Sunday Feb 22, 2026

Sunday Feb 22, 2026

Saturday, 28 December 2019 00:10 - - {{hitsCtrl.values.hits}}

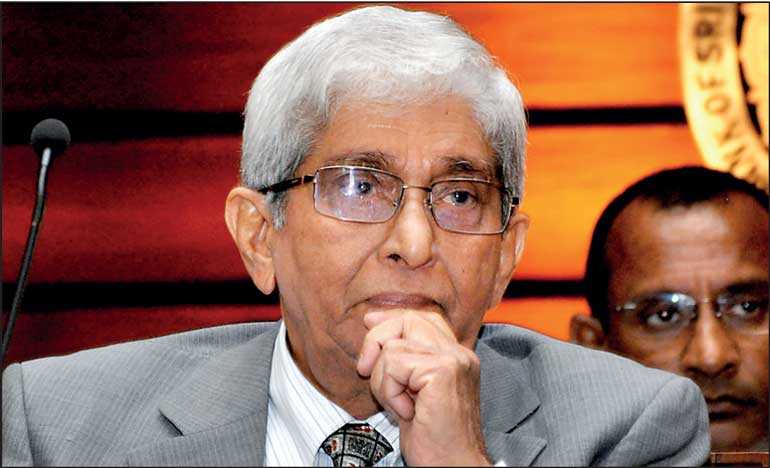

Central Bank Governor Prof. W.D. Lakshman

The Central Bank yesterday said it would keep policy rates unchanged to contain inflation, especially given recent price increases in commodities, but acknowledged its stance could change after President Gotabaya Rajapaksa announces the Government’s policy framework next week.

The Monetary Board of the Central Bank of Sri Lanka, at its meeting held on 26 December, decided to maintain its accommodative monetary policy stance with the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank remaining at their current levels of 7% and 8%, respectively.

The Board arrived at this decision following a careful analysis of current and expected developments in the domestic economy and the financial market as well as the global economy, the Central Bank said in its customary statement.

“In consideration of the current and expected macroeconomic developments as highlighted above, the Monetary Board, at its meeting held on 26 December, was of the view that the current accommodative monetary policy stance is appropriate, and that there is ample space for market lending rates to reduce without further adjustment in policy rates.”

The Monetary Board also noted that the already announced tax relief as well as the proposed moratorium on capital repayments of bank loans for the SME sector were likely to provide further impetus to the economy.

The decision of the Monetary Board is consistent with the aim of maintaining inflation in the 4%-6% range while supporting economic growth to reach its potential over the medium term.

“Most advanced economies, which followed a monetary easing path owing to the general economic slowdown and muted inflation expectations, appear to have paused further monetary easing. However, most of the emerging market policymakers remained open to further accommodation in the period ahead in order to stimulate activity in their economies.”

As per the provisional estimates released by the Department of Census and Statistics, the Sri Lankan economy grew at the slow pace of 2.7% during the third quarter of 2019 following the growth of 1.5% in the second quarter of the year.

Agriculture related activities grew marginally by 0.4%, while Services and Industry related activities expanded by 2.8% and 3.3%, respectively. Going forward, a steady revival of economic activity is envisaged, supported by improved political stability and short-term measures to stimulate the economy. It is expected that this momentum will be sustained through the introduction of appropriate medium to long term structural reforms.

Inflation remains at low single digit levels in the near term and stabilise within 4%-6% in the medium term

Headline inflation, as measured by the year-on-year change in both Colombo Consumer Price Index (CCPI) and National Consumer Price Index (NCPI), decelerated in November 2019 driven by the slowdown in food inflation. Further softening of inflation could be expected in the period ahead mainly due to the impact of the downward tax revisions and the reduction in selected administratively determined prices.

“Nevertheless, weather-affected food price movements could result in increased volatility in inflation in the near term. Projections indicate that inflation is likely to remain in the range of 4%-6% over the medium term, with the gradual closing of the negative output gap and well anchored inflation expectations,” it added.

Performance on the trade front continued to improve during the first 10 months of 2019 with imports contracting considerably and merchandise exports recording a modest growth, thereby leading to a cumulative contraction in the deficit in the trade account. Provisional data suggests a significantly lower current account deficit in the first nine months of 2019 compared to the corresponding period of 2018.

The tourism sector, which suffered a setback following the Easter Sunday attacks, has since recorded a faster-than-expected recovery. Workers’ remittances were somewhat low, while outflows of foreign investment were observed from the Government securities market and the equity market during the year. Nevertheless, the Sri Lankan Rupee appreciated against the US Dollar 0.7% thus far during 2019, with mixed movements being recorded throughout the year.

Meanwhile, gross official reserves remained at $ 7.5 billion by end November 2019, which were sufficient to cover 4.5 months of imports. Although a steady expansion in credit disbursed to the private sector in absolute terms was observed during the four month period commencing August 2019, the year-on-year growth of private sector credit continued to decelerate thus far during the year.

Driven by low credit expansion, the year-on-year growth of broad money (M2b) also continued to moderate. Going forward, money and credit aggregates are expected to recover gradually, with the expected continued decline in lending rates, and other mechanisms that are being introduced to revive economic activity.

“Market lending rates continued to adjust downward in response to monetary and regulatory measures taken by the Central Bank. However, the observed reduction thus far has been less than envisaged, and financial institutions are expected to meet the stipulated reduction in lending rates in the period ahead.”

In addition, President Gotabaya Rajapaksa is expected to announce the government’s policy statement on 3 January 2020, which will provide further clarity to the broad economic policy framework as well as the fiscal policy direction for the medium term.

In this context, the Monetary Board decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 7% and 8%, respectively.