Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 4 July 2018 00:00 - - {{hitsCtrl.values.hits}}

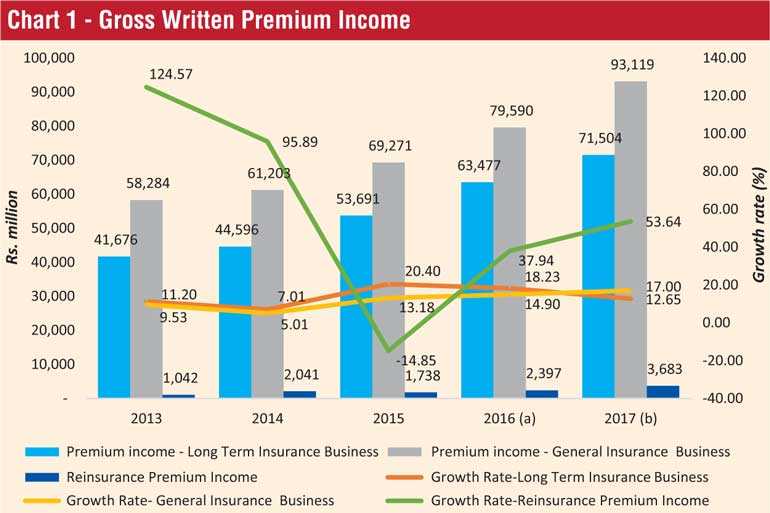

Premium Income and Growth Rate

Premium Income and Growth Rate

The Sri Lankan insurance industry was able to achieve a growth of 15.07% in terms of overall Gross Written Premium (GWP) for both long term and general insurance business sectors in 2017. The total GWP income for both sectors was Rs. 164,623 million compared to Rs. 143,067 million in 2016, recording an increase of Rs. 21,556 million.

The long term insurance sector generated GWP amounting to Rs. 71,504 million in 2017, up by 12.65% against the GWP of Rs. 63,477 million generated in 2016. The general insurance sector recorded GWP amounting to Rs. 93,119 million in 2017, posting a growth of 17% compared to Rs. 79,590 million recorded in 2016.

The reinsurance premium income generated by the National Insurance Trust Fund (NITF) from the compulsory reinsurance cession of general insurance business amounted to Rs. 3,683 million during 2017, recording a significant increase of 53.65% against the reinsurance premium of Rs. 2,397 million generated in 2016. NITF’s reinsurance premium has risen substantially in 2017 mainly due to acceptance of reinsurance business from a wider range of different classes of general insurance business.

Insurance Penetration

and Density

Insurance penetration which reflects the insurance premium as a percentage of GDP amounted to 1.24% in 2017. Although insurance penetration had slightly increased in 2017 compared to 2016, which was recorded as 1.20%, it is still low compared to most of the other countries in the Asian region. Penetration of the long term insurance business in 2017 stood at 0.54% (2016: 0.53%) and the penetration of the general insurance business was 0.70% (2016:0.67%), both classes recording slight increases compared to the penetration ratios recorded in 2016.

Insurance density reflects the insurance premium income per person of the population and has increased to Rs. 7,677 million in 2017 compared to Rs. 6,747 million recorded in 2016, growing by 13.78% mainly due to increased premium income against lower increase in population.

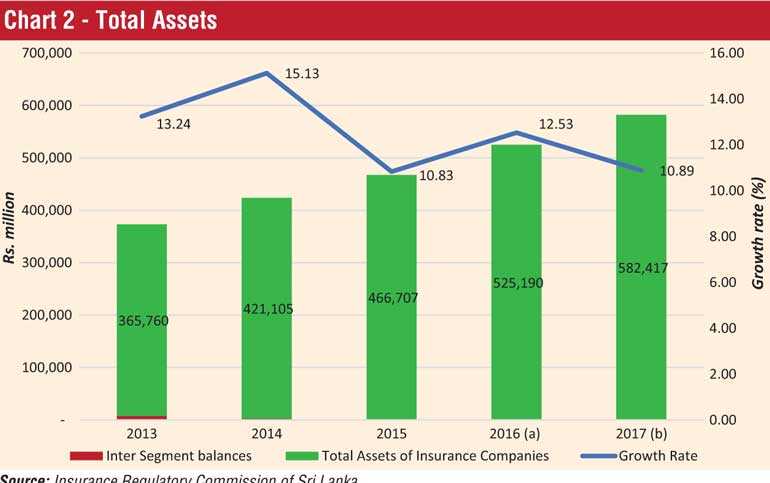

Total assets

The value of total assets of insurance companies has increased to Rs. 582,417 million in 2017, when compared to Rs. 525,190 million recorded in 2016, reflecting a growth of 10.89%. The assets of Long Term Insurance Business amounted to Rs. 392,400 million (2016: Rs. 345,589 million) indicating a growth of 13.55% year-on-year. The assets of General Insurance Business amounted to Rs. 185,767 million (2016: Rs. 173,985 million) and recorded a growth of 6.77%.

NITF held assets relating to reinsurance business, amounting Rs. 4,250 million as at 31st December 2017, recording a significant negative growth of 24.32%, compared to assets recorded as at 31st December 2016, which amounted to Rs 5,616 million.

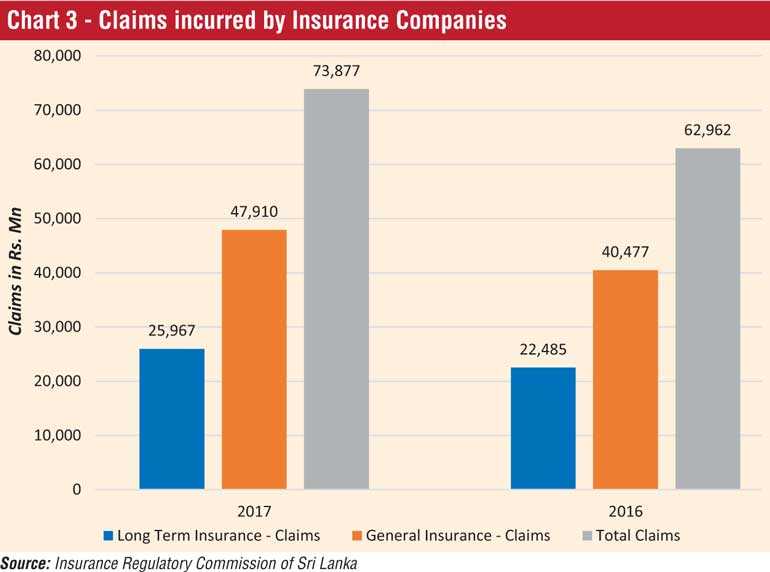

Claims incurred by insurance companies

The total value of claims incurred by insurance companies (both Long Term Insurance Business and General Insurance Business) was Rs. 73,877 million (2016: Rs. 62,962 million) showing an increase of 17.34%. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 25,967 million (2016: Rs. 22,485 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 47,910 million (2016: Rs. 40,477 million). Hence, when compared to 2016, value of claims incurred in Long Term Insurance and General Insurance Businesses in 2017 have increased by 15.49% and 18.36% respectively.

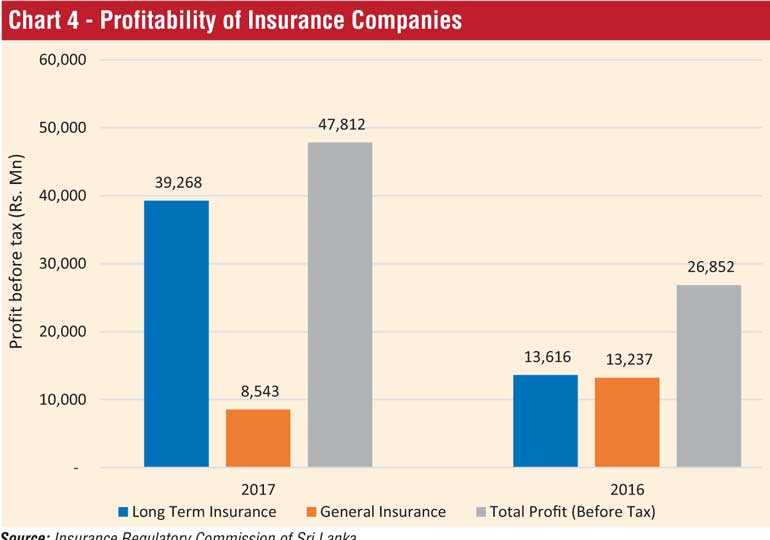

Profitability of insurance companies

The total profitability of the insurance industry has increased to Rs. 47,812 million (2016: Rs. 26,852 million) showing a growth of 78.05%. The profitability of Long Term Insurance Business amounted to Rs. 39,268 million (2016: Rs. 13,616 million) while the profitability of General Insurance Business amounted to Rs. 8,543 million (2016: Rs. 13,236 million). Thus, profitability of Long Term Insurance has increased by 188.41% and profitability of General Insurance Business showed a significant negative growth of 35.46% when compared to the previous year. The reason for the significant increase in profitability with regard to long term insurance business is the transfer of one-off surplus of the insurers carrying on long term insurance business, to the shareholders’ fund.

Dispute resolution and investigations

The IRCSL, under its overall objective of safeguarding the interests of policyholders, inquiries into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. The IRCSL also investigates into any other complaints referred to it against any insurer, broker or agent. During 2017, 348 new matters were referred to the Commission. A total of 341 matters were settled/closed during the period. Aggregate value of the claims settled during the period, due to the intervention of the Commission, is around Rs. 20 million.

Insurers

Out of 26 insurance companies (Insurers) in operation as at 31 December 2017, 12 are engaged in Long Term (Life) Insurance Business, 12 companies are carrying out only General Insurance Business and two are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance brokers

60 insurance brokering companies, registered with the Commission as at 31 December 2017, mainly concentrate in General Insurance Business. The premium income generated through General Insurance Business indicates the importance of brokers as an intermediary in the General Insurance market. However, insurance brokers’ contribution towards Long Term Insurance Business is insignificant as witnessed in previous years. The premium income generated through Insurance Brokering Companies with respect to General Insurance Business amounted to Rs. 22,083 million (2016: Rs. 17,518 million) while the premium income generated with respect to Long Term Insurance Business amounted to Rs. 341 million (2016: Rs. 263 million).

The total premium income from both General Insurance Business and Long Term Insurance Business amounted to Rs. 22,423 million during 2017, compared to Rs. 17,781 million during the previous year. Thus, the total premium income generated through insurance brokering business witnessed a growth of 26.1% and the brokering companies’ contribution as a percentage of the total GWP was 13.62% in 2017.

(Source: Insurance Regulatory Commission of Sri Lanka)