Friday Feb 13, 2026

Friday Feb 13, 2026

Thursday, 6 February 2025 15:45 - - {{hitsCtrl.values.hits}}

By Dr. Kasun D. Pathirage, Senior Economist, Economic Research Department, Central Bank of Sri Lanka

Price stability is a situation where the price levels of an economy, in general, do not record large and frequent changes. In other words, it is a condition where inflation remains stable and at a relatively low level. Economists often claim that maintaining price stability is a prerequisite for sustained growth and economic prosperity. It is important to deduce the reasoning behind this conjecture. Price stability is not merely the lack of or a low level of inflation. It refers to a situation where inflation does not vary much and remains predictable, facilitating better planning. Generally, it is common to observe a higher degree of price instability at higher inflation levels. Suppose prices are very volatile. Then, businesses cannot plan their decisions with optimal pricing since they may need to add markups to account for the cost variability, resulting in low demand and possibly leading to higher business failures and unemployment. Investments by households would be low because they would need to allocate a higher share of their disposable income to essentials, and the required return needs to be higher to account for the increases and volatility of prices. Moreover, resource allocation would be inefficient due to distorted market signals. Further, socio-economic equity would suffer since the poor and fixed-income earners experience a heavy deterioration of their purchasing power. Addressing this social inequity by the Government would also be difficult, as the price volatility makes it harder to target the most needed, reducing the effectiveness of aid and possibly opening space for corruption. Lack of price stability can be detrimental to an economy from several more perspectives, such as losing international competitiveness and the threat to financial system stability. These multiple arguments suggest that achieving economic prosperity is impossible without price stability.

Generally, the responsibility of maintaining price stability falls on central banks, which prefer low positive inflation levels, allowing them the necessary space to prevent unintentional deflation episodes. Many developed economies have independent central banks focusing on long-term economic goals, which have been instrumental in maintaining price stability. However, central banks’ independence can vary significantly in developing countries. Nevertheless, in recent years, many developing economies have established independent central banks to promote long-term economic goals. Moreover, healthy coordination between monetary and fiscal policy is also crucial, mainly when administratively determined prices are important for deciding overall inflation. In developing economies, achieving price stability is also challenged by the presence of a large share of food and energy-related items in the consumer basket. As a result, their inflation is frequently susceptible to supply-related bottlenecks and global commodity shocks. Moreover, these economies face further challenges in the form of the limited depth of the financial sector, which limits the efficiency of monetary policy; lack of competitive markets, which leads to greater monopoly power among few market players; and chronic institutional weaknesses that severely affect the anchoring of inflation expectations.

Central bank actions inherently comprise a trade-off between stability and growth, as their efforts to control high inflation typically require contracting the economy to some extent. While monetary policy alone cannot yield long-term economic growth, maintaining price stability promotes long-term growth through increased long-term investments, protection of purchasing power and strengthened financial stability. In turn, space is created for capital build-up and productivity increases, which are prerequisites for sustainable growth. Therefore, by sacrificing growth for a short period to stabilise inflation, central bank actions promote economic prosperity over a longer time horizon, thereby improving social welfare.

The task of achieving and maintaining domestic price stability in Sri Lanka is the responsibility of the Central Bank of Sri Lanka. With the enactment of the Central Bank of Sri Lanka Act, No. 16 of 2023 (CBA), the Central Bank has been granted operational independence by statute with added public accountability. The task it should achieve is set in an agreement with the Government via the Monetary Policy Framework Agreement (MPFA), signed between the Minister of Finance and the Central Bank, specifying the inflation target. The CBA not only improves the autonomy of the Central Bank but also enhances its public accountability and transparency, paving the way for a stronger, adaptive and flexible institution. As highlighted by many distinguished scholars, such as the 2024 Nobel Laureates on Economics, Daron Acemoglu, Simon Johnson and James A. Robinson, strong institutions are a key contributor to the success of a nation. Accordingly, enacting the CBA is a crucial milestone in Sri Lankan economic history.

As much as price stability facilitates sustained growth and economic prosperity, the lack of price stability could lead to severe economic crises, often linked with socio-political upheavals. Sri Lanka experienced these repercussions first-hand during the 2022 economic crisis. Many examples of even more severe episodes can be noted when observing the economic histories of various countries. As such, maintaining price stability is extremely important, not only for economic well-being but also for a healthy socio-political environment. Accordingly, price stability is an absolute necessity for a healthy economy.

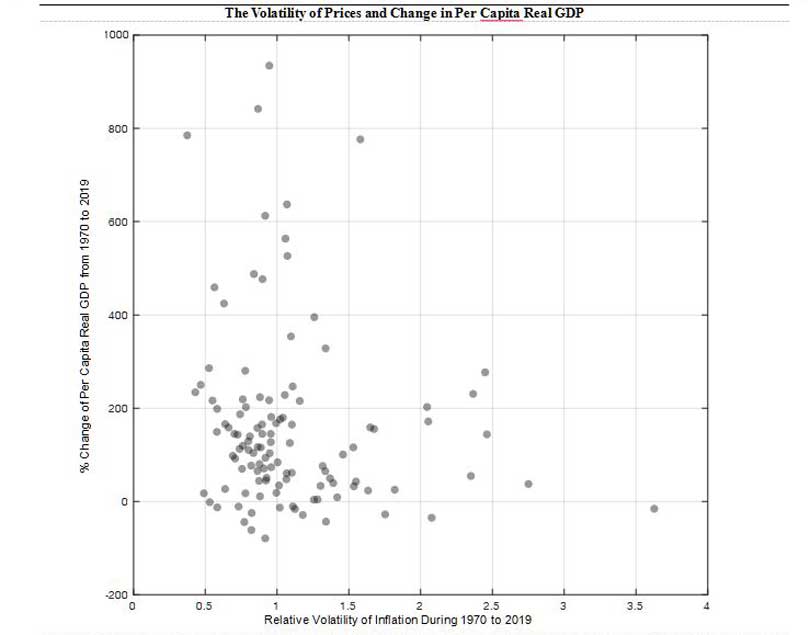

The above diagram plots the volatility of inflation, represented by the coefficient of variation of annual inflation from 1970 to 2019, on the horizontal axis. Higher values on this axis represent higher price volatility, i.e., more significant levels of price instability. The percentage changes in per capita real GDP in 2019 compared to 1970 are represented on the vertical axis. Higher values on this axis represent improvements in living conditions. The data points represent various countries. The lack of observations on the top-right area of the graph suggests that heightened price instability and improvements in living standards do not go hand in hand.

Data sources:

World Bank;

Ha, Jongrim, M. Ayhan Kose, and Franziska Ohnsorge (2023). “One-Stop Source: A Global Database of Inflation.” Journal of International Money and Finance 137 (October): 102896.

Note: The data sample from 1970 to 2019 was selected with the aim of increasing the number of available observations, and avoiding the impact of the abnormal shock experienced by most countries during the COVID-19 pandemic.