Sunday Dec 15, 2024

Sunday Dec 15, 2024

Wednesday, 25 January 2023 00:00 - - {{hitsCtrl.values.hits}}

Speakers and Panellist at Amana Bank GRC Forum

|

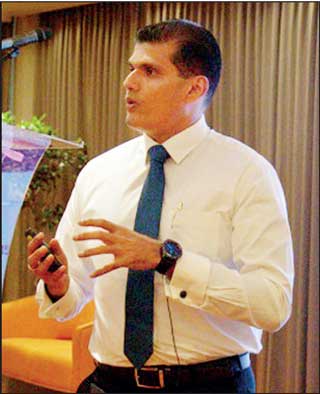

| Director Tishan Subasinghe addressing the gathering

|

Amana Bank recently conducted its Governance Risk Compliance (GRC) Forum at Mandarina Hotel.

The GRC Forum focused on the integrated collection of capabilities and global best practices that

enables the bank to reliably achieve its objectives while addressing uncertainty and ensure compliance through principled performance. Local and international subject experts including the bank’s Directors and other special invitees addressed the forum through informative presentations sharing a wealth of experience with the audience, which included Branch Managers, Head of the Departments, and Customer Relationship Managers.

GRC Forum 2022 began with a welcome note by MD/CEO Mohamed Azmeer, followed by the opening remarks made by Amana Bank Chairman Asgi Akbarally, highlighting the importance of GRC from the Board’s perspective. Then the audience was enlightened by the bank’s retired Founder Chairman Osman Kassim, who shared his hands-on experience on the importance of upholding the bank’s unique People Friendly Banking model, highlighting how the concept takes a profit-sharing, risk-taking and participative approach in all customer engagements. The Board Consultant and Ex-Board Audit Committee (BAC) Chairman, Jazri Ismail, delivered an experience-sharing speech on governance highlighting the existing corporate governance models worldwide.

Ensuring model compliance at all levels and adhering to the unique banking principles were addressed by special Guest Speaker Dr. Aishath Muneeza, who serves as an Associate Professor at INCEIF University, Malaysia. Dr. Muneeza was the first female Deputy Minister of the Ministry of Islamic Affairs in Maldives and was Deputy Minister of the Ministry of Finance and Treasury in Maldives.

Board Integrated Risk Management Committee (BIRMC) Chairman Rajiv Nandlal Dvivedi, who counts over 40 years’ experience in Commercial and Investment Banking, Corporate Finance, and Investments experience in the Middle East and USA, shared his experience on Enterprise-wide Risk Management with a few case studies in an interactive session with the audience. Further, an informative presentation was delivered on effective Internal Controls by Board Audit Committee Chairman Tishan Subasinghe, a Fellow and Council Member of the Institute of Chartered Accountants of Sri Lanka.

The Representative Director of the bank’s largest shareholder, the Jeddah-based IsDB Group, Mohamed Ataur Rahman Chowdury, delivered the shareholder perspective on the importance of GRC. He is a seasoned financial sector specialist, having spent more than 18 years in the Financial Institutions domain covering multiple geographic regions across the Middle East, North Africa, West Africa, Central Asia and Southeast Asia. The practical perspective on Credit Initiation and Portfolio Quality was shared by Board Credit Committee Chairman Dilshan Hettiarachi, an investment banker with over 25 years of banking and financial markets experience. The forum concluded with a Q&A session, availing an opportunity for the audience to interact and engage with the presenters. Asim Raza who is also a representative director of IsDB Group and Khairul Muzamel Perera who is a representative director of Bank Islam Malaysia shared there expert views in response to questions raised during the session.

Commenting on the event Managing Director/CEO Mohamed Azmeer said, “Governance Risk Compliance forms the foundation of any bank and the current turbulent times have proven the importance of it and how adherence and being conscious to GRC can not only protect but also help us capitalise on opportunities in a calculated manner. Businesses require a comprehensive and integrated view of Governance Risk and Compliance to drive better strategic decision-making. With an expert panel sharing their experiences, this forum provided a good understanding to our key front-line personnel on how to manoeuvre these challenging times without compromising on GRC.”

Also sharing his views Amana Bank Chairman Asgi Akbarally said, “GRC is an important concept, especially for regulated institutions like banks, and I am very thankful to the management and the participating directors for facilitating this forum at such uncertain times. GRC helps to set the tone from the top to ensure ethical and effective management of the bank by the Key Management Personnel in accordance with approved business plans and strategies, and this event through its eminent panellists was able to showcase its significance to better decision making.”