Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 2 October 2020 01:56 - - {{hitsCtrl.values.hits}}

A super September it was indeed for the Colombo stock market as the gain of the benchmark index was the highest in eight years whilst since end May it had provided a 23% positive return.

A super September it was indeed for the Colombo stock market as the gain of the benchmark index was the highest in eight years whilst since end May it had provided a 23% positive return.

The capital market bid adieu to a stellar September on Wednesday despite the Moody’s downgrade of sovereign rating being a dampener in the last two sessions of the month.

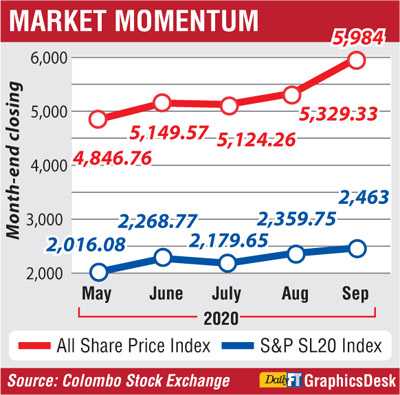

According to NDB Securities, during September the All Share Price Index (ASPI) gained by 12.30%, the highest monthly gain since 2012. The more active S&P SL20 Index gained by 4.39%.

September marked the second consecutive monthly gain at the CSE, reflecting the return of investor and business confidence, especially by locals, despite near Rs. 40 billion net foreign outflow year-to-date.

The market has sustained its momentum since resuming trading on 11 May following the COVID-19-induced suspension.

SEC said early this week that the ASPI gained 31% and S&P Index by 27% since reopening on 11 May.

AS per Daily FT analysis, the ASPI has gained by 23.4% or 1,138 points since end May and the S&PSL20 Index by 449 points or 22%. Market capitalisation has risen by Rs. 329 billion or 14%. Since end August, the market’s value has soared by Rs. 279 billion.

The downgrade of Sri Lanka’s sovereign rating by Moody’s dented investor sentiment on Tuesday and Wednesday, though turnover remained healthy.

The original expectation was that the ASPI would turn year-to-date positive this week, erasing the 4.4% negative growth YTD as of last week. On 30 September, the ASPI was still negative 2.4% whilst the S&PSL20 was down 16% YTD.

“The bourse failed to sustain above the 6,000 psychological level for the second consecutive session, continuing the downfall,” First Capital said.

“The index experienced a downward movement till mid-day due to the selling pressure in selective material counters as it hit its intraday low of 5,937. Later the market bounced back and witnessed an upward movement and closed at 5,985, losing nine points,” it added.

Given the room for growth post-COVID, most analysts maintain that the equity market remains attractive for investors. The Price Earnings Ratio of the market was 10 times as at 30 September against 8.9 times end May.

In its statement on Monday the SEC said that Sri Lanka was one of the markets that had recovered the fastest from the impact of the coronavirus pandemic in comparison to countries in the Asia Pacific region, recording positive price returns in US Dollar terms.

This reflects the strong confidence the investors have placed in the market and the future economic growth of the country. Significant contributions to turnover have been recorded in Colombo, Gampaha, Kandy, Kurunegala, Galle, Kalutara and Matara Districts.

“Local investors have recognised the potential in the market, especially in terms of attractive market valuations and growth potential of Sri Lankan listed companies, and contributed to approximately 68% of the total market turnover. The CSE has also noted a significant increase of over 63% in Central Depository System (CDS) account openings since the digitalisation of the end-to-end operations of the market on 17 September,” the SEC said.