Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 21 October 2020 00:18 - - {{hitsCtrl.values.hits}}

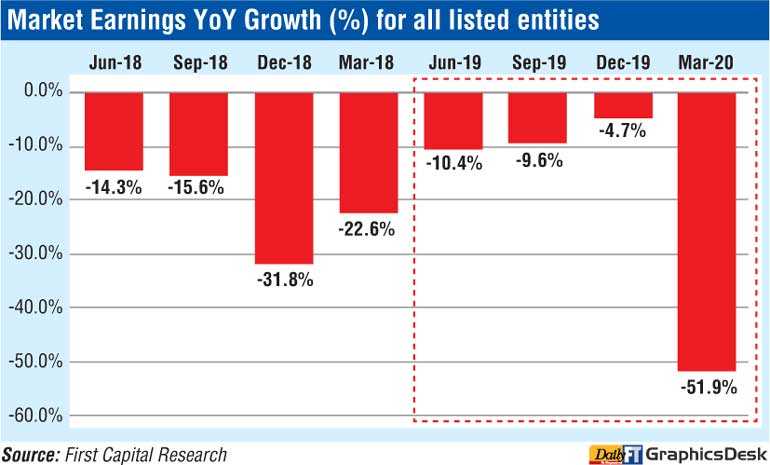

Corporate earnings of listed companies plunged by 52% year-on-year (YOY) to Rs. 33.5 billion in 2020 March quarter, First Capital Research revealed yesterday. The analysis was based on reported earnings of 266 listed companies.

It said the plunge was primarily owing to sluggish performance in Diversified Financials (-87% YOY), Capital Goods (-63% YOY), Food, Beverage and Tobacco (-72% YOY), Telecommunication (-52% YOY) and Consumer Services (-101% YOY).

However, upbeat quarterly performance was only witnessed in the following sectors, Banks (+32% YOY) followed by Food, Staples, and Retailing (+96% YOY) and Materials (+8% YOY).

First Capital said lacklustre performance in Diversified Financials, Capital Goods and Food, Beverage and Tobacco sectors was mainly owing to subdued economic growth, which was heightened by the COVID-19 pandemic striking the country.

Peoples’ Leasing’s profit dipped by -90% YOY due to high impairments, due to the slowdown in the economy causing a reduction in disposable income of customers and business volumes. Consequently, there was a rise in non-performing loans in the sector, which was the main factor for the decline in earnings of Commercial Credit and Finance (-56% YOY), LOLC Finance (-29% YOY) and LB Finance (-19% YOY) as well. “Therefore, primarily led by these counters, the Diversified Financial sector recorded a decline of 87% YOY to Rs. 1.7 billion,” First Capital said.

Plunge in earnings by 63% YOY (to Rs. 4.6 billion) in Capital Goods was chiefly driven by Softlogic Holdings earnings, reporting a loss of Rs. 3.3 billion (-11033% YOY), followed by the decline in earnings in Browns (-53% YOY) and Aitken Spence (-45% YOY).

Notably, John Keells Holdings recorded a growth of 18% YOY primarily due to the growth in profits in Consumer Foods, Retail and Property segments. Overall, the Capital Goods sector recorded a decline in earnings.

The Banking sector witnessed a profit growth of 32% YOY to record Rs. 14.6 billion, primarily driven by Commercial Bank (+20% YOY), HNB (+57% YOY) and Sampath (+27% YOY).

First Capital said COMB, HNB and SAMP profits were boosted due to financial investment gains (forex and mark to market gains) coupled with the removal of NBT and Debt Repayment Levy, which improved the bottom line. CARG recorded an impressive growth of 134% YOY driven by the growth in FMCG and retail space, benefitting the Food, Staples and Retailing sector to record a growth of 96% YOY.