Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 18 July 2018 00:00 - - {{hitsCtrl.values.hits}}

By Research Intelligence Unit

By Research Intelligence Unit

Cigarettes are among the most illegally trafficked goods in the world. Cigarettes are becoming a preferred item to smuggle as they are easy to buy, easy to smuggle and provide a good return on the investment, states a report from the World Health Organization in 2015.

The value of the illicit tobacco trade is estimated to be greater than the illicit trade in oil, wildlife, timber, arts and cultural property, and blood diamonds combined (Financial Action Task Force, 2012). Large quantities of cigarettes are sold on the black market at below retail cost and without tax. Besides, unlike smuggling narcotics or other hard-core trafficked products, punishment for smuggling tobacco is less severe. According to the WHO data, every tenth cigarette consumed globally is part of the illicit tobacco trade.

Based on a recently released report focusing on developing a sustainable policy framework for the tobacco industry in Sri Lanka, the Research Intelligence Unit stated that combating illicit trade (particularly in the area of cigarettes) requires the establishment and deployment of a comprehensive strategy that makes the fight against illicit trade a priority.

The study recommends a strategy that is formulated with the participation of stakeholders such as the government and regulatory entities (Ministries of finance and health, tax administration and customs authorities), revenue collection entities, the tobacco industry and related business alliances.

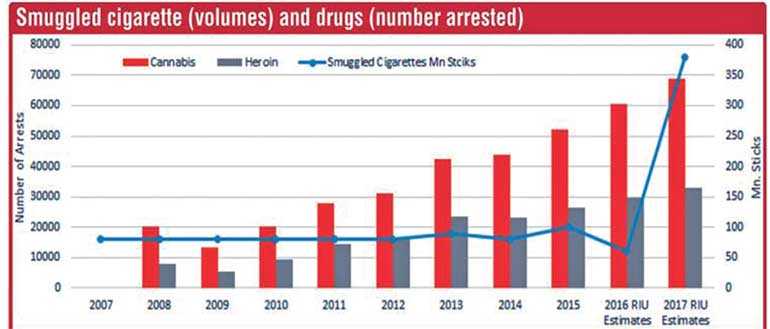

The report discusses several issues in relation to cigarette smuggling, apart from the issue of lost tax revenue to the government. These issues include the fact that growth in the illegal trade of tobacco is serving to increase the spread of organised crime, gang violence and criminal activity which in turn increases social cost, including other drug consumption.

RIU has learned that in addition to smuggling cigarettes, there is also a worry connecting to a rise in trafficking of more dangerous drugs. The Department of Prisons’ statistics show that in 2015, nearly half or 46.4% of prisoners convicted were drug offenders. This means that of the 24,086 who were sentenced, a massive 11,171 went to jail for narcotics crimes.

The previous year (2014), the percentage of total convicts that were drug offenders was 43.5%. In 2013 it was 34%. The data shows an upward trend in the number of those getting sentenced for trafficking, and the data also shows a positive correlation between those who consume narcotics and get sentenced for trafficking.

According to the Customs authorities and other sources met during the RIU research, a 40-foot container of smuggled cigarettes can generate a profit of between Rs. 250-400 million. Customs officials say that most of the brands of illegal cigarettes detected have been smuggled from Dubai, China, Vietnam and Turkey.

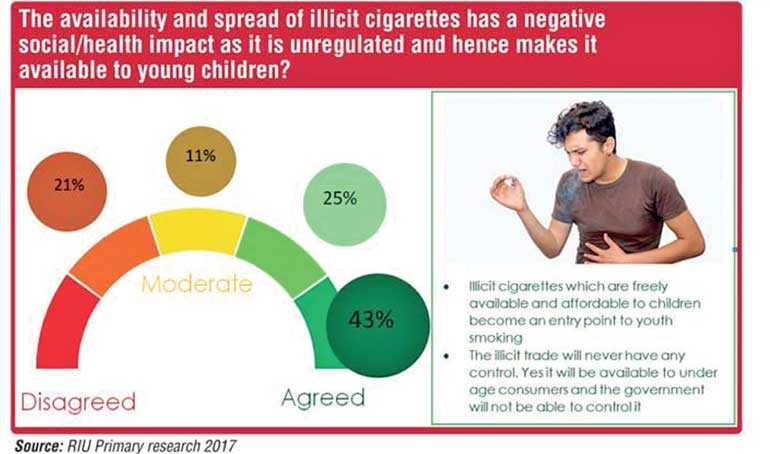

Potential future tax rises on legal cigarettes can spell good news for criminals who already view Sri Lanka as a paradise. According to the Sri Lanka Police who conduct raids island-wide to arrest smugglers, these unscrupulous groups care very little about the age of their customers, or the quality of the product they peddle.

Cooperation

and collaboration

Fortunately, policymakers are now becoming more aware of this phenomenon and are taking steps to combat it. Fighting illegal trade links directly to combatting corruption, contributing to improving human rights, labour rights and environmental standards, principles that organisations involved in illegal trade often ignore or violate.

Governments and law enforcement officials can sometimes struggle to keep pace with tackling the problem on their own. Therefore, cooperation and collaboration is the only way to crack down on the black market. Partnerships and pioneering, and innovative approaches to problem solving will hopefully keep governments one step ahead in order to outsmart the criminals.

Unfortunately, the Sri Lanka Customs authorities are successful in detecting only one in ten sticks smuggled into the country. Smuggled cigarettes entering the country increased over 10-fold in 2017, with 460 million illicit cigarettes infiltrating the market during the year. Smuggled cigarettes are now estimated to be in the region of 15% of the legal cigarette industry in Sri Lanka, causing a revenue loss of about 20 billion rupees to the Government in 2017 alone.

The illegal cigarette trade has received increasing political attention in the light of substantial losses of revenue and growing concerns that the cigarette black market is linked to “organised crime”. Germany was faced with a similar situation where its immediate neighbours along Eastern Europe were all retailing cigarettes at much lower prices, which then led to a surge in illegal smuggling of cigarettes into the country.

Since 2006, the German Government changed its approach to tobacco excise with the emphasis firmly placed on tackling the illegal trade and preventing further market erosion. From early 2006 until May 2011, tobacco excise rates were adjusted moderately. During this period pricing stability reduced the growth of cross-border and illegal cigarette consumption – the share of such products in total cigarette consumption remained flat at 21% over the whole period of five years.

As the Sri Lankan Government wants to balance the Health Ministry perspective with that of the Finance Ministry, it is essential according to the report to de-politicise the issue of tobacco taxation and base it on a rationalised, balanced and well-researched policy framework. It is also important to look at the policy approach of Germany, Pakistan and others who have achieved their goals by monitoring and responding to their local environment and dynamics rather than blindly accept policy dictates from international agencies.

The Sri Lankan Government needs to consider the more important policy measures that are aligned with education and health awareness rather than only looking at taxation to achieve health goals and review policies on related industries like beedi and illegal smuggling.