Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 11 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By Anishka De Zylva and

By Anishka De Zylva and

Ganeshan Wignaraja

At the Commonwealth Heads of Government Meeting that took place in London in April 2018, Sri Lanka took leadership of the newly-formed Commonwealth Centre for Digital Health. This positive news on Sri Lanka’s digital future, however, came just a few weeks after Sri Lanka controversially imposed a temporary ban on social media,1 following local anti-Muslim riots in March 2018.

These are two recent and specific stories on Sri Lanka’s digital economy. The larger story, however, is that of Asia’s growing digital economy and the prospects for latecomers like Sri Lanka. Will Sri Lanka be left behind, or can it invest in and substantially benefit from this regional growth? The following discusses this regional growth, Sri Lanka’s current position and challenges, and some key policy measures that it can take to forge ahead.

Asia is a leader of the global digital economy, as both a producer and a consumer of digital economy goods and services: these include information and communications technology (ICT) goods, electronic commerce (e-commerce), and digital applications. By market capitalisation, about one-third2 of the largest 135 multinational corporations in the digital economy are based in Asia—major regional players include the China-based Alibaba and JD.com, and the Japan-based Rakuten.

E-commerce has increased significantly in Asia; with Japan, China, and South Korea becoming the world’s largest markets for business-to-consumer e-commerce. China now accounts for 40%3 of the total value of e-commerce transactions, while the US accounts for only 20%4 of that value. Southeast Asia’s digital economy alone is expected to amount to $ 200 billion by 2025,5 while Asia is likely to be several times that figure.

Reflecting these impressive changes, mobile subscriptions per 100 people in Asia rose from 73.6 to 102.66 between 2010 and 2016. Sri Lanka’s figure was above the regional average and rose from 83.6 to 118.5 over the same period. Meanwhile, the share of internet users in the region’s total population—arguably a better indicator of digital economy penetration—nearly doubled from 23.1% to 40.5% in the same period.

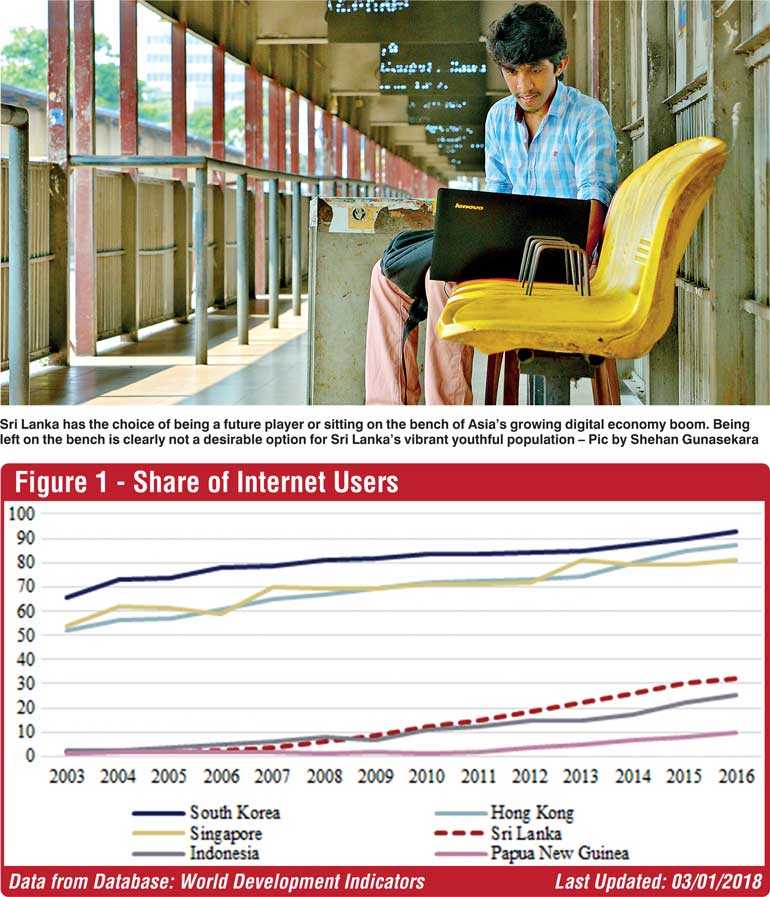

However, internet connectivity is evolving at different speeds in the region. In 2016, the share of internet users in developing economies in Asia (60.5%) were significantly lower than in developed economies (86.9%). The evolution leaders of the digital economy among developing economies are South Korea (92.7%), Hong Kong (87.3%), and Singapore (81.0%). Meanwhile, Sri Lanka (32.1%), Indonesia (25.4%), and Papua New Guinea (9.6%) are closer to the bottom (see Figure 1).

Opportunities of the digital economy extend to consumers, businesses, and the government. Corporations and small and medium-sized enterprises alike, stand to gain from opportunities in higher levels of productivity and greater customer engagement.

For consumers, digital banking and payment gateways offer opportunities in accessing products and services across the globe. Digital trends like social commerce (i.e. sales through social media) and subscription e-commerce (recurring sales through online subscriptions) also maximise e-commerce opportunities7 for both business and consumers alike. Besides economic growth and employment, the digital economy offers the government opportunities to empower citizens, through choice and competition, and paves the way for e-governance.

Given the opportunities, developing economies that under-invest in digital preparedness face several risks. First, higher productivity gains arising from digitalisation typically go to a small number of skilled people which may contribute to polarisation and increasing income inequality.8 Second, many jobs in the wide spectrum of manufacturing (e.g. textiles and garments) as well as services (e.g. retail trade and business process outsourcing) are likely to become obsolete with digitalisation.

Third, in the developed world, there are concerns about privacy and security with the increasing spread of digital communication and data flows. These pose a relatively greater risk to developing countries, whose political and economic systems are less stable and whose populations may be less media literate.9

Ensuring political stability and respect for the rule of law10 is the bedrock for stimulating private investment in Sri Lanka’s digital economy. Improvements are also needed in four public policy areas: (i) foreign direct investment and exports, (ii) education, (iii) digital infrastructure, and (iv) regulations.

FDI and exports

Foreign Direct Investment (FDI) is critical to facilitate Sri Lanka joining Asia’s digital economy. It brings capital, new technology and skills and overseas marketing connections, which are typically scarce locally. Dialog Axiata—a part of Malaysia’s Axiata Group—has brought in investments of more than $ 1.9 billion since 1995.11 This has helped to revolutionise Sri Lanka’s mobile phone industry and create local jobs; according to Dialog, in 2016, it provided direct employment of over 3,000 people (and supported the livelihoods of over 100,000 households)12 who are engaged in supply chains of its operations in Sri Lanka.

Dialog, however, is an exception to the limited FDI flows into Sri Lanka’s ICT industry. Employment and exports in Sri Lanka’s ICT industry are below potential. In 2016, around 1% of Sri Lanka’s workforce (85,000 people)13 were in its ICT industry, and although ICT services exports increased over five-fold from $ 166 million in 2006 to $ 900 million14 in 2016, they still constitute only 12.6 of Sri Lanka’s total service exports. By contrast, around 7% of Malaysia’s workforce (1.07 million people)16 are in Malaysia’s ICT industry and Malaysia exports $ 8.1 billion in ICT services, amounting to 23.1 of its total service exports.

To improve, Sri Lanka could consider joining the World Trade Organisation’s Information Technology Agreement (ITA). Under the ITA, import duties and other charges would need to be reduced to zero on 201 ICT products,18 like touch screens, GPS navigation equipment and medical equipment. This could make Sri Lanka’s ICT goods exports more competitive and help to attract FDI. Joining the ITA would signal Sri Lanka’s entry as a player in the digital economy, since participants of the ITA represent around 97% of global trade in ICT products.19

Education and training build the skills necessary for thriving in the digital economy. Sri Lanka has the advantage of a youthful population; around 31.6% of Sri Lanka’s population is between the ages of 15-34,20 which presents an opportunity for Sri Lanka to maximise this demographic dividend. The country also enjoys near universal literacy, thanks to decades of investment in human development. However, ICT and English language training is inadequate—the national English language literacy rate is only 30% (2012)21 and computer literacy is 28% (2017).22

Insights can be gained and applied in Sri Lanka from the European Commission’s Digital Education Action Plan23 of January 2018 which includes equipping schools with broadband to overcome barriers to internet access and training teachers to use technology in classrooms. In Asia, the Philippines introduced a dual training system24 in its schools in 2013. This system combines theory and practical training in work environments and prepares students for employment by ensuring that employers are part of the skills development process.

Sri Lanka’s approach to digital infrastructure is improving but challenges remain. Around 53% of its population has access to 4G internet,25 and Sri Lanka was the first in South Asia to trial 5G internet.26 Moreover, internet connectivity in Sri Lanka is more affordable than other Asian countries, and the government has shown interest in increasing internet access via public Wi-Fi and Google’s Project Loon. However, there are still gaps in digital infrastructure, including implementation challenges and the lack of disposable income to spend on ICT equipment and services.

To improve this, Sri Lanka should promote zero rating services,27 offered by mobile network operators (MNOs). These services allow internet users with low disposable income to access certain digital applications and websites without using their data plans. By exempting high-usage applications and websites, like Facebook and WhatsApp, from data plans, MNOs allow people to access more of the web at no additional cost. Introducing “Facebook Zero” increased the number of Facebook users by 154% in Nigeria, 85% in Ghana and 50% in Kenya.28 Facebook Zero may have some undesirable effects, given Facebook’s apparent negligence concerning privacy and information flows. Nonetheless, this example highlights the success of zero rating services in developing countries.

The recent privacy scandal involving Cambridge Analytica has reinforced the importance of addressing concerns around sharing and securing data in the digital economy. Digital businesses like Facebook are rethinking how they allow third-parties to access their data. As this discussion advances, Sri Lanka should evaluate and implements ways to ensure that regulation protects privacy while not hampering innovation. Commentators have argued that general laws, like the EU’s General Data Protection Regulation, are more beneficial29 to the digital economy than sector-specific regulations. This because more specific regulations may slow down collaborations between sectors, like car manufacturers and MNOs.

Sri Lanka has previously faced regulatory uncertainty when rolling out digital products and services. In particular, there was confusion about applicable laws30 when Sri Lanka rolled out MNO-led mobile money services in 2007-2010. A strong regulatory framework is also needed to tackle a growing issue of cybercrime. Sri Lanka has an opportunity to develop effective regulations that are flexible and functional, via a bottom-up approach.31 It should, therefore, prioritise a clear regulatory framework, along with the expertise to keep up with rapid changes to digital products and services; a major challenge to ensuring that regulation does not become obsolete. Sri Lanka’s plan to establish the Colombo International Financial City (previously called the Port City), as part of its ambition to become a financial centre between Dubai and Singapore, also makes this a policy imperative.

Sri Lanka has the choice of being a future player or sitting on the bench of Asia’s growing digital economy boom. Being left on the bench is clearly not a desirable option for Sri Lanka’s vibrant youthful population. Sri Lanka should prioritise the joining the WTO’s Information Technology Agreement, improve its standard of ICT and English language skills, increase its investment in digital connectivity through public WiFi and zero rating services, and develop flexible and clear regulations based on the functionality of digital products and services. More broadly, political stability and a proactive public policy are essential elements of the way forward.

[Anishka De Zylva is a Research Associate at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI). Dr. Ganeshan Wignaraja is Chair of the Global Economy Programme at LKI. The opinions expressed in this article are the authors’ own and not the institutional views of LKI, and do not necessarily reflect the position of any other institution or individual with which the authors are affiliated.]

Notes

1Hewage, S., Pinto, C. and Waidyatilake, B. (2018). International Reactions to Anti-Muslim Riots in Sri Lanka. The Lakshman Kadirgamar Institute. Available at: http://www.lki.lk/blog/international-reactions-to-anti-muslim-riots/.

2United Nations Conference on Trade and Development. (2017). Digital Economy Evolving At Different Speeds In Asia-Pacific. Available at: http://unctad.org/en/pages/PressRelease.aspx?OriginalVersionID=431.

3Marinova, P. (2017). This Is Only the Beginning for China’s Explosive E-Commerce Growth. Fortune. Available at: http://fortune.com/2017/12/04/china-ecommerce-growth/.

4 Statista. (2018). U.S. Share of Global E-Retail Sales 2020. [online] Available at: https://www.statista.com/statistics/243699/share-of-global-retail-e-commerce-sales-usa/.

5Google., and Temasek. (2017). e-Conomy SEA Spotlight 2017: Unprecedented Growth for Southeast Asia’s $50B Internet Economy. (2017). Available at: http://storage.googleapis.com/201712/e-conomy-sea-spotlight-2017-unprecedented-growth-southeast-asia-50-billion-internet-economy/APAC-Google-Temasek-2017-spotlight.pdf#page=3.

6 The World Bank Group. (2018). World Bank Open Data. Available at: https://data.worldbank.org/.

7 Park, C., Khan, F. and Justo, C. (2017). How Southeast Asia Can Maximize e-Commerce Opportunities. Asian Development Blog. Available at: https://blogs.adb.org/blog/how-southeast-asia-can-maximize-e-commerce-opportunities.

8 Arntz, M., Gregory, T. and Zierahn, U. (2016). Digitization is Unlikely to Destroy Jobs, but may Increase Inequalities. Jobs and Development Blog. Available at: http://blogs.worldbank.org/jobs/digitization-unlikely-destroy-jobs-may-increase-inequalities.

9 West, D. (2017). How to Combat Fake News and Disinformation. Brookings Institution. Available at: https://www.brookings.edu/research/how-to-combat-fake-news-and-disinformation/.

10 Panditaratne, D. (2018). The Role of Sri Lanka in South Asia and Beyond: Emerging New Contours. The Lakshman Kadirgamar Institute. Available at: http://www.lki.lk/wp-content/uploads/2018/01/The-Role-of-Sri-Lanka-in-South-Asia-and-Beyond_-Emerging-New-Contours-Dr.-Dinusha-Panditaratne.pdf.

11 Dialog Axiata. (2016). Axiata Remains Committed to Long Term Investment in Sri Lanka. Available at: https://www.dialog.lk/axiata-remains-committed-to-long-term-investment-in-sri-lanka/.

12 Dialog Axiata. (2016). Annual Report. Available at: https://www.dialog.lk/dialogdocroot/content/pdf/annual_reports/2016-annual-report.pdf#page=16.

13 Sri Lanka Export Development Board. (2018). ICT Services Overview. Available at: http://www.srilankabusiness.com/export-services/ict/.

14 Ibid.

15 The World Bank Group. (2018). World Bank Open Data. Available at: https://data.worldbank.org/.

16 The National ICT Association of Malaysia. ICT Strategic Review 2017/ 2018: Convergence of the Digital and Physical Worlds. (2017). PIKOM. Available at: http://www.pikom.org.my/2017/PISR/PISR1718.pdf#page=21.

17 The World Bank Group. (2018). World Bank Open Data. Available at: https://data.worldbank.org/.

18 20 Years of the Information Technology Agreement. (2017). World Trade Organization. Available at: https://www.wto.org/english/res_e/booksp_e/ita20years_2017_full_e.pdf#page=9.

19 World Trade Organization. (2018.). Information Technology Agreement - Map of ITA Participants. Available at: https://www.wto.org/english/tratop_e/inftec_e/ita_map_e.htm.

20 Registrar General’s Department. (2017). Mid-year Population Estimates by Age Group and Sex, 2012-2017. The Department of Census and Statistics Sri Lanka. Available at: http://www.statistics.gov.lk/PopHouSat/VitalStatistics/MidYearPopulation/Mid-year%20population%20by%20age%20group.pdf#page=2.

21 Department of Census and Statistics. (2012). Census of Population and Housing. Available at: http://www.statistics.gov.lk/PopHouSat/CPH2011/Pages/Activities/Reports/FinalReport/FinalReportE.pdf#page=199http://www.statistics.gov.lk/PopHouSat/CPH2011/Pages/Activities/Reports/FinalReport/FinalReportE.pdf.

22 Department of Census and Statistics. (2017). Computer Literacy Statistics 2017. Available at: http://www.statistics.gov.lk/education/ComputerLiteracy/ComputerLiteracy-2017Q1-Q2-final.pdf#page=2.

23 Education and Training. (2018.). Digital Competences and Technology in Education. European Commission. Available at: https://ec.europa.eu/education/policy/strategic-framework/education-technology_en.

24 Development Asia. (2018). Using Dual Training Systems to Improve National Education. Available at: https://development.asia/summary/using-dual-training-systems-improve-national-education.

25 Axiata Group. (2018). About Dialog. Available at: https://www.axiata.com/operating/company/20/.

26 Dialog Axiata. (2017). Dialog Axiata Trials 5G for the First Time in South Asia. Available at: https://www.dialog.lk/dialog-axiata-trials-5g-for-the-first-time-in-south-asia/.

27 West, D. (2015). Digital Divide: Improving Internet Access in the Developing World Through Affordable Services and Diverse Content. Brookings Institution. Available at: https://www.brookings.edu/wp-content/uploads/2016/06/West_Internet-Access.pdf#page=1.

28 West, D. (2015). Digital Divide: Improving Internet Access in the Developing World Through Affordable Services and Diverse Content. Brookings Institution. Available at: https://www.brookings.edu/wp-content/uploads/2016/06/West_Internet-Access.pdf#page=15.

29 Fuhr, L. (2017). Innovation Lost—Or A Digital Regulation Tale. Politico. Available at: https://www.politico.eu/sponsored-content/innovation-lost-or-a-digital-regulation-tale/.

30 IFC Mobile Money Study 2011. (2011). International Financial Corporation. Available at: https://www.ifc.org/wps/wcm/connect/6a8d06004a052e158b1affdd29332b51/MobileMoneyReport-SriLanka.pdf?MOD=AJPERES#page=23.

31 GSM Association. (2016). A New Regulatory Framework for the Digital Ecosystem. Available at: https://www.gsma.com/publicpolicy/wp-content/uploads/2016/09/GSMA2016_Report_New RegulatoryFramework ForTheDigitalEcosystem_English.pdf#page=7.