Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 6 September 2019 00:18 - - {{hitsCtrl.values.hits}}

By Ruwandi Gamage and Uditha Jayasinghe

Central Bank Governor Dr. Indrajit Coomaraswamy yesterday said Cabinet approval had been given to appoint a Steering Committee and a Technical Evaluation Committee for the mobilisation of the issuance of a $ 500 million samurai bond.

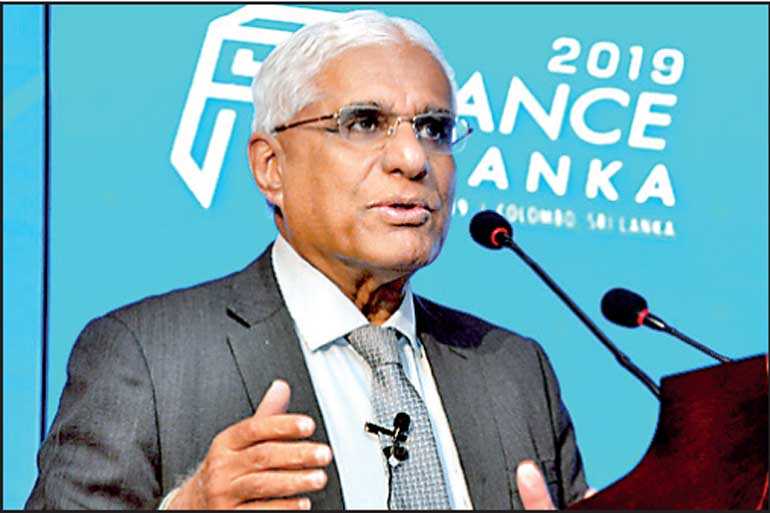

Speaking at The Asian Banker ‘Finance Sri Lanka 2019’ conference in Colombo, the Governor said the Central Bank would work to issue the bond in the next two months as part of its effort to broaden

Sri Lanka’s investment base.

The Steering Committee will select the lead manager for the bond and the Central Bank had earlier stated it may issue the bond in November. This will be Sri Lanka’s first Samurai bond.

Addressing the gathering, Dr. Coomaraswamy also sought to clarify views on legislative and regulatory changes in the pipeline, pointing out that the Monetary Law Act was essential to prevent the Government from pressuring the Central Bank into printing money and would strengthen the independence of the Central Bank.

“Historically the Secretary to the Treasury was a member of the Monetary Board. In practice we have had fiscal dominance. The Central Bank has financed the Government, time and again, through buying Treasury bills, and through printing money, which is the worst thing that any Central Bank can do. It creates inflation, that money leads to imports and it can lead to acid bubbles. Clearly the Central Bank participating in the primary auctions for Treasury instruments is the most destabilising thing a Central Bank has done and we have done that time and again. We want that prevented by law. The Central Bank by law should not be allowed to print money for the Government,” he said.

Dr. Coomaraswamy also called for the support of the Government and Parliament to pass the Act within the next two months ahead of Sri Lanka heading to Presidential Elections and opined that the proposed legislation would not undermine the financial powers of the Government as it had the capacity to use the Active Liability Management Act to raise any necessary funding.

“It is not that the Government is being abandoned by the Central Bank. We have created a new architecture for the Central Bank to be released from this terrible, terrible practice of printing money. I have great conviction about this and I hope the Government and Parliament also bear that view. We need to get this through Parliament in the next couple of months.”

“The Central Bank has been pressurised into damaging the economy time and again by printing money. We need to get away from that,” he added.

The Governor also renewed pleas for the banking sector to voluntarily reduce interest rates, pointing out that it would collectively spur growth and reduce the growing Non-Performing Loan (NPL) ratio, which has challenged the banks in recent times. He insisted that this was the best way to turn around growth and encourage investors to make use of the sound macro fundamentals supported by the Central Bank.

“We have a challenge. We have inflation at 3.3% and growth for this year is expected to be 3.1%. When the economy is growing at a nominal rate of about 6% and if you have lending rates of 14%, it’s just not possible to do business. This is why the Central Bank has been focused on reducing interest rates. We do not believe in caps on deposits or lending rates. It is distortionary. We are extremely aware of that,” he said.

However, the Central Bank is also caught in the structural problem created by stubborn interest rates, which have remained high despite two policy reductions this year.

“This is partly because of non-economic factors such as political instability, the Easter attacks and sentiment, so we need to do something to get the economy going. We are introducing caps on a temporary basis and we feel it is in the enlightened interests of the banking industry to go with it, on a temporary basis, to push growth. If you do that, then the NPL issue also gets resolved,” he said.