Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 12 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

The Central Bank yesterday said it has revised growth down to 3% from 4% earlier in the year, but kept policy rates unchanged on moderate inflation, international rate cuts, and expectations of lending rates declining in the coming weeks, to boost economic expansion.

|

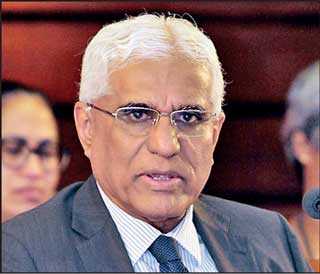

Central Bank Governor

|

Central Bank Governor Dr. Indrajit Coomaraswamy on Thursday remained optimistic about Sri Lanka’s growth prospects in 2019, but acknowledged positive sentiment and confidence was still muted among investors as well as the private sector.

He opined it was realistic to roll back growth projections after the Easter Sunday attacks, but was confident the reduction would not be severe, partly due to robust exports and expenditure by the Government ahead of elections. Private sector credit growth also decelerated to 9.2% by end May, from 15.9% as at end 2018. Following a higher than projected credit expansion in 2018, in absolute terms, private sector credit contracted by Rs. 2.6 billion in May resulting in a cumulative decline of Rs. 19.6 billion during the first five months of 2019.

“As you know, growth was projected to be 4% at the beginning of the year, and after the Easter bombings we have revised it down to about 3%. I’ve seen some projections that have been much gloomier, but I think that is overdone. The 1Q growth was 3.7%, certainly 2Q growth will be disappointing, but 4Q there are very favourable base effects, as in 2018 the 4Q growth was only 1.8%. We are beginning to see faster recovery than anticipated in the tourism sector and elsewhere. I think 3% is realistic.”

He also told reporters that macroeconomic fundamentals remained in “good shape” due to moderate inflation, stronger reserves, and international rates taking a dovish turn. Inflation is expected to be in the 4%-6% margin for 2019. But he also said the Monetary Board decided against loosening rates further, partly because it was concerned about fiscal slippage and also because it wanted to see the earlier policy rate reduction filter through markets.

“The reason why the Monetary Board decided not to reduce policy rates is to wait and see the full effect of everything that has been done so far. Policy rates were reduced on 31 May and we haven’t really seen the Statutory Reserve Ratio (SRR) reduction and the Rs. 100 billion of Government payments, the effects of the deposit cap that we now hope to see spilling over into lending rates. In the coming weeks we anticipate lending rates coming down quite significantly. The Government is also spending about Rs. 300 million in each electorate under the Gamperaliya program, so there is a lot of money being flushed into the system. We would like to wait and see exactly what the overall impact of this money will be before making another call on policy rates.”

Responding to questions, the Governor expressed hope that the Central Bank would not have to resort to imposing a lending rate cap if market rates remain stubbornly high. Since the rate change the Prime Lending Rate has reduced by about 120 basis points, the Governor said, but the average weighted lending rate has remained unmoved.

“To be fair by banks, the deposit cap was placed at the end of April and it would take a bit of time for them to re-price their deposits, and costs will not come down till then. We would anticipate a reduction of up to 200 basis points in lending rates, especially the average weighted lending rates, and will monitor it closely. We don’t want to impose a lending cap because those sort of measures are highly distortionary, but if we are forced to do it, we will. However, we anticipate banks will be cooperative and the impression we get is they also see lending rates come down.”

Following the receipt of the proceeds of the International Sovereign Bonds (ISBs), gross official reserves reached $8.9 billion by end June 2019, which provide an import cover of 5.1 months. The contraction in the trade deficit and the receipt of the proceeds from the ISBs, along with the continuation of the Extended Fund Facility Program with the International Monetary Fund (IMF-EFF), have eased the pressure on the exchange rate, resulting in the Sri Lankan rupee recording a cumulative appreciation of 4.1% against the US dollar thus far in 2019. This appreciation of the rupee has partially corrected its sharp depreciation observed in late 2018, the Central Bank said in its customary Monetary Policy update.

The year-on-year growth of credit extended to the private sector by commercial banks continued to decelerate during the first five months of 2019, while recording an absolute cumulative decline during the period. Following this trend in the growth of credit, the year-on-year growth of broad money (M2b) also decelerated thus far in 2019. Credit to the private sector is expected to gradually pick up in the latter part of 2019, with the expected decline in market lending rates.

A sizable downward adjustment in market lending rates is expected in the near term. Market deposit rates have declined in response to the measures already taken to ease monetary policy and monetary conditions. In particular, the reduction of policy interest rates in May 2019, coupled with sizable liquidity injections through the reduction in the Statutory Reserve Ratio (SRR) and the imposition of maximum interest rates on deposit products in April 2019, have resulted in a notable drop in the Average Weighted Call Money Rate (AWCMR), yields on government securities, new deposit rates as well as the Average Weighted Prime Lending Rate (AWPR), the report added.

However, the transmission of recent easing of monetary conditions to market lending rates, including AWPR, is not yet complete. It is expected that the ongoing downward adjustment in market lending rates would expedite in the immediate future, thus supporting the revival of demand for credit by the private sector and the recovery in economic activity.