Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 26 June 2018 00:00 - - {{hitsCtrl.values.hits}}

The “pumping-up” of Nominal GDP

In May 2017, a few weeks after the Gross Domestic Product (GDP) figures for 2016 were officially announced, I pointed out how the Real GDP growth for 2016 was blatantly “pumped-up” as well as manipulated by the authorities, and how GDP growth for 2016 was shown as 4.4% when it was a mere 2.2%. My article was carried under the title ‘Rs. 231 billion mega growth scam’ by several mainstream newspapers.

(http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=165173) (http://www.ft.lk/article/615333/The-Rs--231-billion-mega--growth-scam--)

(http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=165173) (http://www.ft.lk/article/615333/The-Rs--231-billion-mega--growth-scam--)

In the article, I detailed how certain dubious and ad hoc adjustments had been made to the Nominal GDP and GDP Deflator figures of several years in order to change the Nominal and Real GDP growth rates in general, and to increase the Real GDP growth rate for 2016 from 2.2% to 4.4%, in particular.

In that regard, I showed how a massive GDP value of Rs. 231 billion which had been originally “accounted” for in 2015, was “shifted” from that year and “attached” to 2016, and how the GDP Deflator was brazenly misused to “adjust” the growth rates for 2014, 2015 and 2016. I also showed how those “creative” adjustments had made an absolute mockery of the computation of GDP in Sri Lanka.

My accusations were met with a deafening silence by the Sri Lankan Government authorities, who strategically avoided a public debate on the issue. The Opposition too did not add pressure to highlight this scam, perhaps because it did not comprehend the strategic importance of this vital issue and perhaps also because, at that time, the bond scam exposure was at its peak and hence they may have been pre-occupied with exposing that fraud and found it difficult to focus on another.

Whatever the reason may be, the “growth scam” foisted on the unsuspecting public and investors up to and until 2017 failed to attract sufficient public attention. That apathy may have led the masterminds of this organised “growth scam” to believe that they have successfully got away with their deception, and convinced them that they could do it again and again. That is probably why the authorities have resorted to their data manipulation practice this year too.

Nominal GDP, Real GDP and GDP Deflator

At this stage, it may be relevant to provide readers a brief understanding of the fundamental technical terms, in order to appreciate more fully, the magnitude of the growth scam perpetrated by these authorities.

“Nominal GDP” is the value of all goods and services produced in a country during a particular period of time (typically a year). Current market prices are used to determine such value, and only “final” goods and services (those consumed by the end user) are included.

“Real GDP” is the value that is arrived at by adjusting “Nominal GDP” for differences in price levels, using a scientifically-computed deflationary factor referred to as the “GDP Deflator”. As would be expected, Nominal values of GDP over different time periods vary due to changes in quantities of goods and services and changes in general price levels. Hence, adjusting for the price levels (or inflation) is necessary, if comparisons across different time periods, are to be made. When reference is made to “economic growth”, it is normally “Real GDP growth” that is referred to, unless specifically stated otherwise.

“GDP Deflator” is an economic measure of inflation which is the factor by which the Nominal GDP is converted to the Real GDP. The GDP Deflator is a vitally important measure in macro-economic analysis, because Nominal GDP includes inflation, while Real GDP does not. Since the GDP Deflator converts Nominal GDP to Real GDP, it is often considered a more accurate measure for price inflation, and Economists generally prefer this ratio because the GDP Deflator is not based on a fixed basket of goods and services which could change with people’s consumption and investment patterns, unlike pure price indices (e.g., Consumer Price Indices).

In fact, in the case of the GDP Deflator, the “basket” for each year is the total set of all goods that are produced domestically, weighted by the market value of the total consumption of each of such goods. Naturally therefore, the GDP Deflator, like the values for inflation, is an economic measure that needs to be computed with utmost care, consistency and professionalism, and is not a measure that should to be trifled with, or changed at anyone’s whims and fancies, or for collateral political purposes.

The background and anatomy of the “growth scam”

Over the past three years, under the so-called “Good Governance” regime, the GDP Deflator has become a widely fluctuating macro-fundamental, and Tables1 to 6 clearly reveal that the GDP Deflator and the Nominal GDP figures have been liberally adjusted (nay, manipulated), to change the GDP growth figures for 2014, 2015, 2016 and 2017,with gay abandon.

Nevertheless, those same authorities who have been quick to arbitrarily “adjust” the value of the GDP Deflators, have been cunning enough to maintain the Colombo Consumer Price Index (CCPI)figures without change, probably because they would have surmised that any change to the more familiar “inflation rates” would have led to undue attention towards their Scam.

It must also be stated that, when considering the scale and magnitude with which this scam has been set in motion, it is very likely that the top Government leaders would have given their blessings to the effort to “massage” the GDP figures, in order that the GDP and other numbers appear somewhat respectable, knowing fully well that it was not. As is obvious, it would have been mainly in the government politicians’ sinister interest to do so, since it is mostly those politicians who would have had the motive to portray a robust growth to gain political mileage, and not the technical officials who are mere compilers and analysers of the data.

This high-level political involvement seems highly probable, particularly because the entire country has already seen how a certain Government politician took it upon himself to “announce” the re-based figures with great vigour, thereby gathering some political kudos upon himself and his political party. That attitude suggests that the subsequent “pumping-up” of the GDP figures from 2015 to 2018 would also have been carried out with the knowledge, blessings and active support of the political leaders who would have wanted to show-off “window-dressed” benign figures that are far better than the pathetic, distressing results at the ground-level. Accordingly it is likely that this scam has been carried out by a “Growth Manipulating Team”, possibly consisting of one or two political masterminds and a few key officials from the institutions responsible for the collection, analysis and dissemination of the economic data. In that context, reference would be made to such group as the “Growth Manipulation Team” hereafter. As would be observed from this article, the “Growth Manipulating Team” seems to have commenced the “growth scam” as described, with the “re-basing of GDP” exercise in July 2015. Thereafter, they have continued the series of scams to routinely adjust the GDP growth figures in successive years, arbitrarily adjusting the Nominal GDP numbers and the GDP Deflator with utter contempt to the sanctity of these values.

Manipulations to 2014 figures

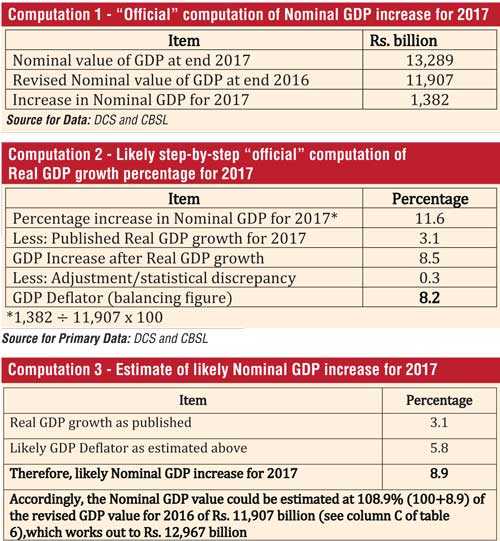

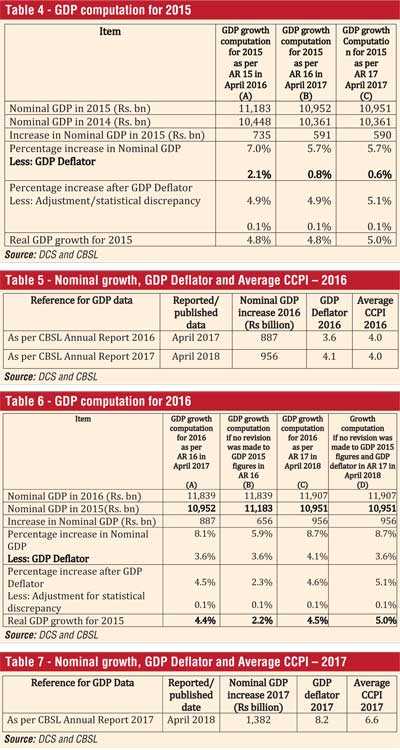

As could be seen from Tables 1 and 2, the Nominal GDP growth and GDP Deflator for 2014 have been changed by wide margins, four times in three years!

(Please note that in the Tables, “AR” refers to the “Central Bank Annual Report” for the relevant year).

As per Tables 1 and 2, the “Nominal GDP increase” for 2014 was first reported in April 2015 as Rs. 1,111 billion. Just three months later, in July 2015, with the “Re-basing” exercise, the “Nominal GDP increase” for 2014 was revised downwards by a massive 37%, showing the increase as only Rs. 700 billion. These new figures were announced to the world by a Government Minister Harsha Silva, who created political history by being the first politician to announce the Department of Census and Statistics’ figures. While making this bit of dubious history, Silva also claimed that the GDP value for 2014 was previously “over-stated” by a value of Rs. 411 billion, and that it has now been rectified. However, nine months later, in April 2016, the authorities increased the “Nominal GDP increase” for 2014 by another 22%, and claimed that the increase was now Rs. 856 billion. Unashamedly, 12 months later, in April 2017, the authorities revised it once again, claiming that the “Nominal GDP increase” for 2014was lower by 10% than the previously stated figure, and that it was Rs. 769 billion only.

In a similar exercise, with equal impunity, the GDP Deflator for 2014 was reduced by a staggering 40% from 5.1% to 2.8% citing the “Re-basing” exercise. While doing so, Minister Harsha Silva gleefully announced that the GDP growth in the year 2014 was only 4.5% and not 7.4% as reported by the DCS and the Central Bank just three months earlier! By Silva personally announcing the “re-based” figures, he unwittingly revealed the political hand that was behind the GDP growth revision exercise.

Unfortunately for Silva, the political points he thought he scored by lowering the GDP growth figure of the previous regime was short-lived. By April 2016, Silva and his colleagues would have realised that the first year of the “Good Governance” Government was an unmitigated economic disaster, and that “growth” for 2015 was highly sluggish. That realisation probably prompted the regime (which by then had been widely-known for its unprecedented corrupt practices in relation to the sordid bond scam), to take some risky measures to conceal the true situation of the stunted economic growth, from the public.

Consequently, in keeping with their practice of deception and cover-up as exercised in the bond scam, the authorities seem to have revised the GDP Deflator to 3.9% in April 2016 and to 2.9% April in 2017, in order to maintain the Real GDP growth rate for 2014 at a somewhat consistent figure of around 5%, after the notorious “Re-basing” in July 2015. Those arbitrary changes to the GDP Deflator were obviously done so as to show the Real GDP growth rate at a somewhat constant figure, since changing that figure by large margins would have drawn attention towards their nefarious scam of “doctoring” the GDP growth figures for the succeeding years.

All in all, the “Growth ManipulatingTeam” changed the GDP growth figure for 2014 from 7.4% to 4.5% to 4.9% to 5.0%. By doing so, they possibly set a dubious world record of an economy having four different GDP growth rates for a single year! (See Charts 1 and 2).

Manipulations to 2015 figures

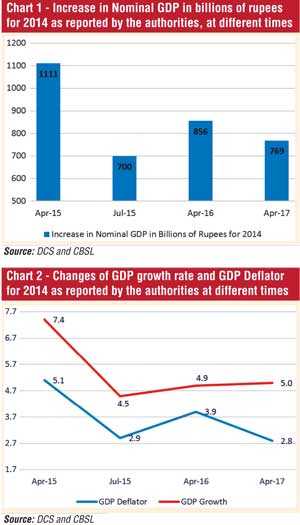

The GDP growth figures for 2015 too, suffered a similar fate as that of 2014, and were changed three times in two years with equal impunity, as could be seen from Tables 3 and 4.

From the Tables 3 and 4, it would be noted that the “Nominal GDP increase” for 2015 was first reported in April 2016 as Rs. 735 billion. One year later, in April 2017, the “Nominal GDP increase” for 2015 was revised downwards by a massive 20% and stated as Rs. 591 billion. The next year, in April 2018, the increase was further revised down to indicate Rs. 590 billion. The GDP Deflator was treated with equal disdain, with the GDP Deflator for 2015 being first reported in April 2016 as 2.1%. Thereafter, it was revised to 0.8% in April 2017, and once again revised to 0.6% in April 2018.Through all these fluctuations, the CCPI remained constant at 0.9%, as done in 2014 as well.

On a closer examination, it would be noted that with the application of the adjusted GDP Deflator, Real GDP growth for 2015 was maintained almost miraculously by these “Growth Manipulating Authorities” at the previously announced figure of 4.8%, even after the “Nominal GDP increase” for the year 2015 had been revised downwards by a massive 20%.(See Charts 3 and 4)

Manipulations to 2016 figures

By early 2017, the “doctoring” of figures had obviously become quite routine for the “Growth Manipulating Team” and they seem to have resorted to that practice and altered the GDP figures for 2016 twice, in two years.

In that context, the “Growth Manipulating Team” would have initially computed the GDP Nominal value at end 2016, and arrived at a value of Rs. 11,839 billion. Further, since the GDP Nominal value as at end 2015 was Rs. 11,183 billion they would have realised that the Nominal GDP increase was a value of Rs. 656 billion only. They would have also noted that values would have delivered a Real GDP growth of 2.2% only. (See Column B of Table 6).

However, the political masterminds would have known that publication of such a low growth value would have been an unmitigated political disaster and would have therefore wanted that figure “adjusted”. Hence, the “Growth Manipulating Team” casually reduced the GDP value in 2015 to Rs. 10,952 billion, and simply shifted Rs. 231 billion of GDP from the year 2015 to 2016. On that basis, growth for 2016 was conveniently recorded at 4.4% (see Column A of Table 6).

Through that exercise,(as could be seen from Column A of Table 5),the “Growth Manipulating Team” was able to show a high GDP growth figure for 2016, based on the artificially “pumped-up” “Nominal GDP increase” for 2016 of Rs. 887 billion, in April 2017.

However, a year later in April 2018, the needs of the “Growth Manipulating Team” changed, as they would have then wanted to increase the Nominal GDP for 2017 by an extraordinary value to “pump-up” the GDP growth for 2017, so that they could show an artificially high GDP Per Capita in 2017.

In order to do so, the “Growth Manipulating Team” created a massive “Nominal GDP increase” of Rs. 1,450 billion, and since that figure would have appeared to be abnormally high, they shifted a part of the increase (amounting to Rs. 68 billion) backwards to 2016. Accordingly, the Nominal GDP increase for 2016 was further increased to read as Rs. 956 billion, in 2018.

However, after “pumping-up” Nominal GDP for 2016 by this value of Rs. 68 billion, the “Growth Manipulating Team” would have been then faced with the dilemma where the Real GDP growth for 2016 would have risen to around 5% (see Column D in Table 6). Such a revision would have obviously generated a great deal of suspicion, and that is why the “Growth Manipulating Team” would have increased the GDP Deflator to 4.4% for 2016 while reporting the changed figures in April 2018. But that simple, inconspicuous action, they were able to maintain the previously published GDP growth figure of 4.4% for 2016, with little attention being focussed on the change. (See Column C of Table 6)

Manipulations to 2017 figures

As mentioned earlier, it is likely that by the end of 2017, the “Growth Manipulating Team” would have been highly-distressed by the humiliating reality that the country’s GDP in USD and consequently the GDP Per Capita in USD was stagnant for three years in a row. i.e., from the time the much-hyped “economic experts” of the Good-Governance Government had come in to power.

Therefore, the political leadership would have wanted the “Growth Manipulating Team” to find a way to show a reasonable upward movement in the GDP Per Capita. In keeping with that need, the team would have been searching for some method to show economic progress. Hence, the desperate “Growth Manipulating Team” seems to have drummed up sufficient courage to artificially “pump-up” the Nominal GDP for 2017of the stagnant Sri Lankan economy by a hefty Rs. 1,450 billion, although such an increase, in the context of the subdued economic activities in 2017, seemed impossible to justify.

Even so, the desperate “Growth Manipulating Team” would have had no choice but to take that risk, as they may have been under orders to achieve that dubious objective by whatever means possible. After carrying out that initial task of artificially boosting the GDP however, they would have realised that, as a consequence of “pumping-up” the GDP increase by such a large value, they were now saddled with the prospect of reporting an unrealistically high Real GDP for2017. That was particularly because the average CCPI inflation for 2017 was at a modest 6.6%, which would have meant that the GDP Deflator based on that value would have been relatively low.

Hence, the “Growth Manipulating Team” seems have worked out another ruse to “cover-up” the effect of the artificially high Nominal GDP increase generated by them for 2017, in two steps:

First (as already stated) the authorities shifted a part of the abnormal increase of GDP value applicable for 2017 by “adjusting” the start point for the GDP values for 2017, which is the end point in 2016. In that regard, the Nominal GDP for the previous year (2016) was arbitrarily increased by Rs. 68 billion: Rs. 11,839 billion inexplicably increased to Rs. 11,907 billion. (See Column C of Table 6)

By doing so, they reduced the “Nominal GDP increase” applicable for 2017 at the “starting point”, since they shifted a part of such Nominal GDP value backwards, to the year 2016.That adjustment reduced the Nominal GDP increase applicable for 2017 to Rs. 1,382 billion. Even so, the GDP value for 2017 was still the highest-ever Nominal GDP growth recorded in Sri Lanka, while Real GDP growth was known and felt by all stakeholders as being the lowest in several decades.

Thereafter, the “Growth Manipulation Team” took the second step in that they set the GDP Deflator for 2017 at a phenomenally high rate of 8.2%, throwing caution to the winds. They would have done so because if they were to deliver a credible Real GDP growth rate of around 3%(they had settled at 3.1%) for 2017, they had no choice but to raise the GDP Deflator to an unrealistic level: that was because all stakeholders were fully aware that 2017 was a sluggish year, and if the authorities were to report a Real GDP growth figure for 2017 that was substantially higher than 3%, that would have aroused a great deal of suspicion.

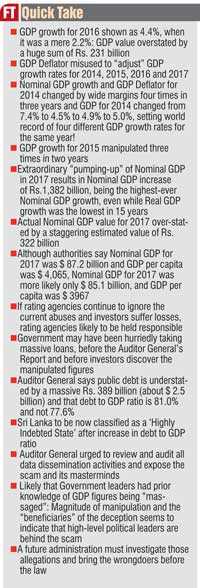

In that background, the “official” Real GDP growth computation would have been “constructed” as shown in Computations 1 and 2.

In this context, it would be noted that the “Growth Manipulation Team” seemed to have cleverly but cunningly kept the selected “Real GDP Growth” for 2017 figure of 3.1% as a constant, and “constructed” the other figures and values, around that number.

In the above manner, the authorities were able to deliver a GDP in USD at an artificially “pumped-up” value of $ 87.2 billion (based on the USD conversion rate of Rs. 152/40 per USD) to the satisfaction of the “Growth Scam Masterminds”. Such enhanced GDP value, in turn, was able to deliver the GDP Per Capita in USD at a figure of $ 4065, which would have been the result that the devious “Growth Scam Masterminds” would have been aiming for.

It should now be clear that the GDP Deflator for 2017 which has obviously been “picked” by the “Growth Manipulating Team” was the “balancing” number that suited their collateral purpose.

However, if a more realistic GDP Deflator for 2017 which would be consistent with the rest of the macro-fundamental indicators were to be estimated, it may be useful to establish the “connection” between the “GDP Deflator” and “CCPI inflation” during the past two to three years, in order to ensure some consistency and rationality.

When examining the relationship between the GDP Deflator and the CCPI over the years 2014, 2015 and 2016, the average proportion seems to be close to the result derived in the year 2014. In that regard, it would be noted that the GDP Deflator for 2014 had been settled at 2.9% in 2017, when CCPI inflation for that year was 3.3%. Assuming therefore, that such proportion would be reasonably applicable for the year 2017 as well, it follows that when the CCPI inflation in 2017 is 6.6%(double that of the 2014 CCPI inflation), the GDP Deflator for 2017 could be reasonably assumed at around double that of the 2014 CCPI inflation, which then works out to a value of 5.8%. Assuming further, that the Real GDP growth at 3.1% was accurate (as such GDP growth for 2017 seems to be somewhat consistent with other macro-economic data), the Nominal GDP increase percentage for 2017 could then be estimated as per Computation 3.

On that basis, it would be seen that the Nominal GDP value for 2017 has been substantially over-stated by a value of Rs. 322 billion, when compared with the “pumped-up” Nominal GDP value for 2017 of Rs. 13,289 billion which was announced by the authorities.

It follows therefore that, if the more realistic Nominal GDP value at the end 2017 was Rs. 12,967 billion, the Nominal GDP in USD terms would have amounted to $ 85.1 billion, which then suggests that the GDP Per Capita in USD would be $ 3,967.

Auditor General’s bombshell suggests that manipulation of figures is rampant

On 31 May 2018, the Auditor General dropped a bombshell on the Government’s published financial statements by reporting that the country’s Public Debt as at the end of 2017 was Rs. 10,702 billion, and not Rs. 10,313 billion. On that basis, the Public Debt was revised upwards by the Auditor General in a staggering sum of Rs. 389 billion. The Auditor General also asserted that the Debt to GDP ratio for 2017 was not 77.6% as reported by the authorities, but 81.0%, which then placed Sri Lanka in the category of “Highly Indebted States”, by way of its ranking on indebtedness.

At the same time, it will be noted that the Debt to GDP ratio had been computed by the Auditor General on the basis of the official Nominal GDP value as at end 2017 of Rs. 13,289 billion which was the “pumped-up” figure. However, if the more realistic Nominal GDP value (as now worked out as per Computation 3) of Rs. 12,967 billion was applied, the Debt to GDP ratio would further increase to 82.5%.

Declining Debt to GDP ratio would lead Sri Lanka to being categorised as a “Highly Indebted State”

It would be noted that the more accurate and realistic Debt to GDP ratio of 82.5% would be nearly 5% higher than the ratio announced to the public and investors by the Sri Lankan authorities.

Quite naturally, if the public and investors realised that the true Debt to GDP ratio was 82.5%, the opinion that they would have formed of Sri Lanka and its economy would have been entirely different to the opinion that they would have formed when the ratio was reported as 77.6%. It is therefore vital that, even at this late stage, that the multi-lateral agencies and international rating agencies respond to this situation, since hundreds of investors in Government securities, international sovereign bonds and Sri Lanka development bonds who have invested billions of rupees and dollars, would have been guided by the figures released by the official authorities, when making their investment decisions.

Already, the present Sri Lankan authorities have delivered a massive shock to the economy via the terrible bond scam and its top level cover-up. In that background, the damage that is now inflicted on the economy by this shameful growth scam could be described as yet another serious blow the Governmental authorities have dealt upon Sri Lanka’s now struggling economy. Therefore, unless this growth scam is stopped forthwith, accurate and credible figures re-stated, and data integrity is restored (even if the truth is a bitter pill for this corrupt Government to swallow), the long-term and permanent damage to the economy cannot be avoided or minimised.

In the meantime, the present Sri Lankan authorities must be held responsible for damaging and destroying the data integrity of the nation, by their foolhardy and selfish political adventures which have inflicted immense damage to the country’s international reputation.

A more proactive role needs to be played by the international rating agencies

As mentioned earlier, details of the “Rs. 231 billion growth scam” had been in the public domain since May 2017. Inexplicably, the rating agencies did not give any consideration to this exposure. More than anyone else, rating agencies know that a scam involving a country’s economic growth numbers would materially affect the validity of that country’s macro-economic indicators, which in turn, would have a material impact on the credit evaluation of the country. Further, had these agencies observed the patterns of presenting of GDP data by the official authorities, they would have realised that a substantial degree of manipulation has taken place, which should have prompted them to follow up on those allegations before the Sri Lankan Credit Rating and Outlook were confirmed. At the same time, the rating agencies and investment banks must be already well aware of the unprecedented bond scam and the intensity with which the top politicians of the present Government have indulged in a disgraceful “cover-up exercise” of unparalleled proportions.

In that background, it would not have been unreasonable for the rating agencies to surmise that a similar “cover-up” of the economic deterioration could also be attempted by the same corrupt authorities, by rigging the GDP and other economic data. In any event, the rating agencies must surely be possessing bitter past experiences where countries in economic distress have doctored their data in order to conceal the true position from the rating agencies and investors. That knowledge too, should have served as a warning to them to exercise greater caution in the case of Sri Lanka under the present “Good Governance” Government.

Notwithstanding the above stated ground conditions which should have put these agencies on guard, it is very strange as to why the rating agencies had decided to overlook these data abuses and continued to condone those dubious practices. In that background, it would not be unreasonable to expect these rating agencies to be called upon to account for their behaviour at some future date, if, as a result of their neglect, investors suffer losses.

Even at this late stage, in their own self-interest, the rating agencies would do well to forthwith undertake a serious review of the entire data computation and publication practices of the Sri Lankan data authorities. If they do not do so, it is likely that the rating agencies would someday be open to some serious damages claims by investors who have relied on the credit ratings as furnished by these international agencies when investing in the Sri Lankan Government Securities and other instruments.

Further, after this detailed exposure, if the rating agencies, investment banks, and the joint lead managers who have so far managed the international sovereign bond issues for the Government continue to bury their heads in the sand like the proverbial ostriches and pretend that all is well, they would have only themselves to blame, if and when these manipulations are finally confirmed after investigations, and investors hold them responsible for neglecting to alert them.

Government seems to have embarked on a hurried “borrowing spree” before the Auditor General’s strictures were made public

In April and May 2018, the Government has been on a borrowing spree of unprecedented proportions, with borrowings of $ 2.5 billion in international sovereign bonds and $ 1.0 billion in syndicated loans, which works out to over Rs. 550 billion.

Coincidentally, these loans were obtained just days before the controversial GDP figures and the Auditor General’s Report on the Government’s financial statements were made public. Needless to say, had the information as detailed above been with the prospective lenders before they made such investments, there may have been a reluctance on their part to provide loans to the Government, or, even if they did, they may have demanded a higher interest rate. Therefore, allegations may well be levelled at the Sri Lankan authorities that those loans in April and May were hastily procured because the authorities wanted to secure such loans before investors could learn about the emerging dubious figures in general, and the strictures of the Auditor General, in particular.

Auditor General is bound to follow up on this scam, and conduct his own investigations

The present Auditor General Gamini Wijesinghe has displayed a laudable sense of responsibility, transparency and independence, by unambiguously and courageously reporting his forthright Opinions and comments in relation to the Government’s financial statements. His recent opinion with regard to the country’s debt position as at 31 December 2017 was indeed praiseworthy, as he set out the true position of the Public Debt as well as the corresponding Debt to GDP ratio. In this background, it is hoped that the Auditor General will initiate a special investigation into this “GDP growth scam” and reveal to the country, the magnitude and extent of this scam.

The Auditor General has the right and responsibility to review the results, practices, processes and systems implemented by the governmental agencies and authorities, and to assess whether any deliberate and/or reckless and/or unsubstantiated and/or politically motivated tampering of the country’s data has taken place. After doing so, if the Auditor General so determines, he could also name and shame all those who are responsible for such misconduct and cover-up. It must also be stated that if the Auditor General initiates such a forensic audit or investigation, it is very likely that such investigative process itself would help (at least partially) to restore data integrity in the country. It is therefore hoped that he will do so, in the interest of the entire economy and the country.

Impunity with which data manipulation has been carried out over the past 3 years is shocking

During the past three years, the Sri Lankan authorities seem to have perfected a shocking series of “creative practices” and “number massaging techniques” which now seem to be routinely implemented in order to achieve politically and/or economically advantageous results. Needless to say, these “creative” adjustments have made a mockery of the computation of GDP in Sri Lanka, since the underlying intention seems to be to “produce” figures and numbers that are “desired” by politicians and not those that are based upon the hallowed principles of consistency, legitimacy and credibility. This cavalier, partisan and reckless attitude would undoubtedly be a cause of grave concern to all stakeholders, particularly the local and foreign investors in Government securities and equities, who would have made vital investment decisions involving several billions of rupees, by relying on these figures.

Accordingly, if this situation were to persist, stakeholders of the Sri Lankan economy would no longer be able to place reliance on the accuracy and objectivity of the information and statistics published by the authorities.

Further, when the manipulations surrounding all these key figures are examined, it also needs to be stated that it is very unlikely that such blatant manipulation and deliberate juggling of a country’s economic data had ever been practised at this magnitude and with such impunity, in any part of the civilised world.

A future government must investigate those allegations and bring wrongdoers to book

Finally, it must be stated that, in any event, the above mentioned suspicious adjustments carried out with sheer impunity and arrogance will need to be necessarily investigated closely and cross-referenced to primary data painstakingly by a future government at a future date.

It is only by doing so, that it could be ascertained as to who had been behind these dubious, damaging and deceptive activities that have brought great disrepute and disgrace to the data integrity of Sri Lanka, which reputation has been patiently and painstakingly built up over decades by dedicated and diligent public officials.

If that is done, the credibility and integrity of the Sri Lankan economic data could be restored, and it is vital that a future government should give such an investigation its topmost priority, and bring all who are responsible for this far-reaching malpractice to account before the law.