Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Saturday, 13 February 2021 00:37 - - {{hitsCtrl.values.hits}}

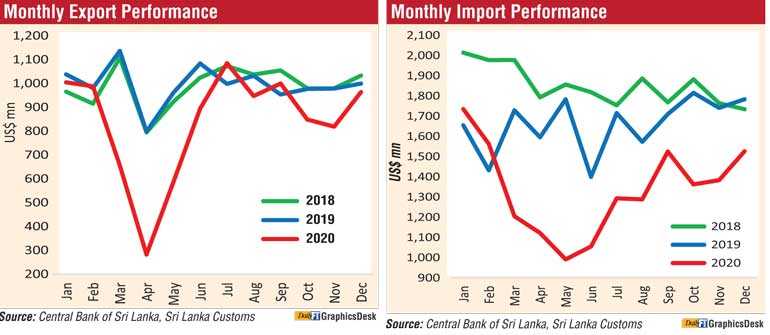

Sri Lanka’s trade deficit shrank by $ 2 billion to $ 5.9 billion in 2020 helped by a $ 1.3 billion lower fuel bill and restrictions on construction and vehicle imports, latest data from the Central Bank showed yesterday.

The deficit for 2020 was mostly assisted by lower fuel prices caused by the pandemic but Sri Lanka also saved $ 532.8 million from restricted vehicle imports. Import restrictions and COVID-19 combined to reduce apparel imports by $ 574 million and building material by $ 473 million.

The deficit in the trade account narrowed in December 2020 by $ 222 million to $ 562 million, from $ 784 million recorded in December 2019, due to a larger decline in imports compared to the decline in exports.

Further, the overall deficit in the trade account in 2020 narrowed to $ 5,978 million from the deficit of $ 7,997 million recorded in 2019. Terms of trade, i.e., the ratio of the price of exports to the price of imports, improved by 3.2% in December 2020, compared to December 2019, with higher export prices and lower import prices.

Earnings from merchandise exports recovered to a great extent in December 2020 from the setback suffered in the previous two months due to the second wave of the pandemic. Earnings from exports in December 2020 were recorded at $ 964 million with a marginal decline of 3.5% from the $ 1,000 million recorded in December 2019.

Gradual easing of lockdowns in Sri Lanka and improved demand from export destinations contributed to this outcome. Earnings from exports in the year 2020 amounted to $ 10,077 million, recording a decline of 15.6% from the previous year. This decline was a result of disruption to production caused by lockdowns during the first and the second waves of the COVID-19 spread in Sri Lanka, as well as lower global demand and disruptions to global supply chains.

Earnings from the export of industrial goods declined by 5.4% in December 2020 compared to December 2019, mainly due to the decline in the export of textiles and garments by 6.5% and the decline in the export of petroleum products by 43.6%.

The export of garments to the EU increased slightly, while exports to the USA and other destinations declined significantly. Earnings from the export of petroleum products that comprises bunkering and aviation fuel and other petroleum products declined due to the decline in quantities supplied as well as prices.

Further, earnings from the export of rubber tyres, gems and jewellery, animal fodder, most of the items under leather, travel goods and footwear and most of the items under base metals and articles (except copper and articles thereof) declined.

On the other hand, the export of surgical and other gloves increased significantly. Sizable increases were also recorded in the export of food, beverages and tobacco (mainly coconut milk and cream and manufactured tobacco, among others); machinery and mechanical appliances (mainly electronic equipment and industrial machinery); chemical products (mainly activated carbon); ceramic products (mainly tableware, kitchenware, wall-tiles and ornaments); and certain wood and paper products.

Export earnings from agricultural goods increased by 4.1% in December 2020 compared to December 2019, due to the increase in the export of spices (pepper, cinnamon, nutmeg, mace, cloves, etc.), tea, coconut kernel and non-kernel products and natural rubber.

The increase in earnings from tea exports was mainly due to the increase in the unit price as the increase in volume exported was marginal. Agricultural products that recorded a decline in export earnings in December 2020 compared to December 2019 were seafood, minor agricultural products (fruits, areca nuts, betel leaves, etc.), unmanufactured tobacco and vegetables.

Mineral exports increased in December 2020 compared to December 2019, due to the increase in earths and stone and ores slag and ash (mainly titanium and zirconium ores).

The export volume index declined by 6% while the unit value index increased by 2.7% on a year-on-year basis in December 2020. This indicates that the decline in export earnings was due to lower export volumes.

Merchandise imports declined in December 2020 compared to 2019, continuing the year-on-year declining trend observed since March 2020, mainly due to relatively low crude oil prices and restrictions imposed by the Government on the importation of non-essential goods.

Expenditure on merchandise imports declined by 14.4% to $ 1,527 million in December 2020 compared to December 2019. Declines recorded in all three major categories of imports, namely, consumer, intermediate, and investment goods, contributed to this outcome. Total expenditure on imports amounted to $ 16,055 million in 2020, recording a 19.5% reduction from 2019.

Expenditure on the importation of consumer goods in December 2020 declined by 16.2% compared to December 2019, mainly as a result of the decline in imports of vehicles for personal use. Expenditure on non-food consumer goods, which includes vehicles for personal use, declined by 30.1%. A general decline of import expenditure was recorded in many subcategories under non-food consumer goods in December 2020, such as clothing and accessories, cosmetics and toiletries, printed materials and stationery, etc.

On the other hand, mobile phones recorded a sizable increase along with many types of household appliances. Consumer goods that are food and beverages recorded an increase of 6.8%, mainly due to the increase in import of coconut oil, sugar, milk powder, and dried sprats. Import expenditure on most of the items classified under other food types, such as vegetables, fruits, fresh fish, spices, and beverages were lower than December 2019.

Expenditure on the importation of intermediate goods declined by 9.6% in December 2020 compared to December 2019, driven by a 29.5% decline in expenditure on fuel imports. The average import price of crude oil in December 2020 was $ 51.89 per barrel, in comparison to $ 71.78 per barrel in December 2019.

Other intermediate good categories that showed a marked decline include textiles and textile articles, diamonds and precious metals, base metals (such as iron and steel and aluminium articles), palm oil, etc. Intermediate goods imports that recorded notable increases included fertiliser and wheat (due to higher volumes), synthetic rubber, certain chemical products, and animal fodder.

Imports of investment goods declined by 23.6% in December 2020 compared to December 2019, with declines in all three subcategories, namely, machinery and equipment, building material and transport equipment.

Declines in import expenditure were particularly apparent in articles of iron and steel, ceramic products, cement, some engineering equipment (such as cranes, lifts and skip hoists, automatic regulating instruments), medical and laboratory equipment and commercial purpose vehicles. However, notable increases in import expenditure were observed in relation to computers, agricultural machinery, tractors, etc.

The import volume index and the unit value index declined by 14% and 0.5%, respectively, on a year-on-year basis in December 2020. This indicates that the decline in import expenditure was caused by the combined impact of lower import volumes and prices.

Gross official reserves at end December 2020 amounted to $ 5.7 billion. This level was equivalent to 4.2 months of imports. Total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 8.5 billion at end December 2020, providing an import cover of 6.4 months.

A notable depreciation pressure on the Sri Lankan rupee was observed during December 2020.

Even amidst such intermittent volatile periods, particularly driven by speculative market behaviour, the overall depreciation of the rupee was limited to 2.6% against the dollar in 2020. The Central Bank was able to absorb $ 283 million, on a net basis, from the domestic foreign exchange market in 2020. The depreciation pressure re-emerged in January, but with temporary regulatory restrictions being adopted in the domestic foreign exchange market to curtail speculation, the rupee stabilised again in the latter part of January.

Meanwhile, reflecting cross-currency movements, the rupee depreciated against the euro, the pound sterling, the Japanese yen, the Australian dollar and the Indian rupee in 2021 up to 11 February.