Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 3 September 2018 00:00 - - {{hitsCtrl.values.hits}}

Container freight rates have fallen by over half in the past 20 years after inflation is taken into account, according to a new analysis by Alphaliner. While average nominal freight rates, as measured by the China Containerised Freight Index, have declined by more than 20% since the beginning of 1998, inflation-adjusted freight rates have shown an even larger reduction, because bunker prices have increased more than five-fold since 1998.

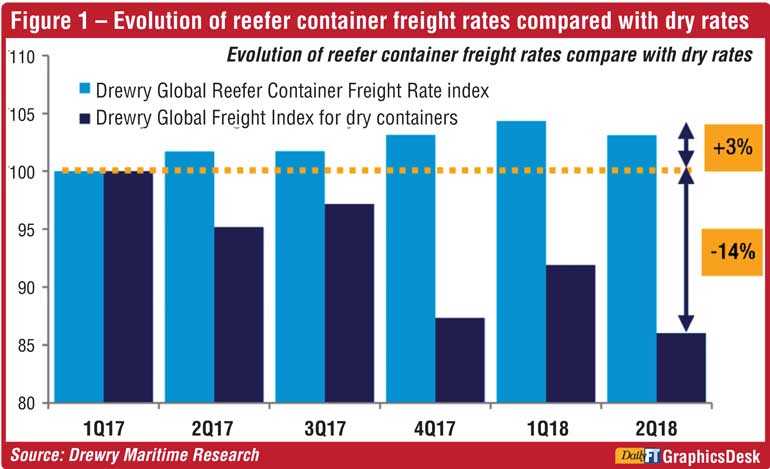

As shown on Figure 1, average containerised reefer freight rates rose 3% in the six quarters to 2nd Quarter 2018, while average dry freight box rates fell 14%.

“Although shippers have been quick to raise their objections against the carriers’ recent attempts to impose ‘emergency’ bunker surcharges, a reaction toward steadily increasing fuel prices, few have acknowledged the significant savings on freight rates they have enjoyed over the years,” Alphaliner said.

Fuel costs, which accounted for only about 8% of carriers’ operating costs in 1998, now make up 15% of total operating costs, Alphaliner said.

Rates on routes from China to US West Coast ports dropped 3.49% from March to April. On routes to the East Coast, rates fell 7.78%, and April rates in 2018 were significantly lower than in 2017. They dropped 23.93% YoY on China to West Coast routes, and 18.77% for the East Coast. The news may be music to shippers’ ears, but it indicates carriers are struggling. According to The Wall Street Journal, rates on Asia-West Coast routes are well below the cost needed for carriers to break even. In addition to rate decreases, container import volumes fell on West Coast ports. The dip appears to be a continuation of decline after the Chinese New Year, which bumped both volumes and rates artificially high.

Most savings from operational and organisational efficiencies in the past two decades have mostly been passed on to shippers in the form of lower freight rates, both in nominal and in real terms.

Oversupply and consolidation a main reason for falling prices

The slump in demand for global container shipping, combined with persistent oversupply in terms of vessel capacity, compounded an already difficult environment for carriers, driving rates through the floor. As a result, the industry has undergone consolidation on a massive scale in the last few years. With the current supply-demand gap in the container industry estimated at 7%, the BCG report projects the gap between global trade volumes and containership capacity will increase to between 8.2% to 13.8% by 2020.

“By the end of 2020, oversupply in vessel capacity will stand at 2 million to 3.3 million TEUs - equivalent to some 90 to 150 or more Triple E class ultra-large container vessels,” BCG said in its report. Industry players are in a race for lower slot costs to ensure competitive advantage,” it noted. “The bigger, newer, and more efficient the vessel, the lower the slot cost, which is why companies want to invest in larger vessels.”

Shipping lines are expecting trade growth as it would help overcome the oversupply in vessel capacity. Trade growth in 2018 is likely to be within a range from 3.1% to 5.5% if current GDP forecasts come to pass, although a continued escalation of trade restrictive policies could lead to a significantly lower figure.

Benefits for shippers

All shipping lines are looking at efficiency gains through consolidation, economies of scale through capacity expansion, and various other initiatives to make sure that costs are controlled to face challenging times ahead. Therefore it is safe to assume that shippers will benefit through lower freight rates, as these initiatives will result in cost savings for the lines. However if cargo volumes don’t increase subsequently to the increasing capacity, it will further aggravate oversupply, which is not healthy for the whole industry. There’s also a container imbalance in Sri Lanka and the 1st half of 2018 showed an imbalance of over 190,000 TEUs. The majority of imports come in 20 FT containers, whereas 40FT containers are used for exports. As a result, shipping lines will have to incur additional costs to reposition empty containers to balance inventory. Therefore it is important that Sri Lanka increases its export volume, so that shippers can benefit through more competitive rates, whilst making Sri Lanka more attractive to shipping lines.

Conclusion

The current oversupply of capacity will not be a status quo and the moment it is resolved rates can increase again. Therefore it is important that as a country we have a long term strategy to increase our export volume to face future pricing challenges. The current low freight rates provide shippers a conducive environment to compete globally which can eventually help in building export volumes.

Import and export containers at Colombo port

Shipping lines are increasingly concerned about the yield of the cargo that they carry. This requires building flexibility into contracting, so that in the peaks a carrier’s ships are not full of low-yielding cargo contracted at annual rates. This will lead to shipping lines reducing space for origins with low yielding containers and carry cargo of high yielding destinations to increase profitably. This is another challenge for Sri Lanka as the low yielding cargo have already resulted in a space crunch for Sri Lankan exports.

References

https://www.lloydsloadinglist.com/freight-directory/news/Sea-freight-rates-fall-50-in-20-years/72079.htm#.W4UGz_ZzA2w

https://www.americanshipper.com/Main/News/BCG_Container_industry_overcapacity_to_increase_th_65949.aspx