Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 19 December 2018 00:00 - - {{hitsCtrl.values.hits}}

The KPMG Academy in Sri Lanka conducted an insightful seminar on the intricacies of the tax on financial services at the Movenpick Hotel on 14 December. The audience consisted of many attached to the financial services industry in Sri Lanka.

|

Tax and Regulatory - Principal Suresh Perera |

|

Tax and Regulatory Associate Director Rifka Ziyard |

Suresh Perera, Principal – Tax and Regulatory and Rifka Ziyard, Associate Director – Tax and Regulatory both from KPMG Sri Lanka addressed the gathering and presented a detailed analysis of the application of Value Added Tax (VAT), Nation Building Tax (NBT), Debt Repayment Levy (DRL) & Crop Insurance Levy (CIL) using presentation slides.

“Tax on financial services is a complex and fascinating arena in the field of taxation. ‘Financial services’ and ‘finance’ are terms of wide importance. The terms have common and popular meaning, dictionary meanings as well as various statutory definitions in various Statutes. Banking, leasing, hire purchase, insurance, Islamic financial structures such as mudaraba, murabaha, musharaka, ijara, ististina, etc., would fall within the scope of the general term. However one should have a bird’s view of the definitions contained in the relevant tax statutes in order to account the accurate quantum of tax due to the state under each such tax statute,” said Perera.

During the presentation it was pointed out that the computation of value addition base for the VAT, NBT and Debt Repayment Levy is not identical and a person who prepares of tax accounts for these three taxes have to be mindful of the implications stemming from the applicable legal provisions from the three tax statutes.

It could be observed that there is much ignorance among the tax payers with regard to the variations applicable to calculation of the respective tax base (value addition) on which the applicable rates are to be applied upon in order to ascertain the relevant tax liability. The applicable VAT rate for calculation of VAT on financial services is 15% whilst rate of 2% is used for calculation of NBT liability stemming from financial services. The newly introduced Debt Repayment Levy is to be calculated by application of 7% on the value addition by a financial institution.

The main focus of the seminar was the indirect taxes that are imposed on the banking and finance industry.

Ziyard mentioned: “banking and finance is an industry that bears a significant tax burden which is approx. 55%. It is important for the banks to know the compliance requirements and also the tax payer rights stemming from the law. Many significant changes were brought in to the VAT law by way of the VAT amendment Act of 2016 and we experience that still many are unaware of the changes to the law.”

She added: “Sri Lanka is one of the few countries who has been successfully charging VAT on financial services from 2003. Brazil, China are other countries who impose VAT on financial services. Although, Gulf countries such as the United Arab Emirates and Saudi Arabia has introduced VAT of 5%, they have identified ‘financial services’ as an exempt activity.”

She added that although the invoice credit method is the most popular method imposed by all nations that as per tax experts there are disadvantages in not taxing the finance sector such as loss of revenue, loss of information, distortions in economy, etc. hence certain countries are also evaluation widening the scope of VAT to extend to financial services similar to Sri Lanka.

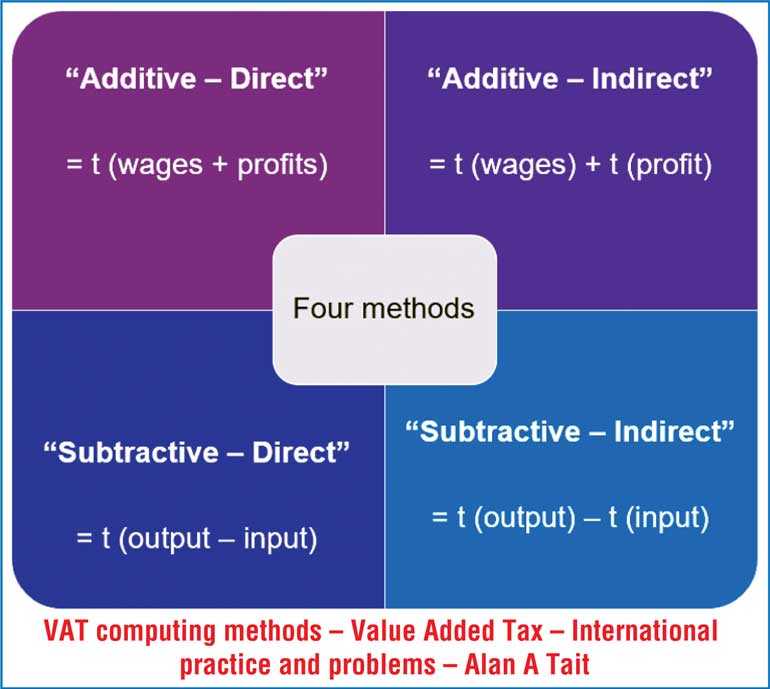

The presentation detailed out the methods of computing VAT and the significance of each method (image 1).

Calculation of value addition could be done from the additive side (profit plus wages) or from the subtracting side (Output-Input). The most common and popular method used world over is the “Subtractive-Indirect” method which also commonly known as the “invoice credit method”. This is where the VAT is charged on the supply and the supplier collect the VAT (output VAT) and remits to the Inland Revenue Department after setting off any VAT paid on its purchases (input VAT).

This methodology is popular in computing VAT since the VAT liability is attached to an invoice. Hence legally and technically this is far superior since it creates an audit trail and the invoice is evidence for the legal transaction. However jurisdictions that charge VAT on financial services used the “additive-direct” method which is also called the “profit-VAT” method. This is where the value addition is calculated by addition of the profits and the wages and then applying the tax rate on such value addition.

In the KPMG presentation, it was explained how the methodology is used in Sri Lanka to compute the VAT on financial services. In addition to the emoluments, the accounting depreciation and economic depreciation is also adjusted in arriving at the total value addition. Such total value addition should be segregated based on turnover ratio between the financial services and non-financial services. The rate of VAT on financial services of 15% should be applied on the Value addition from financial services as a tax fraction (15/117).

Perera explained that when VAT on financial services was introduced it was imposed only on the supply of financial services in Sri Lanka by any specified institution. However after six months of such introduction from 1 July 2003, the chargeability was extended to “Any Person”. Accordingly, as the law stands now VAT on financial services is chargeable on specified institutions and any person (other than a Co-operative Society registered under the Co-operative Societies Law. No 5 of 1972 or Lady Lochore Loan Fund established under the Act No 38 of 1951 or the Central Bank of Sri Lanka. Further, the supply of financial services by a Unit Trust or a Mutual Fund is not treated as a financial service for the purpose of imposition of VAT.

Further the presentation focused on the compliance requirement for VAT on financial services where payments are due monthly and also an interim estimate is expected to be filed at the end of six months. Further the taxable period for financial vat purposes is 12 months and an annual return should be filed for the same within 6 months of the end of the taxable period.

Nation Building Tax (NBT) on financial services was not imposed at the initial stage but only in 2013 as a measure of increasing Government Taxes, NBT was imposed on financial services. NBT is imposed on four categories of persons including interalia service providers. Prior to 2013, the liable turnover of the business of banking and finance was an excepted service and not liable to NBT. However post 2013, the exemption of the business of banking and finance was removed making it liable for NBT.

Section 3 of the NBT law states that the value addition attributable to the financial services should be computed by applying the attributable method referred in the Section 25 C of the VAT Act. The NBT Act does not provide for a definition for the term “business of banking and finance”. Where we refer to the description of banking and finance under the Banking Act, the scope of the business of banking and finance services under the NBT Act is wider than the scope of the financial services defined under Section 25 F of the VAT Act.

Ziyard explained the features of the latest addition to the taxes applicable on banking and finance: the ‘Debt Repayment Levy’ (DRL). She further added that this tax was initially proposed to be imposed on all transactions under the terminology ‘Financial Transaction Levy’, however in the Budget 2017 this was proposed to be imposed as ‘Debt Repayment Levy’ at the rate of 0.02% on cash transactions. Post the budget reading many lobbied on this proposal and further to such pressures the tax was finally introduced under the Finance Act of 2018 as 7% tax on the value addition calculated as per the VAT Act.

The tax was as per the proposal was to be imposed from April 2018 however as per the Finance Act the DRL was implemented from October 2018. The payment is monthly and requires a value addition statement to be attached. The return should be filed annually. The value addition base for DRL is higher than the base for VAT and NBT. The DRL has been introduced with a pre-determined expiry of three years. Accordingly the DRL will automatically cease on December 2021 as per the current law.

The Crop Insurance Levy is a tax applicable on the profit after tax and it is collected by the National Insurance Trust Fund Board. The rate of 1% has been legislated for calculation of Crop Insurance Levy. The tax base for CIL is the accounting profit after tax as opposed to value addition computed in terms of the VAT Act. The CIL is a quarterly payment with a final payment due on 30 September of the following year. This tax has been effective from 1 April 2013.

The banking and finance industry is burdened with diverse compliance requirements although the taxes such as VAT, NBT and DRL are imposed on value addition base. Due to multiple taxes, the banks and financial institutions are burdened with multiple payment dates and returns. Certain payment are falling due on the same dates and creates complexities to a tax manager. The presentation slides included a payment and return filing calendar for the year 2019 for the benefit of the participants.