Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 29 May 2020 00:00 - - {{hitsCtrl.values.hits}}

The onset of islandwide curfew since mid-March delivered a blow to the economy of working people. Millions of working people lost their jobs, or had wage cuts. Small farmers could not sell their harvest or  sell it at a decent price. Fishers could not sell their fish. Domestic workers, street vendors and those who made a living by making ‘kadayappan’ could not go to work. Meanwhile, their debt continues to accumulate. With millions of livelihoods extinguished, a large proportion of the low-income households are progressing towards a debt deluge.

sell it at a decent price. Fishers could not sell their fish. Domestic workers, street vendors and those who made a living by making ‘kadayappan’ could not go to work. Meanwhile, their debt continues to accumulate. With millions of livelihoods extinguished, a large proportion of the low-income households are progressing towards a debt deluge.

Even as working people were reeling under the mounting impact of household debt, the recent loss of livelihoods has yet again compelled people to turn to debt to sustain life. Images of people lining up in front of pawning shops just as the lockdown began illustrate the lack of options and high dependence on debt among low-income households. The more recent stampede in Maligawatta, in which three women died, is another troubling example of people on the brink of survival.

Sadly, the 27 March debt moratorium by the Central Bank did not include microfinance and does not really address the gravity of the low-income household debt crisis. The political and business élite have put forward their financialised solutions such as using social security funds like EPF to boost short term consumption, subsidised loans and equity funds to revive local enterprises. One feature of the demands is justifying use of public funds to save privately owned enterprises.

How does the pandemic-induced economic insecurity and risk, contribute to the household debt problem? And how do financialised solutions to pandemic-induced socio-economic pressures augment the existing debt problem? Is there a way out? These are important questions as we shift towards an interim period seemingly oblivious to the socio-economic fallout of the crisis.

Stagnation of wages and mainstreaming microfinance as a mechanism of rural development have made debt an integral part of life for those from the poorer 50% of household incomes. Preventing a contagion of aggravated household debt among working people is crucial in gearing towards inclusive economic recovery. With little invested in social security and universal services it is unfair to expect people to take on the debt burden all by themselves. The public funds justification must extend to low income households and more so considering the dire and long term nature of the vulnerability.

Debt driven consumer in the smallholder economy

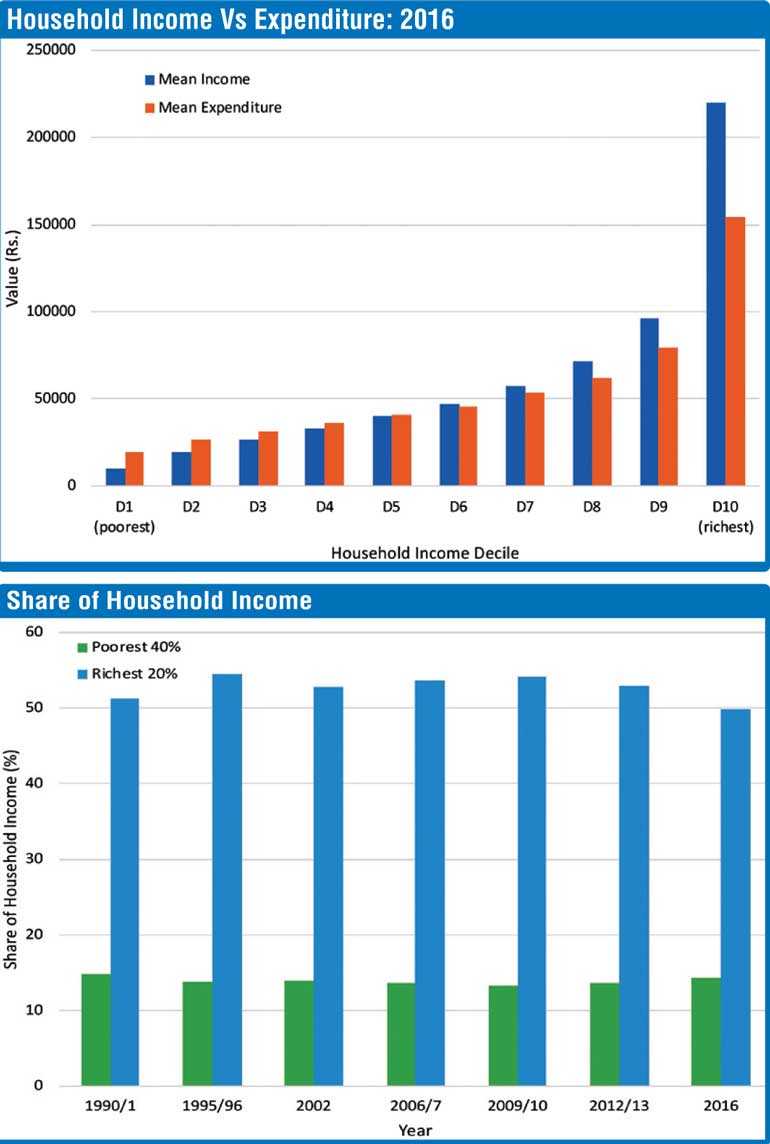

According to the Central Bank Annual Report of 2019, Sri Lanka is a smallholder economy. The Households (HH) and Non-Profit Institutions serving households (NPISH) contribute 48.8% of gross value addition to the economy. However, the value addition of these sectors is not reflected in the living standards of the working people. A comparison of household income across income groups shows that the share of income of the poorest 40% of the population has been more or less stagnant for the last two decades.

The richest 20% have consistently taken more than 50% of the gross household income. The income disparity is accompanied by clear class, geographic and racial factors. Of the poorest 40%, 41.7 are  located in rural areas and 64.6% in the estate sector. Leaving out the estate sector, wages and salaries among households in rural (37%) and urban (40.1%) sectors account for less than half of the total monetary income. Low wages in the plantations, exploited small farmers and fishers who are denied stable and living incomes and daily wage workers characterise livelihoods of these people. Pandemic related disruptions to livelihoods will be unevenly distributed to these people.

located in rural areas and 64.6% in the estate sector. Leaving out the estate sector, wages and salaries among households in rural (37%) and urban (40.1%) sectors account for less than half of the total monetary income. Low wages in the plantations, exploited small farmers and fishers who are denied stable and living incomes and daily wage workers characterise livelihoods of these people. Pandemic related disruptions to livelihoods will be unevenly distributed to these people.

For the poorest 50%, monthly household expenditure offsets monthly income. In other words, they are forced into debt to sustain life. Data on household debt also speaks of racial and geographic inequality in distribution. 73% of the households in the estate sector are in debt whereas it is 61.1% in the rural sector. With 2.4 million microfinance borrowers, we also know that low-income household debt is disproportionately prevalent among women.

Lending at high interest = vacuuming up wealth

Despite campaigns for ‘financial inclusion’, people with low-incomes still access the most expensive credit. For example, microfinance even in its reformed avatar offers the costliest loans for households at 35% interest. We have seen many of the microfinance loans with weekly repayments still exceed the official interest rate cap of 35%. Instead of nurturing micro and small enterprises and supporting people out of poverty, usurious lending has been vacuuming up value created by working people.

The expansion of finance companies to the north and east of Sri Lanka after the end of the war in 2009 with post-war aid and increased international investments in the Sri Lankan microfinance market, corresponds to the global expansion of financial markets in the aftermath of the Global Financial Crisis of 2008. The changing profile of funders had a qualitative impact on the mechanics of lending. A range of pension funds, investment banks and equity fund managers have invested in the Sri Lankan microfinance market. According to the 2019 Symbiotics MIV (Microfinance Investment Vehicles) Survey, Sri Lanka features among the top 10 offshore investment destinations for equity funds. These  investments are driven by expectations for sound financial return, not by caring instincts to socially empower poor women.

investments are driven by expectations for sound financial return, not by caring instincts to socially empower poor women.

One could argue that having big microfinance companies is of national interest even at the cost of the poor because they represent ‘productive’ economic ventures. However, the fact that they are closely linked to transnational networks of finance indicates that they are portals of credit outflows. Vacuuming up value from the grassroots is not limited to territorial borders of the state. Such value accumulated is further extracted by international capital.

For a developing country with a currency highly susceptible to fluctuations, so called poverty alleviation programmes assisted by microfinance have facilitated another avenue for capital extraction.

Debt cancellation and commoning credit as the way forward!

It is only in very recent times has Sri Lanka recognised that low income household debt has reached unsustainable levels. In 2018, the government intervened in microfinance lending by providing a limited debt relief program covering recipients of 45,139 loans in 12 drought affected districts and imposing an annual interest rate cap at 35%. Also, in 2019, during the Presidential election, several political parties mentioned microfinance in their election slogans. However, there has been no significant policy or law towards addressing this pervasive problem since 2018.

The pandemic and responses to it has sped up the economic fallout, particularly for the most vulnerable. A vision for recovery must account for household debt and include course correction from the disaster we were headed towards even before the pandemic. Instead of subjecting these low-income borrowers to further exploitation by finance companies, their debt should be cancelled. A debt burden will only scuttle economic recovery as it will put enormous pressure on small farmers, fishers, tea plantation workers and small and medium entrepreneurs who have to lead the economy towards recovery.

The write-off of farmers’ debt in 1995 is one example of debt cancellation which addressed a humanitarian crisis that was ravaging particularly the farmers in the dry zone. It contributed to enfranchising small farmers over their cultivation and stabilising the smallholder economy. By 2018, smallholders contributed 80% of agricultural production in Sri Lanka.

Cancellation of low-income household debt should accompany empowering the cooperative movement. The cooperatives came to the forefront during the curfews as a mediator to distribute essential goods to people. In addition, cooperatives are capable of playing a more productive and proactive role in addressing poverty, driving local production and distributing produce. Consumer co-ops, credit co-ops, producer co-ops and service co-ops have successfully rendered services to people in Sri Lanka.

With the advent of microfinance in the mid-1980s, the government mediated poverty alleviation programs like ‘Janasaviya’ and even ‘Samurdhi’ in its present form, embraced elements of microfinance like social entrepreneurship that placed the burden of transcending poverty on the individual with some access to credit. This undue pressure on an already dispossessed person manifests in shaming, guilt-inducing responses from the lenders and community at large, at times driving the borrowers to the extreme step of ending their lives.

Co-operatives as instruments of rural development were gradually abandoned. The co-operative owned rice mills and rice storages in the dry zone are examples for the success of the co-operative movement in Sri Lanka. To a significant extent, northern co-operatives have proved successful in keeping microfinance companies at bay in the last few years, by offering alternative cheap credit that is not predatory. Producer co-ops and worker co-ops could be means for bottom-up industrialisation of the local economy. Such initiatives would provide better opportunities for working people than simple import-substitution industries that demonstrably serve the interests of local capitalists, while exploiting working people.

The credit co-operatives can serve towards commoning credit. Credit that is communally owned, controlled and circulated within the locality will assist local development. The co-operative initiated mechanism of commoning credit would also enable equality in economic conditions and opportunities irrespective of gender, race or caste identities. Even as a short term response, credit cooperatives would be able to serve the financially dispossessed low-income households. A large number of debtors from low-income households who are listed in the Credit Information Bureau (CRIB) are unable to access the low interest ‘Saubhagya’ agriculture loans offered by the government to support home gardens. Co-operatives could offer these loans instead of commercial banks.

There is an undeniable urgent need for credit among low-income households right now. Being listed in the CRIB and embroiled in litigation are also characteristic of the unwieldy, solutionless and unjust situation people face. Government and the Central Bank should ensure that people from such households are not further pushed into the suffocating grip of money lenders in the informal credit market. Credit initiatives through co-operatives offer a real alternative, and hope to those in economic distress.

The economy is a union of livelihoods, social needs and expectations of the future. Unsustainable level of household debt has been a massive impediment to people’s development. Debt obligations have bound working people to low-paid jobs and overtime work at the cost of their wellbeing and of their families. The pandemic is forcing us to think of alternative ways of living and producing, debt has become a serious challenge to individual initiatives and also local initiatives. Debt cancellation is a necessary first step towards ceasing poverty based on exploitation and planning for economic recovery. Addressing inequality must become a central theme, with an approach of inclusive economic development within which a vibrant and responsive co-operative movement and credit commons are tools at the working people’s disposal.

(Amali Wedagedara is a PhD candidate at the University of Hawai’i, Manoa and Ermiza Tegal is an Attorney at Law.)