Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 30 August 2017 00:00 - - {{hitsCtrl.values.hits}}

After having engaged the tourism industry for the last 10 years at operational and policy level, one thing is very evident in Sri Lanka. Everybody is an expert in developing the tourism industry of Sri Lanka, be it a cab driver to parking attendant. I look at this as a positive. It means that people are passionate about our country. They all want to make the country look better for visitors. I guess the notion that tourism belongs to every single person in the country holds true.

After having engaged the tourism industry for the last 10 years at operational and policy level, one thing is very evident in Sri Lanka. Everybody is an expert in developing the tourism industry of Sri Lanka, be it a cab driver to parking attendant. I look at this as a positive. It means that people are passionate about our country. They all want to make the country look better for visitors. I guess the notion that tourism belongs to every single person in the country holds true.

I consider tourism as an export of services. Currently the overall traditional export definition products have fetched $5.3 billion for the first half of the year (Jan-June) at a growth of 5.2% vs last year. However what is worrying is that export revenues from the apparel industry are registering a decline of 5.2% at a performance of $2.3 billion dollars which means that the GSP+ benefits have yet not kicked into the system.

The overall exports of agricultural merchandising at +18.3% is very positive given the ongoing drought in almost 14 provinces. Tea is the main beneficiary of this momentum and with the planned digital marketing campaign which is to be launched the trajectory will only continue. But the issue is that this campaign has been in the pipeline for the last four years to be launched and it has not materialised with four billion plus funds lying in the bank account.

Tourism if we consider it as an export has attracted 1.21 million visitors in the first seven months of the year (Jan-July) as against the 1.17 million performance last year, registering a growth of 3.6% bringing in a revenue of 2.08 billion dollars into the country.

Whilst the above tourism performance can be seen as positive, the fact remains that for the seven months, almost four months have recorded a declining number as against last year. February -0.1%, March-2.5%, May-2.5% and July-1.8%. This means there is something that is not working in the blue-eyed sector among foreign investors.

If we analyse the private sector performance in the first seven months the P&L of the formal industry is not that healthy. Cost of food and beverage is outpacing the top line revenue and its impacting the bottom line of the properties. Some analysts speculate that almost 60% of the visitors are attracted by the informal sector which is creating a dent on the occupancy of the formal sector.

The challenge for talent to increase the service levels in the properties remains an uphill task given that the unemployment rate of the county is at below 5%. The million dollar question that has not been answered is that for the next 25,000 rooms coming into the hotel inventory, how can the service be given due to the HR issue in the country?

I guess the answer lies in the concept of ‘carrying capacity’ that we have seen at many a discussion in the recent past. The time has come for a policy decision that needs to be taken but the question is, who can take this decision when for the last three years the country has been awaiting the marketing campaign that is to be launched? As we speak almost four billion rupees is stuck in the bank account of the Government whilst the industry is bleeding.

Whilst we can keep focusing on the issues of our country, we must have the wisdom to understand if the above  issues are global challenges that any country is up against in today’s world. Japan tourism is dominating the world with a ranking of fourth in the Travel and Tourism Competitiveness Report 2017. If one does a deep dive to the issues that Japan has in the tourism development agenda, we see there are many similarities with Sri Lanka. Let me throw more light on this argument.

issues are global challenges that any country is up against in today’s world. Japan tourism is dominating the world with a ranking of fourth in the Travel and Tourism Competitiveness Report 2017. If one does a deep dive to the issues that Japan has in the tourism development agenda, we see there are many similarities with Sri Lanka. Let me throw more light on this argument.

1) Digital strategy

Similar to Sri Lanka, the Japan public sector is challenged by the privates sector stakeholders for the launch of an aggressive digital marketing campaign just like the other top tourism brand contenders led by brand USA. But again for the last two-and-a-half years it has been struggling on impact achievement.

A country that introduced electronics to the world and the most powerful brands in the world – Sony, Toyota and Nissan – is yet on the mat in this strategy. It is not about taking refuge over Sri Lanka’s performance but maybe it’s the current tender procedures that block the launch of such initiatives in the digital space.

2) Lack of regional coordination

Same as Sri Lanka, one of the burning issues is the gulf that exists between the regional tourism development agenda and the national strategy of Japan. Some are now of the view that each region must be run like a mini country so that there is autonomy and localisation in the marketing thrust. A country that follows the decentralised tourism development approach and where it is working is China. Maybe we in Sri Lanka must follow suit.

3) Private-public sector views differ

Even though Japan attracts 24 million visitors and is planning for 40 million visitors by 2020, the views of the private sector differ from the public sector growth agenda, mainly on the infrastructure development agenda.

Whilst the cry of the Sri Lankan tourism industry is similar, in my view the workings in the country are much better than Japan. This could be due to the private sector-led decision making that happens in policymaking. In fact there are more private sector people on the director boards of the tourism industry than technocrats. Maybe the world must study the Brand USA model that works totally on a private sector model and check impact to decision making.

Whilst we can see many similarities between Japan and Sri Lanka on the challenges we see in each of the countries, we also see some drastic different working strategies that are being practiced by Japan tourism which is ranked fourth globally in the World Competitive Report 2017.

1) Research-based objec tives

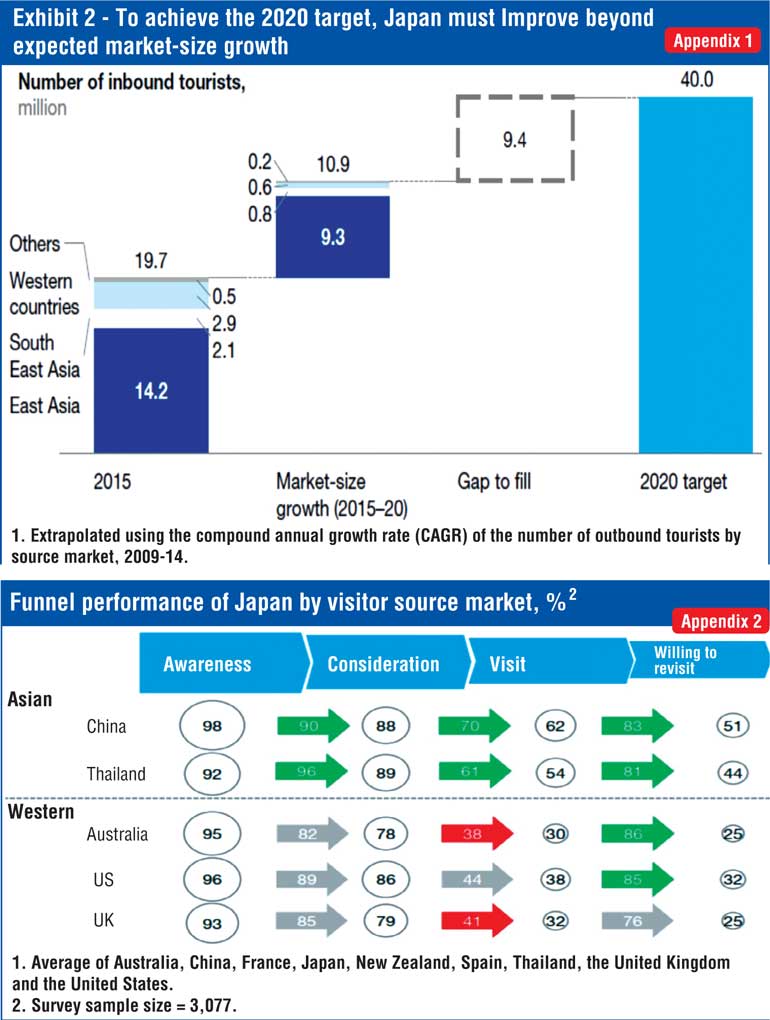

Japan has worked out the organic growth that it can achieve by 2020. Thereafter if the objective of 40 million is to be achieved, the gap that will emerge. Currently the number is 9.4 million visitors as per appendix 1. There after specific target marketing strategies are being implemented to achieve this end.

2) Customer behaviour tracking

Just like in the FMCG industry, where we map the behaviour patterns of the customer and track the movements of the brands, we see Japan tourism doing same as per appendix 2.

1) Sri Lanka tourism needs to calculate the carrying capacity and take a policy decision on the optimum number of visitors Sri Lanka needs to attract here.

2) Based on the above plan the mix of five, four and three star properties that we must give approval to in the next 10-15 years and in which locations so that there is a strategic development of tourism zones. A classic example is the current hotspot being Ella which is said to have the cleanest air in the world.

3) Just like Japan, map the market and understand the purchasing behaviour of the traveller so that a clear and focused action plan can be implemented.

4) The launch of the digital campaign is paramount and thereafter link same to the below-the-line campaign done via exhibitions and country marketing campaigns in the seven key markets.

(The writer is an award-winning marker who has worked for top multinationals for 17 years and then served the State sector as Chairman before going on to serve the United Nations. The thoughts are strictly personal in nature.)