Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 3 February 2020 00:16 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

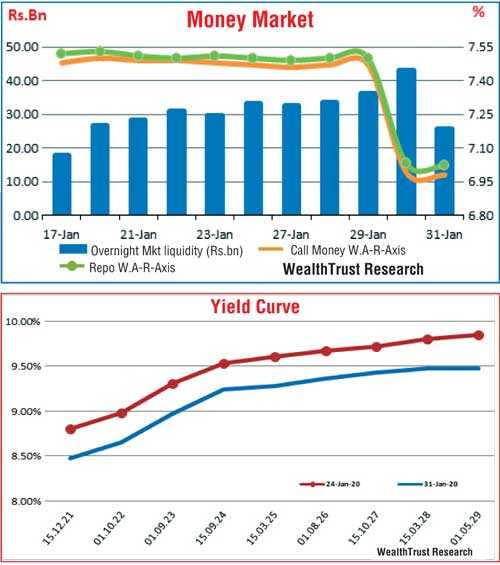

The secondary bond market yields were seen decreasing sharply over the week ending 31 January, to record a steep parallel shift downwards of the yield curve week on week following the policy rate cut of 50 basis points.

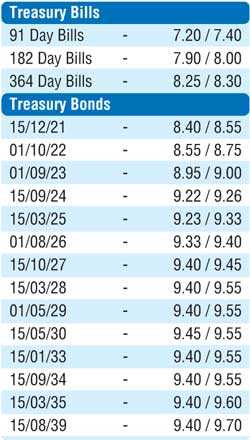

The yields of the liquid maturities of 2023’s (i.e. 15.07.23 & 01.09.23), 2024’s (i.e. 15.03.24, 15.06.24 & 15.09.24) and 15.10.27 were seen declining to intraweek low of 8.90%, 8.95%, 9.15%, 9.20%, 9.18% and 9.37% respectively against its previous weeks closing levels of 9.22/27, 9.30/32, 9.42/47, 9.50/53, 9.51/55 and 9.70/73. In addition, on the long end of the yield curve, 15.05.30 and 15.01.33 were seen changing hands at levels of 9.50% and 9.51% respectively as well. In the secondary bill market, considerable buying interest following the policy rate cut led to the latest 364 day bill changing hands at a weekly low of 8.25%.

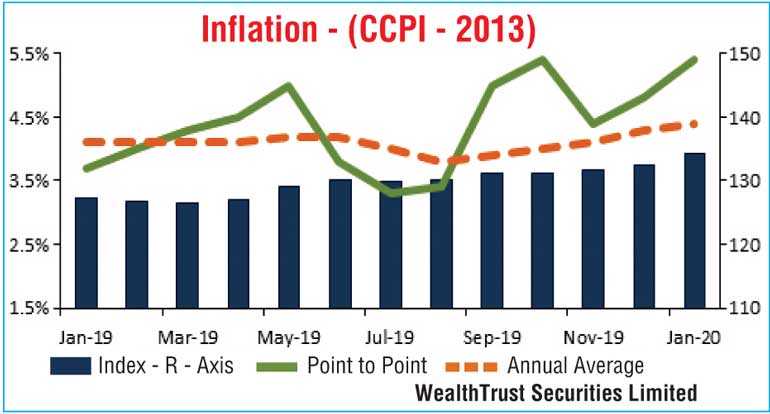

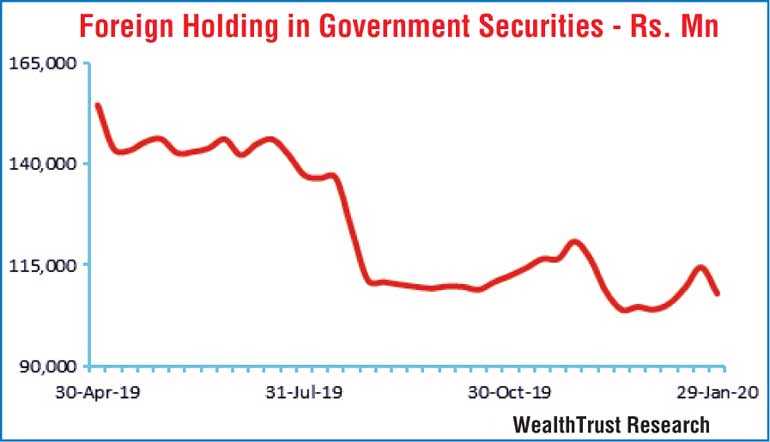

An outflow of Rs. 6.51 billion was witnessed in the foreign holding of Rupee bonds for the first time in four weeks, reversing three consecutive weeks of inflows. Moreover, point to point inflation for the month of January 2020 increased further to register 5.4% against 4.8% recorded in December while its annual average increased to 4.4% from 4.3%.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 16.53 billion.

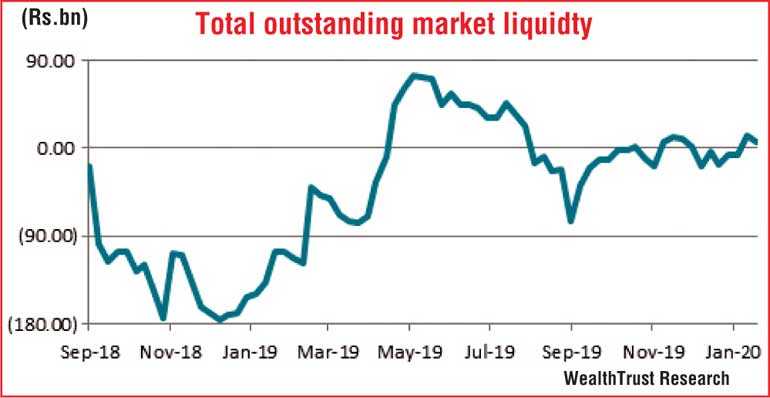

In money markets, the base rate change saw overnight call money and repo rates decreasing to average at 6.99% and 7.03% respectively over the last two days of the week against its initial three days average of 7.47% and 7.50%. The Central Banks OMO department was seen draining out liquidity during the week by way of overnight repo auctions at weighted averages of 6.98% to 7.51%. The overall surplus liquidity in the system was down to Rs. 5.85 billion against its previous week of Rs. 13.33 billion.

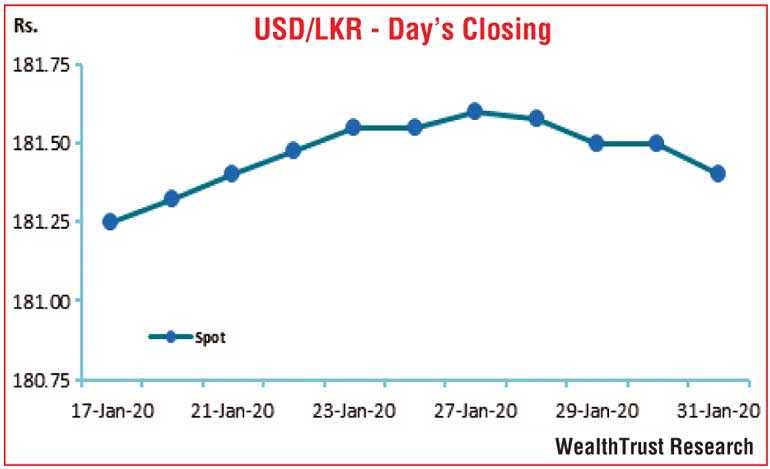

Rupee closes marginally higher

In the Forex market, the USD/LKR rate on the spot contracts were seen closing the week marginally higher at Rs. 181.35/45 in comparison to the previous weeks closing levels of Rs. 181.50/60, subsequent to trading within the range of Rs. 181.35 to Rs. 181.65 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 91.45 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 181.80/90; 3 months - 182.75/95 and 6 months - 184.15/35.