Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 15 October 2020 00:00 - - {{hitsCtrl.values.hits}}

The dynamics of the geopolitics of the Indian Ocean region does give Sri Lanka some leverage, in terms of relations with global players including India, but more broadly it’s in the interest of the smaller country to have a rules-based framework within which bilateral, economic and trade relations are conducted

Sri Lanka-India relations are multifaceted and are characterised by strong civilisational links that span many millennia. Currently, trade and economic relations are structured around an institutional and legal architecture which includes regional platforms such as SAARC and BIMSTEC; as well as bilateral agreements such as the Indo-Sri Lanka Free Trade Agreement (ISLFTA), the bilateral investment promotion and protection agreement, the double taxation avoidance agreement and several MOUs involving Chambers in the two countries.

Sri Lanka-India relations are multifaceted and are characterised by strong civilisational links that span many millennia. Currently, trade and economic relations are structured around an institutional and legal architecture which includes regional platforms such as SAARC and BIMSTEC; as well as bilateral agreements such as the Indo-Sri Lanka Free Trade Agreement (ISLFTA), the bilateral investment promotion and protection agreement, the double taxation avoidance agreement and several MOUs involving Chambers in the two countries.

The multifaceted nature of economic and trade relations between the two countries is reflected in the fact that India is Sri Lanka’s largest trading partner, it has been the third largest source of FDI during the 2015-19 period, and has been the number one source of tourism.

In addition, India has also been a source of concessional and grant assistance. The Exim bank of India has provided $ 1.8 billion by way of credit lines over the years, much of it to develop the railway sector. There have also been a variety of grants for the resettlement and rehabilitation in the post-conflict areas, and most notably, recently there has been grant assistance to establish the all island emergency ambulance service (Suwaseriya), which is greatly appreciated by the people of Sri Lanka. India has also provided many capacity development programs for both the public and private sectors in Sri Lanka.

This article seeks to develop four themes. First, to try to establish that in structuring economic and trade relations between two very asymmetric economies, a rules-based framework is of advantage to the smaller country. Secondly, to identify a number of tailwinds which are favourable in terms of building on the existing economic and trade relations between the two countries. Thirdly, to assess the ISLFTA and finally to draw some lessons as to how bilateral relations can be structured going forward.

On the principles that should underlie a bilateral relationship between two very asymmetric economies, a rules-based framework is very much in the interest of the smaller country because ad-hoc transactional relationships work to the disadvantage of the smaller economy which has less leverage. At the present historical conjuncture, the geopolitics of the Indian Ocean region do give Sri Lanka some leverage. However, as a general principle there is evidence from around the world that rules-based agreements favour the smaller countries.

However, for this to happen such bilateral agreements should be based on the twin principles of non-reciprocity and special and different treatment. India recognised these principles in negotiating the ISLFTA. Under the ISLFTA, India’s positive list is longer; Sri Lanka’s negative list is longer; Sri Lanka was given longer transition periods to fulfil its obligations This is a useful foundation for moving forward.

The dynamics of the geopolitics of the Indian Ocean region does give Sri Lanka some leverage, in terms of relations with global players including India, but more broadly it’s in the interest of the smaller country to have a rules-based framework within which bilateral, economic and trade relations are conducted.

What are some of the tailwinds which make it propitious to strengthen bilateral economic and trade relations? One is India’s Neighbourhood First Policy. There seems to be a political consensus in India around this policy and we have seen progress on the ground, particularly in the north-east of the sub-region. The BBIN (Bangladesh, Bhutan, India and Nepal) countries have made some progress in cooperating on energy, water transit and water management, as well as grid connectivity.

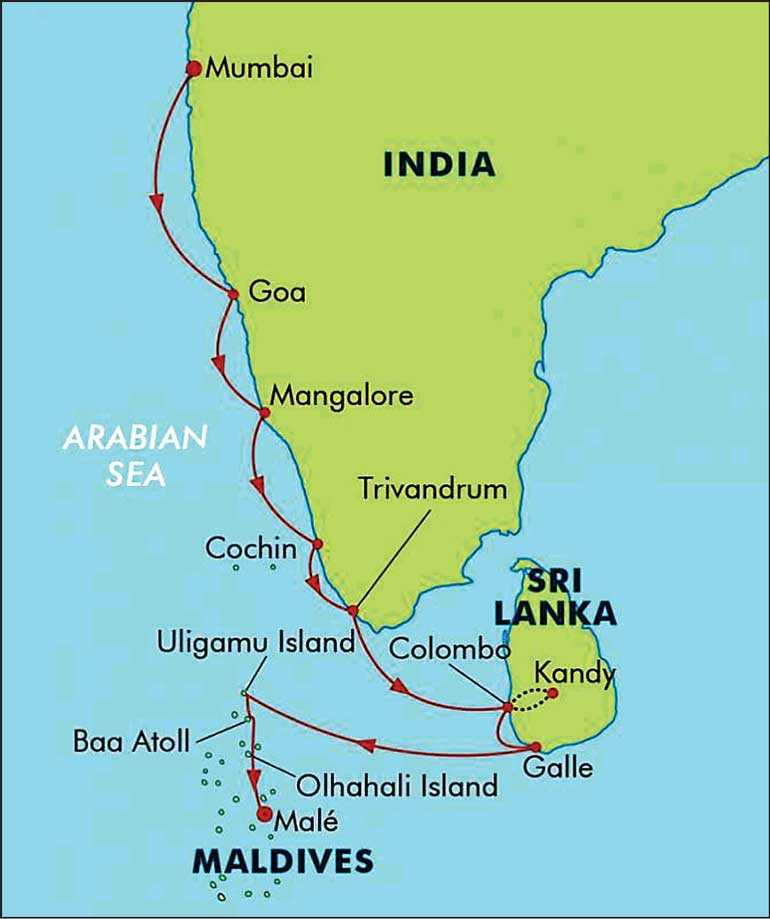

In the South, India has engaged more actively with the Maldives since the change of government there and very recently India has provided prompt assistance to Sri Lanka in dealing with the pandemic, which includes medical supplies, and the RBI has provided a SAARC SWAP arrangement of $ 400 million. A further SWAP arrangement of a $ 1 billion and bilateral debt relief is being negotiated.

Of course, it is in India’s strategic interest to have stability in its neighbourhood. In this respect, a stable and prosperous Sri Lanka will contribute materially to protect India’s southern flank. Given the instability in the northern border of India, many of India’s strategic assets are in the south of the country. In fact, Shivshankar Menon, in his book, wrote that “Sri Lanka is like an unsinkable aircraft carrier parked 20 miles off the coast of India.” He has indicated that his intention was to highlight Sri Lanka’s strategic importance for India. This can be utilised to achieve positive outcomes for Sri Lanka through an enhanced economic and trading relationship. Equally, India’s commitment to prosperity in Sri Lanka would serve its interests in terms of stabilising and protecting its sensitive southern flank.

The second tailwind is related to the ‘Make in India Strategy’ (MIS) and the reconfiguration of global supply chains. If the MIS gains momentum, there is the prospect of replicating, in South Asia, what happened in East and Southeast Asia. When first Japan and then China rose economically, the countries in their neighbourhood were able to plug into Chinese and Japanese company supply chains and they all rose together. This is termed the “wild geese formation.” Similarly, if India’s industrialisation gathers momentum, there are likely to be opportunities where local companies could plug into the supply chains of an expanding manufacturing base in India.

The reconfiguring of global supply chains was already taking place before the pandemic. This was attributable to re-shoring because of the 4th industrial revolution. There was also some relocation of investment from Southern China due to rising costs. This process has accelerated significantly post-pandemic because of the greater preoccupation with diversification and resilience of supply chains. Pressures stemming from global trade, technology and geopolitical tensions are adding further momentum to supply chain reconfiguring. India stands to benefit from this.

In addition, by very successfully containing the COVID-19 virus, opening the economy early and demonstrating the resilience of supply chains, Sri Lanka is also in a position to gain from this trend. There is an opportunity for Sri Lankan companies to work together with Indian companies to attract these reconfigured supply chains.

The third tailwind relates to the improved infrastructure in both countries. There was proximity for millennia but very poor infrastructure in both countries created distance. Transaction costs were high thereby constraining commercial relations. Now, there is an improvement in infrastructure in both countries, bringing down transaction costs and providing new opportunities to develop cross-Palk Strait economic and trade links. In addition, this has improved connectivity and logistics. Colombo is a major transshipment port for India. Of the trans-shipment container handling in Colombo Port (2019) 82.4% involved India.

Port development in India and the new port in the Nicobar and Andaman Islands could change the parameters. However, India’s economy was averaging 7% growth between 2015 and 2019. Though the Indian economy has been badly affected by the pandemic, the consensus is that it is likely to bounce back – with strong growth which should result in trade expansion. This should contribute to providing continued transshipment opportunities for the Colombo Port. There is also excellent air services connectivity. Prior to the pandemic, SriLankan Airlines had the highest number of arrivals per week in Indian destinations.

The fourth tailwind is the General Sales Tax (GST). It has had some glitches but if these are ironed out, the GST can become what it was marketed as: ‘one nation, one market, one tax’. The creation of a single market can facilitate the ease of doing business in India. This is a positive in terms of promoting Sri Lankan businesses in India. The fifth tailwind is the increase in people to people contacts through tourism in both directions as well as other forms of contact through education, training, etc. All of the above taken together mean that there are a number of favourable factors which underpin the economic and trade relations between the two countries. They constitute a good foundation to build on. Another positive factor is Sri Lanka’s proximity to South India. The five South Indian states have enjoyed high growth with a rapidly growing middle class. This is again a positive for Sri Lanka in terms of creating opportunities going forward.

Assessment of the ISLFTA

From a Sri Lankan perspective, there is a considerable body of opinion which feels that the ISLFTA has not been a success. Not only has it not been a success, but that it has positively damaged Sri Lanka’s economic interests. It would be instructive to unpackage this narrative as it is much more nuanced than this simplistic conclusion. It can be a mistake to look at the bilateral deficit to try to determine the benefit of a trade relationship.

Since the signing of the FTA, in 2000, total trade has increased from $ 623 million to $ 4.7 billion in 2019. Sri Lankan exports have increased from $ 55 million to $ 763 million. Imports from India to Sri Lanka have increased from $ 568 million to $ 3.9 billion. There was, therefore, substantial trade deficit of $ 3.1 billion. This is what people are mistakenly displeased with.

The picture changes very materially if one examines trade that has taken place on items covered by the bilateral agreement. Total trade on a preferential basis, was $ 689 million in 2019. Of this, Sri Lankan exports to India under the FTA amounted to $ 490 million out a total of $ 763 million. This meant 64 % of Sri Lanka’s exports to India were on a preferential basis. Sri Lankan imports from India under the FTA were only $ 199 million out of a total of $ 3.9 bn. This indicates that only 5% of Indian exports to Sri Lanka were on a preferential basis. As a result, Sri Lanka enjoyed a surplus of $ 291 million on the preferential trade that took place under the FTA, in 2019. It should be noted that 95% of imports from India have come into Sri Lanka because they were price competitive. If these were sourced from elsewhere, Sri Lanka’s overall trade deficit would have been larger.

Even this presents a misleading picture. The ISLFTA benefits Sri Lanka, if you consider trade flows within its parameters. However, it can be a lot better. Impediments, such as non-tariff barriers, including sanitary and phytosanitary standards, quotas on key Sri Lankan exports, customs clearance procedures, excess documentation charges and delays mean there is considerable unrealised potential from a Sri Lankan perspective. There has also been the issue of Sri Lanka not being able to produce sufficient competitive supplies. This needs to be addressed through reforms to remove the anti-export bias in the domestic policy framework.

Economic and Technology Cooperation Agreement (ETCA)

There have been 11 rounds of negotiations; the last in September 2018. Very high priority should be given by both governments to revive these negotiations. Addressing India’s non-tariff barriers up-front will be an important confidence-building measure. The FTA, at present, is only on goods and needs to be deepened and widened to allow product diversification. It should be extended to cover services in the interest of both countries. Here, the Sri Lankans are concerned about labour movement. The Government of Sri Lanka has been clear that mode 4, the movement of natural persons, will not be included in this Agreement.

Some of the skill gaps, particularly in the ICT/BPM sector, the fastest growing segment of our export, can be filled by streamlining procedures under the existing laws. It is very important that investment is also included in the ETCA as Sri Lanka is now pivoting from debt to equity and is attaching priority to FDI inflows at a time when the country’s external debt dynamics are fragile. More investment will be forthcoming if there is a clear framework within which the investment from India can come into Sri Lanka. Training and technology transfer are crucial areas and there is much Sri Lanka can gain by having a framework within which this can take place.

A second area with promise are the Special Economic Zones. The government is giving priority to the Port City development, Hambantota, Bingiriya, Milleniya and other special economic zones. Indian investment can play an important role in this. There are certain areas, such as pharmaceuticals, ICT/BPM, automotive components, electronic and electrical goods, which have been identified as having potential.

Another area where there are opportunities is transport. The Colombo Port is being expanded and there has been high-level contact on developing the East Container Terminal. A fifth terminal will be built in Colombo, the Hambantota port is being expanded with value added services, BIA is being expanded, Mattala RIA is being revived and Jaffna has an international airport. All these improvements in connectivity and logistics create a new playing field for developing Indo-Lanka economic and trade relations. Another area which can be explored is grid connectivity. There is technical feasibility to have grid connectivity between the two countries. This would help Sri Lanka in terms of load management and for facilitating the expansion of renewable energy-based power generation.

Fisheries is a source of contention. There is a need to minimise incursions, institutionalise assistance for salvage operations of vessels, pay attention to ecological and conservation considerations and also consider a bilateral MOU. The last meeting of the joint working group on fisheries was in October 2017. This needs revival.

Indian companies, particularly Serum, are now involved in massive manufacturing of COVID-related vaccines. They have linked up with the Jenner Centre at Oxford University and AstraZeneca. It would be tremendously beneficial for Sri Lanka, if there can be some kind of agreement to access the vaccine when available.

In the current geopolitical environment, it is important to place Sino-Lanka relations in the appropriate context. It is in Sri Lanka’s interest to maximise the benefits it can derive from the massive amount of capital that China is deploying around the world, much of it within the BRI framework. Sri Lanka is extremely well-located geographically to benefit from this. The Government is moving from debt to equity and needs to find ways and means of maximising Chinese investment. However, as the GOSL has publicly recognised, this should be done while taking account of India’s strategic interests, as Sri Lanka is within India’s defence perimeter. In addition, despite Indo-Pakistan tensions, there is a fair amount of trade that goes through Dubai. Perhaps Indian and Sri Lankan companies can explore whether some of it can be routed via Sri Lanka, particularly trade from southern India to Pakistan. The Sri Lanka-Pakistan Free Trade Agreement offers preferential routing for this.

Finally, Dr. Montek Ahluwalia has stated that even if Sri Lanka exports everything it produces of any item to India, it will not have a material impact. Between 2000 and 2019, Sri Lankan imports into India averaged 0.2% of total Indian imports. So even if we increase our exports to India 10-fold, it will only be 2%. The scope, therefore, exists for India to show great flexibility in accommodating Sri Lanka in its bilateral negotiations on the ETCA. Sri Lanka, in turn, needs to be sensitive to India’s strategic interests. There is a promising foundation and considerable scope to build on.

(This is a ‘Pathfinder Alert’ of the Pathfinder Foundation. Readers’ comments are welcome at www.pathfinderfoundation.org.)