Saturday Feb 28, 2026

Saturday Feb 28, 2026

Monday, 30 March 2020 00:00 - - {{hitsCtrl.values.hits}}

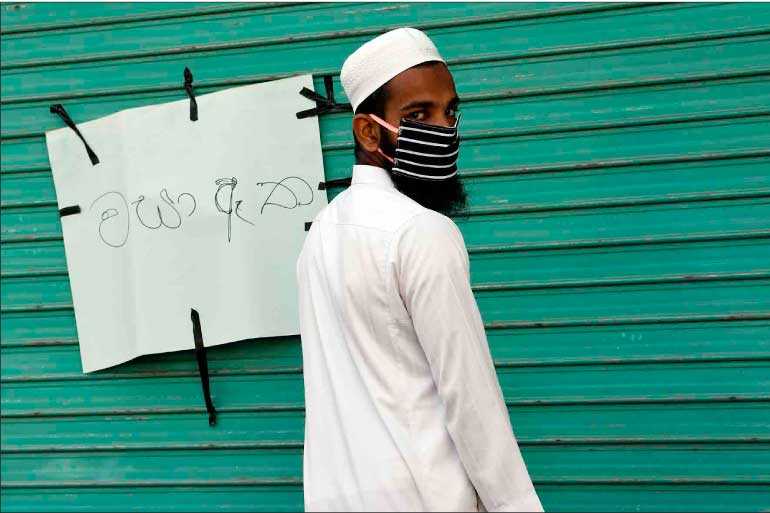

In the coming weeks, Sri Lanka will no doubt come up with further policies, which we will soon read about, marvel at, admire and might even criticise disproportionately. However, the choice left to every individual contributing towards a national economy is clear – it is to be aware, appreciate the scale of impact, be patient and to support domestic, national and global efforts – Pic by Shehan Gunasekara

Exploring the critical need for an ‘all-hands-on-deck’ approach to steer the economy and challenge traditional norms of doing business, as the world looks to leaders to weather the economic implications of COVID-19

The brewing of a storm

In the most unexpected manner, cases of COVID-19 first emerged at the back of 2019, when a mysterious illness was reported in Wuhan, China. A week later, it was confirmed that a new virus was spreading.

Within days, the world came to know of a virus, a disease that can spread rapidly and kill thousands. As the number of fatalities was rising rapidly China became the epicenter of global concerns. By now, it has been upgraded from an endemic to an epidemic and then to a pandemic, an infectious decease that could spread worldwide.

This called for countries to resort to extreme measures such as unprecedented social lockdowns and nationwide curfews. Suddenly social distancing became imperative. Economic activity took a back seat and safeguarding the health and wellbeing of nations became the top priority of their leaders.

Overnight the world was put on alert by an unseen enemy, and the responses displayed an uncanny resemblance to warfare with a general quiet sentiment of a silver screen like Armageddon no one could escape from. People had their movements, travel and daily life restricted; foreign tourists and visitors were banned from entering the country; medical staff prepared for a surge in cases; those who suspected an infection required to undergo a health check and self-quarantine for 14 days. Everyone stopped in their tracks.

No one is fooled, all this is temporary. The world will find a way to eradicate, if not curtail COVID-19, just like we did with SARS and Ebola in the recent past. Once effective measures are in place to deal with health-related concerns and public wellbeing, we will have to look to means of economic stimulus to steer the global economy out of the current storm.

With that optimistic view and with every reason to believe in the on-going extreme measures world over to ‘flatten the curve’, every leader will now be required to strategise business survival post impact and prosper beyond it.

It is imperative that every citizen and corporate, government entity and entrepreneur support the steering of the global economy to restoration. The leveller here is a common global consensus that a cohesive and coordinated effort is the winning formula, along with the need for an orchestra of leaders to perform together in one accord.

Sweeping measures to combat COVID-19

There have already been laudable measures combatting impact of COVID-19 in every nation including an all-of-society, all-of-government approach. During early March, World Health Organisation (WHO) Chief Tedros Adhanom Ghebreyesus praised Singapore’s “all-government approach” in his opening remarks at a press briefing at the WHO headquarters in Geneva, Switzerland. He urged countries around the world to “not give up” in the fight against the disease.

Dr. Tedros said:”Singapore is a good example of an all-of-government approach and that Prime Minister Lee Hsien Loong’s regular videos are helping to explain the risks and reassure people.”

There were reports of a man, who breached a 14-day quarantine order, who lost his Singapore Permanent Resident status and been barred from re-entering Singapore by the Immigration and Checkpoints Authority. Similar reports were globally recorded and Sri Lanka took measures against those who withheld information or resisted complete disclosure of circumstances that may have led to contamination.

Firm action on social lock down and immediate quarantine saw a falling rate of new infections in China and it became a case study on how to bring COVID-19 under control.

National economies may perform significantly better if leaders and decision makers have backgrounds in economics

Every valorous leader in every stratum of society, will be challenged to draw from best practice, global policy, national strategy and common-sense wisdom during this time yet again fortifying the bon mot that necessity is, indeed, the mother of invention.

No matter how unprecedented the present global economic climate maybe, one cannot help but look through the archives of time to draw from best practice and innovation that restored the global economy in the past.

Precedent in this regard is found in a recent reveal, in December 2019 by the World Economic Forum (the research is published online in the Journal of Monetary Economics). The study encompassing 146 countries from 1950 to 2014 found that leaders with an economics background helped their countries perform better. One would think it applies to corporates with equal fervour.

In the said article, researchers pored over the educational and professional backgrounds of 1,681 leaders, including several United States Presidents, and considered economic data of 146 countries from 1950 to 2014.

“When I look at cases within the U.S., such as Ronald Reagan and Bill Clinton, who both studied economics, the story is consistent with what I find in the broader sample,” says Craig Brown, a visiting Assistant Professor of Finance at Purdue University’s Krannert School of Management who focuses on the intersection of finance and politics.

Other examples from across the globe include Singapore, a country that is well known for its economic success, that benefited from the effective leadership of Lee Kuan Yew; and Thabo Mbeki, who presided over the greatest economic expansion in South Africa since the country’s experience with full democratic elections in 1994. Brown found that growth was sustained, on average, during the years following an economist’s tenure.

Innovation as the need of the hour: Lead or be left behind

There is no saying how business models can augment themselves to what cannot even come under the traditional and familiar definition of a force majeure situation, as we look to experts in disaster management for direction.

Be that as it may, on a national front we admire brethren of the soil stepping forward - be it corporates and/or the Government taking the lead to champion innovation. From door-to-door delivery of essential goods; encouraging online platforms to steam ahead, banking on high levels of mobile penetration and strict maintaining social distancing. Work from home practices are the new modus as traffic builds on the super highways of the World Wide Web; online platforms assisting location independent work have kicked in. Social media is buzzing with methods and means of productively using idle time, book stores exploding open subscriptions and music streamed online being available at no charge. All of which transform the norm of survival of the fittest to survival of the quickest.

The critical need of the hour is nothing short of innovation and the willingness and ability to evolve. It will be evident before long that companies shackled with traditional ways of doing business that didn’t ride the wave of the fourth industrial revolution will regret at leisure their inability to be critically responsive. Those entities that planned for a rainy day will delve into their files and unearth all shades of Business Continuity Plans and BCP Tools to ensure that business retains, as much as possible, even a silhouette of normalcy.

Not ignoring that there will still be critical bailouts that are imperative, which is the business of those we have elected to govern, the battalion of naysayers will be polishing their begging bowls and relying on bailout and relief measures, banking on grants and rescue schemes.

How COVID-19 caused macroeconomists to flip the script

In a recent article the World Economic Forum explains that macroeconomists initially saw the pandemic as a negative demand shock that would need to be countered by expansionary fiscal and monetary policies to support aggregate spending. Soon enough, many of them realised that this shock is different. Unlike the 2008 global financial crisis, which led to a collapse in demand, the COVID-19 pandemic is first and foremost a supply shock. That changes everything.

If output is collapsing because people do not want to or cannot spend, adding spending power may help. But if cinemas, universities, schools, sports venues, hotels, and airlines are shut down to stop the spread of the virus, giving money to people will not reignite those industries: they are not lacking in demand. They are shut down as part of the public health policies implemented to flatten the curve. If firms are not producing because their workers are locked down, boosting demand will not magically make goods appear.

As a consequence, macroeconomists are now focusing on how to make social distancing and lockdowns tolerable and limit the damage that the supply shock will generate. In the US and the United Kingdom, governments are planning large fiscal packages to expand health-care provision, protect payrolls, provide additional unemployment insurance, delay tax payments, avert unnecessary bankruptcies, shore up the financial system, and help firms and households survive the storm.

But one frequently unstated assumption of this approach is that governments will be able to mobilise the necessary resources, essentially by borrowing more, if needed, from their own central banks, as they implement quantitative easing. Economists refer to governments’ ability to borrow as fiscal space. In short, the flatter you want the contagion curve to be, the more you will need to lock down your country – and the more fiscal space you will require to mitigate the deeper recession that will result.

Developing countries with precarious access to finance, may run into an inflationary spike, the experts warn.

“As horrific as this sounds, the situation in the advanced economies is likely to be much more benign than what developing countries are facing, not only in terms of the disease burden, but also in terms of the economic devastation they will face” – The World Economic Forum.

Country specific strategies according to the wold economic forum

Just as Sri Lanka, most developing countries rely for foreign income on a combination of commodity exports, tourism, and remittances: all are expected to collapse, leaving economies short of dollars and governments short of tax revenues. At the same time, access to international financial markets has been cut off as investors rush to the safety of government-issued assets. In other words, just when developing countries need to manage the pandemic, most have seen their fiscal space evaporate and face large funding gaps.

The standard prescription for revenue collapses and external financing problems is a combination of austerity (to bring spending in line with income), devaluation (to make scarce foreign exchange dearer), and international financial assistance to smooth the adjustment. But this would leave countries with no resources to fight the virus and no means to protect the economy from the damaging effects of lockdown measures. Moreover, the standard prescription is more inefficient if all countries try it at once, owing to negative spillovers on their neighbours.

To give countries the financial capacity to flatten the curve requires a level of financial support that will not be feasible with existing approaches and with international organisations’ current balance sheets. To help manage the pandemic, therefore, it is critical to recirculate the money that is fleeing the developing countries back to them. To do that, the G7 and the G20 should consider several measures.

The following strategies have been recommended as critical responses;

First, the US Federal Reserve announced swap lines with the central banks of Australia, Brazil, Denmark, Korea, Mexico, Norway, New Zealand, Singapore, and Sweden. This mechanism should be extended to many more countries. If fear of default is an impediment, these funds could be intermediated by the International Monetary Fund, which should redesign its existing Rapid Financing Instrument to meet current needs.

Second, it is said that as central banks implement quantitative easing, they should purchase emerging-market bonds, especially the less risky ones, in order to free up more space for international financial institutions to focus on the more difficult cases.

Third, dollarised or euroised economies that do not have their own currency and hence a lender of last resort, such as Panama, El Salvador, and Ecuador, should be offered special financial facilities so that their central banks can backstop their banking systems.

Lastly, developed countries should not impede or prohibit exports of tests, pharmaceuticals, and medical devices.

Global examples of innovation in policy creation: Response from the United Kingdom with a job retention scheme

As an exercise in theory one looks to the United Kingdom, merely an example of policy innovation. On an announcement made public on 20 March, The Chancellor of the Exchequer stated the Government’s package of support for the self-employed.

In summary, the British Government has said it will pay self-employed individuals who have found themselves without work due to the COVID-19 pandemic, a taxable grant of 80% of average monthly profit (calculated over the last three years) up to £2,500 per month. The scheme is said to be in place for three months, backdated to 1 March 2020. The British Government states this may be extended if necessary.

Payments under the scheme, as set out, will be accessible from the beginning of June, so individuals will receive their three months’ in one lump sum payment whereby Her Majesty’s Revenue and Customs (HMRC): the UK Government department that is responsible for calculating and collecting taxes, will contact eligible individuals directly. Applicants then fill out a form and receive payment from HMRC directly to their bank accounts.

Eligibility of those permitted to avail themselves of the said relief are the self-employed with trading profits up to GBP 50,000 per annum with the majority of income through self-employment and a must have a tax return for 2019 to be able to apply (aimed at ensuring people cannot suddenly claim they are self-employed to access the scheme). Further, July tax return payments are being deferred until January 2021.

Although the scheme does not address immediate cash flow issues, which many self-employed are facing, the public is encouraged to look to multiple sources available such as universal credit (with an advance payment) and business interruption loans.

Sri Lanka’s country specific policy locking into gear

World over there will be policy creators who find themselves cocooned in isolation and yet performing functions of national, regional and global importance. Sri Lanka too will have her own set of policies to respond to the present challenging economic environment as a panacea, as it were, to ease the sting of the aftermath of the unprecedented impact of a global pandemic. What is common however, is the depth of knowledge, appreciation, understanding of the critical steps to be taken and the wherewithal to implement same through state and private mechanisms.

Here at home the stock market and the tourism sector are at the forefront, facing the economic fallout of the spread of COVID-19. Despite closure last week, the stock market crashed, yet again, as millions of daily-income earners continued drawing from the bottoms of barrels while the effects of the impact have only just begun to surface.

The Government has responded proactively to the crisis by offering a relief package to the five sectors most affected. Respectively: tourism, apparel, foreign employment, information technology and small and medium enterprises. Moreover, the government decided to lift taxes on masks and disinfectants and to impose a fuel import tax to build a fund that will be used to repay the debt of the Ceylon Petroleum Corporation and Ceylon Electricity Board.

The Central Bank of Sri Lanka, on the other hand, interrupted the import of vehicles and non-essential goods to ease pressure on the exchange rate, suspended the purchase of Sri Lanka International Sovereign Bonds, limited the issuing of foreign currency notes as travel allowance, and last but not least, cut the interest rate corridor by 25 BP. The Inland Revenue Department announced a grace period until 30 April for the payment of Value Added Tax (VAT).

Additionally, in the fight against the negative impacts of COVID-19, is the Asian Development Bank and the World Bank announcing a financing package of $ 6.5 and 14 billion respectively, to assist companies and countries in their efforts to prevent, detect and respond to the rapid spread of the pandemic.

Call to action

In the coming weeks, Sri Lanka will no doubt come up with further policies, which we will soon read about, marvel at, admire and might even criticise disproportionately. However, the choice left to every individual contributing towards a national economy is clear – it is to be aware, appreciate the scale of impact, be patient and to support domestic, national and global efforts.

From a health and social perspective, the instructions are simple, whereas the implications of noncompliance: global. As has been reiterated time and again, the message cannot be overstated: stay at home; only go outside for food or health reasons; stay two metres (six feet) away from other people; wash your hands often; and have the presence of mind, at all times, that you can spread the virus even if you do not present symptoms.

The common sense pleas are even louder – be considerate; avoid panic purchasing and hysteria; practice gratitude; look inward; enjoy time at home with family; look after the elderly; share the limited resources; be kind and ‘love thy neighbour as thyself’ and whatever else that governs our temporary existence on earth.

Be assured – the worlds of disaster response, academic communities, public-health experts, policy creators and macroeconomists have started collaborative talks. Economically, the call to action is even clearer – it is to endure every effort to hold your post/s and safeguard your business as you would from an unseen enemy looking to obliterate it. As they say in battle – each man for himself, God, for us all.

(The author is an Attorney-at-Law; holds a Bachelor of Laws awarded by the University of London, and is a graduate of the Charted Institute of Marketing – UK.)