Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 27 November 2020 00:00 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

Backing lower interest rates as the best growth formula, the Central Bank yesterday decided banks would charge only 7% on mortgage-backed housing loans and would introduce lending targets to

|

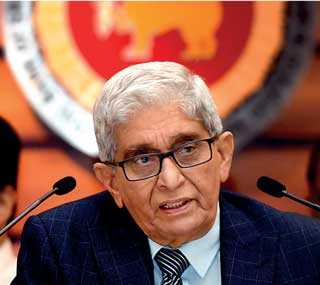

| Central Bank Governor Prof. W. D. Lakshman

|

selected sectors to counter the second COVID-19 wave.

The Monetary Board at its last monetary policy announcement for this year kept policy rates unchanged and decided to introduce two new measures to complement the concessional loan schemes proposed by the Government in the Budget 2021.

Accordingly it was decided to introduce a maximum interest rate on mortgage-backed housing loans obtained by salaried employees from licensed banks, Central Bank Governor Prof. W.D Lakshman told reporters during an online briefing.

“Licensed banks will be made to charge only 7% per annum for such loans, at least for the first five years of the loan tenure. The remaining tenure of the loan is to be charged at the monthly Average Weighted Prime Lending Rate (AWPR) plus a margin of up to one percentage point. Directions to this effect will be issued to licensed banks shortly,” he said, adding that guidelines could be released within a week.

The Monetary Board had also called on all financial institutions, led by Licensed Commercial Banks (LCBs), to pass on the benefit of the low interest rate environment expeditiously to their borrowers, in respect of new as well as existing facilities.

The Board also recognised the need to promote economic sectors with higher growth and earning potential, and in this regard, decided to introduce lending targets in the near future for selected sectors in conformity with the policies of the Government.

The Central Bank’s decision to keep policy rates unchanged was a move that was largely expected due to the impact of the second COVID-19 wave. Central Bank officials noted policy adjustments had been made downwards on seven occasions between January and July this year, along with multiple other measures including a Rs. 179 billion debt moratorium to assist businesses and reduce growth contraction.

The monetary authority was confident that inflation was well anchored but acknowledged the increase of food-driven inflation was a concern. Inflation is expected to gradually gather pace over the next two years with the expected improvement in aggregate demand, stimulated by accommodative monetary and fiscal policies and the normalisation of global oil prices. Officials also argued that central banks around the world had taken the same path due to the pandemic.

The Central Bank insisted monetary easing measures implemented so far during the year were being transmitted to the economy as reflected by the decline in most market interest rates. Both deposit and lending rates have declined notably, while some interest rates have reached historic lows, the Central Bank said, pointing out the Average Weighted Lending Rate (AWLR) declined by 277 basis points to 10.82% in October while Average Weighted New Lending Rates (AWNLR) declined by 407 basis points to 8.73%, which were the lowest seen since the end of 2015.

“However, the pace of reduction of market interest rates has slowed in the recently. The historically-low levels of policy interest rates and the Statutory Reserve Ratio, as well as the availability of significant excess liquidity in the domestic money market, provide further space for market lending rates to adjust downwards in support of the recovery of domestic economic activity,” the Governor said, extending an appeal to banks to continue reducing rates.

Credit extended to the private sector increased for the third consecutive month in October. Private sector credit increased by Rs. 78 billion in August and Rs. 87 billion in September but dipped to Rs. 59 billion in October. Year-on-year private sector credit growth only recorded a 6.4% increase but the monetary authority was confident it would see an uptick from December. The resultant substantial increase in domestic credit caused an acceleration in the growth of broad money (M2b) in October 2020.

Central Bank officials acknowledged the hoped-for strong growth in the third and fourth quarters had been dampened by the latest COVID-19 numbers but argued the impact would be less than in the second quarter given that a countrywide lockdown was averted.

“Despite this disturbance to the near-term growth prospects, the economy is expected to rebound strongly in 2021 and sustain its growth momentum over the medium term, supported by the stimulus measures already in place and the effective implementation of the pro-growth policy proposals announced in the Government Budget 2021,” said Economic Research Department Director Dr. C. Amarasekera.

Provisional data indicate that the deficit in the trade account continued to narrow significantly, on a year-on-year basis, for the sixth consecutive month in October. Workers’ remittances increased for five consecutive months. These developments have largely cushioned the balance of payments effects of the pandemic arising from tourism sector developments.

The exchange rate has stabilised after witnessing some speculation driven pressure prior to the presentation of the Budget 2021. Thus far during the year, the Sri Lankan Rupee has recorded a depreciation of 2% against the US Dollar. Gross official reserves were estimated at $ 5.9 billion at end October 2020, with an import cover of 4.2 months.

Measures that are being introduced to improve the domestic production economy, to enhance exports and to attract Foreign Direct Investment, along with political stability, policy consistency and the projected recovery in the global economy, are expected to strengthen Sri Lanka’s external sector in the period ahead.