Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 25 January 2021 00:00 - - {{hitsCtrl.values.hits}}

Ishara Nanayakkara

Dhammika Perera

By Nisthar Cassim

Individually the duo will deny they are at loggerheads or racing against each other and insist they have better things to do like continuing to drive value in their respective businesses, but with the stock market soaring, analysts and investors have indeed been pitting the two against each other.

Individually the duo will deny they are at loggerheads or racing against each other and insist they have better things to do like continuing to drive value in their respective businesses, but with the stock market soaring, analysts and investors have indeed been pitting the two against each other.

The duo may harbour other plans or acquisitions in mind, however, as of Friday, young business leader Ishara Nanayakkara reigned as ‘Most Valuable’, after the slightly more senior Dhammika Perera the previous day, taking the Colombo Bourse to dizzy heights with a mega move.

Some even assumed the duo and their auras or investor fans were behind last week’s phenomenal stock market rally.

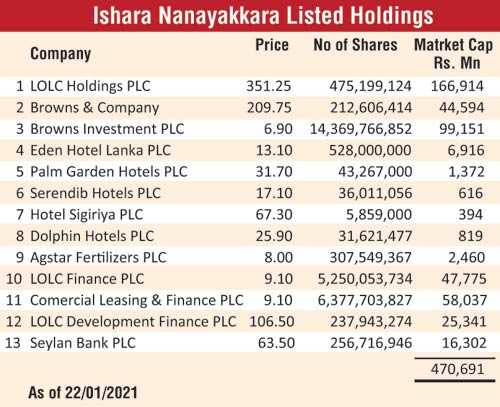

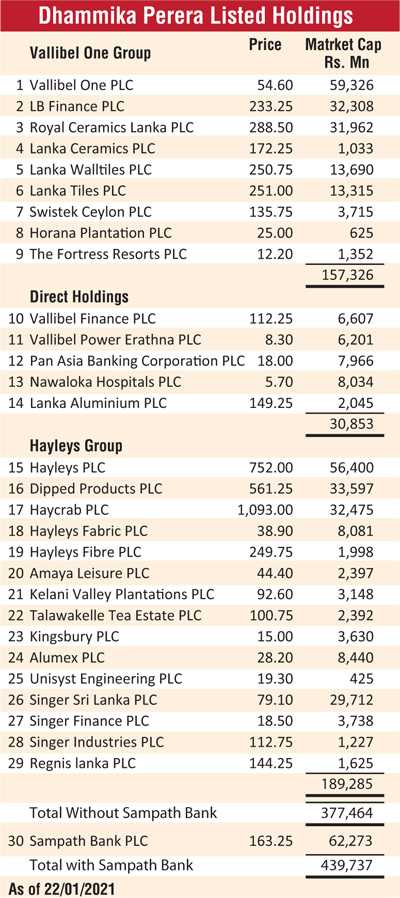

As per a Daily FT analysis, the combined market capitalisation of companies in which Ishara has control, influence or stakes was a staggering Rs. 469 billion or above 12% of the total market cap of CSE. In contrast, coming from a different background, hence a more challenging effort to the pinnacle, market cap of Dhammika-controlled companies or with influence or stake was worth Rs. 440 billion (see tables)

On Thursday, when Dhammika shook the bourse via a mega share sub-division move on Hayleys and Group companies, the combined effect was the value soaring to Rs. 444.6 billion, with Ishara trailing at just above Rs. 400 billion.

Analysts said the fluctuations exposed the fluidity of market value which is based on investor sentiment on a particular day. In less than 20 trading days this year, the market has gained by 25%.

Hayleys ended FY20 as number one with a consolidated revenue of Rs. 210 billion, a rank it has enjoyed for four consecutive years. LOLC Holdings finished FY20 as the conglomerate with highest after tax profit of Rs. 19.2 billion following the hefty one-off profit from the sale of a micro finance company PRASAC in Cambodia.

LOLC, which has been enjoying a bull run since the dawn of 2021, saw its share price jump by Rs. 70.25 or 25% to Rs. 351.25. For the week LOLC’s gain was 55% or Rs. 124.50 to Rs. 351.25. This saw its market capitalisation peaking to Rs. 167 billion, ranking at number three behind premier blue chip John Keells Holdings (Rs. 221.8 billion) and Ceylon Tobacco (Rs. 209.6 billion).

LOLC ended 2020 at number eight with a value of Rs. 64 billion and last week’s figure reflects a jump of over Rs. 100 billion. LOLC and gain by Browns Investments gave the edge to Ishara over Dhammika.

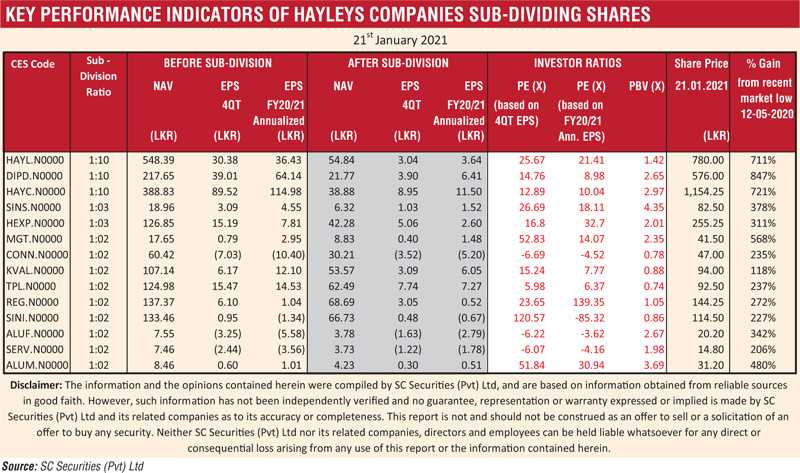

However it was Dhammika who gave new momentum to the Colombo stock market on Thursday, announcing very attractive share sub division on Hayleys and 13 other subsidiaries. All counters saw a sharp rise in prices. Though some counters cooled off on Friday, most of Dhammika’s stocks closed the week at all-time high. His move on Thursday also sent CSE’s market value soaring by over Rs. 100 billion. Six of Dhammika-connected companies topped the gainers’ list last week. Hayleys rose by 53% to Rs. 752, Hayleys Fibre by 76%, and LB Finance by 54%.

Helping Ishara and LOLC was retail favourite Browns Investments (BIL), whose market value saw massive growth to Rs. 99.15 billion by Friday as against Rs. 62 billion in end-2020.

Both LOLC and Hayleys were biggest contributors to the rise in All Share Price Index (ASPI) last week with over 135 points and 44 points, whilst Dhammika’s Group had five more contributors, including Vallibel One, Haycarb, Dipped Products and Royal Ceramics.

LOLC, with Rs. 4.8 billion worth of shares traded, was the biggest contributor to Rs. 60 billion turnover last week. BIL with Rs. 4.5 billion was third highest. Dhammika had three contributors in the top 10 with Hayleys with Rs. 2.73 billion (6th) and Dipped Products (Rs. 3.6 billion) and Vallibel One (Rs. 1.9 billion).

The corporate sector and investors have been commending the dividend yields of companies controlled by Dhammika whilst Ishara has been getting flak for not distributing profits among shareholders. However, no one can today deny Ishara’s argument of serving shareholder interest with capital appreciation, judging by the phenomenal rise.

Both fast-growing multinationals from Sri Lanka, Hayleys has a better investor participation with a public float of 37% with nearly 6,400 shareholders. LOLC on the other hand has 4,625 public shareholders with a free float of only 15%. Dhammika’s move last week of dividing one Hayleys share into 10 will make the stock more affordable and likely to increase the public float.

Some critics viewed the share sub division as a means to ward off a possible hostile takeover but others dismissed it saying Dhammika had enough control and had gone public saying he preferred 51% holding only in most cases.

The market is watching whether Ishara too will go for a share sub division and make LOLC more liquid, whilst speculation is rife on whether Dhammika extending the Hayleys Group move to his other listed entities drove the share price of the latter to new highs last week.