Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Saturday, 14 March 2020 00:00 - - {{hitsCtrl.values.hits}}

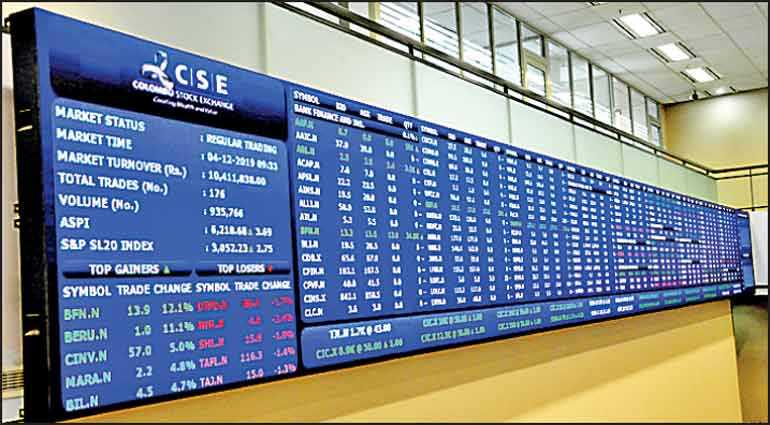

The Colombo stock market ended its worst week with Rs. 214 billion in value lost and the year-to-date dip crossing the 20% mark.

Compared to Tuesday and Thursday, yesterday’s dip was less pronounced whilst turnover was a respectable Rs. 1.05 billion.

The All Share Price Index was down 2.9% or 144.8 points yesterday and the S&P SL 20 Index was down 2.74% or 63 points.

The ASPI plunged by 468.42 points (or 8.77%) and the S&P SL20 Index fell sharper by 11% or 273.64 points. Year-to-date the ASPI is down 20.4% and the S&P SL 20 was lower by 25%. Total turnover for the week was Rs. 3.34 billion up from Rs. 2.57 billion in the previous week. Market capitalisation declined by 8.6% or Rs. 214 billion to end the week at Rs. 2.269 trillion.

Acuity Stockbrokers said foreign investors closed the week in a net selling position with total net outflow at Rs. 390 million, relative to the previous week’s total of Rs. 620 million.

In terms of volume, Sierra Cable and East West led foreign purchases while Dialog Axiata and Hemas Holdings led foreign sales. In terms of value, East West and Three Acre Farms led foreign purchases while Sampath Bank and JKH led foreign sales.

NDB Securities said the ASPI closed in the red yesterday as a result of price losses in counters such as John Keells Holdings, Dialog Axiata and Ceylon Cold Stores.

High net worth and institutional investor participation was noted in John Keells Holdings and Teejay Lanka. Mixed interest was observed in Commercial Bank, Sampath Bank and Expolanka Holdings, whilst retail interest was noted in Access Engineering and Browns Investments.

Capital Goods sector was the top contributor to the market turnover (due to John Keells Holdings) whilst the sector index lost 2.96%. The share price of John Keells Holdings decreased by Rs. 5.60 (4.27%) to close at Rs. 125.70.

Banks sector was the second highest contributor to the market turnover (due to Sampath Bank and Commercial Bank) whilst the sector index decreased by 3.44%. The share price of Sampath Bank lost Rs. 5.20 (3.71%) to close at Rs. 134.80. The share price of Commercial Bank recorded a loss of Rs. 2.90 (3.87%) to close at Rs. 72.10.

Teejay Lanka and Chevron Lubricants were also included amongst the top turnover contributors. The share price of Teejay Lanka moved down by Rs. 1.70 (5.99%) to close at Rs. 26.70. The share price of Chevron Lubricants declined by Rs. 1.80 (2.90%) to close at Rs. 60.20.

For the week JKH was the highest contributor to the turnover value, contributing Rs. 610 million or 18.13%, according to Acuity Stockbrokers. Lion Brewery followed suit, accounting for 16.34% of turnover (value of Rs. 550 million) while Sampath Bank contributed Rs. 380 million to account for 11.26% of the week’s turnover.