Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 8 November 2017 00:00 - - {{hitsCtrl.values.hits}}

One shipload of refined petroleum was rejected because of quality issues. Another was delayed due to rough seas. Rumors and ill-considered ministerial statements caused consumers to want to stock up. Day-to-day activities were affected and livelihoods were harmed.

One shipload of refined petroleum was rejected because of quality issues. Another was delayed due to rough seas. Rumors and ill-considered ministerial statements caused consumers to want to stock up. Day-to-day activities were affected and livelihoods were harmed.

Conspiracy theories abound. Some see an effort to benefit from emergency fuel purchases. Others speculate about efforts to dump poor-quality fuel. Even if we eschew conspiracy theories and speculations, we still have a problem: it’s difficult to get petrol for vehicles and vehicle queues are causing traffic jams. What caused all this?

The larger problem is how we manage risk. In any industry, bad things happen. Suppliers do not deliver; supply lines get disrupted. Every commercial organisation analyses its risks and makes plans to mitigate them. Infrastructure services, which are provided directly by the state or under state authority, pose additional problems. They are essential for the smooth functioning of many other activities. Failure has enormous knock-on effects. One of the biggest challenges facing modern states is how to manage increasingly complex forms of risk. What we are seeing now is how bad we are at this.

The fuel-distribution market (defined as starting from the gate of the storage facility to the pump) is a lopsided duopoly. The market shares are 85% for the state-owned CPC and 15% for LIOC. For the major markets on the west coast of the country, both companies use a Common User Facility (CUF) to store refined petroleum.

The fuel is in the same tanks, but in the books, each knows how much stocks belongs to each. To illustrate, the Kolonnawa facility can store 50,378 MT of 92 Octane petrol and 18,647 MT of 96 Octane petrol. If this were allocated by market share, 43,000 MT of 92 Octane capacity would be for CPC and around 7,000 MT for LIOC. In the case of 95 Octane, around 16,000 MT would belong to CPC and the rest to LIOC.

The CUF is operated by Ceylon Petroleum Storage Terminals Limited (CPSTL), a majority state-owned company. In Trincomalee, LIOC has its own storage facilities. There have been moves to increase storage in Trinco through a joint venture and also to expand capacity in Kolonnawa and Muthurajawala to serve the high-demand markets on the west coast. There are costs to moving fuel from Trinco to the west coast.

Each distribution company purchases its own petroleum products and arranges transportation. But because all the fuel goes into common storage tanks, the Ministry ensures that every shipment meets quality standards.

A shipload of fuel supplied by Total S.A. to LIOC was rejected in October 2017. Total is a French integrated oil and gas company that is one of the seven “Supermajor” oil companies. Once the shipment was rejected, it became the responsibility of Total to fulfill its contractual obligations to LIOC. An offer had been made to filter the fuel in a ship-to-ship operation, with the filtered product still having to meet the quality standards. This offer was rejected by the Ministry.

A ship that was scheduled to arrive in Colombo with fuel supplies for CPC was delayed, reportedly because of bad weather. The delay of two shipments within a short time caused concerns that supplies would not be adequate. Supplies from LIOC’s parent and emergency purchases in the spot market by CPC would still take time to arrive. Demand surged because of rumors and perceptions of the Minister’s statement. Supplies to both CPC and LIOC were rationed at the CUF. Reduced supplies and increased demand led to queues at the retailing points.

An obvious solution is to increase buffer stocks. Much of the discussion around the Trinco tank farm centered on this solution. But keeping stocks is expensive. The Petroleum Ministry has budgeted Rs. 495 million for the construction of a new 15,000 cubic meter tank in Kolonnawa. In addition to capital costs, there are the costs of holding stock instead of selling. It may be expected that CPC’s already high debt levels (Rs. 308.5 billion in 2016 and Rs. 382.5 billion in 2017 Q1) will rise even further if it were to engage in stockpiling.

Given increased motor vehicle imports since 2015 and the resultant increase in fuel consumption, it is understandable that the quantum of stocks should be reassessed. Imports of refined petroleum increased by 17% from 3,321 metric tons in 2015 to 3,885 MT in 2016.

Should the government decree the levels of buffer stocks to be maintained, or should it leave it to the market?

Sri Lanka does not have a competitive petroleum market. State ownership and involvement pervade the entire sector. The dominant supplier, holding 85% of the distribution market also controls the upstream storage and transmission facilities through majority control of CPSTL. The Ministry is policy maker and price setter. There is no independent regulatory authority.

If the market were to be made workably competitive, for example by allowing at least two more additional distributors to reduce CPC dominance and by restructuring CPSTL, decisions regarding buffer stocks and quality may be left to individual distributors under the oversight of an independent regulator. In such a scenario, where the consumers have choice of alternative suppliers, no distributor would want to run out of fuel. There would be no crisis, because customers would simply obtain supplies from competitors. They may come back when supplies return to normal, or they may not.

Given the market power of the operator of the Common User Facility it may be wise to mandate buffer-stock levels. Of course, there is no requirement that all retailers must draw from a CUF. If they are given a ‘build or buy’ option, the market will decide on the most economical solution. Where all retailers of fuel have their own storage facilities, it is common practice in other countries to engage in various kinds of swap arrangements, in normal times but especially in times of supply problems such as we are experiencing now.

Risks cannot be eliminated. But they can be managed well or poorly. Building in redundancy is a solution, but it  has to be balanced against cost. With highly centralised operations such as those that exist in the petroleum distribution market, state involvement in mitigating and managing risk is essential. But the costs will have to be borne by the tax payers because the government does not have money of its own. In a workably competitive market, the risks can be distributed and there would be less need for government involvement.

has to be balanced against cost. With highly centralised operations such as those that exist in the petroleum distribution market, state involvement in mitigating and managing risk is essential. But the costs will have to be borne by the tax payers because the government does not have money of its own. In a workably competitive market, the risks can be distributed and there would be less need for government involvement.

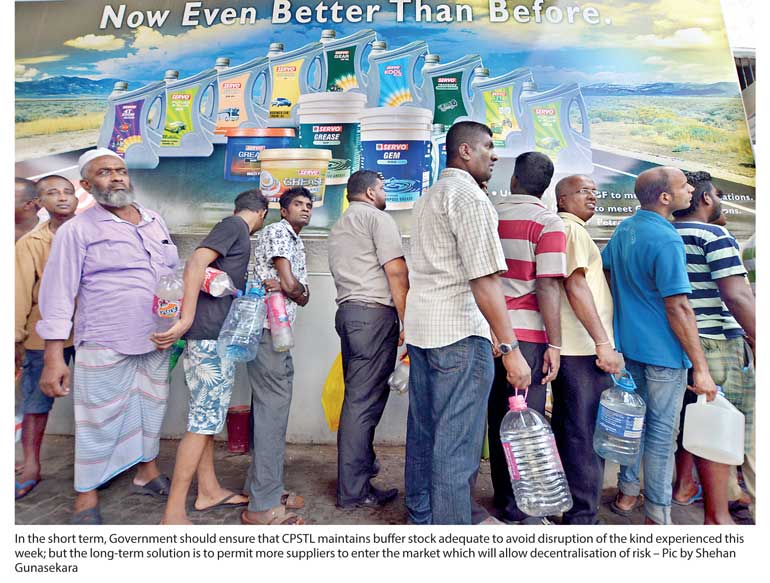

In the short term, the government should ensure that CPSTL maintains buffer stock adequate to avoid disruption of the kind experienced this week. But the long-term solution is to permit more suppliers to enter the market which will allow decentralisation of risk.

In a competitive market, the costs of poor management that results in expensive spot-market purchases will be borne by private companies. In the present centralised market which is pervaded by state control, the costs of emergency purchases will be borne by the taxpayer, who is already looking at Rs. 3.8 billion in losses by CPC just for the first quarter of 2017.