sordid episode.

The BOD and the Credit Line officials who played any role in the alleged transactions will have to establish their innocence of culpability. The Presidential Commission of Inquiry now sitting for finding of irregularities in the SOEs from 2015 onwards may address these issues when representations are made.

(The writer is a former Chairman of Bank of Ceylon, a former President of CBEU and a CMC Councillor.)