Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 6 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Eng. Col. Nissanka N Wijeratne

In any country, the performance of the construction industry is often considered as a barometer of economic development. At present, our construction industry is plagued by low construction volume, skilled worker shortage, high construction costs, and unequal competition from foreign contractors. A clear indication on low construction volume is the 7% drop in cement consumption in 2018, compared to 2017. The construction industry contribute about 9% to the GDP, employing about 600,000. In recent years, the total annual construction turnover is about Rs. 800 billion, which is expected to increase if the investments planned by the Government materialise.

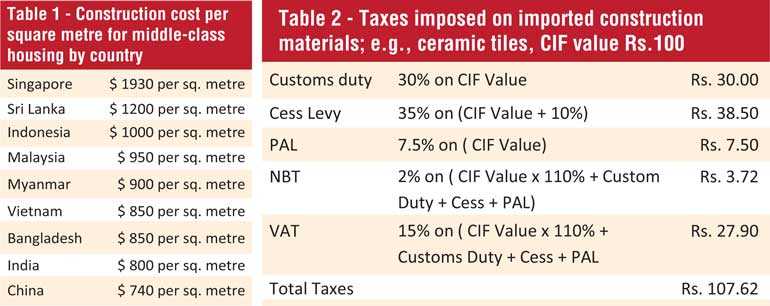

To overcome the present foreign exchange crisis, one of the most viable solutions will be to attract many export-oriented industries through FDIs, capitalising on our strategic location. But our high construction cost, which will increase the setting up costs of an industrial venture, could act as a disincentive to attracting FDIs needed to spur economic growth. From a comparison of the construction costs of middle-class housing, it is evident that our unit cost of construction is the highest in the region, second only to Singapore, which is a well-developed country with a very high GDP per capita.

The following are some measures that can be taken to reduce the construction cost:

NBT on construction contracts

NBT was not previously applicable to construction contracts. It was introduced by the Budget for 2017. Introduction of NBT on construction contracts has a cascading effect, due to the nature of construction projects, which have several layers of subcontractors and specialist contractors (e.g.: piling, air conditioning, electrical, lift installations, etc., which will be constituent components of a main contract). Also, with the present operation of NBT, there is a tax-on-tax situation, as VAT is charged on NBT as well. Considering the above, it may be prudent to completely withdraw the NBT on construction contracts, which was the practice up to 2017.

Withholding tax (WHT) on construction sector services

With the introduction of WHT with effect from 1 April 2018, 5% WHT is to be deducted from work subcontractors and other small service providers, if monthly payments exceed Rs. 50,000. But for employed persons, PAYE tax is applicable only when the monthly gross salary exceed Rs. 100,000. As these small scale subcontractors are not registered with the Inland Revenue Department, this WHT cannot be recovered by them, and as such becomes an additional cost on the main contractors in the end. Therefore, it is proposed to increase the threshold of Rs. 50,000 to Rs. 200,000 for 5% WHT.

High cost of imported materials due to five different taxes imposed

As stated before, our unit construction cost is the highest in the South Asian region. A main reason is the five different taxes imposed on many imported construction materials. The aggregate effect of these five taxes for ceramic tiles amounts to 107.6% of the CIF value. As the majority of the construction materials are imported with the application of such taxes, it is no wonder that our construction cost is the highest.

Table 2 shows an example of these taxes as applicable to ceramic tiles and sanitary ware, for a CIF value of Rs. 100.00. On top of these costs, importers have to pay port charges as well.

It defies any logic that NBT and VAT is charged even on the other 3 taxes, viz. customs duty, Cess and PAL.

To reduce the construction cost and rationalise the tax calculations, the following is proposed on import of construction materials:

Supply of sand for construction work

The Government has very correctly imposed restrictions on mining river sand and transporting it, due to the massive environmental damage caused due to excessive mining. The total annual requirement of sand is estimated at 21 MCM (million cubic meters). The alternatives to river sand are the mechanically washed and sieved offshore sea sand, and manufactured sand by crushing rock. The annual supply of offshore sea sand and manufactured sand is not more than 3 MCM. As such, 18 MCM is still obtained from river beds. Out of this 18 MCM, nearly 30% or 5 MCM of river sand are transported illegally, without permits. The price of river sand in Colombo is Rs. 18,000 per cube (2.83 CM), whereas washed and sieved offshore sea sand price is Rs. 10,300 per cube at Nawala. The only way to curb illicit river sand mining and transport is by making the cheaper sea sand available abundantly to meet the construction demand. This will reduce the demand for river sand, and at the same time reduce construction costs.

At present, offshore sea sand is pumped only at Muthurajawela by the Sri Lanka Land Reclamation and Development Corporation (SLLRDC). But their present maximum annual supply capacity is only 350,000 CM. Even with the expected addition of a 2nd washing plant at Muthurajawela, the supply capacity will increase only to 1,300,000 CM. But to make an impact on the market and reduce price, the annual supply of sea sand should be targeted at a minimum of 5 MCM. As such, in parallel to the SLLRDC supply at Muthurajawela, there should be another 2 supply points to pump sand from the deep sea. One of the biggest constraints to pump sea sand, wash, and sieve, is the large extent of land needed close to the beach, and a fresh water source. As pumping has to be done during a short period of 1-2 months, due to high cost and the need to avoid rough weather during monsoons, to undertake the supply of 2 MCM of sea sand annually will need land in extent of 25 Ha. The Government should make available land 25 Ha in extent near Chilaw, close to the beach, on a concessionary lease with a 10-year tax holiday, to set up an operation to pump sand from deep sea, stockpile and supply after washing and sieving. For this purpose, even the former VOA land at Iranawila will be suitable.

Another alternative to reduce the demand for river sand is to promote the manufacture of rock sand. There are a few companies who have set up manufacturing plants to produce rock sand. But when selling this sand to house builders and small contractors, the producers are at a disadvantage. This is because the manufactured sand is liable to VAT, whereas off shore sand and river sand are not liable. As such, it is proposed to also exempt manufactured sand from VAT.

Competition to local companies from foreign companies

The local construction companies are at a tremendous disadvantage when competing with some of the foreign contractors, due to various incentives provided by the foreign governments, with cheaper import of materials and access to concessionary working capital. In addition, some of these companies continue to use construction machinery, imported on a duty free basis in the past for foreign-funded projects, on new projects for which such facilities are not available. As a result, in some recent tenders, the foreign contractors, especially Chinese, were found to be 30% cheaper than the lowest local tenderer. It is reported that already there are 95 Chinese companies undertaking work, whereas there are only about 70 local construction companies in CIDA grades C 2 and above. If no corrective action is taken to support the local construction industry, very soon many local construction companies will collapse. Of the over 2000 construction companies, first to collapse will be the small and medium companies, who comprise the majority of our construction landscape. Reportedly, Chinese construction companies have access to cheaper working capital at approximately LIBOR + 2% when needed. Such facilities are not available to local companies.

To support the local construction industry, which contribute about 10% to the GDP and employ 600,000 direct, the following measures are proposed:

Support to local construction companies

Foreign consultants/contractors to form JVs with local consultants/contractors

We can have no objection to the foreign consultants and foreign contractors undertaking projects with majority foreign funding. If it is a foreign loan funded project through ERD, then competitive bids should be called from eligible foreign consultants and contractors, rather than awarding on a single bid proposal.

In all instances, foreign consultancy and construction companies shall be compulsorily required to form JVs with local counterparts, sharing at least 40% of the project scope.

This is one of the objectives of the National Policy on Construction adopted by this Government, to ensure better compliance to local regulations and standards, and also to facilitate technology transfer. Such requirements are prevalent in many developing countries, to protect and develop the local companies.

Equal treatment to local steel manufacturers

Another proposal is that all steel manufacturers should be given the same concessions when importing steel billets for the production of reinforcing and structural steel. At present, an exemption on Port and Air Port Development Levy (PAL), which is charged at 7.5%, is allowed for the import of steel billets to only one manufacturer. As proposed above, if PAL is withdrawn on the import of all construction materials, then this anomaly will be automatically removed. Now there is no customs Duty on import of steel billets by all manufacturers. If concessions are to be given to any manufacturer because of the magnitude of investment, then it should be as a concession on corporate tax, and not on the taxes charged on import of raw materials.

Liberalising cement industry by removing MRP

The Government has imposed a Maximum Retail Price (MRP) on cement, which is hindering further investment on cement manufacturing. This has also led to much corruption. This is at much variance to the other major construction material, reinforcing steel, on which there is no price control. Presently, there is sufficient competition on cement supply with two cement manufacturers, five bulk cement importers and 40 bag cement importers. With this level of competition, there is no justification to impose a MRP on cement, when there is no MRP on reinforcing steel. Removal of the MRP will encourage more investment on cement manufacturing, and thus even more competition.

Removing restrictions on bitumen imports

A few years back, the import of bitumen was a monopoly of Ceylon Petroleum Corporation. But since 2016, several private suppliers were allowed to import, in addition to CPC and IOC. As a result, the quantity of bitumen imported by CPC has dropped to 1.2% in 2018. But the present practice is for the Ministry of Petroleum Resources Development to issue letters of recommendation to import bitumen. This has caused many delays, and could be a source of corruption. Bitumen, being a non-hazardous material, should be allowed to be imported according to market demand, subject only to quality control. This will allow a timely supply of bitumen for road development work.

Threat to local roofing products manufacturers

By the 2014 Budget, the import of roof and ceiling sheets on a duty-free basis under the India-Sri Lanka Free Trade Agreement (ISFTA) had been gazetted. Relevant HS Codes are 6811.81 and 6811.82. This is against the policy of the Government to provide protection to local manufacturers. We have to be very careful when importing roof, ceiling, and partition boards, due to the substandard quality and potential fire risk. Even in the Grenfell Tower fire disaster in London, which killed 71 persons, the main cause was the partition boards, which were supposed to be inflammable. As such, these materials should be quality-controlled, and should not be imported free under FTAs. There should be a reasonable duty imposed.

Income tax charged on trade chambers and professional institutes

The trade chambers and professional institutes, which are formed by Acts of Parliament or as companies by guarantee, where no profits or dividends are distributed among the members/shareholders, play a very important role to nurture domestic industry and uplift professional services. Without any financial support from the Government, these chambers and professional institutes have managed to raise funds in an exemplary manner to extend their services, in spite of many difficulties. Some of them were exempted from income tax payments up to 2017. But now, all of them are subject to 28% income tax. This will adversely impact their services.

As such, it is proposed that the trade chambers, which are either formed by Acts of Parliament or as companies by guarantee, with no profits distributed among shareholders/members, be either exempted from income tax, or only subject to 14% concessionary tax rate. Similarly, even the professional institutes who have become members of any one of the above chambers, or formed by Acts of Parliament, should be allowed the above concession. As a policy, professional Institutes should be encouraged to be part of the relevant trade chamber, so that they could function in unison with the industry.

The writer is a former Secretary, Ministry of Housing and Construction and Foreign Employment Promotion and Welfare and currently Secretary General / CEO of Chamber of Construction Industry Sri Lanka

Promoting export of construction services

Export of construction services played a major role in the development strategy of South Korea in the 1980s. As Sri Lanka has many well-developed construction companies, with suitable incentives, export of construction services can be promoted as a major source of foreign exchange earnings. Already there are a few companies who have ventured out amidst many difficulties. The following are proposed to encourage export of construction services:

Bank facilities in countries where work is undertaken

To get an award for a construction contract, it is necessary to get bank guarantees from a bank registered in that country. As our companies are not known to these banks, this is possible only by our banks facilitating guarantees through a bank in the country concerned, on a back to back basis. This is the practice adopted even by the foreign contractors when undertaking work here. Consequently it is proposed that the Government should make arrangements through the Central Bank for our banks to issue back to back bank guarantees to our construction companies, to undertake work in SAARC countries, GCC countries, and countries such as Kenya, Uganda, Tanzania, Zambia, Rwanda, Tonga, Benin, Ghana, Ivory Coast, Ethiopia, Madagascar, Seychelles, Mauritius, Australia, Fiji, Malaysia, and Indonesia, through correspondent banks in these countries. When tendering, it is necessary to have the guarantees within a short period of about two weeks, and as such, it is essential to have standing arrangements made beforehand.

Facilitating easy travel abroad for key company executives to attend meetings

When undertaking construction services abroad, it is necessary for key executives of companies to travel to destinations such as Bangkok, Hong Kong, Kuala Lumpur, and Manila to attend business and progress meetings at short notice. But now, visas to these destinations take over 2 weeks. In addition to explore work possibilities, it is necessary to travel to many countries where economies are expanding. Our company executives face many difficulties when obtaining visas to travel for business purposes to several of these countries. Company executives from China, Singapore, India, Malaysia, Japan, and Korea have no such difficulties.

As such, the following measures are proposed:

Export of construction services to be formally considered as an export

Even though several companies have undertaken overseas contracts for consultancy and construction, this is yet to be considered formally as an export qualifying for concessions given to other exporters. This should be corrected immediately.

In addition, since 2017, earnings from the export of construction services is taxed, whereas these earnings were exempted from tax before. For companies with export income on construction services over 80%, the tax rate is 14%, and for other companies it is 28%. But only one company is engaged totally on construction work overseas, thus qualifying for 14%. This is discouraging our construction and consultancy companies to venture overseas. As such, it is proposed to exempt from tax earnings from overseas operations of these companies, as before.

Establishment of Building Information Modelling Centre

The contribution of the construction industry to GDP is about 9% during the last year. This is expected to reach 15% within the next 2 years, if the expected FDIs become reality. Increasing productivity, timely completion, and avoidance of disputes in the construction industry are essential pre-requisites for a healthy economic growth.

Building Information Modelling (BIM) is a new system widely practiced in developed countries to achieve the above objectives. The USA commenced using this system from 2003, and now more than 70% of construction and consultancy companies use BIM. In UK, use of BIM is mandatory. Norway, Denmark, Finland, Sweden, and Germany are European countries heavily using BIM. In Singapore, BIM is mandatory for project approval. Hong Kong and Malaysia are two other Asian countries where BIM is widely used.

However, in Sri Lanka, most architects, engineers and quantity surveyors still do not use this system.

This is partly due to the very high cost of BIM software, and partly due to the fact that most of our architects, engineers, and quantity surveyors are not trained in this system. Even our universities do not provide training on the BIM system. Already, for all building projects in Colombo Port City, the use of BIM has been made compulsory. This will be the trend with all new buildings with FDIs.

As such, there is an urgent need to establish a BIM Centre, to provide training to industry professionals, as well as to make its facilities available to be used by the consultancy and construction companies on a reasonable payment scheme. The Government should seriously consider establishing a BIM Centre with a minimum of 25 workstations, by extending a financial grant of Rs. 150 million.

Establishment of this BIM centre will make our construction industry more competitive, by reducing costs, and will be a step forward to the future.

Setting up Real Estate Investment Trusts (REITs) under the Colombo Stock Exchange

Globally Real Estate Investment Trusts (REITs) have become an integral part of the investment portfolio, accepted by individual and institutional investors, providing greater access to real estate projects. Sri Lanka can also benefit significantly by the introduction of the same. It can provide a platform for much-needed FDI, without transferring the ownership of real estate assets to the foreign investor. Asian REITs market is now valued at approximately $ 180 billion. Singapore, Hong Kong, Taiwan, Japan, South Korea, Malaysia, and Thailand are the market leaders. Now even Indonesia, Philippines, Pakistan, and India have introduced REITs. Necessary legislation should be enacted to introduce REITs in Sri Lanka soon, which was a previously announced Budget proposal.

The writer is a former Secretary, Ministry of Housing and Construction and Foreign Employment Promotion and Welfare and currently Secretary General / CEO of Chamber of Construction Industry Sri Lanka