Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 31 October 2019 00:05 - - {{hitsCtrl.values.hits}}

By Vinu Wijesekera

Liquefied Petroleum Gas (LPG) refers to two prominent natural gas liquids, namely propane and butane. LPG is a derivative of the two industries involved in processing natural gas liquids and in refining crude oil.

LPG is very safe when properly handled and therefore is highly flexible and easily transportable, making it one of the only energy sources readily available for the rural public being left out of existing energy grids. LPG has a clean emission profile and low sulphur content and is an efficient cooking fuel used by almost three billion people in the world.

Although opponents have emphasised the non-renewable nature of the gas, advocates have highlighted the fact that LPG is an inevitable by-product of oil and natural gas production and oil refining. Additionally, a renewable LPG alternative coined BioLPG has also gained momentum in recent years.

Global LPG supply is limited to a few regions and most LPG using nations, including Sri Lanka, are net importers of the product. The most striking trend in the global market is the rise of the US to be the world’s largest LPG exporter.

The US is currently the largest exporter of propane while the Middle East remains the dominant exporter of butane. The global LPG demand growth for the next five years are projected to be led by Asia with South Korea, India, Japan, Indonesia and Saudi Arabia being the top six LPG demand generators.

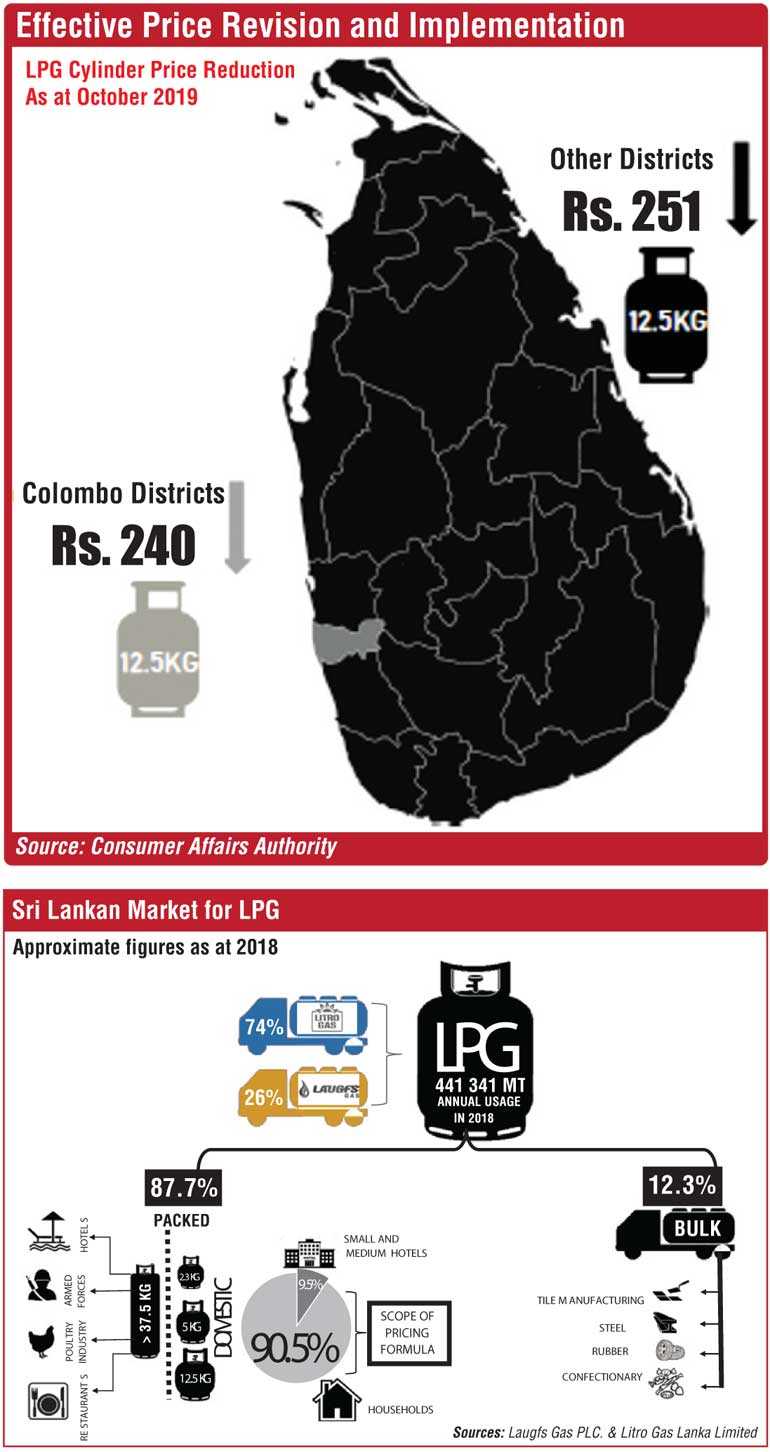

The annual usage of LPG in Sri Lanka summed up to a total of 441,341MT as of 2018. Out of which, 87.7% included packed cylinders of LPG whereas the other 12.3% constituted of the bulk segment of LPG. 90.5% of domestic cylinders, of the size 12.5kg and below, is mainly purchased by households while the rest of it is purchased by small and medium scale hotels.

The country goes through approximately 2.1 million domestic cylinder refills a year. The majority of the 37.5kg cylinders are purchased by hotel, restaurant and poultry industries, as well as by the armed forces. Demand for bulk segment of LPG is largely generated from tile, confectionary, rubber and steel industries.

LPG demand in Sri Lanka has grown steadily over the last two decades, except for a small fall in 2010. Ceylon Petroleum Corporation of Sri Lanka currently produces approximately 5% of the national requirement whereas the remaining 95% is imported, predominantly from Middle Eastern nations.

Market for distribution of Liquefied Petroleum Gas is characteristically a duopoly with its two key players being Litro Gas Lanka Ltd. (LGLL), a State-Owned Entity, and LAUGFS Gas PLC (LGP), a Colombo Stock Exchange-listed company belonging to the LAUGFS conglomerate. These two companies play a vital role in supplying LPG to the Sri Lankan market. However, market share of the State-owned company of LGLL, successor to Shell Gas Lanka Ltd., currently holds approximately 74% of the total market and 77% of the market for packed LPG.

Approximately 42% of the population exclusively uses gas cylinders for domestic purposes while 43% use firewood alongside LPG. 13-15% of the population exclusively uses firewood. Both the LPG Distributors actively conduct awareness programs encouraging households to switch to the exclusive use of LPG for domestic purposes.

The Extraordinary Gazette Notification No. 1302/24 released in August 2003 required LPG to be classified as a “specified good” under Section 18 of the Consumer Affairs Authority Act. According to the Department of Census and Statistics, as at 2013, cost of LPG contributed to 0.83% of all-island household expenditure and to 1.65% of household expenditure in the Western Province. Therefore, the market for this essential item is governed by a state stipulated price ceiling where companies are subject to a maximum retail price and are unable to change prices on their own accord.

The Consumer Affairs Authority (CAA) and both companies have entered into an agreement to implement a Pricing Formula to determine the LPG Maximum Retail Price (MRP) during year 2007. As per this formula, both companies were subject to uniform MRP since 2013. However in the recent years, the market failed to reflect the global market trends of LPG due to the lack of regular implementation of the pricing formula. A regularly updated MRP accommodative to exchange rate fluctuations and changes in cost, insurance, and freight of LPG was required for producers to be able to sustain in a market governed by a price ceiling.

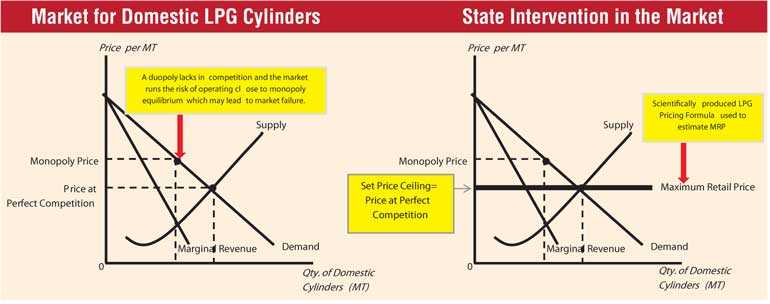

A duopolistic market faces the likelihood of operating closer to monopoly equilibrium due to the lack of competition. Considering that LPG distribution is an industry where there are significant fixed costs of production, encouraging more competitors may lead to an unnecessary duplication of resources resulting in many firms operating at high average costs. The division of market share among many competitors could potentially limit each of their scope to enjoy economies of scale.

In a market where competition naturally tends to be low, a price ceiling is a suitable form of government intervention. However, the existing pricing formula lacked the sophistication needed to accurately measure a competitive price reflecting the price trends in the global market. The need for both public and private sectors to collaborate and devise a comprehensive industry pricing formula was voiced out by both the key LPG companies.

The Cabinet Sub-Committee on Cost of Living (CoL) arrived at the decision to assign Ministry of Economic Reforms and Public Distribution to pioneer the study of an industry pricing formula. Under the leadership of Minister Harsha De Silva, a Pricing Formula Committee for the LPG Industry consisting of representatives of Central Bank of Sri Lanka, Ministry of Economic Reforms and Public Distribution, Consumer Affairs Authority, Ministry of Finance, and Ministry of Industry and Commerce was appointed.

The scope of the study was limited to the review of LPG packed segments as the CoL committee is concerned with delivering policies to alleviate the living standards of consumers. Gas cylinders within range of domestic cylinder sizes includes 2.3kg, 5kg, and 12.5kg cylinders were identified as those frequently used by the average household and was therefore considered for the study. CAA, as a regulator of the industry, will take on the role of the implementing agency of the pricing formula once completed. The finalised pricing formula would act as the basis of the respective pricing agreements which both companies would enter into with CAA.

An inaugural LPG Pricing formula committee meeting chaired by Minister Harsha De Silva was held on 3 March where the scope and the methodology of the study was outlined. Accordingly, both companies were requested to forward proposals for the LPG Pricing Formula along with audited financial statements required to verify the requested margins.

Contd. on Page 25

(The writer is an Analyst at the Economic Reforms Analytics Unit of the Ministry of Economic Reforms and Public Distribution and was a member of the LPG Pricing Formula Committee appointed by the Cost of Living Cabinet Sub Committee. She holds a BBusCom in Applied Economics and Banking and Finance from Monash University.)

Meetings between the pricing committee and designated representatives from Litro Gas Lanka and LAUGFS Gas were conducted in order to arrive at a clear understanding of the two business models. Subsequently, a formula constituting factors such as FOB price of imports, freight and insurance, exchange rates, cost of local purchases, applicable taxes and terminal charges, manufacturer costs and dealer and distributor costs was devised.

Once the components were agreed upon, the basis for calculating each component had to be finalised. The basis of calculation for all components except manufacturer costs, terminal charges and dealer and distributor costs were agreed upon by both companies without any disparity. The committee observed that the two companies followed two different distribution models and made necessary adjustments in the formula to accommodate for these differences. An in-depth analysis of company financial statements and relevant line items was conducted to arrive at manufacturer costs of the two respective firms. Necessary accounting treatments were carried out in order to measure the costs relevant to domestic cylinder production which should be borne by the average consumer.

It was identified that there existed a disparity between the two operational cost components requested by the two companies. Observing past trends of the market, the committee also identified that the market for LPG is one where the comparatively low cost manufacturer would take natural cost leadership. It was also recognised that all policy decisions should be based on the purpose of the price ceiling; to emulate a competitive equilibrium price in a market where there are significant barriers to competition. Taking these factors into consideration, an LPG Pricing Formula based on appropriate industry benchmarks was finalised and submitted to Cost of Living Cabinet Sub Committee.

Effective price revision and implementation

The LPG pricing formula was presented to the Cabinet of Ministers as a joint memorandum by the Minister of Agriculture, Rural Economic Affairs, Livestock Development, Irrigation, Fisheries and Aquatic Resources Development and Minister of Economic Reforms and Public Distribution on 1 October. Accordingly, Litro Gas Lanka entered into a pricing agreement with CAA on 4 October and the first price revision with respect to the new formula was announced.

Considering that the global LPG prices have been on a downward trend in the months leading up to October, application of the pricing formula, resulted in a reduction of the LPG prices per MT. Accordingly, the MRP for a 12.5kg cylinder sold in Colombo has decreased from Rs. 1,733 to Rs. 1,493. The MRP of a 12.5kg cylinder of LP gas decreased by Rs. 240 in Colombo and by Rs. 251 in all other districts. Similarly, the MRPs of both 5kg and 2.5kg cylinders have also been revised. Price revisions according to the pricing formula will take place every two months.

The immediate aftermath of the formula prescribed price reduction saw a rise in demand for LPG cylinders at a magnitude that neither of the suppliers had anticipated. The excess demand induced by the price decrease coupled with insufficient supply has led to a temporary shortage of LPG cylinders in the market. This shortage has further escalated due to panic demand created by consumers fearing a prolonged gas shortage. Both companies declared that the issue was stemming from supply lags involved in responding to the increased demand and that measures are being taken to replenish stocks of LPG. However, given that the elasticity of supply is constrained by factors such as procurement and freight time, it is anticipated that the market will take a few weeks to equilibrate.

Liquefied Petroleum Gas plays an important role in reducing energy poverty in Sri Lanka by fulfilling the energy requirement of the average household while safeguarding consumer health and safety. Given that its market is characterised with significant barriers to entry, government is required to intervene and ensure a competitive market equilibrium.

The newly-released LPG pricing formula is a scientific approach to estimate the price ceiling required to achieve a competitive market equilibrium. Thorough analysis of the industry and the two companies were conducted in order to ensure economic relevance and accuracy of the price ceiling. The formula sets out to enable an efficient market where producers are not subject to ad-hoc pricing changes and where consumers are transferred any cost savings enjoyed by the producers.

Both the pricing formula and the subsequent pricing agreement emphasise regular implementation of the estimated maximum retail price. The successful implementation of this pricing formula will not only pave the way for a more efficient market for LPG market but also for more reforms where both the state and private sector work hand in hand to arrive at sustainable market solutions. However, the success of economic reforms of this nature will greatly hinge on good governance and the State’s commitment to strictly enforce such policies.

(The writer is an Analyst at the Economic Reforms Analytics Unit of the Ministry of Economic Reforms and Public Distribution and was a member of the LPG Pricing Formula Committee appointed by the Cost of Living Cabinet Sub Committee. She holds a BBusCom in Applied Economics and Banking and Finance from Monash University.)