Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 5 February 2021 00:00 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

The country’s tiles and bathware sector yesterday insisted that the tax and duty regime still tilts in favour of imports contrary to popular perception, and a revert to pre-2015 structure will ensure interest of all stakeholders, including importers and investors.

The country’s tiles and bathware sector yesterday insisted that the tax and duty regime still tilts in favour of imports contrary to popular perception, and a revert to pre-2015 structure will ensure interest of all stakeholders, including importers and investors.

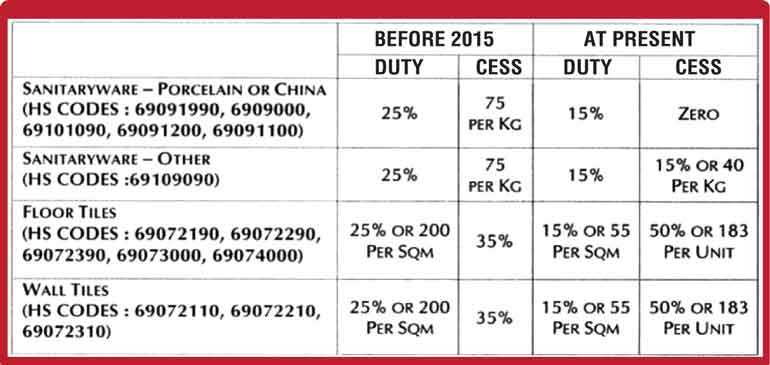

Noting that imports, which cater to 50% of local demand, are impacted owing to foreign exchange restrictions following the COVID-19 pandemic, local manufacturers revealed that taxes and duties on imports (see chart) are more favourable at present than prior to 2015.

Prior to 2015, applicable import duty on sanitary-ware, floor and wall tiles was 25%, but at present it has been reduced to 15%. With regard to the CESS as opposed a straightforward method prior to 2015, the present structure not only reflects a reduction but also openly encourages under-invoicing.

“The duty and CESS structure prior to 2015 was very simple. It ensured both parties – manufacturers and importers – could do business. However, successive governments, influenced by vested interests, have blundered the structure, preventing equitable room for both sides to grow,” tile and bathware industry sources told the Daily FT.

“Imports have been reduced because of restrictions on opening Letters of Credit (LCs) and other factors. We need imports as local manufacturers can at best supply 60% of the demand in the short-to-medium-term. Even if restrictions are lifted, local manufacturers can compete but not at the present duty/CESS structure. It must be reverted to pre-2015 level,” industry sources explained.

Failure to do so, they warned, will see local manufacturers resorting to imports as at least one leading player did post-2015.

The blame on changing the status quo was pointed at the previous Yahapalanya regime. At that time the move was seen as directed at impacting the near-monopoly in the bathware and tile sector enjoyed by business leader Dhammika Perera, who is the major shareholder of Royal Ceramics, Lanka Tiles and Lanka Walltiles. However, the then Government justified the move by saying the local construction industry would benefit from the lower import cost.

The change in duty structure prompted the Dhammika Perera companies to begin trading operations and eventually emerge as one of the leading importers. His companies also dry-leased four factories in India to source imports.

With the Yahapalana Government out of office and following President Gotabaya Rajapaksa and Prime Minister Mahinda Rajapaksa’s election promise of support to local manufacturers, five new companies have started producing bathware. Perera also stopped the trading operations.

The five new manufacturers are RSL Ceramics Ltd., OTTO Bathware, Ambilpitiya Ceramics, Hega Ceramics and Novel Ceramics. They join the local market leader Rocell Bathware. In the tile sector at present, there are only the Lanka Tiles, Lanka Walltiles and Mack Tiles.

However, these new local manufacturers maintain that overall conditions remain not so favourable for Sri Lankan brands, despite the new Government’s promise to extend support.

“New entrants in effect means fresh investments and more jobs. However, now there is uncertainty,” sources added.

The Ministry of Finance on Tuesday published a note indicating the relaxation of tile imports and the next day, the Controller General of Imports and Exports repealed to ensure support for local manufacturers is intact.

On Tuesday, following the original Finance Ministry move to relax import restrictions, Lanka Tiles and Walltiles share price declined by 20% to Rs. 224 and Rs. 221.75 respectively, whilst RCL dipped by 16.5% to Rs. 319.75. However, on Wednesday, RCL regained by 5% to close at Rs. 335.25, whilst Lanka Tiles improved by 4% to Rs. 233, and Walltiles gained by 7% to Rs. 237. The 52-week highest share price of Lanka Tiles was Rs. 342, that of Walltile was Rs. 340 and Rs. 439.50 for RCL, all achieved last month.

Some analysts opined the sharp dip in tile sector share prices cannot be linked to the original import relaxation move. It was pointed out that shares of these companies linked to Vallibel One Group of Dhammika Perera shot up last month, not on fundamentals but on anticipation of splits after the sensational Hayleys move on share subdivision on Group companies. With no immediate sign of a share split, the craving for tile sector stocks has waned, they added.

Bartleet Religare Securities, in a 3Q FY21 earnings preview on the tile sector, said fortunes of local tile manufacturers changed post-COVID, with restrictions in imports resulting in all manufacturers selling full capacity.

"During 2Q FY21, top line soared on sales above full capacity with accumulated inventory, too, being sold. We believe in 3Q FY21E, too, remaining inventory and the full capacity will be sold, catering to the void created by imports," Bartleet Religare said.

It said imports catered to 50% of market share before the market was restricted. With import restrictions extended to July from the earlier Gazette (15 December), Bartleet Religare believes all local tile manufacturers will benefit from selling in full capacity.

"We expect TILE, LWL and RCL earnings to rise by 185%, 227%, and 83% Y-o-Y for 3Q FY21E," Bartleet Religare added.

It estimates a Rs. 50.4 billion gross turnover for RCL in FY21 as against Rs. 34.5 billion in FY20. In the first half of FY, turnover was Rs. 17.7 billion. It also estimated RCL net profit to be Rs. 5.61 billion in FY21 up from Rs. 2.7 billion in FY20.

For Lanka Tiles, the net revenue estimate for FY21 is Rs. 13.7 billion as against Rs. 6.7 billion achieved in FY20. Net profit is expected to improve from Rs. 582 million in FY20 to Rs. 1.8 billion in FY21. For Lanka Walltiles, Bartleet Religare forecasts a revenue of Rs. 30.4 billion in FY21, up from Rs. 20 billion in FY20. Profit-After-Tax is expected to increase to Rs. 2.8 billion in FY21 from Rs. 415 million in FY20.