Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 14 December 2020 05:01 - - {{hitsCtrl.values.hits}}

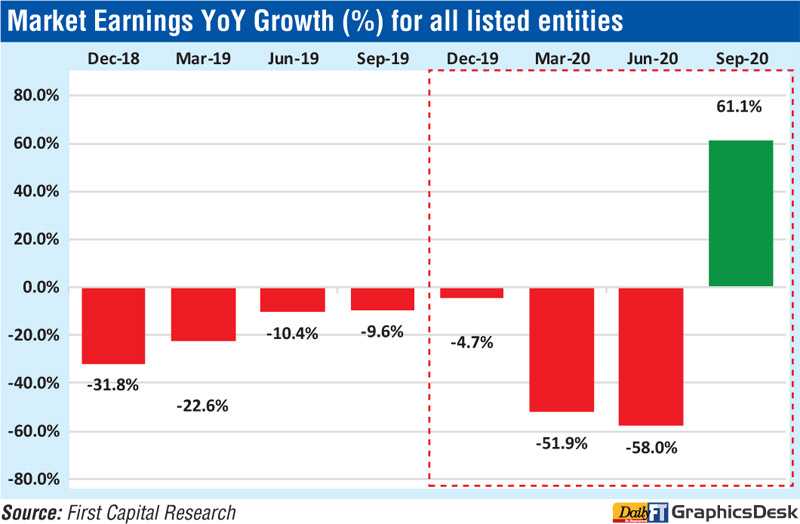

Listed companies saw a ‘Super September’ thanks to healthy earnings in most sectors owing to recovery from the COVID-19 pandemic, according to First Capital Research.

It said September 2020 quarter earnings surged by 61.1% YoY to Rs. 73.9 billion owing to the robust performance in most of the sectors primarily led by Food, Beverage and Tobacco (96% YoY), Transportation (578% YoY), Capital Goods (112% YoY) and Materials (154% YoY). However, sluggish quarterly performance was witnessed on Consumer Services (-32% YoY), Banks (-17% YoY) and Real Estate (-37% YoY).

First Capital said resilient performance in Food, Beverage and Tobacco, Transportation, Capital Goods and Materials witnessed significant recovery on the back of recommencement of economic activities.

CTC’s earnings were up by 9% YoY on the back of volume growth while earnings of MELS spiked by 193% YoY through the positive contribution from the Beverage segment and LION’s earnings was up by 17% YoY owing to the recovery in activities during the quarter amidst significant growth in Beer exports. Consequently, led by the contribution from these counters, Food, Beverage and Tobacco sector earnings recorded an increase of 96% YoY.

Transportation sector witnessed a growth of 578% YoY primarily driven by the super normal profits attained by EXPO (646% YoY) because of the pandemic situation where there was a surge in demand for emergency supplies via air freight into North American markets.

Capital Goods witnessed a surge of 112% YoY, led by the growth in HAYL (19,612%) boosted by the strong performance in Hand Protection, Purification Products, Agriculture and Plantation sectors.

The Materials sector witnessed a growth of 154% YoY largely benefitted from the exceptional performance in TKYO (163% YoY) amidst the increased demand for cement mainly arising from the residential sector.

First Capital said Consumer Services, Banks and Real Estate presented lacklustre performance.

Amid the prevalent situation, the hospitality industry continues to be adversely influenced, hence, Consumer Services sector earnings recorded a dip of 149% YoY. Banking sector witnessed a decline of 17% YoY largely driven by SAMP (-53% YoY) and COMB (-23% YoY) impacted by the increase in impairment.

Real Estate sector earnings (-37% YoY) has slowed down due to the ongoing pandemic out of which OSEA witnessed a decline in earnings of 50% YoY chiefly due to the decrease in the sale of apartments by 81% YoY while rental income too dipped by 3% YoY, First Capital added.