Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 29 January 2020 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka’s position as the leading supplier of orthodox tea to the world market is challenged by other countries due to the decline in tea production volume and the standard of tea. Unless these issues are addressed immediately the country may not be able to command higher prices for its tea

By The Tea Exporters Association

The value of a currency depends on number of factors that affect the economy of a country such as balance of payment, government debt, foreign exchange reserves, foreign investment, trade deficit, economic growth rate, inflation, macro-economic policies, etc. The general belief is that, a strong currency would make imports cheaper and exports uncompetitive while a weak currency could make imports expensive and exports more competitive.

The price of an export commodity such as tea is influenced by both internal and external factors that would include quality and uniqueness of the product, world supply and demand, the value of currencies of importing countries, tariff and non-tariff barriers, etc.

According to principles of economics, short supply of a product could move the prices up and excess of supply would lead to lowering the prices if all other factors remain constant. Since over 90% of the Sri Lanka tea production is meant for exports, the price of tea at the Colombo Tea Auction is also subject to influence of number of external factors in addition to the domestic issues of tea quality, standards, etc.

When the value of the currency of an importing country depreciates it will have a negative impact on the purchasing power of the buyer/consumer and hence the importer may not be able to pay the same price as before or could reduce the volume of purchase depending on the necessity of the product to the end consumer. Also when the supply is more than the demand the buyers have more options to choose and possibility of moving from high cost suppliers to low cost suppliers is greater unless a producing country offers a unique product that cannot be matched by the others.

The tariff and non-tariff barrier issues will also have an impact on the demand and the price of an exportable commodity irrespective of the exchange rate movements. The recent MRL issue that affected Sri Lanka tea exports to Japan, Germany and Taiwan is a good example of non-tariff barriers that negatively affected the demand and prices of Ceylon Tea. In a highly competitive market the quality of the product also plays a vital role in maintaining prices as better quality products can fetch good prices. The international sanctions on Iran, civil war in Libya and Syria are some other issues that influence the tea prices.

The purpose of this article is to examine how the movement of Sri Lanka Rupee in the recent past has influenced the average tea auction prices and average FOB prices of bulk tea. It does not examine whether Sri Lanka has gained or lost any markets due to exchange rate fluctuation. Theoretically the depreciation of the rupee should have positively impacted on the Colombo Tea Auction prices at the same or similar ratio of the depreciation. However, in realty this theory has not worked in the same manner due to the influence of above mentioned internal and external factors.

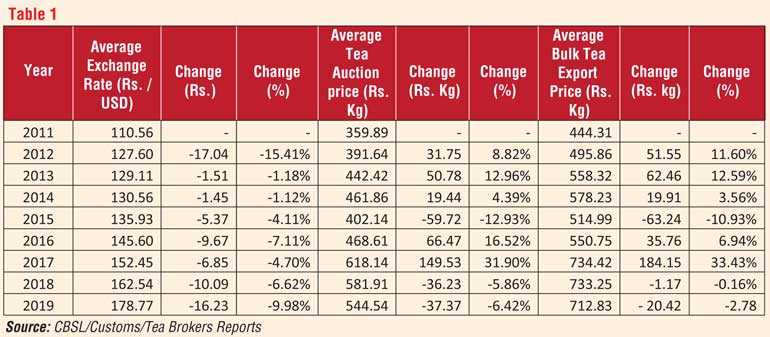

Movement of the rupee

An analysis of the movement of Sri Lanka rupee from 2011-2019 periods reveals that the local currency has continuously depreciated against the US dollar during the last eight years. From point to point, the average value of the rupee depreciated from Rs. 110.56 in 2011 to Rs. 178.77 per dollar in 2019 registering depreciation of Rs. 68.21 or by 55.73% to the dollar. During this period the average tea auction prices went up from Rs. 359.89 in 2011 to Rs. 544.54 per kg in 2019, an increase of Rs. 184.65 per kg or 51.30% and average FOB price of bulk tea (excluding 10kg packages) moved up from Rs. 495.86 in 2011 to Rs. 715.74 per kg in 2019, an increase of Rs. 219.88 per kg or by 44.34%.

These point to point analyses has revealed that tea auction prices have gone up by almost a similar margin of depreciation of the local currency while average FOB prices of bulk tea exports have gone up by a lower margin against the level of depreciation of the rupee. However, an in depth analysis of the movement of average tea auction prices and average FOB prices of bulk tea against the movement of value of the local currency on an annual basis from 2012 to 2019 shows somewhat different picture as the influence of both internal and external factors are captured in the annual prices. (Table 1)

In 2012, the average value of the rupee depreciated from Rs. 110.56 to Rs. 127.60 against the dollar, a reduction of 15.41% but the average tea auction prices increased only by 8.82% while average FOB price of bulk tea moved up by about 11.60%. In 2013, the rupee further depreciated by 1.18% but the average tea auction prices increased by 12.96% and average FOB price of bulk tea went up by 12.59%, in a much higher proportionate than the depreciation of the local currency.

In 2015, the rupee depreciated by 4.11% over 2014 and contrary to the general belief that depreciation makes price of tea more attractive to the buyers, the average tea auction prices came down by 12.93% and average FOB price of bulk tea also came down by 10.93%. This scenario changed dramatically in 2016 when rupee depreciated by 7.11% against the USD and largely due to the crop shortage, the average tea prices at the Colombo Tea Auction went up by 16.52%, more than double the ratio of depreciation of the rupee but average FOB price of bulk tea was unable to maintained the same momentum due to external factors and the average FOB price of bulk tea went up by 6.94% only.

It is observed that, a large portion of increase in auction price of tea was born by the exporter as they were unable to pass the price increase over to foreign buyers. In 2017, the rupee depreciated by 4.70% over 2016 but the average tea auction price went up by 31.90% while average FOB price of bulk tea too went up by 33.43%.

The general acceptance that, depreciation would make local tea products more competitive was proved wrong in 2018 and 2019 when average tea prices failed to gain despite the depreciation of the local currency. In 2018, the rupee depreciated by 6.62% and further depreciation of 9.98% was registered in 2019. Despite the depreciation of local currency the average prices at the Colombo Tea Auction came down by 5.86% and 6.42% respectively in 2018 and 2019 due to sluggish demand from foreign buyers with over supply of tea in the world market.

However the average FOB prices of bulk tea exports in the two years came down by 0.16 % and 2.78 % only. It appears that, there is no strong co-relation between the depreciation of the local currency and price of tea as the price is always influenced by a number of internal and external factors. Further, it is also evident that the average FOB prices of bulk tea behave differently to the movement of tea auction prices due to addition of export taxes, blending cost, export packing and different trading terms used by the exporters.

Exchange rates of major tea buyers

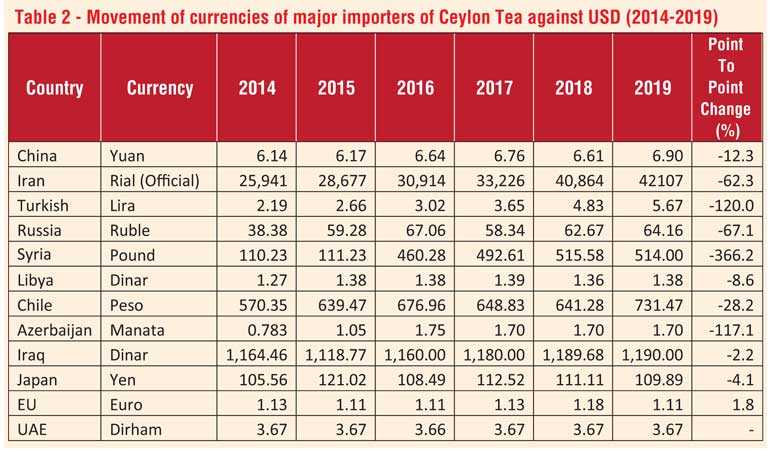

A review of movement of exchange rates of top twelve buyers of Ceylon Tea during the last six years has revealed that except the value of Euro and UAE Dirham, all the other currencies have depreciated against the US Dollar (Table 2).

Over 50% of average depreciation of the currency is recorded from Iran, Turkey, Russia, Syria and Azerbaijan while China and Chile have registered depreciations of their currencies by more than 10% during 2014 – 2019 periods. Since Iran tea buyers use the open market rate of the dollar for tea imports, the fluctuation of the Iran Rial is more than the depreciation of the official rate by 62.3%.

Although the UAE currency remains unchanged it did not help the Colombo tea auction prices as its imports from Sri Lanka reduced during the last five years as a result of lower demand from her major re-export markets such as Iran, Iraq, and CIS, etc. Since the export of Ceylon Tea to EU markets accounts for less than 10% of the total tea export volume of Sri Lanka, the stable Euro also failed to make a significant impact on the tea prices. It is observed that, the buying power of major importing countries of Ceylon Tea has significantly reduced in the last six year period that may have negated the benefit of depreciation of the local currency to the local tea trade.

World production and exports

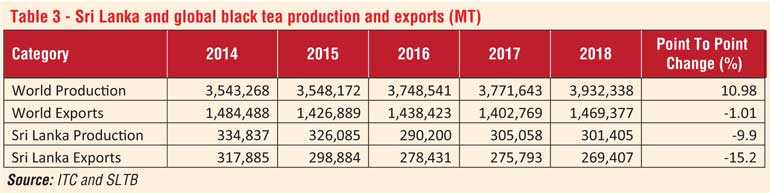

The world supply of black tea has gone up from 3,543,268 MT to 3,932,338 MT over 2014-2018 periods. This reflects a growth of 389,070 MT or 10.98% during the last 5 year period. However, Sri Lanka has experienced a setback with her black tea production coming down from 334,837 MT to 301,405 MT during the same period registering a decline of 9.9%. The international tea committee statistics reveal that world tea exports reached 1.469 million MT in 2018 against the volume of 1.484 million MT in 2014 registering a marginal decline of 1.01% in the last five years while Sri Lanka black tea exports declined by almost 15.2% during the same period. In terms of volume Sri Lanka has lost 47 million kg of tea of its exports during the same period.

Since the global black tea production has gone up by a significant volume and exports have come down by only 1% in the last five years, the foreign buyers who were patronising Sri Lanka could have moved to other destinations for procurement of their black tea requirements which could have also negatively impacted on the tea prices at Colombo Auction despite the depreciation of the local currency (Table 3).

The recent World Bank commodity outlook report has stated that, the global tea prices declined by 1% in the 3rd quarter of 2019 against the previous quarters and remained 6% below the same period of 2018. The tea prices at auction centres in India and Kenya also came down in 2019 due to excess supply situation in the world market especially the CTC tea varieties. As per available data the average tea prices at Mombasa auction in Kenya came down from $ 2.81 per kg in 2017 to $ 2.43 per kg in 2018 and $ 2.22 per kg in 2019. The average Indian tea prices remained almost same at Indian Rupees 140.26 per kg in 2018 and Indian Rupees 141.17 per kg in 2019 thanks to the large domestic consumer base.

The EU and US sanctions imposed on Russia since 2014, tightening of USA financial sanctions on Iran in May 2018, civil war in Libya, Syria, Iraq, etc., MRL issue with Japan, EU and Taiwan and the failure to maintain the tea quality standards could have also affected the tea prices at the Colombo Auction in the recent past. When there is huge competition in the world tea market the depreciation of the local currency alone cannot push the tea prices up.

Conclusion

Although the averages may not show the complete picture of tea price variances in relation to exchange rate fluctuations it is evident that there is no single factor responsible for the movement of prices of agricultural commodities including tea, but rather a set of factors.

The general beliefs that, the depreciation of local currency will always leads to enhance the prices of tea or export commodities is subject to fulfilment of various internal and external factors. Since external factors are beyond the control of Sri Lanka tea trade members what is necessary is to address the domestic issues affecting the tea prices. A consorted effort by all stakeholders is necessary to overcome the domestic issues to attract more foreign buyers towards Ceylon Tea.

Sri Lanka’s position as the leading supplier of orthodox tea to the world market is challenged by other countries due to the decline in tea production volume and the standard of tea. Unless these issues are addressed immediately the country may not be able to command higher prices for its tea. Finding new markets and development of more strong Sri Lanka tea brands could be the long term solution to enhance the tea prices at Colombo Tea Auction.