Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 30 June 2020 00:09 - - {{hitsCtrl.values.hits}}

By the Advocata Fellows

Even though Sri Lanka’s economy has opened up, businesses are still recovering from the dual shock of the locally imposed curfew as well as the global fallback from the coronavirus.

A vast majority of Sri Lankan businesses are in need of support if they are to survive the next few months. The need of the hour is for liquidity support and enhanced access to credit. However, banks are finding this situation to be challenging. They need to be able to finance the loans that are being demanded, but they also need to have some guarantee that their loans will not go bad.

Will the Central Bank’s solution work?

In response to this problem the Central Bank has announced a subsidised credit scheme for businesses. Through this, the Central Bank will be offering a facility of Rs. 150 billion to Licensed Commercial Banks (LCBs) at a concessionary rate of 1%. LCBs in turn will be required to lend to businesses at a rate of 4%.

Put simply, the Central Bank is essentially offering commercial banks a credit line to solve their issue of a source of financing this new demand for loans.

Assuming that the bank’s marginal cost would be around 1%, they are left with a contribution of 2% before provisioning. Lending to this segment of businesses will be risky as many of these borrowers are already leveraged, and do not have spare collateral to pledge. Under distressed economic conditions, non-performing loans could increase significantly.

While a part of the non-performing loans could be partially recovered, the impairment cost or credit cost could be as high as 6%. If the net contribution to the banks is 2% after their direct cost, a potential 6% credit cost per year would mean a pre-tax loss of 4% per year; creating the need for a credit enhancement or guarantee.

This credit line means that the Central Bank is printing money to meet this requirement, leading to a monetary expansion. The risks of increasing money supply in the current economic context is that the subsequent pressure on the exchange rate will result in a depreciation of the currency.

Looking at Sri Lanka’s import bill, 19.8% of our imports are consumption goods, and 57% of imports are intermediate goods for production. The share of investment imports is also higher than consumption goods at 23.1%. The impact of a depreciating currency will be significant on the economy’s ability to recover and grow.

There are additional risks associated with this solution. A key problem is that while banks are receiving newly minted money from the central bank to finance the loans, the bank and the depositors have to take the credit risk on the lending. The collapse of finance companies in recent years shows what happens when deposit taking institutions take on risks that they cannot bear.

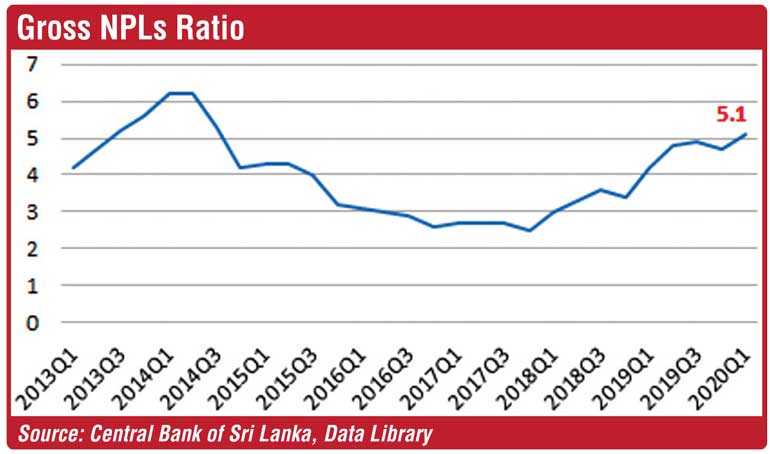

Bad loans of Sri Lanka’s banks have been rising since the currency crisis in 2018, and the Easter Sunday bombings. The banks are already burdened with the credit moratorium that was also given in early 2020. In the first quarter of 2020, bad loans had risen to 5.1%, which is the highest since the third quarter of 2014. If banks collapse, the Government may end up having to bail them out with capital injections. At the moment Sri Lanka’s banking system is fairly sound and given the indications that bad loans will rise, all efforts must be made to keep banks stable.

Further complications

As highlighted by the former Deputy Governor of the Central Bank, and senior economist, W. A. Wijewardene, the issue with excess liquidity already in the system the problem is not about liquidity but the fear of default.

According to Wijewardene, this fear of default could be tackled by a comprehensive credit guarantee scheme and smoothing out banks’ internal credit approval systems. Instead of using CRIB reports for rejecting loans, a rating system could be used to eliminate the worst ones. If treasury guarantees are available, it may not be necessary to create new money and endanger the balance payments. Banks may be willing to make loans from their own deposits if there is a guarantee.

There is also a moral hazard associated with this decision. This crisis hit at a time where there was significant pre-existing distress in the economy, there is the possibility that this financing will be utilised to keep ‘zombie entries’ alive. Additionally, this would prevent resources from being allocated to productive and efficient firms.

What is needed is quick support for viable companies to get their business going. Steeply subsidised credit may induce businesses to go after loans that are not needed and re-finance other loans which are at higher rates. Or whenever they have the cash the incentive will be to settle the higher cost loan than the low cost one, inviting default or delays. The artificially low rate of interest of 4% for working capital also may create other distortions.

A working solution

Given a challenging environment, if the authorities want to direct banks to give loans, the Government will have to share the risk. Ideally the credit risk should be split three ways between the Government, multi-laterals and the banks to ensure that they have skin in the game. The worst case scenario would see banks with a potential zero profit from this scheme, and not the alternative of sustaining heavy losses, incentivising banks to lend.

Guarantees could also be structured to give high credit cover to smaller firms and lower amounts to large firms, as it may not be necessary to give all borrowers the same amount of credit cover. For instance, loans up to a million rupees for very small firms could be covered by a 100% guarantee, loans from one to 10 million by a 90% guarantee, from 10 to 20 million 75% and loans above 20 million to 50% or a similar suitable share of risk. Of course this solution is not devoid of risk. This would allow the LCBs to meet the demand for the loans, with the guarantee offered by the Government.