Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 20 March 2018 00:27 - - {{hitsCtrl.values.hits}}

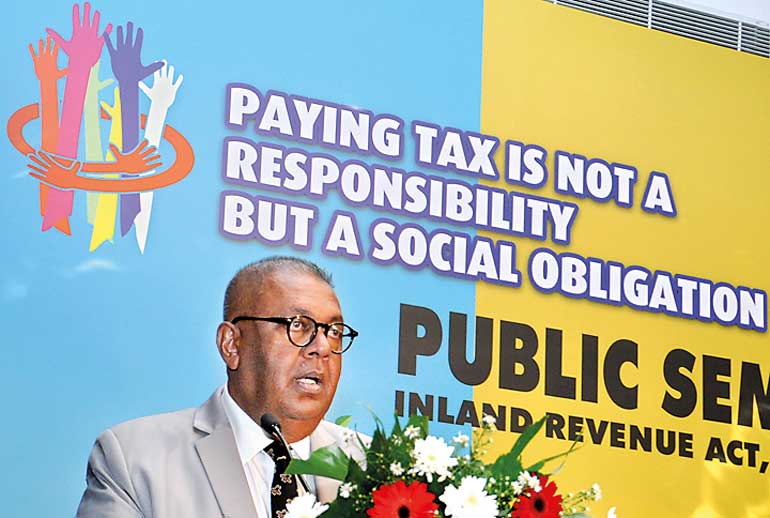

Finance Minister Mangala Samaraweera yesterday (19 March) said the implementation of the new Inland Revenue Act would double the share of direct taxes of the total collection in two years, while creating a level playing field for everyone to do business, moving away from the culture of preferential treatments.

“We expect to increase the share of direct income tax against indirect taxes. The preferred ratio is 40% to 60% by 2020 from the current level of 18% to 82%. That is one of the hallmarks of a fairer tax system,” he said, addressing the inauguration public seminar on the new Inland Revenue Act No. 24 of 2017, which will come into force from 1 April.

The Minister said that along with the broader strategic direction, they are also setting the platform and working continuously on promoting the business climate by enhancing taxpayers’ protections and providing greater certainty on tax affairs.

“This new legislation carves a clear strategic direction about taxation in the country. Our Government has shown steadfast commitment towards making an investor-friendly environment, by carrying out necessary improvements in doing business and providing infrastructure and other facilities. Every citizen who wishes to be an entrepreneur will have an environment of transparency, fairness and equity in Sri Lanka’s future, once our new rules-based legal system is in operation. The new IR Act is a widely endorsed piece of legislation that needs methodical implementation,” Samaraweera stressed.

Samaraweera believes the implementation of IR Act will bring a paradigm shift to taxation in Sri Lanka, in line with the policy reforms updating complex legislations to achieve the country’s development goals in the 21st century.

In addition, the Finance Ministry is aiming at improving tax compliance by strengthening administrative powers of the IRD to supplement the technological advancements that are being implemented.

“There are many areas to improve. Our tax compliance is one of the weakest in the region. The number of individuals and firms registered for paying taxes remains at surprisingly low levels. These numbers are very hard to corroborate with the realities given the profile of corporate sector in the country and our labour market dynamics,” the Minister emphasised.

According to Samaraweera, over two decades, Sri Lanka recorded a downward tax revenue that reached just over 10% in 2014 as a share of the GDP. “Sri Lanka was among the lowest tax revenue countries. Despite the continued rise in income levels, our tax revenue failed to record any improvements. Some experts opined that on one hand our tax system was complex and confusing, while on the other hand there were numerous ad-hoc tax concessions – over 200 of them – which were granted without any rationale.”

He also said that Sri Lanka’s current phase of international economic standing as a middle-income country does not allure significant amounts of foreign aid and grants.

“In a precarious international investment and trade environment, developing countries like Sri Lanka must enhance their fiscal income with a view to offset the narrowing external drains. We must optimise utilising our local resources with a well-managed and efficient tax system as a pro-growth catalyst,” Samaraweera stressed.

The Minister urged that all citizens to become partners, stakeholders and masters of Sri Lanka’s own development endeavours, insisting that the new IR Act was designed to broad-base the taxpayer under structure and to encourage everyone to shoulder that collective responsibility.

“As taxpayers, you all responsibly contribute towards a noble objective of bettering and enhancing the welfare of our society. On a more fundamental basis, we are aiming at lessening imbalances in income and wealth creation in the country as we progress towards an upper-middle income country. Your tax payments drive the country’s future. Your money goes into expenditure on education, health, infrastructure, environmental protection, law and order and welfare improvements, among others,” he added.

Acknowledging that it is an enormously challenging goal, Samaraweera said the new IR Act was a timely step in right direction and expects there will be a smooth transition and a better system with the passage of time.