Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 4 October 2017 00:00 - - {{hitsCtrl.values.hits}}

The recent focus by many on the tourism sector from restaurant owners to hoteliers and travel agents given is a view of the value chain development taking place in the country. As at now tourism accounts for 4.5% of the GDP whilst in developed markets on tourism the number moves up to as high as 22% of the GDP. This indicates why many countries focus on developing the tourism industry given the impact it has on the quality of life.

The recent focus by many on the tourism sector from restaurant owners to hoteliers and travel agents given is a view of the value chain development taking place in the country. As at now tourism accounts for 4.5% of the GDP whilst in developed markets on tourism the number moves up to as high as 22% of the GDP. This indicates why many countries focus on developing the tourism industry given the impact it has on the quality of life.

Last week we saw a headline in the media that the Prime Minister wants the industry to attract five million tourists into the country. I)t sure sounded positive given that we are registering just 3.6% volume growth in arrivals as at end July 2017 (this includes four of the seven months registering a negative growth over last year’s performance). Hence the industry will have to grow at around 12-15% per month if we are to achieve this number within this Government’s lifecycle which is a challenge given the slow progress on the demand generation front, be it the global advertising campaign, the digital marketing drive or the below-the-line activity we see of destinations that are registering a 15% growth agenda as at now.

If we take the current situation, we see the challenge on the food industry with the spiralling costs. Inflation has picked up by 7% in September 2017 whilst as against last year it is at as high as 10% which indicates the pressure on the supply chain. A fact that many have forgotten is that as against 2009 we have almost 1.5 million extra mouths that Sri Lanka has to feed. In 2009 we had just 0.5 million visitors to Sri Lanka whilst today we have exceeded two million. This sure adds to the demand-supply equation.

This takes us to the discussion point carrying capacity which Sri Lankan policymakers have not given heed to. Wikipedia defines this concept as the carrying capacity of a biological species in an environment is the maximum population size of the species that the environment can sustain indefinitely, given the food, habitat, water, and other necessities available in the environment.

In relation to tourism a classic case in point is the sewerage system in the Bentota area. If we take the new properties that have come into the system in the last three years and the planned properties to be launched there is a severe challenge on the infrastructure.

In this background if we go on to target five million tourists one can just imagine the pressure on the carrying capacity on Sri Lanka. As we speak there are around 25,000 hotel rooms that have been approved for construction which are essentially in the three star and below category, which indicates the pressure it will create on the food chain.

A point to note is that the type of tourists that we will attract given this background and the recent insight that almost 60% of current visitors are attracted by the informal sector direct is one fact; the basket of goods of an average Sri Lankan will be further challenged. This will ultimately result in a political fallout between the people of Sri Lanka and the Government.

There has been many a debate on if Sri Lanka is going to drive for increasing the number of rooms or attracting a higher end visitor to the country so that we can work around the issues highlighted on the concept of carrying capacity. A point to note is that if we analyse the Q2 results of the leading tourism companies, the results are very poor. Overall top line growth is between 1-3% but the escalating costs on food and beverage is above 20%, which takes the property to the red on the bottom line.

higher end visitor to the country so that we can work around the issues highlighted on the concept of carrying capacity. A point to note is that if we analyse the Q2 results of the leading tourism companies, the results are very poor. Overall top line growth is between 1-3% but the escalating costs on food and beverage is above 20%, which takes the property to the red on the bottom line.

Hence the question is whether Sri Lanka should invest on new properties attracting customers with a higher ARR. A point to note is that when the gestation time is between three to five years and at an Internal Rate of Return of around 12-15% with a payback period that can range from eight to 10 years, such investments can be challenging decisions. The logic is that the market is throwing out many other growth opportunities that are much more attractive – especially if one’s company is a large conglomerate operating in a diverse product portfolio.

I guess the time has come for policymakers to make some serious hard decisions which can impact the future of Sri Lanka not just from a tourism front but for the general public.

A point that must be noted from a demand side of the business is that almost 60% of the hotel rooms in the country are located in the beach belt. In my view we cannot price a room rate above the 250 dollar threshold as a typical beach holiday seeker will compare Sri Lanka’s proposition as against the Maldives that can offer better beaches and an exclusive beach frontage to a typical traveller at around 450 dollars.

Whilst we can argue that Sri Lanka offers more than beaches, this proposition needs to be further discussed as research has revealed that purpose of travel by a foreigner hinges on a single-minded reason, be it beaches, wildlife or culture based. This means that strictly from a marketing perspective, we have no option but to practice strategy differentiated marketing, meaning separate business propositions for identified key market segments.

One option of differentiation to attract a top end visitor into Sri Lanka is by driving up wildlife tourism and its relevance to today’s emerging landscape of Sri Lanka so that we can move the game to ARR-based agenda.

Wildlife tourism can be broadly defined as trips made to destinations with the main purpose being to observe the local fauna and flora. This can be simply explained as an activity of watching animals in the wild and it covers all types of animals – large mammals, flock of birds, all kinds of insects and even marine life. This is essentially an observational activity although in some countries some interactions are allowed in control conditions. This market is worth around 12 million trips each year, with Africa accounting for around half of all these trips with the hotspot destinations being Kenya, Tanzania and Botswana.

My pick is Kenya for game watching as the big five can be spotted much more easily in its natural habitat but if one has done game in Kenya you would have experienced the extent one has to travel from Nairobi, maybe right up to Samburu or even the great Mara. The 500 million dollars that it contributes to the Kenyan economy in value is almost 14% of GDP in Kenya, which makes the difference.

On the other hand Galapagos Island which relies exclusively on wildlife tourism accounts for 60 million dollars to the nation’s economy. Sri Lanka on the other hand has crossed the three billion dollar mark in tourism as at September 2017 and given that Euro Monitor also said that Sri Lanka is the best place for viewing game outside Africa we must drive this agenda stronger.

A core group of wildlife enthusiasts working on the concept of ‘conservation tourism’ has released a set of data on the attributes of how easy it is to actually see wildlife, termed observability, and time required to sight the game. It has also looked at what species can be seen as charismatic, like for instance the leopard or the sloth bear that can be sighted in Yala.

The targeted travellers essentially come from the US, Europe, mainly Germany, the UK and the Netherlands. There has been an emerging segment travelling from Canada and Australia in the recent past. The profile of the traveller is around the 50-65 year age group, who have just about retired and are wealthy in nature, healthy and active and on average spend around $ 475-1,500 per day, which makes this target group attractive for the private sector of Sri Lanka tourism to seriously consider.

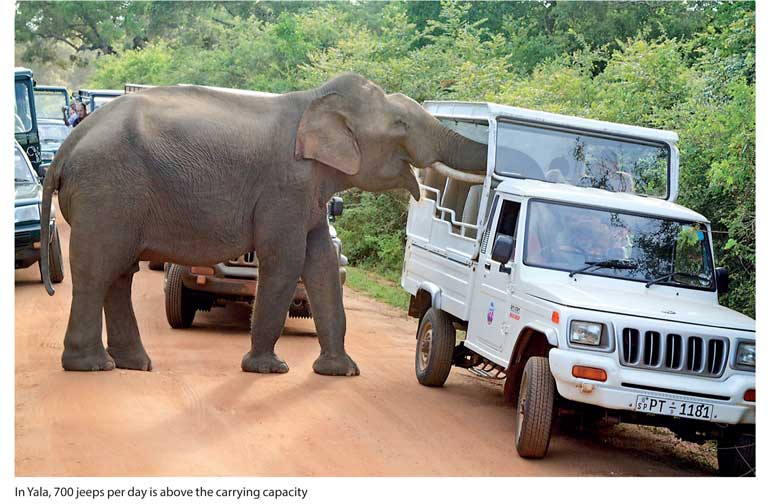

Once again the discussion moves to the concept of carrying capacity. Visitation has increased from 43,368 visitors in 2008 to 545,007 visitors in 2015, an increase of over 1,000% in seven years. Yala, the most popular National Park in Sri Lanka, had over 658,000 visitors, sometimes with an average of 250 vehicles entering Yala Block 1 per day with increased numbers during holiday seasons, often exceeding 700 vehicles per day which is way above the carrying capacity for any wildlife park. I have personally seen a bear surrounded by 53 jeers in one location which is a pressure that will hurt the system in the long term.

1. We need to first clearly demarcate and profile the geographic locations that offer wildlife in Sri Lanka and the carrying capacity on a daily basis. Udawalawe and Minneriya can be ranked as the best place for sighting the Asian elephant whilst Yala and Wilpattu can undoubtedly be ranked the best places in the world to watch leopards. To be honest, they cannot be even compared to the great parks of Kenya where leopard spotting is very rare which should be the key value proposition that can be highlighted globally. Trinco, Kalpitiya and Mirissa can be highlighted for the sighting of blue whales and the sperm whales whilst Kumana is ideally situated for bird watching, which is very strong growth market globally and dominated by Bempton Cliffs in UK, Keolandeo in India and Pantanal in Brazil. We can also market the rainforests and biodiversity areas like Sinharaja forest and Horton Plains, which have now been declared World Heritage Sites but avoid overcrowding.

2. We need to architecture the brand guidelines in each of these product areas that Sri Lankan wildlife showcases, so that there is consistency of the sub brands that emerge from each park. Ideally only one characteristic animal species must be highlighted in each game park so that brand positioning is easier.

3. This brand guideline must be then developed to a brand toolkit template where a documentary, TV clips, brochures and pullouts are provided by a separate unit of the Tourism Ministry to the private sector for promotional purposes. The private sector can use this template to include one’s own lodging facility (hotel) but copied to the regulator for reference.

4. This unit under Sri Lanka Tourism must architecture the code of conduct when watching game and visiting the game parks that will include the officials of the park, the safari vehicle drivers and owners, highlighting the principles of conservation tourism and carrying capacity.

5. The lodging facilities can have the architecture of African safaris but may be some support can be provided with certain guidelines on the basic architecture of the hotels so that there is a central theme like ecotourism.

6. There has to be monitoring and certification at periodic levels. For instance in Kenya if a safari jeep goes off track to watch game, the fine is as high as 600 dollars and the confiscation of the driver’s license. This also gives exclusivity.

7. International media must be covered by the regulators to build this niche market with vehicles like CNN, National Geography, Animal Planet, Lonely Planet as well as social media like Facebook, Four Square, YouTube, Twitter and a dedicated website operated by the Ministry linking to the lodging sites and code of conduct norms.

8. All national events can link to highlighting game parks for endorsements. For instance, the Cricketing world cup celebrities can be used to tour the game parks and this can be a string PR tool in markets of UK and Australia.

9. Nationally dedicated travel and tourism fairs, magazines and tour operators can be targeted that specialise in wildlife tourism.

10. Set a target for revenue collection from this segment at next year’s National Budget with a minimum room rate in consultation with the private sector.

Whilst there are some burning issues that the industry is grappling with, we must address the issue of carrying capacity. One option is to take a segment and drive the agenda stronger for quality than quantity. We must remember that the number one reason for a destination to become unpopular is overcrowding. As someone said, the soul of a country’s destination is like one’s virginity, you only get to lose it once.

(The writer is a board director of many companies and he is the President/Group CEO of an international property development company. The thoughts are strictly his personal views.)